The Scope of the Economic-Financial Analysis of an Enterprise

|

| < Day Day Up > |

|

The typical process of granting credit covers stages as shown in Table 3.

| No | Stage | Result | Performer |

|---|---|---|---|

| 1 | initial acceptance of the credit application | application acceptance | credit inspector |

| 2 | estimation of legality of the enterpreneur | authentication (or lack of) the information and documents within an application | credit inspector |

| 3 | making analysis:

| data for the credit decision | credit inspector |

| 4 | deciding on the credit | terms of credit | authorized person |

| Source: The authors, based on scoring methodology (one of 10 biggest Polish banks acc. to "Gazeta Bankowa") | |||

The system presented in this paper is conceived to be helpful in the third stage of the process. This stage of preparing information for the credit decision is the longest and most expensive part of the credit granting process. Striving for consistency of the criteria in all agencies of bank involves definition of precise rules and using the same processing techniques.

Necessary conditions for granting working-capital credit are: [1]

-

current credit capacity of a customer

-

the estimated credit risk of the transaction has to be below the admissible level

-

customer is able to furnish collateral appropriately

Current credit capacity of a customer means his ability to repay the credit and interests in time. The ground to estimate the ability is the economic-financial analysis of his current position.

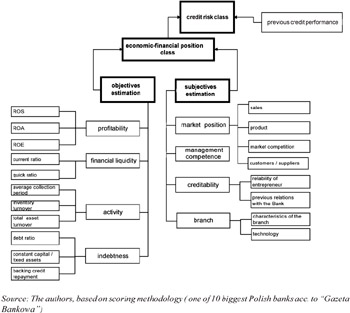

Figure 3: The model of credit risk estimation

To estimate the credit risk of the transaction one needs the information on:

-

the class of the economic-financial position (result of the analysis)

-

previous credit performance [2]

The result of the estimation defines credit risk level.

The key problem for the credit decision is defining the class of economic-financial position of a customer.

It was not our aim to create a model for estimating the position, but to present and to some extent compare presentation, and to some extent comparing the effectiveness of two techniques, using the same model. We use a model of estimation whose scope is in accordance with typical systems that are in use in many Polish banks.

To define the position of an enterprise we use a number of characteristics (factors) which characterize both the financial position of an enterprise and its business surroundings. Some of them are quantitative characteristics; others are qualitative. All are grouped into the nine areas of the analysis (Table 4).

| Quantitative factors | Qualitative factors | |

|---|---|---|

| 1 | profitability | market position of the firm |

| 2 | financial liquidity | management competence |

| 3 | activity | reliability of an enterpreneur |

| 4 | indebtedness | character of the industry |

| 5 | - | previous credit performance |

| Source: The authors, based on scoring methodology (one of 10 biggest Polish banks acc. to "Gazeta Bankowa") | ||

Quantitative characteristics use only financial data to calculate standard financial ratios (ROS, current ratio, etc.). That part of the analysis is called estimation of objective factors.

Qualitative characteristics present causal relations, which we cannot simply qualify, at least so far. They can be estimated only in a subjective way and are called subjective factors.

The structure of the characteristics in the model is hierarchic, which makes synthetic estimation of every area possible.

The multi-criteria estimation model makes it possible to regard different aspects of business activity and makes analysis wider.

The most significant parameters of the system are weights fixed for different attributes [3] and characteristics. Weights correspond with the influence on credit risk level. Generally, traditional scoring systems use statistical techniques for calculating weights (Janc & Kraska, 2001).

[1]None of these conditions are a satisfactory condition.

[2]As far as a new consumer is concerned (with no established credit at the bank), the position of the enterprise stays the only criteria.

[3]Attributes mean possible states of a characteristic.

|

| < Day Day Up > |

|

EAN: 2147483647

Pages: 174