Introduction

|

The pricing of a product or service refers to the pricing models and processes involved in determining a firm's price. The firm's strategy typically dictates the type of pricing model chosen, such as a high volume, low penetration strategy. Physical goods are frequently discounted if a large enough quantity is ordered.

Web-based marketers are already producing interesting pricing strategies. Some sites providing free services for visitors in order to create a community for which it can sell advertising space, such as www.parenthood.com. A more dramatic move is for a site to pay customers to use its services. Frequent purchase systems are also being used to help strengthen customer loyalty and encourage repeat buying. Because of the development of search engines, consumers are easily able to compare prices of many products/services offered for sale on the Internet.

One question raised by the increased use of Internet for price comparison is—Will prices be forced down to the lowest possible point? Clearly, increased competition and consumer buying power will force prices down somewhat, but other attributes such as service, availability, vendor reliability, incentives, warranty, refund/exchange policies and so forth are also important in the purchasing decision. Further, the differential pricing scheme presents a challenge for Web-based electronic sites. Price is an extremely important factor in purchasing decisions, but intelligent enterprises engaging in electronic commerce must also develop value-based pricing strategies, which call for increasing perceived value and then settling the price at a level compatible with that value. Those businesses that charge a premium have the challenge of providing customers with premium service and possibly premium products.

Today the questions managers of intelligent enterprises ask when deciding a price for their products/services to be sold online are as follows:

-

Can we change the way we price products and services using technology?

-

Should we use optimal dynamic pricing (Kambil & Agrawal, 2002) or revenue optimisation techniques?

-

Are we pricing at a premium for the latest technology or at a discount for commodity products?

-

Do we charge extra for post-sales service?

-

Do we offer financing to aid the purchase of the product?

These are just a few of the questions that managers of intelligent enterprises have trouble answering due to the dynamic nature of the Internet.

Since pricing of the product is crucial to the survival of the business, managers should pay a lot more attention to it. Pricing has become dynamic and it has to be reviewed at almost a daily or weekly basis (Kambil & Agrawal, 2002). It is no longer enough to have just a good website with fancy features; it is also how to price the products online as customers now have a number of sites to choose from.

Low-Pricing Myth

Contrary to conventional wisdom, the Internet offers tremendous advantages to companies that use its capabilities to set and manage prices more astutely for their products and services. These advantages far outweigh what is possible offline and permit a more precise and timely alignment of price with customer value, competitive actions, and market conditions.

Indeed, evidence is building that rather than pushing prices universally downward and squeezing margins, the Internet provides unique opportunities in pricing to enhance margins and generate growth. To capture that advantage, companies must understand that there's often a big difference between what consumers say and what they do. For example, 75 percent of respondents in an Ernst & Young survey identified low price as an important driver of their online shopping, contrasted to 50 percent for convenience and 48 percent for selection. Low price was identified by a similar margin in a joint Jupiter Communications/NFO Worldwide survey.

Behavioural research suggests, however, that neither individual consumers nor businesses are overly aggressive online price shoppers. Researchers at McKinsey & Co. analysed actual online behaviour using a sample of the most active online consumers among the Media Metrix U.S. panel of 50,000 people under measurement (Marn et al., 2000). They found that:

-

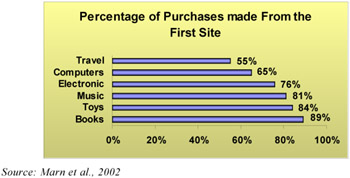

Eighty-nine percent of online book buyers purchase from the first site they visit, as do 84 percent of toy, 81 percent of music, and 76 percent of electronics buyers online.

-

More than 29 percent of users are "Simplifiers," looking more for the promise of superior "end-to-end" convenience rather than price.

-

The 36 percent who use the Internet primarily to connect with friends and family generally default to their offline brand preferences if they do buy online.

-

Only 8 percent of users are "Bargainers," finding entertainment value by aggressively searching for the best deals online.

Figure 1 illustrates the percentage of online purchases made by online shoppers from the first site that they visited.

Figure 1: Percentage of Online Purchases Made from the First Site Visited.

Furthermore, low-priced competitors online seldom command greater market share. Between 1997 and 1999, for example, market leaders Amazon.com and Barnes & Noble raised online book prices by 8 percent and 7 percent, respectively, while discount competitor Books-A-Million lowered prices by 30 percent. Even with the proliferation of shopping bots, Amazon's market share increased from 64 percent to 72 percent and Barnes & Noble's from 12 percent to 15 percent. Next, we look at how the Internet affects pricing.

|

EAN: 2147483647

Pages: 195