Condensing the Sales Cycle

|

When you sell as a vendor, you invite the two-pronged costs of a drawn-out sales cycle. You incur the direct costs of selling over and over again until a sale is made or lost. Either way, you also incur opportunity cost. While you are waiting to close with one customer, you are delayed in starting up a new sales cycle with another. You pay this part of the price in lost opportunities or inflated costs for staff that could be smaller if it could be freed sooner to make the next sale.

Vendor sales cycles are unnecessarily prolonged because it is in the customer's interest to trade off time for the price cuts that inevitably accompany it. Consultative Selling makes time the customer's enemy. Delay works against the customer because it increases the opportunity cost of not improving profits day by day, week by week, and month by month. The longer the customer delays, the greater the cost. Once a revenue improvement or cost reduction is available, the customer must begin to flow it into operations or it is lost, either in whole or in part.

This internal pressure to improve profits provides customers with a strong incentive to close proposals. Each day's delay postpones payback of their investment and moves the eventual return on the investment at least one more day into the future. Because of the time value of money, each dollar they can obtain from working with you is worth more to them today than it will be worth tomorrow. If they have it today, they can invest it. By not having it until tomorrow, they sacrifice the value of both the principal and its interest.

By prolonging your sales cycle through vending, you sacrifice the contribution your own sales force can make to your profits. Assume that you currently have a twelve-month sales cycle, which is a common cycle in telecommunications and data processing system sales. Make the further assumption that each sales representative has an annual quota of $1.5 million and costs you $300,000 a year. If you can shorten the sales cycle by only one month through Consultative Selling, you can save $25,000 on the cost of each representative each year. The extra month of selling time will give you an incremental yearly gain of $125,000 in sales by each seller.

This adds up to a total improved contribution per representative of $150,000 a year. If ten representatives deliver the same incremental contribution, you will have achieved the equivalent contribution of one additional representative each year: $1.5 million that you will not have to spend a single dollar to realize. These virtual sales representatives are your most productive sellers because they generate only revenues, no costs.

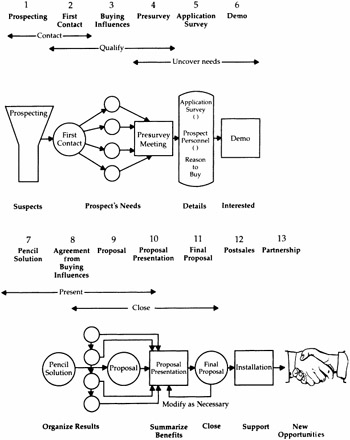

Figure I-3 shows the Hewlett-Packard sales cycle, typical of vendors. The close takes place, if at all, at the end of eleven successive steps.

Figure I-3: Vendor sales cycle.

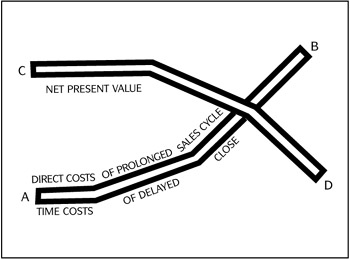

The origin of the time costs and direct costs in the H-P type of sales cycle are shown in Figure I-4. Line A-B represents the increasing direct costs of sales from a prolonged sales cycle. It also includes the opportunity costs of a delayed close that postpones the creation of a receivable. While these costs rise as the vendor sales cycle goes on, line C-D shows how the net present value (NPV) of the vendor's technology decreases over time, making it worth less when the customer finally decides to buy. The customer is being cheated of the supplier's value as well but is able to compensate for some of the loss by paying a lower price.

Figure I-4: Vendor sales cycle costs.

Applying a technology to add value to a customer business is a 180-degree different strategy from adding value to the technology. When you claim that your technology can be an enabler of improved customer profitability, you take on two new responsibilities. First, you must know the customer business well enough to know how to enable it. Second, you must know how much of a contribution you can make to its current values and how soon you can make it.

The second responsibility makes it necessary to learn how to convert technical values into economic values, in other words, to translate operating performance specifications into financial specifications.

The first responsibility introduces you to the customer's world of management acronyms:

-

You have to know each customer manager's CSFs (critical success factors) that compose the 20 percent of all the factors that person must manage that contribute 80 percent or more to success.

-

You have to know each customer manager's KPIs (key performance indicators) by which his or her success in managing the critical factors is measured and the objectives for improving them that each manager is tasked with. For each KPI you have to know the industry BOB (best of breed) or BP (best practice) against which your manager partners are being evaluated by their top managements.

-

You have to know the EVA (economic value added) that each customer manager is currently contributing to total profits, and you have to learn the economic value you are able to contribute over and above the current EVA. This is your "product." Its value in dollars and time becomes the basis for your price.

|

EAN: 2147483647

Pages: 105