The Aggregator Level

|

| < Day Day Up > |

|

Aggregators can help to overcome fragmentation problems within the WISP industry by taking the fragmented layers and aggregating them into a single service. (The more HotSpot operators an aggregator can incorporate into its network, the more opportunity for that aggregator and the HotSpot operators.) Although companies operating in the aggregator layer may have different target markets and business strategies, they all have one thing in common: the hope that they can exploit Wi-Fi's potential by helping the end-user to obtain access to as many HotSpots as possible.

Many smaller HotSpot operators realize that to exponentially grow their network requires not only a huge investment in time and money, but also the skills to combine the varied components of the WISP value chain, and to enable all of those components to work in tandem. They also know that due to their size and budget, it wouldn't be long before they found themselves overwhelmed with running a network, generating sales, arranging roaming affiliations, and handling the necessary marketing and customer service chores. Is it any wonder that many of these operators (and venue owners) begin to see the advisability of investing in only the front side of the value chain-focusing on end-user acquisition and the resulting relationship-and letting others deploy the infrastructure, handle the branding and billing relationship, and the roaming technicalities?

| Note | Other terms for the aggregator group are "virtual WISPs" as most do not really have an actual physical network; "brokers," since they broker deals between companies within the WISP Industry; and "managed service providers," since their business model is based upon managing Internet access service for others. The companies in the aggregator layer typically provide centralized authentication services in order to compute and validate the broadband traffic; fix the airtime prices in which they trade; operate as intermediaries between HotSpot operators through buying and selling HotSpot operators' airtime minutes; and fix tariffs for roaming between diverse HotSpot operator networks. |

Most national and regional aggregators' operations are similar to Boingo Wireless Inc. Boingo, a start-up whose log-on and authentication software provides a wrapper around existing HotSpot operators' networks that allows end-users access to a variety of HotSpots using a single account. Boingo strikes wholesale access agreements with HotSpot operators, and then consolidates the venue HotSpots into a single seamless network.

| Note | Boingo also provides WLAN capabilities to brands, such as Cingular, General Electric, Pepsi, and Sprint, that might contract with Boingo to provide the whole WLAN set-up-software, technical support and back-office services. |

A different tack is being taken by Wireless Retail, Inc., a well-known member of the wireless industry-through its recently launched aggregator service, FootLoose Networks, Wireless Retail plans to facilitate the build-out of a carrier-neutral, unified national network of HotSpots. Wireless Retail hopes that its new aggregator service will become the catalyst for cooperation among the nation's wireless carriers, by providing a straightforward, cost-sharing model for the build-out and ongoing maintenance of a single aggregated national network. FootLoose will offer enterprise customers and consumers alike multiple service and payment options, including subscribing for service through their own wireless carrier's data plans, enabling the HotSpot charges to be incorporated into their current wireless phone bill.

Another approach is hereUare Communication Inc.'s business model. This aggregator neither owns nor operates public wireless networks, nor does it actively pursue end-users. Instead, it focuses on three ingredients that are necessary to the creation and growth of the WISP marketplace: (1) the extension of partner branding through an aggregated network of wireless locations, (2) the creation of a universal experience for wireless users on a global, roaming network of wireless locations, (3) enabling HotSpot operators and venue owners to deploy public for-pay wireless through its eCoinBox device, which performs router and Domain Host Control Protocol (DHCP) functions. Thus the modifications to any existing wired network are minimal, if any. The hereUare system consists of an "eCoinBox," and an access point. All the venue owner (or HotSpot operator) needs to do is to install both at the venue location. The venue owner (or HotSpot operator) is responsible for:

-

A high-speed Internet link (T-1/DSL/Cable Modem).

-

A wireless infrastructure, i.e. an 802.11b WLAN-enabled computer, a functioning Internet browser, and a null-modem serial cable.

All other components necessary for the operation of a fee-based HotSpot exist remotely and are hereUare's responsibility. (It's interesting to note that the hereUare eCoinBox technology is integrated into the Colubris Network's CN3000 wireless access controller depicted in Fig. 11.3.)

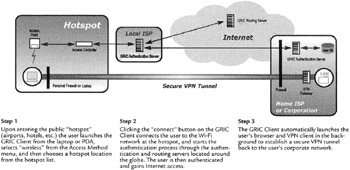

Of course, not all aggregators focus on the consumer market. According to Perry Lewis, GRIC Communications' manager of business development, GRIC only deals with large carriers. "We don't sign up the end-user." GRIC's business model differs from most Wi-Fi aggregators, in that it gives its client (carrier or enterprise) the ability to supply a subscriber with one user name, one password, and one monthly invoice. Then the end-users can use either a GRIC wireline access point, or a wireless HotSpot, anywhere in the world and get connectivity. GRIC provides all the billing and settlement functionality, but it's GRIC's client who bills the end-user. Lewis says that GRIC is "focused on a global footprint. The business user doesn't always travel in North America."

There are more than 800 HotSpots supported by GRIC's TierOne Alliance. John Rasmus, GRIC's vice president of marketing, adds, "We are in the business of putting RADIUS authentication servers on these networks so that little islands of Wi-Fi are tied into a true global wide-area network. The key issues are security and network management. And things are moving along quickly in the industry to address those concerns. Also, we offer a portfolio of security solutions that are embedded with our client and access servers."

iPass Inc. is another network aggregator with an international bent. It bypasses the consumer market and pulls together various types of networks so it can sell access to the enterprise market. It also facilitates roaming between various carriers by taking care of all the settlement issues and back-end needs.

Figure 11.7: Anatomy of a HotSpot from GRIC Communication's point of view. Graphic courtesy of GRIC Communications.

Since both GRIC and iPass target the carrier and enterprise markets, they are quality conscious that if one of their client's end-users goes to a HotSpot and the network fails to operate properly, the client (which may be a large corporation or another aggregator) may drop their subscription. These aggregators make sure that their HotSpot partners meet a defined set of standards. GRIC's Lewis explains, "It isn't worth it to have customers complaining about service. It's a footprint versus quality issue."

Many within the industry believe that aggregators are the solution to making mass-market Wi-Fi services a reality. According to Analysys Research Ltd., more than 21 million Americans will use HotSpots by 2007; but that leap in public Wi-Fi use can be propelled only by a proliferation of HotSpots, which Analysys predicts will grow to more than 41,000 in 2007. In-Stat/MDR is another research firm that has taken a stab at estimating growth in the HotSpot market. This time the measurement is projected revenue. According to the In-Stat/MDR research, HotSpot revenue will grow to close to $225 million in 2007. "I think aggregators play a valid role in bringing these isolated locations [HotSpots] into a larger footprint," says Amy Cravens, an industry analyst with In-Stat/MDR.

The story is about the same in Europe. Gartner, Inc. says the number of HotSpots will increase in Europe, from a mere 70 at the end of 2001, to 15,000 by the end of 2003, and 43,000 by 2008. And research from Research and Markets indicates that 80 percent of European urban mobile data users will use HotSpots by 2005.

These positive projections have lit a fire under the aggregators. "We've seen incredible, overwhelming interest in Wi-Fi and what we are doing," says Sky Dayton, founder of Boingo Wireless Inc. As the industry matures, the aggregator sector will find itself with only a few major players (probably fewer than five).

There is immense complexity in negotiating with and aggregating thousands of individual HotSpot operators, providing systems for network management and authorization, authentication, and accounting. Aggregators can drive significant traffic to HotSpot operators, helping them cross the line of fixed costs into positive cash flow. Furthermore, it's expected that aggregators will serve as the vital link between the HotSpot operators and the major brands, and that the brands will drive the mass-market adoption of mobile Wi-Fi access.

Some aggregators may choose to act as clearinghouses for other HotSpot operators operating in different regions. In this case, the aggregator signs agreements with many local HotSpot operators, and then makes those HotSpots available not only to its own subscriber base, but also to roaming subscribers belonging to other HotSpot operators and aggregators.

|

| < Day Day Up > |

|

EAN: 2147483647

Pages: 273

- Article 353 High Density Polyethylene Conduit Type HDPE Conduit

- Article 396 Messenger Supported Wiring

- Article 406: Receptacles, Cord Connectors, and Attachment Plugs (Caps)

- Example No. D3 Store Building

- Example No. D10 Feeder Ampacity Determination for Adjustable-Speed Drive Control [See 215.2, 430.24, 620.13, 620.14, 620.61, Tables 430.22(E), and 620.14]