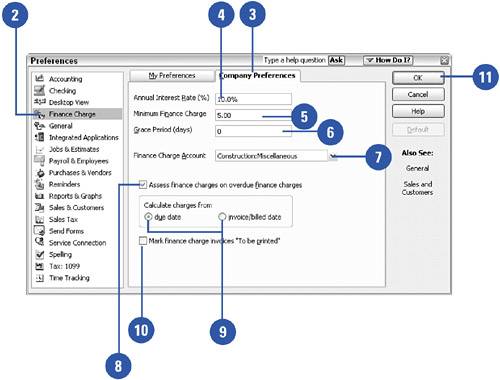

Setting Finance Charge Preferences

| Do you charge your customers a fee for late payments? If so, you can create several settings to ensure that the process of assessing finance charges is consistent and automatic. Any settings you establish here can be revised later, but you'll save yourself time by thinking through these options and configuring the settings before you start dealing with customers who made late payments.

|