PRIMA Proposal Preparation Process

|

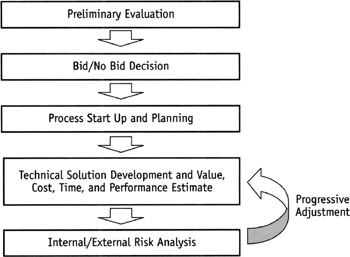

A PRIMA model of the proposal preparation process has been developed in order to point out the main decision steps where risk aspects should be taken into account.

Normally, the first step of the proposal preparation process is the preliminary analysis of the request for proposal (RFP), leading to a bid/no bid decision. In the case of a bid decision, a corresponding bid strategy should be determined. The second step should include the startup and planning of the proposal preparation process.

The actual development of the technical solution suitable for the client's requirements and the corresponding cost estimate involves different contributions coming from each functional department, with all contributions to be integrated by the proposal team. In PRIMA (IST-1999-10193), the analysis of internal and external risk is developed during the bidding process. Each alternative technical solution, corresponding to a bid profile and a project baseline, should be evaluated in terms of internal and external risk (Figure 1). An iterative adjustment process may be requested in order to obtain an effective trade-off between internal and external risk. At each iteration possible risk mitigation actions can be considered—modifying the bid profile and the project baseline—or further information can be requested. In both cases the degree of confidence on the value and cost of the bid should be estimated as a result of the risk analysis. The process ends with the final approval and the closeout step, in which lessons learned should be gathered.

Figure 1: Proposal Preparation Process

As a follow-up step, data about each bid should be collected and maintained in a RMCM. The project actual values should be recorded and compared to baseline expected values in terms of time, cost, and product performance for each successful bid; in any case, estimated deviations of the bid profile from other competitors' bid profile, particularly from the winner's bid profile in case of unsuccessful bid, should be analyzed and recorded.

Principles of the PRIMA Project

As a consequence of the previous considerations about the proposal preparation process, objectives of the PRIMA project are to define, develop, and disseminate a management by risk method and the associated software tools: a RMCM and a DSS for bidding.

The PRIMA method and toolkit organizes:

-

Risk knowledge capture, storage, and reuse during the early phase—e.g., bidding process—of programs, projects, products, or services life cycle

-

A risk reference system with a precise definition of internal risk (affecting products, processes, resources, costs) and external risk (stemming from clients, customers, market, competitors, strategic position, regulation, environment, and so on), structured for business decision-making

-

Projects and enterprise performance estimators.

The RMCM is designed to be:

-

Knowledge-constructive, as it supports adjustment to new cases when reusing knowledge, restructuring ontology, and adding cases, either from the bid process itself or from other sources.

-

Knowledge-emergent, as it allows tacit knowledge capture from senior proposal managers, encourages learning from experience for young employees, and supports best practices.

The DSS:

-

Supports bid construction. Bids can be arranged through the provided analytical organization of products and processes, allowing for better precision and quickness; blueprints, sketches, bid/no bid decisions, essays and simulation, risk drivers estimation, and work distribution and refinement.

-

Provides bid pricing and evaluation by risk, with internal and external risk analysis.

-

Helps organize cooperative work during the process of bid construction. The risk breakdown structure is the basis for group ware as it provides a cooperative language used by the proposal team to acquire, share, make coherent, and value distributed knowledge about risks.

The research project starts with a review of as-is methods and practices. Benchmarking techniques are used. Information is gathered through interview techniques and used to support the initial expression of needs. In parallel, a research overview is performed in order to determine the state of the art of scientific developments and new research areas in the field of DSS and knowledge capture. The conceptual modelling will then be adapted to the bidding phase. The results of these tasks are then combined to define the global system architecture making the best use of functional analysis results and existing tools, modules, and methods available within the PRIMA consortium.

The toolkit production makes use of prototyping methods. The detailed specifications and architecture of the software tools are established and the generation of module specifications is shared among the PRIMA partners. After being tested the modules will be integrated and the complete tool will be validated. During the last part of the development phase the users' representatives will undertake an evaluation phase to examine the capability of the product to satisfy the customer needs. The initial needs expression will be reviewed and improvements implemented. The documentation (user's guide and tutorial) will be updated and released.

The experimentation phase follows to evaluate the efficiency of the approach. This phase is prepared in the early months of the project in parallel with the global architecture definition by identifying the type of test schemes and input data, the database organization, and the performance indicators. Once the tool is eventually available, simulations will allow for evaluating the overall system performance.

Dissemination will be conducted along the project life cycle together with the preparation of the exploitation plan. It starts with a marketing study; the customization strategy in each country is defined and industrial associations are kept informed. Once the product is available, the methodology is disseminated by means of publications, workshops, Internet sites, and so on; and the tools are disseminated toward industries (especially small- and medium-sized companies) through the industrial partners.

The composition of the consortium in charge of the PRIMA research project includes important research and industrial partners, specifically: ALCATEL Space Industries, Universit Toulousel—Department Sciences Sociales Pour I'Ing nieur (UT1), CR2A-DI (software house specialized in the use of IC technologies for scientific and technical applications), Andalusian Association for Research and Industrial Cooperation (AICIA), Sociedad Anonima de Instalaciones de Control (SAINCO), National Technical University of Athens (NTUA)—Division of Mechanical Design and Control Systems and Industrial Management & Operations Research Sector, Hellenic Company for Space Applications S.A. (HCSA), Politecnico di Milano Dipartimento di Meccanica, and Snamprogetti, S.p.A.

External Risk

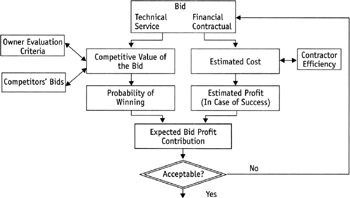

Assuming that the decision to take part in the bid auction has already been made, the bidding strategy, i.e., defining the bid profile in terms of technical, financial, service-related, and contractual aspects, can be driven by different objectives. For instance, a period of crisis due to a work under-load could force the contractor to submit a bid in order to maximize the probability of winning (PWIN) even if the resulting profitability could be low or even negative. When a significant workload is available, on the other hand, the objective could be maximizing the monetary value that is expected in submitting the bid. The latter is widely assessed as the expected profit contribution (EPC), i.e., the product of the probability of winning (PWIN) and the profit contribution if the bid is won, which is equal to the difference between the price offered and the expected cost, (P – C):

![]()

The bid profile, in terms of technical, financial, service-related, and contractual aspects, determines both the project baseline and the competitive value of the bid (Figure 2), which may be evaluated considering both the owner set of evaluation criteria and the competitors' bid profiles. The contractor faces an obvious trade-off: the more competitive the bid in terms of price and non-price factors, the greater may be the probability of winning, but, conversely, the lower may be the profit contribution because of price reductions and/or cost increases. The bidding problem is generally a question of choosing the bid profile that maximizes the EPC. However, in order to enter a new market or when there is a work underload the contractor could accept a lower EPC, trading off a lower profit contribution with a greater probability of winning.

Figure 2: Decision Framework in the Bid Preparation Process

Since competitive bidding is a one-of-a-kind process, the proposal manager has to face it with uncertainty concerning his judgments, due to imprecise and vague knowledge of the competing context and the project baseline as well. The degree of uncertainty is generally high at the beginning of the bid preparation process and reduces as new pieces of information become available.

Both the problem of an accurate project baseline estimate and a quantitative evaluation of bid competitive value are well recognized as fundamental issues in the bid preparation process (Kotler 1987; Churchman 1957; King 1990; Ward 1988). This section focuses on the latter issue, since fewer results are available, especially in decision contexts in which multiple, quantitative, and qualitative factors have to be considered.

The assessment of the bid competitive value is characterised by at least two relevant sources of uncertainty:

-

The appraisal scheme of the owner, i.e., owner evaluation criteria and their relative importance

-

The profile of competitors' bids.

Assuming the point of view of the owner, the bid appraisal is, in general, a multicriteria decision problem where both economical and technical elements must be considered. In fact, due to the complexity of the offered "product", bids may conform differently to the specific requirements and be non-homogeneous in their technical, financial, service-related, and contractual aspects. Moreover, the growing level of competition together with increasing customer expectations have broadened the number of service and financial aspects that are used to differentiate competing bids. In addition, competitive bidding is usually a group decision-making process in which different points of view should synthesise into a common decision.

It becomes necessary to develop a model allowing the contractor to estimate the bid competitive value on the basis of the information currently available concerning the owner, the competitors, and the profile of his own bid.

Models so far developed to assess the probability of winning are mainly based on the assumption that the competitive value of the bid primarily depends on the price offered. Various methods of calculating PWIN as a function of the price offered have been suggested (King 1990; Friedman 1956; Vickrey 1961; Gates 1967; Rothkopf 1991; McAfee 1987). In most cases, the computation of PWIN is a hard task due to the necessity, on one hand, to consider the relationships of dependence among the competitive value of competing bids and, on the other hand, to refer to historical data on competitors' past performances. These difficulties have the effect of reducing the user's confidence in the results of the techniques mentioned previously. Moreover, making decisions based just upon price is getting less and less important. The only way to design a useful decisional support tool is to take into account non-price competitive factors as well.

The importance of non-price factors is well recognized in the literature (Ward 1988; Simmonds 1968; King 1985, 1988; Seydel 1990). Table 1 provides a tentative overview of the main competitive factors describing the profile of a bid concerning the engineering and contracting sector. Even though some papers also suggest to correct PWIN with non-price elements (Ward 1988; Simmonds 1968; King 1985, 1988), little work has been done on this issue and no analytical means are provided to implement these suggestions.

| Delivery Time | Time interval between the coming into force of the contract and the plant start up. |

| Technical Assistance | Maintenance service offered to the owner after plant start up. |

| Technology Transfer | Training service to help operators and managers effectively run the plant. |

| Process Technology | Process features influencing plant performance (quality, efficiency, etc.). |

| Dependability | Plant performance in terms of reliability, maintainability, availability, and supportability. |

| Safety | Plant performance in terms of operators safety and environmental impact. |

| Price | Monetary value of the offered plant. |

| Terms of Payment | Time profile for the owner expenditures. |

| Financial Package | Capacity of proposing convenient financial sources to the owner. |

| Utilization of Local Vendors | Share of local goods and services within the bid scope of work. |

| Contractors Cooperation | Measure of the overall financial solidity and technical capacity provided by cooperation forms (consortium, joint-venture, etc.). |

| Conformity to Tender Documents | Measure of the accomplishment of contract clauses specified in tender documents. |

| Liquidated Damages Clause | Fine the contractor commits to pay in case of damages for the owner due to delay in delivery time. |

A model for the evaluation of the bid competitive value should present the following characteristics:

-

Multi-attribute structure, allowing the integration of quantitative and qualitative factors in the assessment of the bid competitive value

-

Allowance for uncertainty in individual judgments

-

Integration in a rigorous way of the information becoming available during the decision-making process

-

Support to group decision-making

-

Flexibility, i.e., easy adaptability to decisional contexts which may be extremely different and characterized by one of a kind conditions

-

Robustness, i.e., reduction of the possible uncertainty effects of the overall estimate.

Multi-attribute decision-making techniques in general and analytic hierarchy process in particular, appear to be suitable for competitive bidding problems, particularly using a probabilistic version based on Monte Carlo simulation. This way not only a rank order of the competing bids may be obtained, but also an evaluation of the probability of winning.

Internal Risk

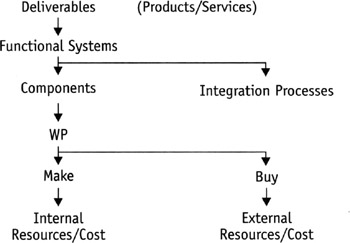

In the case of internal risk, the first problem to be addressed is which element of the project is affected by a given risk driver. In order to carry out a systematic analysis, a work breakdown structure (WBS) is requested, considering for instance; deliverables, functional systems, components, integration make and buy processes, resources, and costs (Figure 3).

Figure 3: Work Breakdown Structure

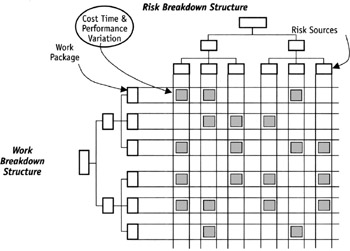

At this point a very critical decision has to be made about the detail level of the risk analysis: the more detailed the breakdown of the project, the higher the amount of information to be collected and maintained. As a second problem, it is necessary to identify the links between risk sources (identified by the risk breakdown structure [RBS]) and project elements (identified by the WBS) in order to estimate the major effects of a given risk source on different project elements (obviously, effects stemming from the same risk source are correlated). In this context, risk events correspond, for each project element, to possible deviations of actual values from expected values in terms of cost, time, and product performance (Figure 4).

Figure 4: Risk Breakdown Structure and Work breakdown Structure

The RBS allows for an identification of the major risk types: policy, sales, contractual and legal, procurement, management, technical, safety, financial, and so forth. For instance, "management risk" could be broken down into different sources, such as WBS badly defined, project schedule inconsistent, lack of circulation of useful information, resources inadequate or unavailable, and so on.

Note that a given risk source (e.g., currency fluctuation) may affect both the internal and external risk parameters (i.e., estimated project budget and price offered).

Considering the probability of incurring a risk event, the magnitude of the possible deviation allows for a quantification of the risk. Obviously different models of the project are required if different types of risk are to be analyzed: a cost breakdown structure (CBS) model for cost risk, a network model for time risk, a functional model of the product for performance risk, a cash flow model for financial risk, and so forth.

|

EAN: 2147483647

Pages: 207