Hotspot Operator Layer

|

| < Day Day Up > |

|

Numerous new businesses provide the technology, know-how, and back-office operations necessary for operating a HotSpot in a venue location. In this book, these businesses are referred to as "HotSpot operators," although they are also known as "resellers," "WISPs," or "microcarriers." Included in this layer are a multitude of small players, such as Deep Blue, Ikano, Surf and Sip, and Cafe.com, and a few large ones, e.g. T-Mobile (which has the largest footprint) and Wayport (with around 450 locations). This is the layer that holds the future of the WISP industry, since the marketing strategy of these companies is what's driving the current explosion in HotSpot availability.

Outside the U.S., the HotSpot phenomenon is just as extraordinary. Two major telcos in South Korea have installed around 10,000 HotSpots, and plan to ultimately deploy 25,000 in their efforts to saturate the country with Wi-Fi signals. In Australia, two telcos-Telstra and Optus-are rolling out HotSpots in retail outlets and other locations. In the U.K., British Telecom (BT) and several independent HotSpot operators are ramping up the HotSpot market. For instance, BT customers can buy DSL service together with a wireless modem and a subscription to BT's "Openzone" HotSpots. The Swedish cellular carrier, Telia, has launched its own HotSpot division, which it calls "HomeRun." HomeRun has already installed a few hundred HotSpots in locations throughout the Nordic peninsula. Telia recently entered into a roaming agreement with both BT and Finnish cellular operator Sonera, allowing either network's customers to roam freely into the other.

France's top three telecommunications providers have also joined the Wi-Fi hit parade. All three are aggressively deploying HotSpot networks. In addition, as of September 2003, France Telecom SA (through its mobile subsidiary Orange France), SFR, and Bouygues Telecom will allow a subscriber of one network to access a HotSpot owned and operated by either of the two other carrier's HotSpot network-a move touted by analysts as Europe's first high-profile domestic roaming agreement.

The start-up costs of a HotSpot operator business model are relatively low. Of course, there are the normal accouterments of any new business (office, utilities, etc.), but other than that, the software and gear to outfit a venue for wireless Internet access require relatively little overhead. Once you get past those needs, what follows is the execution of the business plan as it has been laid out.

The physical characteristics of Wi-Fi technology enable a HotSpot operator to start on a very small scale-covering one café, or one small apartment house-then enlarging its footprint from there (e.g. adding a neighborhood restaurant, gas station and laundromat, etc.). That is exactly how the southern California HotSpot operator, Cafe.com, got its start. The founders of Cafe.com, however, didn't just decide one day to become a HotSpot operator. They researched the market for this type of service in their geographical market, and learned all they could about the content and marketing side of the HotSpot operator business model. Once they had the confidence that their venture could succeed, they researched what gear and software they should use when setting up a HotSpot venue. With this information in hand, they decided to install HotSpots with access controllers from Tri-M, access points from GemTek, and NetNearU software for system monitoring, performing user authentication, and processing online payment.

Up to this point, the founders had used their own money to fund the venture, but the advance work outlined above positioned them to approach angel investors from whom they eventually raised $150,000. With everything in place, the Cafe.com network was born, one venue at a time.

Cafe.com's first venue client, the Novel Café in Santa Monica, initially operated in a controlled environment. The founders, Ronan Higgins and Chris Van Vleit, launched the HotSpot in "stealth mode," i.e. no fanfare, no press releases. They wanted to test the network under real network conditions. Even without any public announcement, the Novel Café HotSpot saw slow but steady growth in network usage. It wasn't long before both Higgins and Van Vleit were convinced that they had the right mix-technology, skillset and marketing-to expand their network. The HotSpot operator gradually added more cafés, and as of this writing, Cafe.com has HotSpots in nearly 20 venues and, according to founder Ronan Higgins, hopes to add at least ten more before the end of 2003.

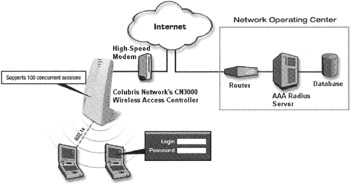

An access controller is a hardware device that resides on the wired portion of the network between the access point(s) and the protected side of the network. (See Fig. 11.3.) This device provides the centralized intelligence behind the access point(s). It regulates traffic between the relatively open WLAN and the typically guarded internal network resources. Although access controllers can be used in a wide range of wireless LAN applications (e.g. a corporation might use an access controller in order to prevent an unauthorized user from getting entry to sensitive data and applications contained in its internal network), in the case of a HotSpot, an access controller regulates end-user access to the Internet by authenticating and authorizing those users based on a subscription plan. Many HotSpot-specific access controller products also provide access point capabilities, eliminating the need for a separate access point device, e.g. the Colubris Network CN3000 Wireless Access Controller.

Figure 11.3: Example of a HotSpot deployed by a HotSpot operator using a wireless access controller. In this instance it is Colubris Networks' CN3000 Wireless Access Controller, which is designed for small to medium HotSpots, such as an Internet café or a small hotel. The functionality included in the CN3000 provides, among other things, access point capabilities, a full router, a customizable firewall, a RADIUS AAA (Authentication, Authorization, and Accounting) client, customizable login pages, per session per user access lists, an embedded VPN client for secure remote manageability, directed traffic to ensure the integrity of the HotSpot operator's back-office Network Operating Center (NOC), and more.

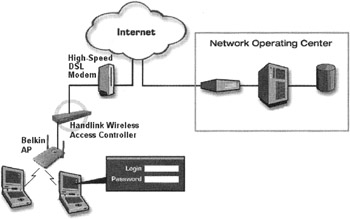

Currently, the Cafe.com HotSpot provisioning model supplies the venue operator with all of the necessary hardware and software, which now consists of a Handlink wireless hotspot access controller, Belkin access point(s), cabling, and surge protection. If necessary, Cafe.com also will install the high-speed Internet service, which is provided by either DSL Extreme (Los Angeles) or Verizon. If necessary, Cafe.com personnel will go to the venue, install the access controller and access point, and do whatever is required to get the HotSpot up and running. Cafe.com bears all of the up-front setup costs. (The network layout would be similar to that depicted in Fig. 11.4.)

Figure 11.4: A Cafe.com venue owner's HotSpot network would look something like this.

After the node is operational, Cafe.com provides all of the support needed to be a HotSpot, including taking care of customer authentication and billing, sending informational emails to customers, and providing the necessary marketing materials to help grow usage. When an end-user logs onto Cafe.com's network, the system knows the location used and the venue that signed up or "owns" that customer. This information is then used to send the venue owners their commission checks and usage statements. The idea is to make it simple for the venue owner, akin to how telephone companies provide service and share revenue for payphones that they locate in various venues.

To increase its network value, Cafe.com has entered into partnership with larger, wireless access providers. Its partnership with NetNearU provides a network operating center with a NetNearU management system that supplies Cafe.com with an established remote management, credit card processing, and billing system, and also gives Cafe.com's network users access to the international GRIC network. Cafe.com also has entered into a two-pronged roaming partnership deal with Boingo Wireless, which provides (1) for Cafe.com to integrate its southern California-based Hotspots into the Boingo network, and (2) for Cafe.com to serve as a Boingo HotSpot reseller by transitioning additional HotSpots into the Boingo network using Boingo's installation solution.

Roaming partnerships, such as the ones into which Cafe.com has entered, are a win-win situation for everyone involved. The venue owner benefits through the HotSpot operator and the aggregator's marketing efforts. The HotSpot operator benefits not only by growth in its customer base, but also from a larger footprint for its network (e.g. Boingo Wireless's nationwide network and GRIC Communication's international network). For its part, the aggregator gains an infusion of new customers, and a larger footprint through the incorporation of Cafe.com's nodes into its network.

To counter the reluctance of some venue owners to contract for HotSpot placement, Ronan Higgins sometimes enters into a verbal agreement with the venue owner in order to develop a relationship and to prove the HotSpot's value to the venue. Once the HotSpot is up and running, the venue owner is usually willing to sign a formal HotSpot provision agreement. However, just because Higgins is willing to enter into temporary verbal agreements doesn't mean that he underestimates the importance of a fully executed location agreement. He knows that outside investors want to see signatures on paper binding the venue to the operator before they will even consider investing. He is also aware that success breeds competition-a successful venue will show up on the radar of other HotSpot operators who will be only too happy to steal a money-making venue from an incumbent HotSpot operator.

The HotSpot operators' market is still wide open and the individual HotSpot operator faces little competition. Currently, only a few thousand commercial HotSpots are in operation worldwide. The latest figures from the well-respected research firm Gartner Inc. estimates that by the end of 2003, there will be more than 75,000 HotSpots worldwide, up from a mere 6000 in 2002. (These numbers include FreeSpots-free Wi-Fi networks put up around libraries and other public spaces by local governments or by consumers who share their high-speed Net connections with neighbors.)

Ultimately, however as Gartner's data indicates, thousands of HotSpot operators, some of them very large, will flood the marketplace. And while this type of viral growth is healthy, it also causes fragmentation within the HotSpot layer. That's because anyone with a few hundred dollars to spend for a "HotSpot in a Box," access to a DSL line, and an "in" with the owner of a compelling HotSpot location, can become a HotSpot operator. And since even a large operator, such as T-Mobile or Cometa with their relatively unlimited bankrolls, won't be able to block out all of the small HotSpot operators, the fragmenting forces inherent in this layer's business model serve to ensure that no one single provider will ever own more than 10% or so of the total HotSpot footprint.

| Note | A "HotSpot footprint" refers to the range or radius of coverage for a typical HotSpot, which with current technology can range up to as much as 500 feet/164 meters for each access point installed. As more access points are installed, the footprint enlarges. |

Mainstream Data and Airpath Wireless have created a joint solution to offer carrier-class satellite Internet connectivity for HotSpot providers in need of broadband connectivity in remote or cost-prohibitive locations. Mainstream's high quality two-way VSAT network, allows Airpath customers to order low-cost broadband access anywhere in North America.

Using the integrated solution, HotSpot providers who use Airpath solutions (e.g. the Airpath WiBOSS system, which provides back office processing including authentication, accounting, subscriber management, and roaming settlement) can provide wireless high-speed Internet access at locations such as remote marinas, truck-stops, campgrounds, resorts, and hotels located in rural areas-locales where it previously was impractical to offer high-speed Internet access due to a lack of Internet infrastructure or the high cost of telephone data circuits.

The combined solution seamlessly integrates the technologies and services of Airpath and Mainstream into a scalable and extremely cost effective package. "Mainstream's satellite offering is an ideal solution for HotSpot providers looking for carrier class service, and is a very cost effective alternative for our providers in locations where terrestrial offerings are non-existent or cost prohibitive," says Todd Myers, Chairman and CEO of Airpath. "Our providers can now expand their HotSpot build-outs throughout North America and beyond the reach of traditional telco circuits."

Scott Calder, President and CEO of Mainstream comments, "We believe that Wi-Fi is a major step forward in the quest for ubiquitous connected computing and are pleased to be able to play an important role in making that happen. We are excited to be working with Airpath to expand the number of locations where always-on broadband connections are available to those equipped with Wi-Fi."

The Road to Success

A successful HotSpot operator must operate its network at a low cost and maintain a high volume of traffic and revenue. A HotSpot operator's monthly per venue costs are mostly fixed: depreciation of equipment, network management and maintenance, HotSpot maintenance, and possibly the cost of the HotSpot's pipe to the Internet. Then, once traffic volume overcomes these fixed costs, any additional revenue is pure margin. Thus, for profits to grow, it is essential that the operator sign as many partners as possible.

Most HotSpot operators assume that they will expand their initial footprint. After all, subscribers who have invested in a wireless LAN card and a subscription will want to connect to the operator's network in many different geographical locations.

HotSpot operators can expand their networks in a number of ways:

The most costly is to deploy access points in as many venues as possible. This means a massive investment in both time and capital, not only to build out the network but also to negotiate with venue owners, ISP's, service vendors, and manufacturers. In addition, since each HotSpot must be connected to a local ISP, the HotSpot operator must work within a complex system architecture consisting of gateways, servers, customer service and so forth. Finally, the end-user must be directed to a HotSpot by some type of marketing campaign, and be educated on the authentication process, security, and billing procedures through a combination of venue owner education, documentation, and customer support.

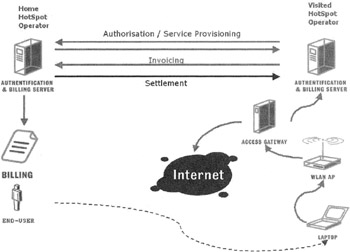

An easier and less costly way to expand a HotSpot operator's footprint is for the operator to enter into partnership agreements, i.e. bilateral roaming agreements with other HotSpot operators. This method eliminates some of the complexity within the WISP value chain (i.e. fewer ISPs and venue owners to deal with), although it still requires that the HotSpot operator possesses the skills to keep everything working smoothly especially in the area of authentication, authorization, and accounting (AAA).

Figure 11.5: When a HotSpot operator enters into bilateral agreements, it must have the wherewithal to adequately handle all of the back-end tasks.

Figure 11.6: When a HotSpot operator partners with an aggregator, the aggregator takes on most of the back-office chores.

| Note | A "value chain" refers to a group of organizations that work together to progressively add value in response to a market opportunity. The end result is that materials and/or services are transformed into something that can be purchased by the final consumer-the end-user. |

However, an even better approach may be to partner with an aggregator. Such a partnership can (1) take the headaches out of roaming agreements since the aggregator handles all of the negotiations concerning roaming-contracts, expansion of geographical coverage through the continuous addition of new roaming partners, etc., and (2), which is perhaps more important, spares the operator the back-office drudgery.

What if a HotSpot operator doesn't want to share its network, even for a fee? Well, in that case, it would be more difficult to recover the fixed costs of operating such a network. After all, HotSpot profitability is inevitably determined by traffic, which means opening the network to as many end-users as possible. Moreover, a non-sharing HotSpot operator that moves out of its domain of control (e.g. an owner of a small hotel chain selling its HotSpot operator services to other small chains) would soon find its venue owners becoming rebellious, demanding access to multiple HotSpot operators-they know the folly of holding their customers captive to a single product, be it coffee, hamburger, mystery books, or a HotSpot operator's closed network.

Hardware and software deployment as well as the management of the infrastructure to support an ever-expanding footprint require excellent co-ordination between many different components within the operator's value chain. This is especially true for the venue owners, since this group typically requires some handholding. Thus, unloading some of the back-office infrastructure, roaming agreement details, and other business processes to an aggregator can help a HotSpot operator and its venue owners to grow their businesses.

Minimizing Up Front Costs

Let's now look a little closer at what needs to be considered before jumping into the HotSpot market. Begin by investing some time in doing research. At minimum, your research should answer the following:

-

Is there a market for wireless Internet access in your area?

-

Will you set up your own network, or will you use a virtual network model (i.e. partner with an aggregator)?

-

How many HotSpots can your operation handle over the next year, two years, or five years?

FRANCHISE REGULATION This section is provided courtesy of the law firm of Wiley, Rein & Fielding LLP, a U.S.-based law firm specializing in wireless communications issues. Included in the firm's client list are the Wireless Information Networks Forum (WINForum), which pioneered the Unlicensed Personal Communications Services band at 2 GHz, and the Unlicensed National Information Infrastructure band at 5 GHz; UTAM, Inc., the joint industry frequency coordination body for 2 GHz LTCS spectrum; and the Wi-Fi Alliance (formerly the Wireless Ethernet Compatibility Alliance or WECA).

In July 2002, the firm issued a Wi-Fi primer entitled, "Wi-Fi-802.11: The Shape of Things to Come." That document includes sage advice, which with Wiley, Rein & Fielding LLP's permission, is set out below.

"Some participants in the Wi-Fi hotspot market fail to consider whether their business model subjects them to franchising regulations. Even if aggregators or hotspot providers do not think of themselves as selling franchises, they may be considered franchisors based on the setup of their business operations. If considered a franchise, a business is subject to additional regulation. In particular, in many states, franchisors are required to register with the state and to comply with disclosure procedures when marketing franchises. Additionally, franchisors are subject to additional substantive laws that prohibit them from engaging in certain practices and govern other elements of the franchise relationship such as requirements for termination.

"Generally, there are three elements that are necessary for a business model to be considered a franchise relationship. First, there is a trademark element that requires a franchisee to distribute products or services under the franchisor's service mark or trademark, Second, there is a control and assistance element that considers whether a franchisor exercises significant control or provides significant assistance to its franchisees in an ongoing relationship. Lastly, there is a required payment element that considers whether the franchisee is paying the franchisor either directly or indirectly for the privilege of operating under its service mark.

"Notably, as discussed above, the business models of many aggregators and individual hotspot providers feature many of the characteristics of a franchising model. Thus, before selecting a particular business model, a company should seek counsel as to whether their model may be considered a franchising arrangement in order to ensure proper compliance with existing laws and regulations. Moreover, companies should fully understand the advantages and disadvantages of adopting a franchising model.

"(Note that this discussion of franchising refers to franchise as the licensing of trademarks for distribution purposes, not as a special privilege granted by government such as in the case of cable franchises. Thus, aggregators and hotspot providers may engage in business relationships similar to those that McDonald's creates with its franchisees.)"

Want more information on franchise regulation? Contact Peter Klarfield at <pklar-fel@wrf.com> or David Koch at <dkoch@wrf.com>.

-

How do you envision the scale of the business-regional, national or international?

-

How will you contain your operational costs while building a customer base?

-

How much, and in what ways, do you want to segment services and users?

-

Do you have a clear understanding of the relationship between your company and its venue owners?

-

In what ways will your company support and benefit from inbound and outbound roaming? If you do decide on a roaming model, will uncertain quality of service and end-user experience have a negative effect on your HotSpot operation?

-

What gear will you support and in what combination?

-

What type of authorization, authentication, and billing methods will you provide?

-

What will your network look like and how will it be managed in the beginning, then at the end of one year, two years, five years?

-

What is your sales and marketing strategy? What will it be in two years or five years?

-

What will be the total marketing costs needed to introduce your brand to the marketplace?

-

Will the company court, or work with, content providers? If so, what will be the requirements for these providers?

-

Will the company seek to obtain additional revenue through ads? If so, when? Immediately, two years down the road, five years?

-

What type of customer relationship management requirements will be expected of your company? And what will be the customer service requirements? How will you provide these items?

-

How will your company deal with problems such as fraud, repair, claims, etc.?

-

What are your partnership strategies, especially in the area of compensation?

-

What is your exit strategy? If it is acquisition or merger, how will you build out your network to minimize integration work?

Other related issues that you need to address will depend upon your specific business plan (e.g. self-funded, angel investors, or whatever), revenue model (subscription only, ads, etc.), specific circumstances (e.g. locale and existing competition). Furthermore, well thought-out business and marketing plans must be drawn up and adhered to for the project to have any chance of real success.

|

| < Day Day Up > |

|

EAN: 2147483647

Pages: 273