Quantitative Methods in Project Contracts

Now this is not the end. It is not even the beginning of the end. It is perhaps the end of the beginning.

Sir Winston Churchill

London, 1942

Project Contracts

Contracts between suppliers and the project team are commonly employed to accomplish two objectives:

- Change the risk profile of the project by transferring risk from the project team to the supplier. Presumably, a due diligence examination of the supplier's ability to perform confirms that the supplier has a higher probability of accomplishing the scope of work in acceptable time at reasonable cost than does the project team. The decision-making processes discussed in this book provide a method and tool for making contracting decisions.

- Implement policy regarding sharing the project opportunity with participants in the supply chain. If the contract is related to a public sector project, public policy regarding small business and minority business participation may be operative on the project team. In the private sector, there may be policy to involve selected suppliers and customers in projects, or there may be policy to not involve selected participants in the project.

In this chapter, we will address project contracting as an instrument of risk management.

The Elements of a Contract

A contract is a mutual agreement, either oral or written, that obligates two or more parties to perform to a specific scope for a specified consideration, usually in a specified time frame. The operative idea here is mutual agreement. A contract cannot be imposed unilaterally on an unwilling supplier. In effect, as project manager you cannot declare the project to be in contract with a supplier, have an expectation of performance, and then return later and claim the supplier is in breach for not performing. Therefore, it is generally understood in the contracting community that the following five elements need to be in place before there is a legal and enforceable contract:

- There must be a true offer to do business with a supplier by the project or contracting authority.

- There must be a corresponding acceptance of the offer to do business by the supplier's contracting authority.

- There must be a specified consideration for the work to be performed. Consideration does not need to be in dollar terms. Typical contract language begins: "In consideration of _______, the parties agree......"

- The supplier must have the legal capacity to perform. That is, the supplier may not materially misrepresent the supplier's ability to perform.

- The statement of work (SOW) must be for a legal activity. It is not proper to contract for illegal activity.

Project and Supplier Risks in Contracts

Contracts are used largely to change the risk profile of the project. Project managers contract for skills, staff, facilities, special tools and methods, and experience not available or not available at low enough risk in the project team itself. Some contracts begin as "team agreements" wherein two companies agree to work together in a prime contractor-subcontractor role, whereas other contracts are awarded to a sole source, selected source, or competitive source. [1]

Regardless of how the two parties come together with a contract, the fact is that both parties assume some of the risk of the endeavor. Contracting cannot eliminate project risk; project risk can simply be made manageable by transference to a lower risk supplier. For the project manager, the primary residual risk, once the contract is in place, is performance failure on the part of the supplier. The supplier may run into unforeseen technical problems, experience business failures elsewhere that affect the project, or be subject to external threats such as changes in regulations or uncontrollable acts of God. Of course, depending on the type of contract selected, the project manager may choose to retain some or most of the cost risk of the SOW and only transfer the risk of performance to the supplier.

The supplier is on the receiving end of the risk being transferred out of the project. If the supplier is competent and experienced, and has the staff, tools and methods, facilities, and financial backing to accept the SOW, then the supplier's risk is minimized and the contract is a viable business opportunity for the supplier. Further, as mentioned above, the project manager may elect to retain the cost risk and thereby transfer only performance risk to the supplier. But, of course, in all contracting arrangements, the project is the supplier's customer. Customers in a contracting relationship are a source of risk. The project (customer) could breach the contract — by failing to provide specified facilities, information, technical or functional assistance — or could fail to pay or could delay payments.

Both parties seek to minimize their risk when entering into a contract. The supplier will be inclined to identify risks early enough so that provisions in the contract can cover the risks: more money, more time, and assistance in various forms. The project team will be inclined to seek performance guarantees and the means to reward upside achievement or punish downside shortfalls. Each party invokes its risk management plan when approaching a contract opportunity.

Contracting Vehicles

Contracts used to convey the SOW from the project to the supplier fall into two broad categories:

- Fixed price (FP) contracts that transfer both the cost and performance risk to the supplier. FP contracts require the contractor to "complete" the SOW. In this sense, FP contracts are "completion" contracts. FP contracts are appropriate when the scope of the SOW is sufficiently defined that a price and schedule can be definitely estimated and "fixed" for the required performance. FP contracts are inappropriate for many R&D activities where the scope of work is indefinite.

- Cost plus (CP) or cost-reimbursable contracts that transfer only a portion of the cost risk to the contractor (supplier) and require only a contractor's "best effort" toward completing the SOW. CP contracts are not completion contracts. CP contracts are the appropriate vehicle for R&D and other endeavors where the scope is not defined to the point that definitive estimates can be made. Although CP contracts have an estimated scope of work, the contractor is only bound to perform in a reasonable and competent manner. The contractor is not bound to "complete" the SOW since the true scope is unknown. Projects with large "rolling wave" plans are best accomplished with CP contracts.

In addition to the FP and CP categories that broadly define which party has the cost and scope risk in the arrangement, there are categories for handling the amount of profit that a supplier can make on a contracted scope of work:

- The profit (fee) could be built into the contract price and not visible to the project manager. Firm fixed price (FFP) contracts have only one dollar parameter: price. Only the supplier knows the potential profit in the deal; the profit is a combination of a risk premium to cover the supplier's assumed risk and a profit amount to earn the contractor's required return on cost.

- The fee could be fixed by mutual negotiation (fixed fee, FF). FF is appropriately combined with cost-reimbursable contracts.

- The fee could be variable depending on performance. Variable fees could be combined with either FP or CP contracts. Two fee types are typically employed: (1) an incentive fee that is paid according to a formula based on performance of either cost or schedule or both and (2) an award fee that is paid according to criteria of performance attributes. Award fee is not necessarily formula driven and the amount paid is always subject to the judgment and opinion of the award fee authority in the project.

[1]Sole source: there is only one contractor known to have the ability to perform the SOW. Selected source: a contractor selected without competition to perform the SOW. Competitive source: a contractor selected from among a peer group of competent offerors on the basis of competition.

The Mathematics of Project Contracts

Mathematical formulas enter the picture when the project manager seeks to dollar-quantify the risk transferred or retained by a contracting activity. Each contract type, whether FP or CP, has a set of mathematical parameters. Table 9-1 provides a summary of the major contract types and the principal financial parameters for each. In the following paragraphs, we will present examples of how these parameters are applied to various contracts. Let's begin with FFP.

|

Contract Type |

Contract Parameters |

|---|---|

|

Firm fixed price (FFP) |

Total price |

|

Fixed price incentive fee (FPIF) |

Target cost, target fee, target price, price ceiling, share ratio |

|

Fixed price award fee (FPAF) |

Total price, award fee, fee criteria |

|

Cost plus fixed fee (CPFF) |

Estimated target cost, fixed fee |

|

Cost plus incentive fee (CPIF) |

Target cost, target fee, target price, share ratio |

|

Cost plus award fee (CPAF) |

Target cost, target fee, target price, award fee, fee criteria |

|

Cost plus percentage of costs (CPPC) |

Actual cost, % uplift on cost |

|

Time and materials (T&M) |

Labor rates by labor categories, uplift fee on materials if any |

Fixed Price Contract Math

Firm Fixed Price Example

Scenario: A supplier is awarded an FFP contract for a special facility with certain specified features and functions. The contracted price is $100,000 and the schedule is 120 days. The facility is ready in time with all required features and functions. The supplier announces that the actual cost was only $80,000.

|

Q: |

How much does the project owe the supplier on obtaining a certificate of occupancy? |

|

Answers

|

A: |

$100,000. The price is firm and fixed regardless of whether the supplier overran or underran the estimates. |

Let us move to another form of FP contract, one with an incentive fee, called FPI (fixed price incentive). In an incentive fee arrangement, some of the cost risk is retained by the project, but the supplier is given the opportunity to earn more or less fee commensurate with performance. There are several financial parameters in the FPI calculation.

Fixed Price Incentive Example

Scenario: A supplier is awarded an FPI contract to build a special facility with certain specified features and functions. The contract cost (risk) sharing parameters are negotiated between the project and the contractor. In this example the parameters are as follows: the contracted target price (TP) is $100,000, the target cost (TC) is $85,000, the target fee (TF) is $15,000, the target return on cost (ROC) is equal to 15/85 = 17.6%, the ceiling price (CPr) is $110,000, and the sharing ratio (SR) is 80%/20% applied to cost. The schedule is 120 days.

In this example, the facility is ready in time with all required features and functions. Actual cost is denoted AC, the contractor's share is denoted SRc, and in this example SRc is equal to 20%.

The FPI formula is:

Contractor payable = (TC - AC) * SRc + AC + TF ≤ CPr

Case 1. The supplier announces that the actual cost was only $80,000, $5,000 below target cost; the supplier is paid according to the formula

Contractor payable ($000) = ($85 - $80) * 0.2 + $80 + $15 = $96 ≤ $110

ROC = (96 - 80)/80 = 20%

Case 2. The supplier announces that the AC = $95,000, $10,000 above TC:

Contractor payable ($000) = ($85 - $95) * 0.2 + $95 + $15 = $108 ≤ $110

ROC = (108 - 95)/80 = 16.25%

Case 3. The supplier announces that the AC = $105,000, $20,000 above TC:

Contractor payable ($000) = ($85 - $105) * 0.2 + $105 + $15 = $116 ≤ $110

In this case, the ceiling price is exceeded. The project's cost risk is capped at $110,000, so the contractor is paid only $110,000.

ROC = (110 - 105)/105 = 4.8%

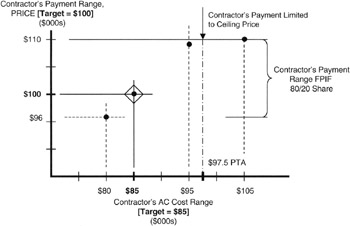

It is instructive to understand what supplier cost, adjusted for incentive sharing, exactly equals the risk cap of the project. For this case, the contract situation has reached the point of total assumption (PTA). Costs above the cost at PTA are borne exclusively by the supplier, as shown in Figure 9-1. Below the PTA, costs are shared by the project according to the sharing ratio. The cost at PTA is defined by the formula

Figure 9-1: FPIF Risk.

Cost at PTA: (TC - AC) * SRc + AC + TF = CPr

Solving for AC: AC at PTA = (CPr - TF - TC * SRc)/(1 - SRc)

In the example that we have been discussing, the AC at PTA is ($000):

AC at PTA = ($110 - $15 - $85 * 0.2)/(1 - 0.2) = $97.5

Cost Plus Contract Math

Let us look at the CP contract vehicle and see how the project manager's cost risk is handled. Recall that the CP contract is primarily applied in situations where scope is indefinite and a cost estimate cannot be made to the precision necessary for an FP contract. In all CP contracts, the cost risk (as different from the fee) is largely retained by the project. On the other hand, the fee can either be fixed (no risk to the project) or made an incentive fee, usually on cost. With an incentive fee, the project assumes some of the risk of the total fee paid.

The simplest example of CP contracts is the CPFF (cost plus fixed fee), wherein the contractor is reimbursed cost [2] and receives a fixed fee that is negotiated and set before work begins. [3]

Cost Plus Fixed Fee Example

Scenario: A software program is to be developed for which the estimated cost is $100,000. A fixed fee of $8,000 is negotiated before the work starts. The estimated ROC is 8%. What is the contractor paid under the following cases?

Case 1: AC = $90,000.

Answer:

Contractor payment = $90,000 + $8,000 = $98,000

ROC = 8/90 = 8.9%

Case 2: AC = $110,000.

Answer:

Contractor payment = $110,000 + $8,000 = $118,000

ROC = 8/110 = 7.3%

To reduce the risk to the project, the project manager decides to create an incentive on cost such that on a 70%/30% share ratio, the contractor participates in any cost savings. Let's see how this might work in the example just discussed.

Cost Plus Incentive Fee Example

Scenario: A software program is to be developed for which the estimated target cost is $100,000. An incentive fee (IF) of $8,000 is negotiated before the work starts; the target price is $108,000; there is no ceiling price. The project's cost liability is unlimited, as in all CP contracts, regardless of incentives. The sharing ratio is 70%/30%. src=30%. The estimated target ROC is 8% = 8,000/100,000. What is the contractor paid under the following cases ($000)?

Case 1: AC = $90, $10 under the estimated cost.

Contractor paid = AC + (TC - AC) * SRc + IF

Contractor paid ($000) = $90 + ($100 - $90) * 0.3 + $8 = $101.3

ROC = 11.3/90 = 12.6%

Case 2: AC = $110, $10 over the estimated cost.

Contractor paid ($000) = $110 + ($100 - $110) * 0.3 + $8 = $113.7

ROC = 3.7/110 = 3.4%

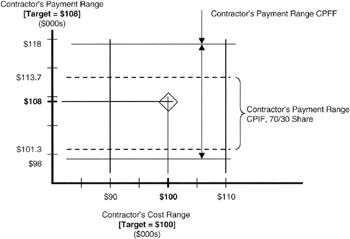

Now compare the two CP examples to see how the risk to the project manager changed with the introduction of the incentive fee on cost ($000). The cases are illustrated in Figure 9-2:

- Case 1: AC = $90. With the CPFF, the project paid $98, whereas on the CPIF the project paid $101.3.

- Case 2: AC = $110. With the CPFF, the project paid $118, whereas on the CPIF the project paid $113.7.

- The risk range for the CPFF is from $98 to $118, a range of $20; on the CPIF, the risk range is from $101.3 to $113.7, a range of a lesser figure of $12.4. The risk range has been reduced by employing incentives:

- Risk range improvement = (20 - 12.4)/20 = 38%

Figure 9-2: CPIF Risk.

Time and Materials Contract Math

A commonly employed contract vehicle for obtaining the services of temporary staff or to engage in highly speculative R&D is the time and materials (T&M) contract. The usual form of this contract is that the time charges are at a standard and fixed rate for a labor category, but there may be many different labor categories, each with a different labor rate, that are chargeable to the contract. Nonlabor items for all manner of material, travel, subsistence, and other things are charged at actual cost, or actual cost plus a small percentage uplift for administrative handling.

The T&M contract is somewhat of a hybrid, having FP rates but CP materials. In addition, the total charges for labor are wholly dependent on how much of what kind of labor is actually used in the contract. The T&M contract shares the CP problem of no limit to the dollar liability of the project. The contractor need only provide a "best effort" toward the SOW. There is no fixed or incentive fee. The fee is fixed on a labor rate, but the total fee paid is dependent on what labor rates are employed and how much of each is used in the performance of the tasks on the work breakdown structure.

Time and Materials Example 1

Scenario: Two labor categories are chargeable to the contract, developer at $75/hour and tester at $50/hour; 50 hours of the former and 100 hours of the latter are employed on the work breakdown structure. In addition, $500 in tool rental and $300 in training expense are chargeable to the contract. A 2% fee is assessed for material handling.

|

Q: |

What is the contractor paid at the end of services rendered? |

|

Answers

|

A: |

Contractor paid = $75 * 50 + $50 * 100 + ($500 + $300) * 1.02 = $9,566 |

The supplier is at some risk on T&M contracts, but compared to FFP, the supplier's risk is pretty minimal. The supplier's risk is in the difference between the actual salaries and benefits paid to the employees and the standard rates charged in the contract. If salaries are higher than the standard rates for the specific individuals provided, the supplier will lose money. Consider the following example.

Time and Materials Example 2

Scenario: For the T&M scenario given above, assume that two developers, Tom and Mary, are provided for 25 hours each. Including benefits, Mary makes $76/ hour, more than the standard rate, and Tom makes $65/hour, less than the standard rate. Each billable hour by Mary is a loss for the supplier, but each billable hour by Tom is profitable. Susan is provided as the tester and her salary is $48/hour, again profitable at the standard rate.

|

Q: |

What is the contractor's ROC on this deal, considering only the labor (time) component? |

|

Answers

|

A: |

Cost = 25 * 76 + 25 * 65 + 100 * 48 = $8,325 Revenue on labor = $75 * 50 + $50 * 100 = $8,750 ROC = ($8,750 - $8,325)/$8,325 = 5.1% |

[2]In cost-reimbursable contracts, the contractor's costs consist of three components: direct costs of performance for labor and material (nonlabor) applied exclusively to the contract; overhead costs attendant to the direct costs, usually for managers, buildings, general supplies like pencil and paper, utilities, and so forth; and general and administrative costs (G&A) that cover marketing and sales, general management, finance and accounting, independent R&D, and human resources. Overhead and G&A are applied through multiplying the direct costs by a rate that recovers the overhead and G&A proportionately. For instance, if the overhead rate is 110% and the G&A rate is 35%, then for every direct dollar of cost, the project is charged $1.10 additional for overhead and $0.35 for G&A, making the burdened cost to the project of a direct dollar of cost equal to: $1 direct + $1.10 overhead + $0.35 G&A = $2.45.

[3]For organizations that routinely engage in CP contracting, guidelines are developed for calculating fee. Normally these guidelines are published for both parties, the contractor and the project. The guidelines help identify the fee rate given the fact that the contractor's cost risk is all but zero. Without risk, the fee represents more of an opportunity cost wherein the project is seeking to attract the contractor's assets rather have some other opportunity capture the contractor's capability.

Summary of Important Points

Table 9-2 provides the highlights of this chapter.

|

Point of Discussion |

Summary of Ideas Presented |

|---|---|

|

Project contracts |

|

|

Project and supplier risks |

|

|

Contract vehicles |

|

|

Fees in contracts |

|

Preface

- Project Value: The Source of all Quantitative Measures

- Introduction to Probability and Statistics for Projects

- Organizing and Estimating the Work

- Making Quantitative Decisions

- Risk-Adjusted Financial Management

- Expense Accounting and Earned Value

- Quantitative Time Management

- Special Topics in Quantitative Management

- Quantitative Methods in Project Contracts

EAN: 2147483647

Pages: 97