Introduction

|

THIS BOOK links strategy and finance through a Step-Wise Approach to Value (SWAV). The Step-Wise Approach to Value is an analytical framework that combines strategic and financial analysis to evaluate Strategic Alternatives. The framework is conceptual in nature, so it has the flexibility to accommodate different types of cases. A Strategic Alternative (SA) is defined as an initiative that is implemented to increase shareholder value. The central premise of the SWAV is that the effectiveness of business strategy is validated through the creation of shareholder value.

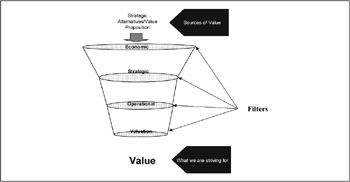

This work follows the analytical flow of the SWAV, as illustrated in Exhibit I-1. It is similar to a funnel because it becomes increasingly more difficult to pass through the filters. I will first examine how value is created. I will look at the following strategic alternatives: mergers and acquisitions, technology, reengineering, and outsourcing.

Exhibit I-1: The Step-Wise Approach to Value.

I will then discuss tools that are used in each filter. The goal is to develop a conceptual understanding of these analytical tools and how they are applied. The Step-Wise Approach to Value applies four filters, or screens, to assess the creation of shareholder value. The filters are designed to eliminate the Strategic Alternatives that do not have the prospect of creating shareholder value. As each filter is applied to an SA, one makes a decision to subject the Strategic Alternative to the tests in the next filter, or to remove it from consideration. A side benefit of SWAV is that it facilitates the planning process by continually focusing the planning group on viable alternatives.

What are the four filters in the SWAV framework? They are:

-

The economic filter

-

The strategic filter

-

The operational filter

-

The valuation filter

The Economic Filter

The economic and strategic filters take a macro view, which is a high-level assessment of a Strategic Alternative. These aspects of the SWAV involve analysis based on trends in the economy and industry.

Economic factors play a significant role in the successes and failures of businesses. In the case of large companies, value is tightly linked to the performance of the economy. As a company grows to Fortune 1000 proportions, this relationship increases in strength. Revenues, profits, and value tend to move in lockstep with economic conditions. This filter looks at key economic drivers and their impact on market demand. Our definition of market demand is simply:

Product Price Number of Buyers = Market Demand.

Based on market demand for a product or service, you can understand whether the Strategic Alternative will create or destroy shareholder value. This economic filter tests the alignment of the SA with the direction of market demand.

|

EAN: 2147483647

Pages: 117