Charging Expenses to a Customer

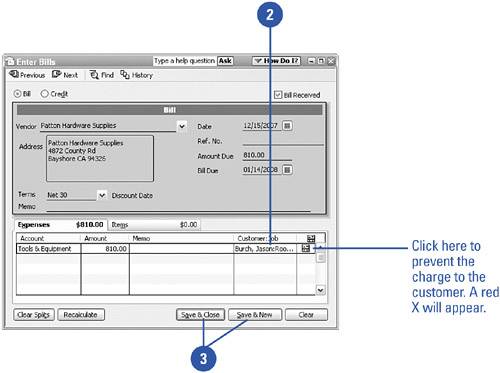

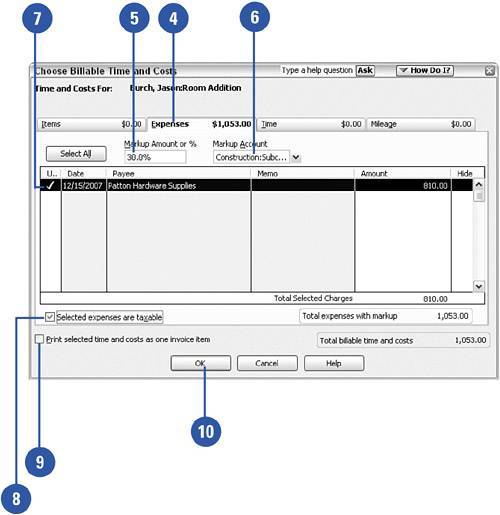

| When you make a purchase on behalf of a customer, you need to designate the customer on the bill. Then, when you create an invoice for the customer, you can request that expenses be charged as well as any other items that go on the invoice. You can also select a markup for the expense if you intend to sell this to your customer at a profit. Designate Customer When Making a Purchase

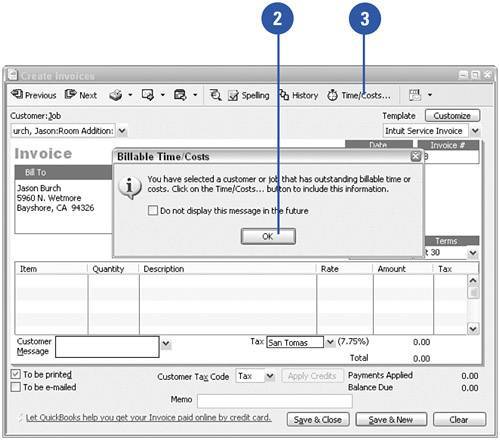

Place Expenses on a Customer Invoice

|