CASE DESCRIPTION

|

|

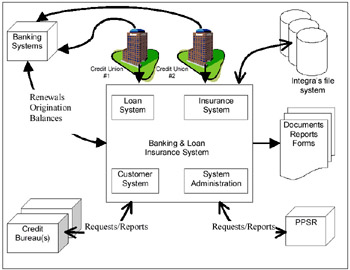

On February 20, 1996, Integra signed a partnership agreement with Intex Consulting for the development and implementation of the Banking and Loan Insurance Software System (BLISS). According to this agreement, Intex would assume the development of the loan system and interface it with both the Integra's insurance systems and the Credit Unions' banking systems in a client-server configuration. Furthermore, Intex would have the responsibility to implement the new system in each participating Credit Unions and offer technical support thereafter both at the Credit Union level and at Integra's level. For its part, Integra would assume responsibility for developing the client-side loan insurance module (InsurCalc) which would be integrated into Intex's loan system. Integra also had the responsibility to assemble a User Group composed of Credit Unions' representatives and functional managers from Integra. In forming this group, managers from Integra felt confident that they could avoid misspecifying the system. User participation has been advocated for in the IS literature for a long time (Tait & Vessy, 1988). Finally, the company had the responsibility of testing both the loan and the insurance modules of the application, find suitable pilot sites, and commercialize the new system in Canada. The business flow diagram depicted in Figure 1 puts into perspective the general architecture of the proposed system.

Figure 1: Business Flow Model

Once implemented in a Credit Union, the system would permit the origination or the renewal of a loan in the banking system of the institution. Simultaneously, the system would initiate the process of risk evaluation and insurance costing for that particular loan by automatically assessing the client's financial background through the link with the Credit Bureau, and validating the transaction through the Personal Property Securities Register Service (PPSR). Finally, with the client's consent and under certain actuarial considerations, the system would compute the premium to be charged for this particular insurance coverage, which would then be incorporated in the monthly reimbursement calculations of the loan. In short, the BLISS system would offer the Credit Unions the same functionalities as those already available to the Quebec institutions and which proved to be such a commercial success.

Roles and Responsibilities of Each Partner

With an annual IT operating budget of nearly eight million dollars, Integra's IT function has ample experience with IS project management. Over the years, IT management had put into place rigorous project management techniques, which contributed to the successful realization of large and complex IS projects. The company was also confident that Intex Consulting possessed the know how to effectively develop and implement the new system in the Credit Unions branches. A Steering Committee, composed of a very select group of senior executives, was assembled (see Appendix II for an overview of the project organization chart). Because of the high strategic potential of the project, it was felt that the venture had to be managed under very stringent security controls. Thus, apart from the project personnel and a few senior executives, only a handful of people at Integra knew in any detail the content and the scope of the project. For these same "obvious" reasons, it was decided that project planning could be put on a fast-track mode, thus bypassing the standard risk management and feasibility studies and the political and economic impact studies of the new system for the prospective clients. That decision would eventually prove to be ill-advised, as later events would clearly demonstrate[5].

For its part, Intex Consulting focused almost exclusively on the technical aspects of the project, relying on Integra's experience and know-how in the loan insurance market for the application design and functionality specifications. The partners laid out everything to ensure the prompt development of an adequate solution: assigning a high priority status to the project; doing a thorough assessment of the integration requirements for the insurance, loan and banking systems; insuring a tight coordination of the project by a coordination committee composed of the project director (Carl Gagnon), the business project leader (Stephanie Lemaire), the development team leader (Judith Tremblay), and Intex Consulting's project manager (Tom Delany)[6]. The development effort was subdivided between two teams. The first one, headed by Integra's Judith Tremblay, worked on the loan insurance module to be integrated into Intex' loan systems and on diverse interface modules to link up the BLISS system and Integra's back-office insurance systems.

IT managers felt that they were clearly aligned with the organization business strategy and that they had the indefectible support of higher management. They also had a partner with exceptional technical abilities. Even while acknowledging that the project could present a certain level of risk, they assumed they were in what many would consider an ideal situation for successful project development.

The Development group worked in close cooperation with the Business group. Their task consisted mainly in circumscribing the detailed business requirements for the client side of the insurance module. The definition of the interfaces with outside agencies, such as the Personal Property Securities Register (PPSR), and with Integra's own internal business systems and data repositories also required extensive efforts. The second team, staffed with Intex's personnel, worked on the adaptation the Canadian Credit Unions' context of the loan and banking systems developed for the US market. Due to the wide variety of circumstances amongst the prospective institutions, the new system had to be flexible, bilingual, modular, and capable of running on multiple platforms such as OS2, Unix, and Windows NT (see Appendix I for a more detailed description of the diverse mix of platforms encountered in the project).

To limit the possibility of competitive intelligence leaks, both partners opted to deal with the implementation details of the project later on, when the preliminary tests would be completed and the application would be ready for deployment. To that end, the project plan called for the formation of a User Group composed of seven representatives from local Credit Unions branches across Canada. The main responsibilities of this group was to participate in the needs and processes revisions, produce the basic business documents, give feedback on functionalities, screens, forms and reports, validate Integra's added-value components and participate in the BLISS integration tests.

At the technological level, the targeted institutions were using a rather disparate IT technological infrastructure. The hardware and the applications varied from region to region, from group to group, and often even within a particular institution (see Appendix III). Opportunity studies carried out by Integra revealed that those institutions used at least ten different technological platforms. In this context, the BLISS project, as conceived originally, consisted in developing a software solution that could be implemented at those institutions with a minimum of personalization while aiming to support the widest variety of existing IT already in place. The total development cost of the project topped 2.5 million dollars. Half of this amount (1.3 million dollars) came from Intex Consulting and the other half came from Integra in the form of wages for Integra's personnel (15 managerial staff, 1½ years). The project officially started in January 1996 and ended one year later, in March 1997.

Roles and Responsibilities of Each Partner in the Implementation Phase

With regard to the eventual deployment and exploitation of the new system, as explained by Integra's CIO, both partners signed an agreement delimiting each other responsibilities and participation in the future benefits from the project. Under the terms of this contract, Intex Consulting obtained the exclusive rights to commercialize the new system in the US market. It also had the rights to commercialize it in the Canadian market, but only when authorized by Integra on a client-by-client basis. In both cases, Integra would be entitled to royalties on each sale.

"We signed an agreement of joint ownership on the software. Roughly speaking, in the end, we kept the ownership of the system. If, for some reason, we decided to give it to a financial institution that bought our products, we could give it for free. Actually, this is what we wanted from the start. If they [Intex Consulting] found to sell the software outside of our territory [in the US], there were also contractual clauses which bind us and which applied. They could approach a customer on their own and sell the software: they were joint owners. That could create enticements for our insurance products in communities outside of our reach."

Unfolding of the Project

In late December 1995, senior management approved the formation of the Steering Committee and allocated the necessary funds to launch the project. Carl Gagnon immediately set out for the task of assembling the Coordination Committee. He was given license in choosing the best internal resources available in the persons of Stephanie Lemaire as the business project leader and Judith Tremblay as head of the internal development team. Both managers had extensive experience with Integra's business processes and their supporting information systems and had participated in several highly successful IS projects before.

| Dec. 15, 1995 | Possibility of partnering in a joint IS project is broached with INTEX representatives |

| Dec. 21, 1995 | Steering Committee formed |

| Jan. 11, 1996 | Coordination Committee is created |

| Jan. 29, 1996 | Project is presented to selected CU representatives |

| Feb. 6, 1996 | Signature of partnership agreement with Intex |

| Feb. 29, 1996 | Preliminary list of work requirements submitted |

| March 21, 1996 | Prototype level I completed |

| May 3, 1996 | InsurCalc module completed (basic) |

| July 10, 1996 | Needs and process revision completed |

| Aug. 23, 1996 | A new Coordination Committee director is nominated |

| Aug. 30, 1996 | Banking system modifications completed |

| Aug. 29, 1996 | Prototype level II completed |

| Sept. 13, 1996 | Start of preliminary activities for BLISS implementation in CU's |

| Dec. 13, 1996 | Added-value development completed |

| Dec. 13, 1996 | Prototype level III completed |

| Jan. 13, 1997 | Project is put on hold indefinitely |

The project was subdivided into 10 main tasks (Table 2), and the roles and responsibilities for each one of them were apportioned to the concerned parties. One of the first tasks of the project team was to assess the needs and processes revision mandated by the project. The first few weeks were thus spent analyzing the implications of extracting the relevant functionalities of the existing loan insurance module and adapting them to the BLISS context.

| Task | Responsibility | Participation | Milestone Schedule |

| Needs and processes revision | Integra | Intex | June 1996 |

| Development of insurance application (InsurCalc Module) | Integra | Intex/CU | May 1996 |

| Development of loan application | Intex | Integra/CU | July 1996 |

| IT infrastructure adaptation

| Intex CU CU | Integra/CU Integra/Intex Integra/Intex | August 1996 |

| Development of value-added components | Integra | Intex/CU | September 1996 |

| Banking system modifications | CU | Intex/Integra | September 1996 |

| Final system tests | Integra/CU | Intex | September 1996 |

| Training | Integra | Intex/CU | October 1996 |

| Implementation | Intex | Integra/CU | November 1996 |

| Support — Help desk | Integra | Intex/CU | November 1996 |

Efforts were also spent in the creation of a User Group composed of CU's representatives that would participate in the project. In all, seven CU from New-Brunswick (1), Ontario (1), Manitoba (1), Saskatchewan (2) and British-Columbia (2) accepted to collaborate. Their contribution essentially consisted in individual working sessions at the respondent's premises with representatives of the development team. During those sessions, the development team attempted to assess the functional specifications of the future system from the point of view of each participating institution. By the end of February 1996, a preliminary list of work requirements was compiled and presented to the Steering Committee for approval. These were approved within the following two weeks, allowing the team to start work on a first version of the prototype. In rapid succession, Integra's development team was able to deliver a Prototype Level I, and on May 3, the basic functionalities of the InsurCalc module that would eventually be incorporated in the banking module developed by the Intex team.

Meanwhile, work on the completion of the needs and process revision task proceeded rather haltingly. For one thing, it was found that interfacing Integra's file systems was a greater challenge than anticipated. There were actually more than 80 different legacy file systems (hosted on MVS and VSE/ESA platforms) to integrate in the new BLISS system. At least 15 of these systems were in service since the 1980s and were slated for major revisions in light of the Year 2000 deadline. Further complicating the process, the Business Project Team insisted in adding what they termed ‘value-added components’ on top of all the standard utilities already implemented in the existing insurance system. From their point of view, the new system imperatively had to offer sophisticated customization and auditing tools, a flexible report generator, and a complete on-line help file in order to favorably reflect Integra's high standards of excellence and quality. All these requirements had to fit in a system small enough and efficient enough to operate in a microcomputer based client-server configuration suitable for the smaller CUs.

On the Credit Union side of the project, the collaboration with the CU's representatives did not unfold exactly as planned either. According to the original plans, each CU was to assign a loan officer for the project duration (approximately a 55 person-days effort for needs and process revision and a 70–90 person-days effort for tests and implementation). Of the seven original CUs who had participated in the first round of meetings in February 1996, only three remained more or less active by the end of June 1996. Even with such a reduced input, the development teams nonetheless managed to complete the requirements and process revision report, which was presented to the Coordination Committee in time for their bimonthly meeting on July 10, 1996.

Carl Gagnon ascribed the lack of CU's participation to the fact that he had had little time to spare to cultivate his contacts with the participating CUs. As he explained to the Steering Committee, most of his efforts were now devoted to coordinate the development teams from each company, and to resolve numerous technical and organizational problems stemming from the fusion of two complex systems developed in very different organizational and business contexts. He felt that the business requirements were now clearly circumscribed, and that only the technical issues were left to resolve. Therefore, the reduced participation of the User Group was not to be perceived as a major problem.

Moreover, Gagnon confided that he felt slightly overwhelmed by the task at hand. He suggested that his time could be better spent at the helm of the project rather than being dispersed as both the project director and the head of the Coordination Committee. The committee members acquiesced to his request and nominated the newly designated V.P. for Product Development, Jim Cochran, to take charge of the Coordination Committee, upon his return from the Summer vacations in mid-August.

Cochran was a new player in the project: up to that point, he had not been directly involved in the project.

"The BLISS system, when I inherited the project in August 1996, was already on hand and it had been... Its development program, the contracts with Intex had been negotiated and signed before I arrived at the vice-presidency. My predecessor and the management teams in place before that had been absolutely convinced that, in order to sell the loan-insurance product in the Credit Unions network in Canada, it was imperative to develop this information system tool, that the two were inseparable."

Cochran had a long experience in dealing with financial institutions outside the Province of Quebec, having been in charge of the commercialization for Integra of various travel insurance products across Canada. He felt quite comfortable in his new role as an intermediary between Integra and the prospective pool of clients for the new BLISS system. The first clear sign that something was seriously amiss with the project materialized when, in September 1996, the marketing team returned from a field trip empty-handed. Although the Credit Unions' managers generally expressed a genuine interest in the new system, they seemed somewhat reluctant to commit themselves in any meaningful way to the project. This initial disquieting perception crystallized when, a few weeks later, at the end of the development phase, the project managers tried to enlist pilot sites to field-test the new system. As reported by Jim Cochran, the project seemed to hit a brick wall: "How many do you think that I [have] sold? I have... even when we offered them the system for free, not a single one wanted to become a test site, not even those that had participated in the User Group. They didn't want any part of it!"

Integra's management speedily setup a crisis management group whose primary task was to find what had happened and what corrective actions could be undertaken, if any, to bring the project to completion. Jim Cochran was designated to lead this effort. As explained by Cochran, the first order of the day for the task group was to go back to the Credit Unions and investigate why they had apparently changed their mind on the project.

"From then on, I decided we should go up the chain [of the Credit Unions]. I found resistance at the Credit Union level, with all the excuses that came with it. I went up to the regional level, and I still had resistance, but with better excuses. I went all the way up to the National Central where I was squarely laughed at. The CanCoop representative said to me: ‘Put an ax on this project! Do you want to destroy us? You are asking the Credit Unions to autodestruct themselves. It is plain nonsense!"

To their astonishment, the Coordination Committee members learned that these high level executives had never been consulted by the project management group and therefore, had not had any input on the project. The requirements analysis had been conducted exclusively at the Credit Union level without ever taking into consideration the larger business context of these institutions and their affiliation to regional centrals. Typically, Carl Gagnon and another member of the coordination committee (either Stephanie Lemaire or Judith Tremblay) would meet with some junior executive or a loan officer of the Credit Union branch to discuss the technical aspects of the proposed system. While the requirements were technically sound and the system design filled the specific needs of the branches, surprises were to be expected when considering the larger institutional picture. At no point in the analysis process did it occur to the project sponsors that both the individual Credit Unions and their Centrals had financial stakes in the CanCoop Group and that a switch to Integra's products might pose some problems.

As was later discovered by Cochran's team, each Credit Union, each Regional Central and the National Central owned a significant part of this insurance firm, and therefore had good reasons to keep doing business with it. "The problem was that we were asking potential clients to turn their back on a product with which they were comfortable, which generated important incomes for them, which contributed to the development of their insurance company, which generated profits for their provincial Central, which provided them with services, and which generated income for their National Central." Understandably, the Credit Unions Centrals managers were not very enthusiastic about the idea of having "outsiders" trampling on what they considered as their own territorial business relationships with the Credit Unions.

In hindsight, the task group realized the even if the new system had been offered free of charge, its installation still mandated relatively major investments in network infrastructures and computer equipment for the small Credit Unions, ranging from 100 thousand dollars to more than one million dollars per site. More fundamentally, the Centrals would have considered as treasonous the active participation of any of their institutions in the project. In fact, the adhesion of the Credit Unions to the BLISS project would have meant a gradual weakening of the financial position of their respective Centrals, since a significant part of their financing came from the profits generated by their participation in the CanCoop. Project planning totally overlooked this aspect and it came as a complete surprise to the project managers.

At the end of the fact-finding mission, in January 1997, Jim Cochran knew the Credit Unions would never implement the BLISS system in its present form. "My boss Donald Lapierre could very well see for himself that this project had been sold quite efficiently by the IT people to Marketing. He could also see that senior management hadn't had a clear grasp of the scope of the project, and more importantly, that the whole thing had never been validated by the potential market." Integra's management discreetly shelved the project, and negotiated an acceptable settlement with Intex Consulting to put an end to the development effort. Internally, obviously, it was necessary to emerge from the project in an elegant way to avoid the appearance of harassing the intermediate managers who had taken part in that decision.

[5]On this subject, see Ewusi-Mensah (1987) and Barki et al. (2001).

[6]The Loan Insurance Manager for Canada joined the project coordination committee in the later stages of the development effort.

|

|

EAN: 2147483647

Pages: 367