The Development of E-tail Logistics

John Fernie and Alan McKinnon

Introduction

Non-store shopping is not new. Traditional mail order goes back over a century. The ‘big book’ catalogues have experienced slow decline with the advent of more up market ‘specialogues’. Nevertheless, the tradition of selling to friends and family continues with party plans, most notably Ann Summers, and door to door selling through Avon and Betterware catalogues. These ‘low tech’ forms of selling have accounted for around 4–5 per cent of all retail sales in the UK and the US for many years but this was forecast to change dramatically in the new millennium when ‘higher tech’ options would dominate the market place. The ‘hype’ exceeded reality and after the dot.com boom in the late 1990s, a considerable shakeout of the industry has occurred since 2000 with the prospect of a more stable pattern of development occurring until 2010. This chapter will discuss growth of e-commerce, the evolving market and consumer responses to online retailing. The challenges faced by the grocery sector will be discussed in some depth, especially the ‘killer costs’ of picking and delivering to customers’ homes.

The Growth of E Commerce

While it is generally accepted that e-commerce has grown considerably in the 1990s and the early part of this century, accurate, reliable figures are difficult to ascertain because of the need to agree upon a widely accepted definition. Most research has focused on business to consumer (B2C) transactions, although few companies in this sector have made a profit. It has been the business to business (B2B) and consumer to consumer (C2C) sectors that have produced real benefits to customers and hence increased profitability for the partners involved. In C2C markets, intermediaries such as eBay are online auctioneers brokering deals between bidders and sellers. Similarly B2B exchanges, such as GlobalNetXchange and WorldWide Retail Exchange, promote online auctions and collaborations between partners to reduce costs. Businesses involved in these e- commerce markets are infomediaries in that they are trading information, and are facilitators in reducing transaction costs between buyer and seller.

The problem with the B2C model compared with C2C and B2B models is the requirement to trade goods and services that are tangible and need to be stored and transported to the final consumer. Additionally, a market presence and brand identity are necessary ingredients to wean customers away from their traditional methods of buying behaviour. Yet despite these apparent drawbacks, the ‘hype’ associated with this new form of trading led many analysts to discuss the notion of disintermediation in B2C markets. Traditional retail channels were to be disrupted as new players entered the market with online offers. Not surprisingly conventional retailers reacted passively to the new threat in view of their investment in capital assets. Pure e-tailers, with the exception of niche players, sustained losses, with numerous bankruptcies and others such as Peapod being taken over by major retail groups (Ahold in this case). With hindsight, a multi-channel strategy is the obvious route to success, especially for companies with a mail order presence. Some multi-channel retailers, such as Eddie Bauer, indicate that customers shopping at all channel alternatives (stores, catalogues and online sites) spend more than single or dual channel customers. This ‘clicks and bricks’ approach gives a customer greater flexibility, including in the case of clothing products, the opportunity to return goods to their nearest stores.

This approach is confirmed by research in the United States undertaken by the Boston Consulting Group (see Ganesh, 2004). In a survey of 63 retailers of various sizes and categories, it found that the most valued customer is the multi-channel customer. Retailers are utilizing cross- channel coordination whereby Web sites promote stores and catalogue offers. It is not unusual for customers to walk into stores with Web site printouts. More importantly to our later discussion here is the whole issue of returns management. Around 25 per cent of all goods purchased online are returned, hence the ability to handle returns can improve customer retention.

The Market

One of the reasons for over-optimistic forecasts for e-commerce growth in the 1990s was consumer acceptance of the Internet and widespread adoption of PC usage. By 2002 it was estimated that the number of Internet users numbered 450 million, with over half of this market coming from five countries: the United States, China, the UK, Germany and Japan (Table 9.1). Over 90 per cent of Internet users are English-speaking, with a similar percentage of ‘secure’ commercial sites (those that can perform ‘secure’ credit card transactions) on offer. Growth has been greatest in North America partly because of the relative cheapness of transaction costs: telephone charges there are lower than in other parts of the world. In Europe, however, deregulation of national monopolies, such as in the UK, will facilitate growth in the future. The increased sophistication of mobile phones with WAP applications also offers potential opportunities.

|

Country |

Estimate |

Country |

Estimate |

Country |

Estimate |

|---|---|---|---|---|---|

|

1. USA |

149.0 |

14. Brazil |

6.1 |

27. Czech Republic |

2.2 |

|

2. China |

33.7 |

15. Australia |

5.6 |

28. Norway |

2.2 |

|

3. UK |

33.0 |

16. India |

5.0 |

29. Finland |

2.1 |

|

4. Germany |

26.0 |

17. Poland |

4.9 |

30. Argentina |

2.0 |

|

5. Japan |

22.0 |

18. Thailand |

4.6 |

31. Philippines |

2.0 |

|

6. South Korea |

16.7 |

19. Sweden |

4.5 |

32. Malaysia |

2.0 |

|

7. Canada |

14.2 |

20. Hong Kong |

3.9 |

33. Chile |

1.8 |

|

8. France |

11.0 |

21. Turkey |

3.7 |

34. Denmark |

1.6 |

|

9. Italy |

11.0 |

22. Switzerland |

3.4 |

35. South Africa |

1.5 |

|

10. Russia |

7.5 |

23. Portugal |

3.1 |

36. Greece |

1.3 |

|

11. Spain |

7.0 |

24. Belgium |

2.7 |

37. New Zealand |

1.3 |

|

12. Netherlands |

6.8 |

25. Austria |

2.7 |

38. Singapore |

1.3 |

|

13. Taiwan |

6.4 |

26. Mexico |

2.3 |

39. Israel |

1.2 |

|

Source: Michalak and Jones, 2003 |

|||||

The technology for delivering e-commerce solutions is much more sophisticated and reliable than a decade earlier. Unfortunately, forecasts of online retail sales were strictly technological rather than behavioural-based. This should present a warning to those who see WAP technology as the new medium for e-commerce in the next 5 to 10 years.

To give an indication of the optimism exhibited by commentators in the mid-1990s with regard to the scale of online retail sales penetration, the Financial Times produced a conservative estimate of sales in Europe by 2000 in 1995. The author estimated that 10 to 15 per cent of food sales and 20 to 25 per cent of non-food sales would be made by home shopping (Mandeville, 1995). In reality, online grocery sales throughout Europe were around 0.24 per cent in 2000, with non-food sales only making an impact in computer software, CDs, books and videos. The position is much the same in the United States where online sales accounted for around 1 per cent of all retail sales in 2000 and 2001 (Reynolds, 2001). This slow growth in sales can be attributed to consumers using the Web for informational rather than transactional purposes, in addition to purchasing other services rather than retail. For example, Forrester Research show that of the US $20–30 billion estimate of the online consumer market in the United States in 1999, only 60 per cent accounted for the physical distribution of goods (Laseter et al, 2000). The other 40 per cent accounted for digital delivered goods, such as airline and event tickets, banking services and auctions.

More recent research indicates that retail sales online have been buoyant in 2001–3 in the United States and Europe. Whereas conventional retail sales in the United States grew 3.1 per cent throughout 2002 to US $3.26 trillion, online sales grew 26.9 per cent to US $45.6 billion during the same period, thereby accounting for 1.4 per cent of all retail sales. Forecasts for the years to 2005 suggest that a figure of 4–5 per cent will be reached. Similar trends are evident in Europe, where total EU e- commerce sales increased from 1,195 billion euros to 2,660 billion, a 123 per cent increase. Retail sales doubled, with notable increases in household (214 per cent) and supermarket categories (123 per cent) relative to more established e-tailing sections, books/music (40 per cent) and electronics (86 per cent). Furthermore, the digital delivered products continue to exhibit strong growth, especially in airlines (666 per cent) and car rental (586 per cent).

The E Commerce Consumer

Internet connectivity, as revealed in Table 9.1, depicted an English- speaking, developed country phenomenon. This concealed the different stages of development of these markets and the geodemographic profile of Internet consumers. It is generally accepted that most European countries lag behind the United States, which had more than 80 per cent of households connected to the Net in 2001. As the market matures, the profile of the consumer begins to be more representative of the population it serves. In the early stages of development the profile of the e- commerce shopper was a young male professional living in a middle-class neighbourhood. As the technology becomes more accepted the gender and socio-economic mix has changed. CACI (2000), the market research group, has undertaken an analysis of online behaviour and buying activity of adults (over 18 years of age) in the UK. Table 9.2 provides a detailed classification of e-Types, combining CACI’s core database of 30 million lifestyle records with Forrester Research’s UK Internet Monitor. This shows an online lifecycle from infrequent online purchases – virtual virgins, chatters and gamers and dot.com chatters – to frequent online purchases – surfing suits and wired living.

|

Group 1 Virtual Virgins |

|

Of those online, this group is least likely to have bought online. Less than 2 per 1,000 will have made any form of online purchase last month. Their time online is half the national average and they are likely to have started using the Internet more recently than other people. With the exception of chatting, this group do Internet activities less frequently than average. Because of their relative inexperience they are more likely to worry about security and delivery problems with buying online and to consider the process to be difficult. People in this group are twice as likely as those in any other group to be female. The elderly and children are more commonly found in this type than any other. |

|

Group 2 Chatters & Gamers |

|

This group, predominantly young males, might spend as much time online as the most avid type of Internet user; however they tend not to be buyers. Only one in five has ever made an online purchase. They may consider shopping online to be difficult and their fear of delivery and security problems is above average. These people are avid chatters and gamers who use news groups and download as frequently as the most active and experienced surfers. Nearly half are under 25. The schoolchildren in this type are more likely to connect from school/university than any other e-type, although connection from home is still the most frequent. |

|

Group 3 dot.com Dabblers |

|

As average Internet users, these people have mixed feelings regarding the pros and cons of online shopping. Around 40 per cent will have made some form of purchase online, and with the exception of chatting, their interests spread across all forms of Internet activity. These people may see benefits of the Internet in convenience and speed of delivery. Alternatively a specialist product not available elsewhere may have introduced them to buying online. In any event their enthusiasm for e-commerce is not yet complete. |

|

Group 4 Surfing Suits |

|

Although they spend less time on the Internet than average, these people can be quite enthusiastic online purchasers. They are more likely than average to have bought books, software, hardware, holidays, groceries, insurance and tickets for events online. Shopping online is seen to offer benefits such as range of product information, speed of ordering, price advantages, and an element of fun. They are less likely to fear e-commerce. They control their time on the Internet, and surfing, searching, e-mail and news groups tend to be preferred to chat, games and magazines. |

|

Group 5 Wired Living |

|

These are cosmopolitan young people and the most extensive Internet users, spending four and a half hours online each week. They are more experienced than most online and on average they have been using the Internet for three years. Over 70 per cent will have purchased over the Internet, covering between them the full gamut of products available for purchase. Over 60 per cent of these people are educated to degree level. These people use the Web as part of their lifestyle. Preferred interests tend to be newsgroups, news and magazines, with only an average interest in games or chat. |

|

Source: CACI, 2000 |

When this classification of online shopping categories is applied to 3,000 retail catchment areas, a more detailed picture of online geodemographics is evident. As would be expected, London and the south-east of England lead the way in terms of online shopping. Nevertheless, there are ‘hot spots’ across the UK with Edinburgh, Aberdeen and Bristol scoring highly despite poor overall representation in Scotland and the south-west. Areas with a poor score are north of England cities with a mixed income profile, and rural towns and centres.

In Canada, Statistics Canada has undertaken a Household Internet Use Survey since 1997. This provides a comprehensive data source to monitor e-commerce trends on a longitudinal basis. Michalak and Jones (2003) have analysed data from these surveys and show that the Internet adoption rate has grown from 29.4 per cent to 51.3 per cent from 1997 to 2000. Similar geodemographic trends are evident in Canada to those of the UK. The spatial distribution of e-commerce sales is strongly related to population and income distribution in Canada, with households in Ontario accounting for 41.8 per cent of all Internet shoppers, followed by British Columbia with around a quarter of all purchases. They note, however, that e-commerce is overwhelmingly a middle-class phenomenon, with regions of Canada with lower incomes or lower population densities having much lower rates of e-commerce sales activity.

Much of this discussion on the e-shopper has focused on the PC and the Internet as the medium of choice. For much of the 1990s, however, the development of television shopping was often mooted as the likely channel to dominate the e-commerce market. Television shopping channels were already common in the United States, and by the early 1990s had entered the UK market. Penetration of cable and satellite television was low in Europe compared with North America but the arrival of digital television (DTV) was seen as the catalyst for the growth of inter- active television. Much of this optimism has failed to materialize. DTV services have not proven as popular as expected and operators have made losses or have gone out of business (ON Digital in the UK).

Even if DTV was to become more popular in Europe, evidence from the United States suggests that the motivations for watching television are very different from PC usage. The latter is individualistic compared with the companionship associated with the television. Pace Microtechnology, one of the companies involved in making set-top boxes for existing analogue television sets, has undertaken research into consumer attitudes to digital TV services (Ody, 1998). Most potential consumers are interested in DTV because of the enhancement of traditional features (better picture quality, sound, more channel choice) rather than to use it for shopping purposes.

It is clear that DTV is still a long way off from challenging the Internet as the medium for home shopping, especially as cheap Internet access PCs are made available on the market. Reynolds (2002) indicates that convergence between the two technologies will take time because the two markets are sufficiently dissimilar. This is reflected in the early adopters of cable and satellite television, who tended to be from lower income socio-economic groups – a different market segment from the early adopters of the Internet.

Longitudinal surveys undertaken by various authors in the late 1990s have shown how the e-tailing market has matured in terms of both the customer base and the range of online offerings. In the United States the peak period of demand for Internet retailing is between Thanksgiving and Christmas. Lavin (2002) draws on consumer surveys undertaken by consultancy companies during Christmas 1998 and 1999 and her own primary research of retailers’ Web sites during the same period. She comments that the profile of the Web shopper had changed, e-tailers had worked to meet rising consumer expectations and the ‘first to market’ advantage of early adopters had been eroded. The customers of 1998 were predominantly male, technologically proficient and relatively affluent. More significantly they were not mainstream shoppers and had low expectations for their online purchase experience. She equates this with the innovator and early adopter stages of the product adoption lifecycle. A year later, with a rapidly growing market, the profile of the online customer had changed to a more balanced gender and age with overall lower average incomes. These are more likely to be mainstream shoppers with higher expectations from their purchase experiences. This early majority segment raised the stakes for online providers. Considerable investment was made to upgrade sites, advertise on traditional media to attract customers, and in logistical infrastructure to ship products to customers’ homes. Despite this, the 1999 Christmas period was notorious for failure to meet the Christmas deadline, partly due to consumers delaying purchase to the last minute but also to sheer volume of business in the network.

In the UK, Ellis-Chadwick, Doherty and Hart (2002) completed a longitudinal study of Internet adoption by UK multiple retailers from 1997 to 2000. Again, as in Levin’s study, the primary research was largely based on reviewing retail Web sites over this four-year period to ascertain how Internet business models were being developed. They report a sixfold increase in the number of retailers offering online shopping to their customers. Companies have moved from offering purely informational services to a fully serviced transactional e-shop. In the case of the well- established retailers, they have been more creative in linking their sites to other companies with complementary products: for example, birthday.co.uk to Thorntons, suppliers of chocolates and Wax Lyrical, a specialist candle retailer.

These studies, and other more sector-specific research investigations, indicate that retailers are responding to this changing market environment. As the market matures consumers tend to behave in a similar fashion to dealing with traditional retail outlets. The basics of convenience, product range, customer service and price will always feature in a consumer’s ‘evoked set’ of attributes. Above all, retailers have become brands and customer loyalty has been established through continually high levels of service. It is not surprising therefore that traditional retailers with strong brand equity can gain even more leverage through a sound Web strategy. They have the trust of the consumer to begin with, and the capital to invest in the necessary infrastructure. Many dot.com pure players needed to build a brand and tackle the formidable challenge of delivering to customers’ homes. This is why it has taken Amazon.com so long to register a profit. Nevertheless, Amazon.com has strong brand presence, and research by Brynjolffsson and Smith (2000) indicates that the company can charge higher prices because of this brand equity, or what they term ‘heterogeneity of trust’. In their survey of online pricing in specific markets, they showed that Amazon.com had a market share of around 80 per cent in books yet charged a 10 per cent premium over the least expensive book retailer researched.

All of this research shows that e-tailing has been most successful to date where a multi-channel ‘click and bricks’ approach is adopted. In this context, we are referring to non-food products, where traditional department stores and clothing specialists have considerable experience of dealing with the non-store shopper through their catalogues and ‘low tech’ selling techniques. These companies were well equipped to deal with home deliveries and a returns policy. Similarly the early e-tailing specialist pioneers with CDs, books, videos and computing equipment already had an infrastructure to deal with home-based orders. The grocery sector is much more complex, and home delivery is more associated with food service and added-value products. Nevertheless, the sector has attracted most attention in the literature, and we turn to a more detailed assessment of the market and the online issues pertaining to grocery in the next section.

The Grocery Market

Despite the fact that online grocery sales account for less than 1 per cent of retail sales in most country markets, this sector has attracted most attention from researchers and government bodies, including the DTI in the UK (DTI, 2001). Grocery shopping impacts on all consumers. We all have to eat! However, our populations are getting older so shopping is more of a chore; conversely, the younger, time-poor, affluent consumers may hate to waste time buying groceries. The relatively slow uptake of online grocery shopping in the United States can be attributed to the lack of online shopping availability, in that only about one-third of super- market operators offer some type of home shopping service.

Morganosky and Cude (2002) have undertaken one of the few studies on the behaviour of online grocery shoppers. Their research was based on a longitudinal study of consumers of Schnucks Markets, a St Louis-based chain of supermarkets operating in Illinois, Missouri and Indiana. The first two surveys in 1998 and 1999 asked Schnucks’ online shoppers to complete a questionnaire online on the completion of their order. The final survey re-contacted respondents from the 1999 survey to track their shopping behaviours in 2001.

The results here did have some parallels with other surveys of non-food online shopping, most notably more sophisticated consumers who had moved on from being ‘new’ users to experienced online shoppers. This is further reflected in their willingness to buy most or all of their groceries online, and to improve their efficiency at completing the shopping tasks. Online grocery shoppers bought for the family. They were younger, female and better educated with higher incomes. The final survey showed that customer retention rates were good. The main reason for defections was the relocation to another part of the United States where the same online service was not available.

Although similar empirical research has not been carried out in the UK, trade sources indicate that the online consumer has become more experienced and is buying more online. The two main e-grocers in the UK, Tesco and Sainsbury, claim that their online customers spend more than their conventional customers. Tesco also explodes the myth that online customers would not buy fresh products because of the so-called ‘touch and feel’ factor. Indeed the opposite is true: of the top 10 selling lines, seven are fresh, with skinless chicken breasts at number one (Jones, 2001).

Tesco, however, is one of the few success stories in e-grocery. In Europe, grocery retailers are powerful ‘bricks and mortar’ companies and the approach to Internet retailing has been reactive rather than proactive. Most Internet operations have been small, and few pure players have entered the market to challenge the conventional supermarket chains.

The situation is different in the United States, where a more fragmented, regionally orientated grocery retail structure has encouraged new entrants into the market. In the late 1980s this came in the form of Warehouse Clubs and Wal-Mart Supercenters; by the 1990s dot.com players began to challenge the traditional supermarket operators. (Table 9.3 identifies the key players, along with Tesco for comparison.) Unfortunately these pure players have either gone into liquidation, scaled down their operations, or been taken over by conventional grocery businesses.

|

Tesco UK |

Webvan USA |

Streamline USA |

Peapod USA |

|

|---|---|---|---|---|

|

Background |

The biggest supermarket chain in the UK |

Started as a pure e-grocer in1999 |

Started as a pure e-grocer in 1992 |

Started home delivery service before the Internet in 1989 |

|

Investments in e-grocer development |

US $58 million |

Approx US $ 1200 million |

Approx US $80 million |

Approx US $ 150 million |

|

Main operational mode |

Industrialized picking from the supermarket |

Highly automated picking in distribution centre (DC) |

Picking from the distribution centre, reception boxes, value adding services |

Picking from both DC and stores |

|

Current status |

The biggest e-grocer in the world. Expanding its operations outside the UK. Partnering with Safeway and Groceryworks. |

Operations ceased July 2001 |

Part of operations were sold to Peapod in September 2000. The rest of operations ceased in November 2000. |

Bought by global grocery retailer Royal Ahold. Second biggest e-grocer in the world. |

|

Source: Tanskanen, Yrjola and Holmstrom, 2002 |

||||

Why have pure players failed? Laseter et al (2000) identify four key challenges:

- limited online potential;

- high cost of delivery;

- selection–variety trade-offs;

- existing entrenched competition.

Ring and Tigert (2001) came to similar conclusions when comparing the Internet offering with the conventional ‘bricks and mortar’ experience. They looked at what consumers would trade away from a store in terms of the place, product, service and value for money by shopping online. They also detailed the ‘killer costs’ of the pure play Internet grocers, notably the picking and delivery costs. The gist of the argument presented by these critics is that the basic Internet model is flawed.

Even if the potential is there, the consumer has to be lured away from existing behaviour with regard to store shopping. Convenience is invariably ranked as the key choice variable in both store patronage and Internet usage surveys. For store shoppers, convenience is about location and the interaction with staff and the store experience. Internet users tend to be trading off the time it takes to shop. However, as Wilson-Jeanselme (2001) has shown, the 58 per cent net gain in convenience benefit is often eroded by ‘leakages’ in the process of ordering to ultimate delivery. Furthermore, the next two key store choice variables in the United States tend to be price and assortment. With the exception of Webvan, pure players offered a limited number of stock keeping units (SKUs) compared with conventional supermarkets. Price may have been competitive with stores but delivery charges push prices up to the customer. In the highly competitive US grocery market, customers will switch stores for only a 3–4 per cent differential in prices across leading competitors. Ring and Tigert therefore pose the question, ‘What percentage of households will pay substantially more for an inferior assortment (and perhaps quality) of groceries just for the convenience of having them delivered to their home?’ (2001: 270).

Tanskanen et al (2002) argue that e-grocery companies failed because an electronic copy of a supermarket does not work. They claim that e- grocery should be a complementary channel rather than a substitute, and that companies should be investing in service innovations to give value to the customer. Building upon their research in Finland, they maintain that the ‘clicks and bricks’ model will lead to success for e-grocery. Most of the difficulties for pure players relate to building a business with its associated infrastructure. Conventional retailers have built trust with their suppliers and customers. The customer needs a credible alternative to self-service, and the Finnish researchers suggest that this has to be achieved at a local level, where routine purchases can be shifted effectively to e-grocery. To facilitate product selection, Web-based information technology can tailor the retail offer to the customer’s needs. The virtual store can be more creative than the restrictions placed on the physical stocking of goods on shelves; however, manufacturers will need to provide ‘pre-packaged’ electronic product information for ordering on the Web.

The Logistical Challenges

Forecasts of the growth of online retail services are invariably demand- driven and assume that it will be possible to deliver orders to the home at a cost and service standard home shoppers will find acceptable. This is a bold assumption. Over the past decade many e-tail businesses have failed primarily because of an inability to provide cost-effective order fulfilment. Several market research studies have identified delivery problems as a major constraint on the growth of home shopping. Anderson Consulting (quoted in Metapack, 1999), for example, found that six of the 10 most frequently quoted problems with online shopping were related to fulfilment. As Verdict (2000) notes, ‘Persuading customers to buy direct once is relatively simple. Keeping them coming back is far more difficult and is dependent on their satisfaction with all stages of the delivery experience.’ A survey by Ernst and Young (2000) also revealed that high shipping costs were a major concern of potential online shoppers in the UK, the United States, France and Germany.

The greatest logistical challenges are faced by companies providing a grocery delivery service to the home. They must typically pick an order comprising 60–80 items across three temperature regimes from a total range of 10–25,000 products within 12–24 hours for delivery to customers within 1–2 hour time-slots. For example, Tesco is currently picking and delivering an average of 110,000 such orders every week. New logistical techniques have had to be devised to support e-grocery retailing on this scale.

Online shopping for non-food items has demanded less logistical innovation. Catalogue mail order companies have, after all, had long experience of delivering a broad range of merchandise to the home, while some major High Street retailers have traditionally made home delivery a key element in their service offering. Online shopping is, nevertheless, imposing new logistical requirements. First, it is substantially increasing the volume of goods that must be handled, creating the need for new distribution centres and larger vehicle fleets. Second, many online retailers are serving customers from different socio-economic backgrounds from the traditional mail order shopper. As they live in different neighbourhoods, the geographical pattern of home delivery is changing. Third, online shoppers typically have high logistical expectations, demanding rapid and reliable delivery at convenient times.

Definition of the Home Delivery Channel

The home delivery channel terminates at the home or a nearby customer collection point. It is less clear where it begins. For the purposes of this review, the start of the home delivery channel will be defined as the ‘order penetration point’ (Christopher, 1992). This is the point at which the customer order, in this case transmitted from the home, activates the order fulfilment process. This physical process usually begins with the picking of goods within a stockholding point. Only when picked are the goods designated for a particular home shopper. Distribution downstream from this point is sometimes labelled J4U, ‘just for you’.

With the move to mass customization, an increasing proportion of customer orders are penetrating the supply chain at the point of production. Consumers, for example, can configure a personal computer to their requirements online and relay the order over the Web straight to the assembly plant. Where this occurs the home delivery channel effectively starts at the factory.

Within multi-channel retail systems, this order penetration point is the point at which home deliveries diverge from the conventional retail supply chain which routes products to shops. For example, in the case of those supermarket chains that have diversified into home shopping, the order penetration point is either the shop or a local fulfilment (or ‘pick’) centre, where online orders are assembled. Both of these outlets draw supplies from a common source, the regional distribution centre. It makes sense, therefore, to regard the home delivery channel for grocery products as starting at the shop or the pick centre.

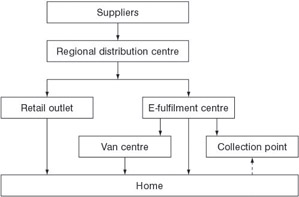

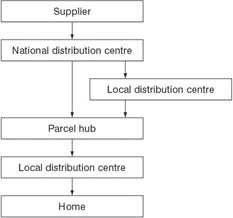

While the upper levels of the home delivery channels for grocery and non-food products are markedly different (Figure 9.1), the last link in the chain (the so called ‘last mile’) presents similar logistical problems for different types of online retailer. We will examine first the ‘upstream’ fulfilment process and then focus on the ‘last mile problem’.

Figure 9.1a: Online Grocery Distribution

Figure 9.1b: Delivery of Online Order via Parcel Network

Distribution of Online Purchases of Non Food Items

The distribution of these items normally exhibits the following characteristics:

- They are generally supplied directly to the home from the point of production or a central distribution centre. Each order comprises a small number of items (often just one) and the order picking is centralized at a national or regional level. A large proportion of the orders are channelled through the ‘hub and spoke’ networks of large parcel carriers or mail order companies. By carrying a loose assortment of orders, the vehicles operated by these companies typically have lower load factors than those achieved by vehicles moving solid pallet- loads of products through the traditional echelon-type distribution channels which supply conventional retail outlets.

- Within these J4U delivery networks, each order must be individually packaged at the central distribution point. This not only increases the volume of packaging in the supply chain: it also takes up more space on vehicles in both the forward and reverse channels.

- Within home shopping systems, whether catalogue- or Internetbased, there is a large flow of returned product. Typically, around 30 per cent of non-food products delivered to the home are returned to etailers (in contrast to 6–10 per cent for ‘bricks and mortar’ retailers) (Nairn, 2003). This requires a major reverse logistics operations comprising the retrieval, checking, repackaging and redistribution of returned merchandise.

Wide fluctuations in online demand for particular products, particularly newly released items, can cause the flow of freight through home delivery channels to surge. This was illustrated by the distribution of the fourth and fifth Harry Potter books through the Amazon.com networks to arrive on the doorsteps of tens of thousands of households on the day of publication. In the United States, for example, Fedex delivered 250,000 copies of the fifth book in the series for Amazon on its publication date, using its network of 130 overnight flights and 20,000 ‘home delivery contractors and Fedex express couriers’.

Concerns have been expressed that online retailing is likely to generate more transport and impose a heavier burden on the environment than store-based retailing (Hesse, 2002). Research by Matthews, Hendrickson and Soh (2001), however, suggests otherwise. They compared the externalities associated with the distribution of books through a conventional retail channel and from an online bookseller, and came to the conclusion that the latter was less environmentally damaging. According to their calculations, which included ‘trucking, air freight, production, packaging and passenger trips’, energy consumption, air pollution, greenhouse gas emissions and the quantity of hazardous waste were respectively 16 per cent, 36 per cent, 9 per cent and 23 per cent lower in the case of online retailing.

Distribution of Online Grocery Sales

In contrast to the average general merchandise order, which comprises from one to three separate items, the average online grocery order contains 60–100 items, many of which are perishable and need rapid picking and delivery. This requires localized order picking in either an existing shop or a dedicated fulfilment (or ‘pick’) centre. Over the past few years there has been much discussion of the relative merits of store-based or fulfilment centre picking.

The main advantage of store-based fulfilment is that it minimizes the amount of speculative investment in new logistical facilities for which future demand is uncertain. Webvan, for example, was planning to build a network of 26 new automated warehouses, at a cost of approximately US $35 million each, to provide e-grocery delivery across the United States. Fewer than half of these warehouses were set up before the company went bankrupt in 2001. As a ‘pure player’ in the e-grocery market, Webvan did not have an established chain of retail outlets and would have had to form an alliance with an existing retailer to adopt the store-based model. Four British supermarket chains (Sainsbury, Asda, Somerfield and Waitrose), as ‘bricks and clicks’ retailers, had the option of pursuing store-based or pick-centre fulfilment and opted initially for the latter. Tesco, by contrast, opted for the store-based model. Its experience is described below.

Basing home delivery operations at existing shops allows retailers to improve the utilization of their existing assets and resources. Retail property can be used more intensively and staff shared between the store and online operations. It is possible to pool retail inventory between conventional and online markets, improving the ratio of inventory to sales. This also gives online shoppers access to the full range of products available in a supermarket to which most of them will be accustomed.

Another major benefit of shop-based fulfilment is that it enables the retailer to achieve a rapid rate of geographical expansion, securing market share and winning customer loyalty much more quickly than competitors committed to the fulfilment centre model.

On the negative side, however, integrating conventional and online retailing operations in existing shops can impair the standard of service for both groups of customer. The online shopper is disadvantaged by not having access to a dedicated inventory. Although a particular product may be available on the shelf when the online order is placed, it is possible that by the time the picking operation gets underway conventional shoppers may have purchased all the available stock. Where these in- store customers encounter a stock-out they can decide themselves what alternative products to buy, if any. Online shoppers, on the other hand, rely on the retailer to make suitable substitutions. Substitution rates are reckoned to be significantly higher for store-based fulfilment systems than for e-grocers operating separate pick centres. For example Ocado, the only UK e-grocer to rely solely on a pick centre, claims that it can achieve substitution rates of less than 5 per cent, whereas customers using its store-based competitors sometimes experience substitution rates more than twice this level (McClellan, 2003). In comparing substitution rates, however, allowance must be made for difference in product range. Ocado’s range of around 10,000 products is less than half that of the major supermarket chains engaged in online shopping.

Doubts have been expressed about the long-term sustainability of store- based fulfilment. As the volume of online sales expands, conflicts between conventional and online retailing are likely to intensify. At the ‘front end’ of the shop, aisles may become increasingly crowded with staff picking orders for online customers. In practice, however, much of the picking of high-selling lines is done in the back store-room. It is at the ‘back end’ that space pressures may become most acute. Over the past 20 years the trend has been for retailers to reduce the amount of back storage space in shops as in-store inventory levels have dropped and Quick Response replenishment become the norm. This now limits the capacity of existing retail outlets to support the online order fulfilment operation. New shops can, nevertheless, be purpose-built to integrate conventional retailing and online fulfilment. The Dutch retailer Ahold has coined the term ‘wareroom’ to describe a dedicated pick facility colocated with a conventional supermarket (Mees, 2000).

Most of the purpose-built fulfilment centres so far constructed are on separate sites. They offer a number of logistical advantages over store- based picking. As their inventory is dedicated to the online service, home shoppers can check product availability at the time of ordering and, if necessary, alter their shopping list. The order picking function should also be faster and more efficient in fulfilment centres, as they are specially designed for the multiple picking of online orders with high levels of mechanization. Significant teething problems with the early fulfilment centres set up in the UK, however, resulted in pick rates falling well below target levels.

To be cost-effective, dedicated pick centres must handle a large throughput. The threshold level of throughput required for viability also depends on the breadth of the product range. It is very costly to offer an extensive range in the early stages of an e-tailing operation when sales volumes are low. Offering a limited range can cut the cost of the operation but make it more difficult to lure consumers from conventional retailing. Another inventory-related problem which retailers using pick centres have encountered is the difficulty of disposing of excess stocks of short shelf-life product. When over-stocking occurs in a shop, consumer demand can be stimulated at short notice using price reductions or in- store merchandising techniques. It is more difficult using electronic media to clear excess inventory of fresh produce from fulfilment centres that consumers never visit.

Several studies have argued that store-based fulfilment is more appropriate in the early stages of a retailer’s entry into the e-grocery market. It represents a low-risk strategy and allows new business to be won at a relatively low marginal cost. As the volume of online sales grows, however, the cost and service benefits of picking orders in a dedicated centre steadily increase until this becomes the more competitive option. Several break-even analyses have been conducted to estimate the threshold online sales volume at which the fulfilment centre model is likely to be superior. This volume is likely to vary from retailer to retailer depending on the size and layout of shops, the nature of the upstream distribution system, the product range and the customer base. It will also be highly sensitive to the allocation of retail overheads between the conventional and online shopping operations.

A further complicating factor is the geography of the retail market. The relative efficiency of the two types of fulfilment is likely to vary with the density of demand and level of local competition in different parts of the country. In a mature e-grocery market, dedicated pick centres may serve the conurbations, while store-based distribution remains the most cost-effective means of supplying the rural hinterlands. The US e-grocer Peapod has a policy of using store-based fulfilment when penetrating new local markets, working in collaboration with retail chains. Once volumes have reached an adequate level, as in Chicago and San Francisco, the company has invested in ‘distribution centres’.

Experience in the UK suggests that most new entrants to the e-grocery market opted for the fulfilment model prematurely. Somerfield and Asda both set up pick centres and closed them down within a couple of years. Sainsbury was also originally wedded to the fulfilment centre concept, establishing two centres in London (Park Royal) and Manchester. It shut the Manchester depot in 2001 and has been expanding its online business primarily through store-based fulfilment. It is now generally acknowledged that at the present level of e-grocery sales in the UK, the store-based distribution model, pioneered by Tesco, is the most cost-effective. By supplying online orders from its existing shops Tesco has secured 60 per cent of the UK e-grocery market, achieved 95 per cent coverage of the UK retail market and established itself as the world’s largest online retailer. Through an alliance with the US retail chain Safeway, it has successfully exported its system of store-based fulfilment to North America.

The Last Mile Problem

In making the final delivery to the home, companies must strike an acceptable and profitable balance between customer convenience, distribution cost and security. Most customers would like deliveries to be made urgently at a precise time with 100 per cent reliability. This would minimize waiting time and the inconvenience of having to stay at home to receive the order. Few customers would be willing to pay the high cost of time-definite delivery, however.

The relationship between the width of home delivery ‘windows’ and transport costs has been modelled for the London area by Nockold (2001). Expanding the window from 180 minutes to 225 minutes and 360 minutes was found to cut transport costs by, respectively, 6–12 per cent and 17–24 per cent. Eliminating the time constraint completely yielded cost savings of up to a third. Similar research undertaken in Helsinki has indicated that transport cost savings of 40 per cent are possible where carriers can deliver at any time during the 24-hour day.

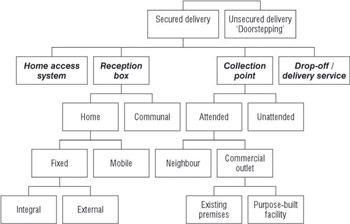

Such flexibility can usually only be achieved where a system of ‘unattended delivery’ is available. Figure 9.2 provides a classification of the main forms of unattended delivery (McKinnon and Tallam, 2003). A fundamental distinction exists between unsecured and secured delivery. Unsecured delivery, sometimes called ‘doorstepping’ in the UK, involves simply leaving the consignment outside the house, preferably in a concealed location. This eliminates the need for a return journey and can be convenient for customers, but obviously exposes the order to the risk of theft or damage.

Figure 9.2: Classification of Unattended Delivery Systems

When no one is at home, the delivery can be secured in four ways:

- Giving the delivery driver internal access to the home or an outbuilding.

- Placing the order at a home-based reception (or ‘drop’) box.

- Leaving it at a local collection point.

- Delivering the order to a local agency which stores it and delivers it when the customer is at home.

Home Access Systems

A prototype home access system has been trialled in the English Midlands. This system employed a telephone-linked electronic keypad to control the opening and shutting of the garage door. The keypads communicated with a central server, allowing the ‘home access’ agency to alter the pin codes after each delivery. When the driver closed the door, the keypad device issued another code number confirming that the delivery was made. At the same time a confirmation message was sent to the customer’s mobile phone or e-mail address. It was found that this system could cut average drop times from 10 minutes to 4 minutes and, if coupled with a 5-hour time-window, achieved a productivity level (measured in drops per vehicle per week) 84 per cent higher than the typical attended delivery operation (Rowlands, 2001).

Home Reception Boxes

Several types of reception box have so far been developed:

- Fixed, integral box: these can either be built into the house at the time of its construction or ‘retrofitted’. One system, installed in a few upmarket houses in the UK, comprises three chambers for ambient, chilled and frozen product and provides access directly into the kitchen.

- Fixed, external box: in the short/medium term, there is likely to be more rapid uptake of external boxes, which are much cheaper to install and do not require structural modification to the property. They typically have a keypad which is in communication with a service centre and can be activated by a single-use pin code issued to a delivery driver. Boxes vary in size and shape, and in some cases are either insulated or refrigerated to store products requiring temperature control.

- Mobile reception box: mobile reception boxes are filled by the supplier at their premises, delivered to the customer ’s home and secured temporarily to an outside wall. The main system of this type operating in the UK connects the box to an electronic device resembling an intercom (called the ‘Homeport’) by means of a steel cable. The supplier or carrier retrieves the box once it has been emptied and can use it to recover any returned items.

- Communal reception boxes: communal boxes are more suited to apartment blocks and generally comprise banks of lockers. One of the main systems employs luggage locker technology that has been extensively used in railway stations and airports around the world. These have been adapted to the role of reception box by establishing a communication link with a service centre which issues pin codes to delivery drivers and customers.

Collection Points

Having to travel to a collection point significantly reduces the convenience of home shopping and may only be acceptable to a small proportion of online shoppers. Market surveys suggest that for around two-thirds of home shoppers in the UK the most popular form of unattended delivery is leaving goods with neighbours (Verdict Research, 2000). Local shops, post offices, petrol stations and railway stations have also assumed the role of collection points. Communal reception boxes have been used in these locations to automate the collection process. With the customers’ approval, collection points can be used either as the initial delivery location or as a secondary dropping-off point when there is no one at home.

Local Drop off and Delivery

This represents an extension to the collection point service, where the company not only receives the order on the customer’s behalf but also delivers it to his or her home at a convenient time. When the goods arrive, the customer is notified by e-mail, phone or mobile text message, and asked to specify a narrow time window within which the goods can be delivered.

To date, there has been very limited investment in home reception facilities. Many of the companies marketing innovative solutions to the last mile problem have gone out of business, while others have redirected their attention to the faster growing and more lucrative B2B market for the unattended delivery of shop orders, spare parts and laundry. One of the first companies to introduce reception boxes, the American e-grocer Streamline, installed them within customers’ garages, essentially combining the home access system with the use of a box. The company failed to achieve long-term viability and ceased trading in 2000. The mobile reception box operator, Homeport, ran a trial in a district of London with the supermarket chain Sainsbury but this too did not prove commercially sustainable. Experience with reception boxes has been more encouraging in some other countries, such as Finland (Punakivi and Tanskanen, 2002). Investment in a fixed box at an individual home can only be justified at present where the customer makes regular use of an e- grocery service. The volume of non-food product being delivered to the home is still much too low to make such an investment worthwhile for the average household. For example, it has been estimated that in 1999 only around 17 packages were delivered to the average household in the UK (McKinnon and Tallam, 2003).

It is likely that, for the foreseeable future, communal reception boxes strategically located at public buildings, transport terminals and local shopping centres offer the best prospects of commercial viability. They appear to strike a reasonable balance between the conflicting demands of customer convenience, delivery efficiency and security. They can also integrate flows of B2C and B2B orders to achieve an adequate level of throughput.

Conclusions

Despite the collapse of the dot-com bubble, online retailing has been enjoying healthy growth in recent years, and this is predicted to continue. The future rate of growth will partly depend on the quality and efficiency of the supporting system of order fulfilment. After a shaky start, many etailers have established effective logistical systems and built up customer confidence in the delivery operation. This has been most easily achieved in the non-food sector, where well developed home delivery systems already existed and, in essence, only the ordering medium changed.

E-grocery logistics has presented more formidable challenges. In retrospect, the initial rush to build dedicated pick centres seems to appear reckless. Store-based fulfilment offers a surer path to market growth and profitability, though doubts remain about its longer-term sustainability if online grocery sales continue to grow at their current rate. The more successful ‘bricks and clicks’ retailers may eventually have to invest in new facilities to accommodate future growth. As consumers’ commitment to home shopping strengthens they too are likely to start investing in home reception facilities, partly to liberate themselves from the need to stay in for deliveries. Online retailers may also promote a switch to unattended delivery by passing on some of the resulting transport cost savings in lower delivery charges. This trend could be further reinforced by local authorities keen to constrain the growth in van traffic in urban areas and have more deliveries made during the night on uncongested roads.

References

Brynjolfsson, F and Smith, M (2000) Frictionless commerce? A comparison of internet and conventional retailers, Management Science, 46 (4), pp 563–85

CACI (2000) Who’s Buying Online?, CACI Information Solutions, London

Christopher, M (1992) Logistics and Supply Chain Management, Financial Times/Pitman, London

Department of Trade and Industry (DTI) (2001) @ Your Home: New markets for customer service and delivery, Retail Logistics Task Force, Foresight, London

Ellis-Chadwick, F, Doherty, N and Hart, C (2002) Signs of change? A longitudinal study of Internet adoption in the UK retail sector, Journal of Retailing and Consumer Services, 9 (2), pp 71–80

Ernst and Young (2000) Global Online Retailing, Ernst and Young, New York

Ganesh, J (2004) Managing customer preferences in a multi-channel environment using Web services, International Journal of Retail and Distribution Management, 32, forthcoming

Hesse, M (2002) Shipping news: the implications of electronic commerce for logistics and freight transport, Resources Conservation and Recycling, 36 (3), pp 211–40

Jones, D (2001) Tesco.com: delivering home shopping, ECR Journal, 1 (1), pp 37–43

Laseter, T, Houston, P, Ching, A, Byrne, S, Turner, M and Devendran, A (2000) The last mile to nowhere, Strategy and Business, 20, September, 40–48

Lavin, M (2002) Christmas on the Web: 1998 v 1999, Journal of Retailing and Consumer Services, 9 (2), pp 87–96

Mandeville, L (1995) Prospects for Home Shopping in Europe, FT Management Report, Pearson, London

Matthews, H, Hendrickson, C and Soh, D L (2001) Environmental and economic effects of e-commerce: a study of book publishing and retail logistics, Transportation Research Record, 1763, pp 6–12

McClellan, J (2003) Sweet smell of success, Guardian, 4 Sept

McKinnon, A C and Tallam, D (2003) Unattended delivery to the home: an assessment of the security implications, International Journal of Retail and Distribution Management, 31 (1), pp 30–41

Mees, M D (2000) The place of the food industry in the global e-commerce universe: Ahold’s experience, paper presented to the CIES conference on Supply Chain for E-commerce and Home Delivery in the Food Industry, Berlin

Metapack (1999) Be-ful-filled, Metapack, London

Michalak, W and Jones, K (2003) Canadian e-commerce, International Journal of Retail and Distribution Management, 31 (10), pp 5–15

Morganosky, M A and Cude, B J (2002) Consumer demand for online food retailing: is it really a supply side issue?, International Journal of Retail and Distribution Management, 30 (10), pp 451–8

Nairn, G (2003) Not many happy returns, Financial Times, 5 Feb

Nockold, C (2001) Identifying the real costs of home delivery, Logistics and Transport Focus, 3 (10), pp 70–71

Ody, P (1998) Non-store retailing, chapter 4 in The Future for UK Retailing, ed J Fernie, FT Retail and Consumer, London

Punakivi, M and Tanskanen, K (2002) Increasing the cost efficiency of efulfilment using shared reception boxes, International Journal or Retail and Distribution Management, 30 (10), pp 498–507

Reynolds, J (2001) The new etail landscape: the view from the beach, European Retail Digest, 30, pp 6–8

Reynolds, J (2002) E-tail marketing, chapter 15 in Retail Marketing, 2nd edn, ed P J McGoldrick, McGraw-Hill, London

Ring, L J and Tigert, D J (2001) Viewpoint: the decline and fall of Internet grocery retailers, International Journal of Retail and Distribution Management, 29 (6), pp 266–73

Rowlands, P (2001) Why access is the key, elogistics, 15, Nov/Dec Tanskanen, K, Yrjola, M and Holmstrom, J (2002) The way to profitable Internet grocery retailing – 6 lessons learned, International Journal of Retail and Distribution Management, 30 (4), pp 169–78

Taylor, E (2002) Swiss online grocer LeShop thrives thanks to low costs, Wall Street Journal, 15 Feb

Verdict Research (2000) Electronic Shopping, UK, Verdict, London

Wilson-Jeanselme, M (2001) Grocery retailing on the Internet: the leaking bucket theory, European Retail Digest, 30, pp 9–12

Preface

- Retail Logistics: Changes and Challenges

- Relationships in the Supply Chain

- The Internationalization of the Retail Supply Chain

- Market Orientation and Supply Chain Management in the Fashion Industry

- Fashion Logistics and Quick Response

- Logistics in Tesco: Past, Present and Future

- Temperature-Controlled Supply Chains

- Rethinking Efficient Replenishment in the Grocery Sector

- The Development of E-tail Logistics

- Transforming Technologies: Retail Exchanges and RFID

- Enterprise Resource Planning (ERP) Systems: Issues in Implementation

EAN: 2147483647

Pages: 119