Paying Federal Unemployment Compensation Taxes with Form 940

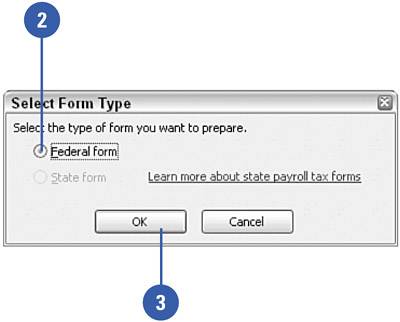

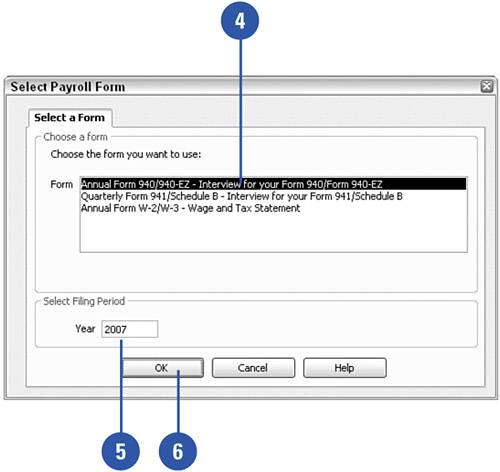

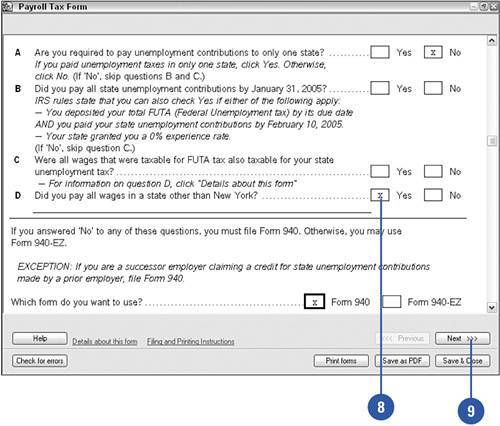

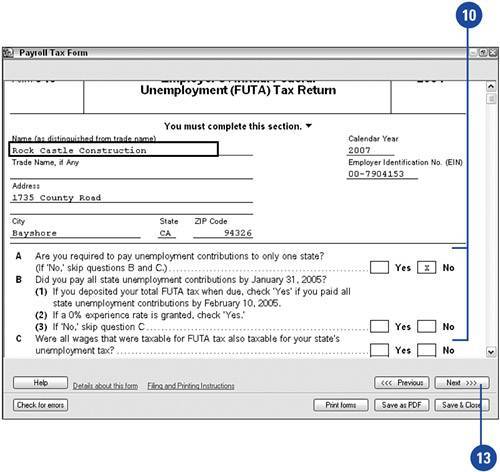

| Throughout the year, you might be required to make deposits of federal unemployment compensation tax. Once a year you are required to file a federal Form 940 reporting your annual unemployment compensation tax liability, and at that time you must arrange to pay any amount previously unpaid. QuickBooks can prepare this form for you to print, sign, and mail. Pay Federal Unemployment Compensation Taxes with Form 940

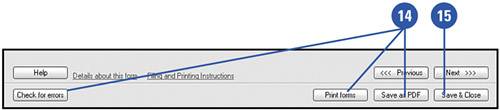

|