Chapter 2.6: Foreign Trade Activity and its Administration

Li Yong, Deputy Secretary General, China Association of International Trade

Trade environment

Until now, market access for new entrants to China's foreign trade activities have been strictly controlled. Significant changes have taken place in more than two decades of reform and the foreign trade administration system has gradually been liberalized. Liberalization of foreign trade is mainly manifested in the relaxation of restrictions on import and export trading rights and reduction of import and export licence control. In the past, only a small number of companies and enterprises had legitimate trading rights and a large number of commodities whose import and export were subject to licence control. These control measures created monopolistic advantages for those who had the privileges of trading rights, and barriers to the free flow of import and export.

Relaxation of trading rights

Alongside the progress of economic reform and the opening up drive, economic development has advanced to the point where the present limited trading rights will need to be expanded in order to meet increasing import and export needs. Reform of the foreign trade system has responded to these needs by loosening the reins on trading rights control. As a result, trading rights are no longer the privilege only of professional trading companies (ie companies that used to be under the jurisdiction of the foreign trade and investment authorities), but are also available to other types of companies, such as industrial trading companies, manufacturing enterprises, manufacturing joint ventures (who have automatic trading rights for their exports of own products and imports of necessary equipment and materials), research institutions, private entities and Sino-foreign joint venture trading companies, although the qualification requirements for some of these have been quite demanding. Even more encouraging is the fact that efforts to liberalize trading rights are ongoing and lowering the threshold to an eventual registration of trading rights (instead of approval) has been set as the final objective of the reformation process. Reform has been accelerated by China's commitment under the WTO to further open up trading rights within a specified period of time. On joining the WTO, China has agreed to grant full trading rights to joint-venture enterprises with minority share foreign investment in 2002 and to majority share foreign-invested joint- ventures in 2003. Within three years of accession , all enterprises in China would be granted full rights to trade.

Phase-out of non- tariff measures

At the same time, effort has also been made to reduce non-tariff measures such as the number of commodities that are subject to import and export licence controls. The reduction of non-tariff barriers was an ongoing process prior to WTO entry; by the end of 2001, for example, quotas and licensing requirements involved only 5 per cent of all imports compared with about 50 per cent little more than a decade ago. From 1 January 2002, the number of commodity categories further dropped from 33 to 12. China has pledged to eliminate the remaining import quota and licence restrictions by 2005 (for details, please refer to Chapter 2.3).

Tariff reduction

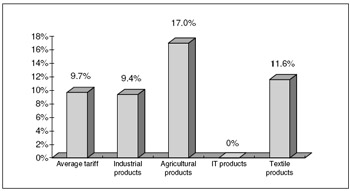

In addition to non-tariff measures, China has also committed to reduce the import tariff level. In fact, by the time it entered the WTO in 2001, the general tariff level had already fallen to an average of 15 per cent. In 2002, the first year of China's WTO accession, the average tariff has been further reduced to 12 per cent and by 2005 it will be reduced to 10 per cent (see Figure 2.6.1).

Figure 2.6.1: Average tariff by key categories of products by year 2005

State trading

However, there are a number of products that are subject to state trading and designated trading. According to China's WTO protocol,

without prejudice to China's right to regulate trade in a manner consistent with the WTO Agreement, China shall progressively liberalize the availability and scope of the right to trade, so that within three years of accession, all enterprises in China shall have the right to trade in all goods throughout the customs territory of China, except for those goods listed in Annex 2A which continue to be subject to state trading in accordance with this Protocol.

In Annex 2A are two separate lists that specify the types of commodities falling into the scope of state trading: state importation and state exportation (see Tables 2.6.1 and 2.6.2). These commodities are considered essential goods with an important bearing on national security and social stability.

| Vegetable oil (7 sub-categories) |

|

| Sugar (6 sub-categories) |

|

| Tobacco (6 sub-categories) Crude oil (1 category) and Processed oil ( 7 sub-categories) | China National Tobacco Import & Export Co.

|

| Fertilizer |

|

| Cotton (2 sub-categories) |

|

| [a] Source: Ministry of Foreign Trade and Economic Cooperation, available in detail at www.moftec.gov.cn/table/wto/law05.doc | |

| Products | State Trading Enterprises |

|---|---|

| Tea (4 sub-categories) | China National Native Products and Animal By-Products Import & Export Co. |

| Rice (4 sub-categories) | China National Cereals Oil and Foodstuffs Import & Export Corp. |

| Soy bean (5 sub-categories) | Jilin Grain Import & Export Co. Ltd.

|

| Coal (5 sub-categories) |

|

| Crude oil (1category) |

|

| Silk (13 sub-categories) | China National Silk Import & Export Co. |

| Cotton (2 sub-categories) |

|

| Antimony ores (2 sub-categories) |

|

| Silver (3 sub-categories) |

|

| Source: Ministry of Foreign Trade and Economic Cooperation, available in detail at www.moftec.gov.cn/table/wto/law06.doc | |

In addition to state trading products are products subject to designated trading, including natural rubber (4 sub-categories), timber (28 sub-categories), plywood (3 sub-categories), wool (9 sub-categories), acrylic (18 sub-categories) and steel (183 sub-categories).

Price controls

While China is committed to allowing prices for traded goods and services in every sector to be determined by market forces, and multi- tier pricing practices for such goods and services will be eliminated, China still maintains its control over the pricing of some categories of products and services.

Products that are subject to state pricing include tobacco (4 sub-categories) salt (1 category), natural gas (1 category) and pharmaceuticals (40 sub-categories).

Public utilities subject to government prices are gas for civil use, tap water, electricity, heating power and water supplied by irrigation works.

Services subject to state pricing include postal and telecommunication services charges (including postal services charges, national and trans-provincial telecommunication services charges), entrance fees for tourist sites (significant historical relics and natural landscape under protection) and education services charges.

Apart from government priced products and services, there are also products and services to which government guideline pricing will apply. Products that are subject to such guideline pricing include grain (14 sub-categories), vegetable oil (4 sub-categories), processed oil (7 sub-categories), chemical fertilizer (1 category), silkworm cocoons (2 sub-categories) and cotton (1 category). The services that fall into this category are listed in Table 2.6.2.

EAN: 2147483647

Pages: 648