John M. Mulvey  John Mulvey is a Professor of Operations Research and Financial Engineering at Princeton University. His specialty is strategic financial planning and dynamic optimization. He has implemented financial risk management systems for many companies, including Pacific Mutual, American Express, Towers Perrin, Merrill Lynch, American Re-Insurance, Siemens, and Lattice Financial. Books Worldwide Asset and Liability Modeling , Cambridge Univ. Press, 1998 Financial Engineering , AOR, co-editor, 1994 Portfolio optimization Note: Thanks are in order to Ron Madey at Towers Perrin for initial discussions regarding the investment rules -

Invest for a purpose. Investors should link their assets, liabilities and goals in an integrated fashion. For example, a couple saving for retirement should put together a savings and investment plan with a view of their consumption requirements. Uncertainties should be addressed in the planning process. -

Risk is not achieving one's goals. Traditional portfolio theory suggests that risk is equated with volatility or standard deviation of investment returns. However, a young investor with a long horizon will take on less risk by investing in equities, as compared with an elderly person (also investing in equities) who needs liquidity this year. Measuring risk requires an understanding of the investor's goals. -

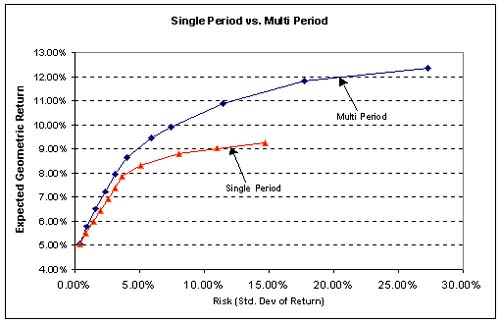

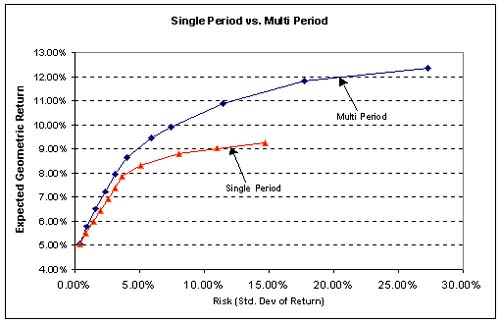

Long- term investors should employ multi-period portfolio models. The Markowitz mean variance model is generally posed as a single period model. This approach, while simple, misses an important dimension since it is a static approach to investing. It is better to conduct a dynamic analysis in which the investor re- balances his portfolio at the beginning of each period. Dynamic analysis will give different recommendations than a static model. -

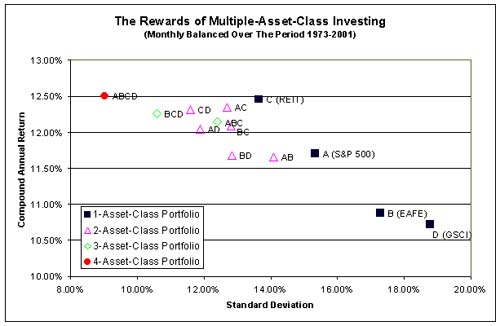

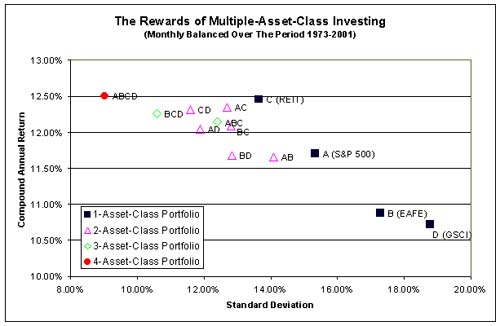

Take advantage of volatility pumping. Within a dynamic investment model, the most aggressive side of the efficient frontier consists of a set of high returning assets (see graph). The investor must re-balance his portfolio to the target mix at the beginning of each period. This fixed-mix approach can provide higher returns than any single asset category by taking advantage of the market's natural volatility. In fact, highly volatile assets with high growth are sought after. Historical returns show a similar result (see graph below).   -

Asset allocation is critical for long-term performance. High net worth and institutional investors focus on asset allocation as a critical aspect of investment planning. Any investor can readily employ a passive index approach to investing within an asset allocation framework. The passive portfolio provides a benchmark for active management. Active managers are paid to beat their benchmark. In many cases, the active managers do not beat their benchmarks due to high fees and other causes. -

Find robust recommendations. A portfolio model is dependent upon a set of parameters, such as the equity risk premium. These parameters are determined by analyzing historical returns in conjunction with current market conditions and expert opinion. Blending these aspects together can be difficult. Recommendations of a portfolio model should be stress tested . The final recommendations should be robust with regard to the assumptions. -

Optimal portfolios should make sense. The recommendations of an investment model should be explainable in common sense terms. How does the model react to changing market conditions? What are the projected ranges on the upside and the downside? Any model suggesting an outcome that is too good to be true is likely to be flawed. Optimization will attempt to exploit any advantage, without regard to the practicality of the strategy. Care must be given to the output of an investment model. -

Protect the investor's surplus . Investors should diversify their assets in concert with their liabilities and goals. For instance, a pension plan must make contributions when their assets fall below the market value of their liabilities. These contributions can be difficult to make when the economy is experiencing a recession . Similarly, an individual investor should protect their own surplus by finding assets that are correlated to their long-term goals. -

Avoid computer black boxes. Periodically, there are proposals to develop deep 'mathematical' methods for forecasting the returns on financial assets, such as stocks, bonds , and currencies. These computer systems depend upon a complex set of equations that involve feedback, highly nonlinear functions and other exotic techniques. The investor is told that model is too complex for understanding the underlying approach. Beware of these black box systems. Investors should be able to understand the underlying methodologies. -

Implementing a strategic plan requires persistence. The goal of a planning system is to develop insights towards a plan of action. The investor must implement their financial plan and stick with it during both good and bad periods. Changing strategies during strong market moves generally leads to poor performance. www.princeton.edu/~mulvey 'As difficult as it may be, picking stocks whose earnings grow is the name of the game. Consistent growth not only increases the earnings and dividends of the company but may also increase the multiple (P/E) that the market is willing to pay for those earnings. The purchaser of a stock whose earnings begin to grow rapidly has a potential double benefit: both the earnings and the multiple may increase.' ”Burton Malkiel | |