Problems

| 1. | A farmer in Iowa is considering either leasing some extra land or investing in savings certificates at the local bank. If weather conditions are good next year, the extra land will give the farmer an excellent harvest. However, if weather conditions are bad, the farmer will lose money. The savings certificates will result in the same return, regardless of the weather conditions. The return for each investment, given each type of weather condition, is shown in the following payoff table:

Select the best decision, using the following decision criteria:

| ||||||||||||||||||||||||||||||||||||||||||||||||

| | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2. | The owner of the Burger Doodle Restaurant is considering two ways to expand operations: open a drive-up window or serve breakfast . The increase in profits resulting from these proposed expansions depends on whether a competitor opens a franchise down the street. The possible profits from each expansion in operations, given both future competitive situations, are shown in the following payoff table:

Select the best decision, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 3. | Stevie Stone, a bellhop at the Royal Sundown Hotel in Atlanta, has been offered a management position. Although accepting the offer would assure him a job if there were a recession , if good economic conditions prevailed, he would actually make less money as a manager than as a bellhop (because of the large tips he gets as a bellhop). His salary during the next 5 years for each job, given each future economic condition, is shown in the following payoff table:

Select the best decision, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 4. | Brooke Bentley, a student in business administration, is trying to decide which management science course to take next quarterI, II, or III. "Steamboat" Fulton, "Death" Ray, and "Sadistic" Scott are the three management science professors who teach the courses. Brooke does not know who will teach what course. Brooke can expect a different grade in each of the courses, depending on who teaches it next quarter, as shown in the following payoff table:

Determine the best course to take next quarter, using the following criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| | |||||||||||||||||||||||||||||||||||||||||||||||||

| 5. | A farmer in Georgia must decide which crop to plant next year on his land: corn, peanuts, or soybeans. The return from each crop will be determined by whether a new trade bill with Russia passes the Senate. The profit the farmer will realize from each crop, given the two possible results on the trade bill, is shown in the following payoff table:

Determine the best crop to plant, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 6. | A company must decide now which of three products to make next year to plan and order proper materials. The cost per unit of producing each product will be determined by whether a new union labor contract passes or fails. The cost per unit for each product, given each contract result, is shown in the following payoff table:

Determine which product should be produced, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 7. | The owner of the Columbia Construction Company must decide between building a housing development, constructing a shopping center, and leasing all the company's equipment to another company. The profit that will result from each alternative will be determined by whether material costs remain stable or increase. The profit from each alternative, given the two possibilities for material costs, is shown in the following payoff table:

Determine the best decision, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 8. | A local real estate investor in Orlando is considering three alternative investments: a motel, a restaurant, or a theater. Profits from the motel or restaurant will be affected by the availability of gasoline and the number of tourists; profits from the theater will be relatively stable under any conditions. The following payoff table shows the profit or loss that could result from each investment:

Determine the best investment, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 9. | A television network is attempting to decide during the summer which of the following three football games to televise on the Saturday following Thanksgiving Day: Alabama versus Auburn, Georgia versus Georgia Tech, or Army versus Navy. The estimated viewer ratings (millions of homes ) for the games depend on the winloss records of the six teams , as shown in the following payoff table:

Determine the best game to televise, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 10. | Ann Tyler has come into an inheritance from her grandparents. She is attempting to decide among several investment alternatives. The return after 1 year is primarily dependent on the interest rate during the next year. The rate is currently 7%, and Ann anticipates that it will stay the same or go up or down by at most two points. The various investment alternatives plus their returns ($10,000s), given the interest rate changes, are shown in the following table:

Determine the best investment, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 11. | The Tech football coaching staff has six basic offensive plays it runs every game. Tech has an upcoming game against State on Saturday, and the Tech coaches know that State employs five different defenses. The coaches have estimated the number of yards Tech will gain with each play against each defense, as shown in the following payoff table:

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 12. | Microcomp is a U.S.-based manufacturer of personal computers. It is planning to build a new manufacturing and distribution facility in either South Korea, China, Taiwan, the Philippines, or Mexico. It will take approximately 5 years to build the necessary infrastructure ( roads , etc.), construct the new facility, and put it into operation. The eventual cost of the facility will differ between countries and will even vary within countries depending on the financial, labor, and political climate, including monetary exchange rates. The company has estimated the facility cost (in $1,000,000s) in each country under three different future economic and political climates, as follows :

Determine the best decision, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 13. | Place-Plus, a real estate development firm, is considering several alternative development projects. These include building and leasing an office park, purchasing a parcel of land and building an office building to rent, buying and leasing a warehouse, building a strip mall, and building and selling condominiums. The financial success of these projects depends on interest rate movement in the next 5 years. The various development projects and their 5-year financial return (in $1,000,000s) given that interest rates will decline, remain stable, or increase, are shown in the following payoff table:

Determine the best investment, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 14. | The Oakland Bombers professional basketball team just missed making the playoffs last season and believes it needs to sign only one very good free agent to make the playoffs next season . The team is considering four players: Barry Byrd, Rayneal O'Neil, Marvin Johnson, and Michael Gordan. Each player differs according to position, ability, and attractiveness to fans. The payoffs (in $1,000,000s) to the team for each player, based on the contract, profits from attendance, and team product sales for several different season outcomes , are provided in the following table:

Determine the best decision, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 15. | A machine shop owner is attempting to decide whether to purchase a new drill press, a lathe, or a grinder. The return from each will be determined by whether the company succeeds in getting a government military contract. The profit or loss from each purchase and the probabilities associated with each contract outcome are shown in the following payoff table:

Compute the expected value for each purchase and select the best one. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 16. | A concessions manager at the Tech versus A&M football game must decide whether to have the vendors sell sun visors or umbrellas. There is a 30% chance of rain, a 15% chance of overcast skies, and a 55% chance of sunshine, according to the weather forecast in College Junction, where the game is to be held. The manager estimates that the following profits will result from each decision, given each set of weather conditions:

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 17. | Allen Abbott has a wide- curving , uphill driveway leading to his garage. When there is a heavy snow, Allen hires a local carpenter , who shovels snow on the side in the winter, to shovel his driveway. The snow shoveler charges $30 to shovel the driveway. Following is a probability distribution of the number of heavy snows each winter:

Allen is considering purchasing a new self-propelled snowblower for $625 that would allow him, his wife, or his children to clear the driveway after a snow. Discuss what you think Allen's decision should be and why. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 18. | The Miramar Company is going to introduce one of three new products: a widget, a hummer, or a nimnot. The market conditions (favorable, stable, or unfavorable) will determine the profit or loss the company realizes, as shown in the following payoff table:

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 19. | The financial success of the Downhill Ski Resort in the Blue Ridge Mountains is dependent on the amount of snowfall during the winter months. If the snowfall averages more than 40 inches, the resort will be successful; if the snowfall is between 20 and 40 inches, the resort will receive a moderate financial return; and if snowfall averages less than 20 inches, the resort will suffer a financial loss. The financial return and probability, given each level of snowfall, follow:

A large hotel chain has offered to lease the resort for the winter for $40,000. Compute the expected value to determine whether the resort should operate or lease. Explain your answer. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 20. | An investor must decide between two alternative investmentsstocks and bonds. The return for each investment, given two future economic conditions, is shown in the following payoff table:

What probability for each economic condition would make the investor indifferent to the choice between stocks and bonds? | ||||||||||||||||||||||||||||||||||||||||||||||||

| | |||||||||||||||||||||||||||||||||||||||||||||||||

| 21. | In Problem 10, Ann Tyler, with the help of a financial newsletter and some library research, has been able to assign probabilities to each of the possible interest rates during the next year, as follows:

Using expected value, determine her best investment decision. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 22. | In Problem 11 the Tech coaches have reviewed game films and have determined the following probabilities that State will use each of its defenses:

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 23. | A global economist hired by Microcomp, the U.S.-based computer manufacturer in Problem 12, estimates that the probability that the economic and political climate overseas and in Mexico will decline during the next 5 years is .40, the probability that it will remain approximately the same is .50, and the probability that it will improve is .10. Determine the best country to construct the new facility in and the expected value of perfect information. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 24. | In Problem 13 the Place-Plus real estate development firm has hired an economist to assign a probability to each direction interest rates may take over the next 5 years. The economist has determined that there is a .50 probability that interest rates will decline, a .40 probability that rates will remain stable, and a .10 probability that rates will increase.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 25. | Fenton and Farrah Friendly, husband-and-wife car dealers, are soon going to open a new dealership . They have three offers: from a foreign compact car company, from a U.S.-producer of full- sized cars , and from a truck company. The success of each type of dealership will depend on how much gasoline is going to be available during the next few years. The profit from each type of dealership, given the availability of gas, is shown in the following payoff table:

Determine which type of dealership the couple should purchase. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 26. | The Steak and Chop Butcher Shop purchases steak from a local meatpacking house. The meat is purchased on Monday at $2.00 per pound, and the shop sells the steak for $3.00 per pound. Any steak left over at the end of the week is sold to a local zoo for $.50 per pound . The possible demands for steak and the probability of each are shown in the following table:

The shop must decide how much steak to order in a week. Construct a payoff table for this decision situation and determine the amount of steak that should be ordered, using expected value. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 27. | The Loebuck Grocery must decide how many cases of milk to stock each week to meet demand. The probability distribution of demand during a week is shown in the following table:

Each case costs the grocer $10 and sells for $12. Unsold cases are sold to a local farmer (who mixes the milk with feed for livestock) for $2 per case. If there is a shortage, the grocer considers the cost of customer ill will and lost profit to be $4 per case. The grocer must decide how many cases of milk to order each week.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| | |||||||||||||||||||||||||||||||||||||||||||||||||

| 28. | The manager of the greeting card section of Mazey's department store is considering her order for a particular line of Christmas cards. The cost of each box of cards is $3; each box will be sold for $5 during the Christmas season. After Christmas, the cards will be sold for $2 a box. The card section manager believes that all leftover cards can be sold at that price. The estimated demand during the Christmas season for the line of Christmas cards, with associated probabilities, is as follows:

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 29. | The Palm Garden Greenhouse specializes in raising carnations that are sold to florists. Carnations are sold for $3.00 per dozen; the cost of growing the carnations and distributing them to the florists is $2.00 per dozen . Any carnations left at the end of the day are sold to local restaurants and hotels for $0.75 per dozen. The estimated cost of customer ill will if demand is not met is $1.00 per dozen. The expected daily demand (in dozens) for the carnations is as follows:

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 30. | Assume that the probabilities of demand in Problem 28 are no longer valid; the decision situation is now one without probabilities. Determine the best number of cards to stock, using the following decision criteria.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| | |||||||||||||||||||||||||||||||||||||||||||||||||

| 31. | In Problem 14, the Bombers' management has determined the following probabilities of the occurrence of each future season outcome for each player:

Compute the expected value for each player and indicate which player the team should try to sign. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 32. | Construct a decision tree for the decision situation described in Problem 25 and indicate the best decision. | ||||||||||||||||||||||||||||||||||||||||||||||||

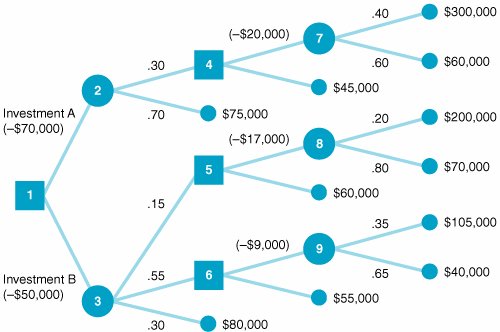

| 33. | Given the following sequential decision tree, determine which is the optimal investment, A or B: | ||||||||||||||||||||||||||||||||||||||||||||||||

| 34. | The management of First American Bank was concerned about the potential loss that might occur in the event of a physical catastrophe such as a power failure or a fire. The bank estimated that the loss from one of these incidents could be as much as $100 million, including losses due to interrupted service and customer relations. One project the bank is considering is the installation of an emergency power generator at its operations headquarters. The cost of the emergency generator is $800,000, and if it is installed, no losses from this type of incident will be incurred. However, if the generator is not installed, there is a 10% chance that a power outage will occur during the next year. If there is an outage , there is a .05 probability that the resulting losses will be very large, or approximately $80 million in lost earnings. Alternatively, it is estimated that there is a .95 probability of only slight losses of around $1 million. Using decision tree analysis, determine whether the bank should install the new power generator. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 35. | The Americo Oil Company is considering making a bid for a shale oil development contract to be awarded by the federal government. The company has decided to bid $110 million. The company estimates that it has a 60% chance of winning the contract with this bid. If the firm wins the contract, it can choose one of three methods for getting the oil from the shale. It can develop a new method for oil extraction, use an existing (inefficient) process, or subcontract the processing to a number of smaller companies once the shale has been excavated. The results from these alternatives are as follows: Develop new process:

Use present process:

Subcontract:

The cost of preparing the contract proposal is $2 million. If the company does not make a bid, it will invest in an alternative venture with a guaranteed profit of $30 million. Construct a sequential decision tree for this decision situation and determine whether the company should make a bid. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 36. | The machine shop owner in Problem 15 is considering hiring a military consultant to ascertain whether the shop will get the government contract. The consultant is a former military officer who uses various personal contacts to find out such information. By talking to other shop owners who have hired the consultant, the owner has estimated a .70 probability that the consultant would present a favorable report, given that the contract is awarded to the shop, and a .80 probability that the consultant would present an unfavorable report, given that the contract is not awarded. Using decision tree analysis, determine the decision strategy the owner should follow, the expected value of this strategy, and the maximum fee the owner should pay the consultant. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 37. | The Miramar Company in Problem 18 is considering contracting with a market research firm to do a survey to determine future market conditions. The results of the survey will indicate either positive or negative market conditions. There is a .60 probability of a positive report, given favorable conditions; a .30 probability of a positive report, given stable conditions; and a .10 probability of a positive report, given unfavorable conditions. There is a .90 probability of a negative report, given unfavorable conditions; a .70 probability, given stable conditions; and a .40 probability, given favorable conditions. Using decision tree analysis and posterior probability tables, determine the decision strategy the company should follow, the expected value of the strategy, and the maximum amount the company should pay the market research firm for the survey results. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 38. | The Friendlys in Problem 25 are considering hiring a petroleum analyst to determine the future availability of gasoline. The analyst will report that either a shortage or a surplus will occur. The probability that the analyst will indicate a shortage, given that a shortage actually occurs is .90; the probability that the analyst will indicate a surplus, given that a surplus actually occurs is .70.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 39. | Jeffrey Mogul is a Hollywood film producer, and he is currently evaluating a script by a new screenwriter and director, Betty Jo Thurston. Jeffrey knows that the probability of a film by a new director being a success is about .10 and that the probability it will flop is .90. The studio accounting department estimates that if this film is a hit, it will make $25 million in profit, whereas if it is a box office failure, it will lose $8 million. Jeffrey would like to hire noted film critic Dick Roper to read the script and assess its chances of success. Roper is generally able to correctly predict a successful film 70% of the time and correctly predict an unsuccessful film 80% of the time. Roper wants a fee of $1 million. Determine whether Roper should be hired, the strategy Mogul should follow if Roper is hired, and the expected value. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 40. | Tech is playing State in the last conference game of the season. Tech is trailing State 21 to 14, with 7 seconds left in the game, when Tech scores a touchdown. Still trailing 21 to 20, Tech can either go for 2 points and win or go for 1 point to send the game into overtime. The conference championship will be determined by the outcome of this game. If Tech wins, it will go to the Sugar Bowl, with a payoff of $7.2 million; if it loses, it will go to the Gator Bowl, with a payoff of $1.7 million. If Tech goes for 2 points, there is a 33% chance it will be successful and win (and a 67% chance it will fail and lose). If it goes for 1 point, there is a 0.98 probability of success and a tie and a 0.02 probability of failure. If the teams tie, they will play overtime, during which Tech believes it has only a 20% chance of winning because of fatigue.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 41. | Jay Seago is suing the manufacturer of his car for $3.5 million because of a defect that he believes caused him to have an accident. The accident kept him out of work for a year. The company has offered him a settlement of $700,000, of which Jay would receive $600,000 after attorneys' fees. His attorney has advised him that he has a 50% chance of winning his case. If he loses, he will incur attorneys ' fees and court costs of $75,000. If he wins, he is not guaranteed of his full requested settlement. His attorney believes that there is a 50% chance he could receive the full settlement, in which case Jay would realize $2 million after his attorney takes her cut, and a 50% chance that the jury will award him a lesser amount of $1 million, of which Jay would get $500,000. Using decision tree analysis, decide whether Jay should proceed with his lawsuit against the manufacturer. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 42. | Tech has three health care plans for its faculty and staff to choose from, as follows: Plan 1monthly cost of $32, with a $500 deductible; the participants pay the first $500 of medical costs for the year; the insurer pays 90% of all remaining expenses. Plan 2monthly cost of $5 but a deductible of $1,200, with the insurer paying 90% of medical expenses after the insurer pays the first $1,200 in a year. Plan 3monthly cost of $24, with no deductible; the participants pay 30% of all expenses, with the remainder paid by the insurer. Tracy McCoy, an administrative assistant in the management science department, estimates that her annual medical expenses are defined by the following probability distribution:

Determine which medical plan Tracy should select. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 43. | The Valley Wine Company purchases grapes from one of two nearby growers each season to produce a particular red wine. It purchases enough grapes to produce 3,000 bottles of the wine. Each grower supplies a certain portion of poor-quality grapes, resulting in a percentage of bottles being used as fillers for cheaper table wines, according to the following probability distribution:

The two growers charge different prices for their grapes and, because of differences in taste, the company charges different prices for its wine, depending on which grapes it uses. Following is the annual profit from the wine produced from each grower's grapes for each percentage defective:

Use decision tree analysis to determine from which grower the company should purchase grapes. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 44. | Kroft Food Products is attempting to decide whether it should introduce a new line of salad dressings called Special Choices. The company can test market the salad dressings in selected geographic areas or bypass the test market and introduce the product nationally. The cost of the test market is $150,000. If the company conducts the test market, it must wait to see the results before deciding whether to introduce the salad dressings nationally. The probability of a positive test market result is estimated to be 0.6. Alternatively, the company can decide not to conduct the test market and go ahead and make the decision to introduce the dressings or not. If the salad dressings are introduced nationally and are a success, the company estimates that it will realize an annual profit of $1.6 million, whereas if the dressings fail, it will incur a loss of $700,000. The company believes the probability of success for the salad dressings is 0.50 if they are introduced without the test market. If the company does conduct the test market and it is positive, then the probability of successfully introducing the salad dressings increases to 0.8. If the test market is negative and the company introduces the salad dressings anyway, the probability of success drops to 0.30. Using decision tree analysis, determine whether the company should conduct the test market. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 45. | In Problem 44, determine the expected value of sample information ( EVSI ) (i.e., the test market value) and the expected value of perfect information ( EVPI ). | ||||||||||||||||||||||||||||||||||||||||||||||||

| 46. | Ellie Daniels has $200,000 and is considering three mutual funds for investmenta global fund, an index fund, and an Internet stock fund. During the first year of investment, Ellie estimates that there is a .70 probability that the market will go up and a .30 probability that the market will go down. Following are the returns on her $200,000 investment at the end of the year under each market condition:

At the end of the first year, Ellie will either reinvest the entire amount plus the return or sell and take the profit or loss. If she reinvests, she estimates that there is a .60 probability the market will go up and a .40 probability the market will go down. If Ellie reinvests in the global fund after it has gone up, her return on her initial $200,000 investment plus her $25,000 return after 1 year will be $45,000. If the market goes down, her loss will be $15,000. If she reinvests after the market has gone down, her return will be $34,000, and her loss will be $17,000. If Ellie reinvests in the index fund after the market has gone up, after 2 years her return will be $65,000 if the market continues upward but only $5,000 if the market goes down. Her return will be $55,000 if she reinvests and the market reverses itself and goes up after initially going down, and it will be $5,000 if the market continues to go down. If Ellie invests in the Internet fund, she will make $60,000 if the market goes up, but she will lose $35,000 if it goes down. If she reinvests as the market continues upward, she will make an additional $100,000; but if the market reverses and goes down, she will lose $70,000. If she reinvests after the market has initially gone down, she will make $65,000, but if the market continues to go down, she will lose an additional $75,000. Using decision tree analysis, determine which fund Ellie should invest in and its expected value. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 47. | Blue Ridge Power and Light is an electric utility company with a large fleet of vehicles, including automobiles, light trucks, and construction equipment. The company is evaluating four alternative strategies for maintaining its vehicles at the lowest cost: (1) do no preventive maintenance at all and repair vehicle components when they fail; (2) take oil samples at regular intervals and perform whatever preventive maintenance is indicated by the oil analysis; (3) change the vehicle oil on a regular basis and perform repairs when needed; (4) change the oil at regular intervals, take oil samples regularly, and perform maintenance repairs as indicated by the sample analysis. For autos and light trucks, strategy 1 (no preventive maintenance) costs nothing to implement and results in two possible outcomes: There is a .10 probability that a defective component will occur, requiring emergency maintenance at a cost of $1,200, or there is a .90 probability that no defects will occur and no maintenance will be necessary. Strategy 2 (take oil samples) costs $20 to implement (i.e., take a sample), and there is a .10 probability that there will be a defective part and .90 probability that there will not be a defect. If there is actually a defective part, there is a .70 probability that the sample will correctly identify it, resulting in preventive maintenance at a cost of $500. However, there is a .30 probability that the sample will not identify the defect and indicate that everything is okay, resulting in emergency maintenance later at a cost of $1,200. On the other hand, if there are actually no defects, there is a .20 probability that the sample will erroneously indicate that there is a defect, resulting in unnecessary maintenance at a cost of $250. There is an .80 probability that the sample will correctly indicate that there are no defects, resulting in no maintenance and no costs. Strategy 3 (changing the oil regularly) costs $14.80 to implement and has two outcomes: a .04 probability of a defective component, which will require emergency maintenance at a cost of $1,200, and a .96 probability that no defects will occur, resulting in no maintenance and no cost. Strategy 4 (changing the oil and sampling) costs $34.80 to implement and results in the same probabilities of defects and no defects as strategy 3. If there is a defective component, there is a .70 probability that the sample will detect it and $500 in preventive maintenance costs will be incurred. Alternatively, there is a .30 probability that the sample will not detect the defect, resulting in emergency maintenance at a cost of $1,200. If there is no defect, there is a .20 probability that the sample will indicate that there is a defect, resulting in an unnecessary maintenance cost of $250, and there is an .80 probability that the sample will correctly indicate no defects, resulting in no cost. Develop a decision strategy for Blue Ridge Power and Light and indicate the expected value of this strategy. [1]

| ||||||||||||||||||||||||||||||||||||||||||||||||

| 48. | In Problem 47, the decision analysis is for automobiles and light trucks. Blue Ridge Power and Light would like to reformulate the problem for its heavy construction equipment. Emergency maintenance is much more expensive for heavy equipment, costing $15,000. Required preventive maintenance costs $2,000, and unnecessary maintenance costs $1,200. The cost of an oil change is $100, and the cost of taking an oil sample and analyzing it is $30. All the probabilities remain the same. Determine the strategy Blue Ridge Power and Light should use for its heavy equipment. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 49. | In Problem 14, the management of the Oakland Bombers is considering hiring superscout Jerry McGuire to evaluate the team's chances for the coming season. McGuire will evaluate the team, assuming that it will sign one of the four free agents. The team's management has determined the probability of the team having a losing record with any of the free agents to be .21 by averaging the probabilities of losing for the four free agents in Problem 31. The probability of the team having a competitive season but not making the playoffs is developed similarly, and it is .35. The probability of the team making the playoffs is .44. The probability that McGuire will correctly predict that the team will have a losing season is .75, whereas the probability that he predicts a competitive season, given that it has a losing season, is .15, and the probability that he incorrectly predicts a playoff season, given that the team has a losing season, is .10. The probability that he successfully predicts a competitive season is .80, whereas the probability that he incorrectly predicts a losing season, given that the team is competitive, is .10, and the probability that he incorrectly predicts a playoff season, given the team has a competitive season, is .10. The probability that he correctly predicts a playoff season is .85, whereas the probability that he incorrectly predicts a losing season, given that the team makes the playoffs, is .05, and the probability that he predicts a competitive season, given the team makes the playoffs, is .10. Using decision tree analysis and posterior probabilities, determine the decision strategy the team should follow, the expected value of the strategy, and the maximum amount the team should pay for Jerry McGuire's predictions . | ||||||||||||||||||||||||||||||||||||||||||||||||

| 50. | The Place-Plus real estate development firm in Problem 24 is dissatisfied with the economist's estimate of the probabilities of future interest rate movement, so it is considering having a financial consulting firm provide a report on future interest rates. The consulting firm is able to cite a track record which shows that 80% of the time when interest rates had declined, it had predicted they would, while 10% of the time when interest rates had declined, the firm had predicted that they would remain stable and 10% of the time it had predicted that they would increase. The firm has been correct 70% of the time when rates have remained stable, whereas 10% of the time it has incorrectly predicted that rates would decrease, and 20% of the time it has incorrectly predicted that rates would increase. The firm has correctly predicted that interest rates would increase 90% of the time, whereas incorrectly predicting rates would decrease 2% and remain stable 8% of the time. Assuming that the consulting firm could supply an accurate report, determine how much Place-Plus should be willing to pay the consulting firm and how efficient the information will be. | ||||||||||||||||||||||||||||||||||||||||||||||||

| | |||||||||||||||||||||||||||||||||||||||||||||||||

| 51. | A young couple has $5,000 to invest in either savings bonds or a real estate deal. The expected return on each investment, given good and bad economic conditions, is shown in the following payoff table:

The expected value of investing in savings bonds is $1,000, and the expected value of the real estate investment is $5,200. However, the couple decides to invest in savings bonds. Explain the couple's decision in terms of the utility they might associate with each investment. | ||||||||||||||||||||||||||||||||||||||||||||||||

| 52. | Annie Hays recently sold a condominium she had bought and lived in while she was a college student over 15 years ago. She received $150,000 for the condominium and is considering two investment alternatives. Annie can invest the entire amount in a bank money market for 1 year at 8% interest and thus receive $162,000 at the end of a year, or she can invest in a speculative oil exploration project with a 5050 chance of doubling her investment at the end of the year or losing everything.

| ||||||||||||||||||||||||||||||||||||||||||||||||

EAN: 2147483647

Pages: 358