STP as One Possible Solution

|

| < Day Day Up > |

|

STP is defined as the end-to-end automation of security trading process from order to settlement (Hee & Huang, 2002; Anonymous, 2001). It involves the seamless, automated electronic transfer of trade information to all parties in as close to real-time as possible. It also involves moving electronically through a trading process from initiation through post-execution and final settlement without manual intervention. It aims to achieve:

-

No re-keying of information once the transaction has entered the workflow;

-

Automatic linkages and paperless processing from front-end to back-end, regardless of the parties involved or their geographic location;

-

Workflow automation to facilitate transaction monitoring and exception alerts;

-

Manual intervention or data processing only on an exceptional basis.

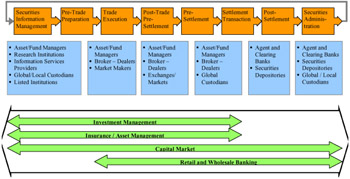

Properly implemented, STP can increase efficiencies, improve customer services, and reduce operational costs and risks. Figure 1 depicts the security trading processes as well as the participating parties that are under the umbrella of STP.

Figure 1: Trading Processes and Participation Parties Under STP Umbrella.

A Theoretical Framework for STP

STP may be implemented in different levels. Intra-STP refers to STP implementation inside an organization and all of its branches. Extra-STP refers to STP between firms that allows direct access into other companies' internal processes and facilitates an industrywide integrated straight through process. Global-STP refers to a set of interconnected extra-STPs that cover worldwide boundaries. It represents the level of integration of core processes, systems, and information interchange within firms, between firms, and between industries. As the implementation of STP expands, cost reduction effect escalates.

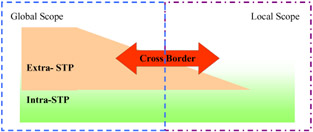

Financial firms are moving to integrated connections for direct interactions/ transactions with customers, partners and suppliers. All concerned parties need to work with the same data and information. Recent usage has defined different stages of interconnection between firms, such as intranet, extranet or Internet. The term "intranet" refers to a Web-based private network. An intranet facilitates dissemination of company information within the boundaries of the company and its sub-organizations. An "extranet" is a group of intranets that connects companies with suppliers or other business partners. An extranet facilitates information sharing across the companies. The Internet is an open system which allows interconnectivity across all sectors of industry. Taking into consideration the distinction between internal processes (within a firm and its subsidiaries) and external processes (with other trading partners or customers' processes), and the integration level as well as connectivity between the two types of processes, we can propose a theoretical framework for STP (illustrated in Figure 2).

Figure 2: A Theoretical Framework for STP.

The proposed theoretical framework includes "intra-STP", "extra-STP", and "full-STP". Intra-STP refers to STP implementation inside the organization and all of its branches. Extra-STP refers to STP between firms, which allows direct access into other companies' internal processes, and facilitates an industry-wide integrated straight through process. Full-STP (a special and highest level of Global Extra-STP) refers to a set of interconnected extra-STPs that covers worldwide boundaries. It represents the level of integration of core processes, systems and information interchange within firms, between firms, and between industries. It is the largest and most complicated integration of STP.

There needs to be a distinction made between local and global boundaries for extra-STP and/or full-STP capabilities. To some extent, local boundaries can place limitations on the capabilities of STP. For example, in Australia, the SEATS system (an Australia security settling system) allows only nationally originated access into the system. An overseas transaction has to relay to a local processing centre to be able to initiate the transaction.

In an ideal or full-STP-enabled global environment, such restrictions should be reviewed to facilitate worldwide transaction at any time. According to GSTPA, a globalized (full)-STP solution will be a multilateral interconnectivity to establish an environment for Investment Managers, Brokers/Dealers, and Global Custodians to interoperate in the process of trade enrichment and matching. It is obvious that STP in a global scope requires international standard protocols, substantial network backbone and comprehensive cooperation among all participants in the global system.

A Brief History

The Industry Standardization for Institutional Trade Communications (ISITC) was set up in 1992, focusing on standardizing the links and the format of trade settlement instructions and other messages among fund managers and custodians. The Financial Information Exchange (FIX) was also formed in 1992 to deal with pre-trade and trade communications among counterparties. FIX's objective is "to improve the global trading process by defining, managing, and promoting an open protocol for real-time, electronic communication between industry participants, while complementing industry standards" (Greensted, 2001). In 1999, a key new standard to facilitate STP implementation became available. The ISO 15022 standard permits migration of the securities industry to a standardized use of XML, guaranteeing interoperability across the industry and others. Each country or region will adapt its message formats to suit its own particular requirements. One of the first initiatives taken by Fidelity Investment in establishing the Electronic Trade Confirmation (ETC) facility was to provide electronic post-trade communications among fund managers and brokers. The availability of quasi-industry message standards such as ISITC, FIX, and ISO 15022 has enabled this seamless automated trade processing.

Emerging Standards

Intra-STP, extra-STP and full-STP do not imply simple interconnectivity among different parties in the market. STP, like any electronic communication arrangement, comprises multiple layers that need to be standardized and agreed upon to facilitate true STP in a global environment. Currently, the two major central matching approaches to STP are the GSTPA and OMGEO models. Both entities have significant market presence and are important in the move toward T+1, and both also support the emerging standards. A brief outline of these two entities is presented.

There are some major differences between the OMGEO and GSTPA models. The GSTPA approach is not intended to support existing domestic market infrastructures and practices, while OMGEO utilizes the existing infrastructure. OMGEO has made significant progress in getting to market, as it continues to leverage from existing systems to drive the workflow. On the other hand, the GSTPA solution is taking a longer time to be developed, implemented and fully functional (two years to get to its current state and is expected to take another one or two to be fully functional). So, in terms of the fast changing nature of technology and market requirements, the current level of responsiveness might be an issue for GSTPA. The GSTPA solution is being built from scratch, thus its compatibility with, and ability to re-use, the huge legacy infrastructure of most participants is likely to affect its adoption. Some of the larger dominant players in the processing area cover multiple functions (investment managers, global custodian, broker dealers).

| OMGEO | GSTPA | |

|---|---|---|

| History | Joint venture between TradeSuite of the Depository Trust & Clearing Corporation (DTCC) with Thomson Financial ESG, a division of Thomson Financial in 2000 | Founded in August 1998, the GSTPA is an industry association open to all Investment Managers, Brokers/Dealers and Global Custodians involved in the processing of cross-border trades. |

| Objective | To create the leading global trade processing platform and bring the securities industry closer to shortened settlement cycles | To accelerate the flow of cross-border trades information, to reduce the number of failed cross-border trades and to reduce the risks and the costs of cross-border trade settlements |

| STP Solution |

|

|

According to research by DST International (Frolich, 2001), both STP models have received equal levels of support, with 5% of respondents indicating support for each. This research also indicated that the most important factor determining the choice of the STP model is which one will most easily enable new product flexibility. So, there are two solutions from different vendors which are basically aimed at providing broadly similar services. This, plus the prospect of antitrust restrictions, raises the prospect that these two competitive models will have to eventually become interoperable. Not to do so will risk significant investment funding for two separate initiatives and significant negative market reaction. Notwithstanding the differences and uncertainty about which model may eventually emerge as superior, the imperative of T+1 implementation in the US remains. Firms need to begin assessing their STP readiness, while any issues between the two models are resolved in the background.

|

| < Day Day Up > |

|

EAN: 2147483647

Pages: 207