Automobile manufacturing

At present, there are over 100 vehicle assemblers in China, but the market is concentrated in the hands of a few. The Big Three auto companies, First Auto Works (FAW), Shanghai Auto Industry Corporation (SAIC) and Dong Feng Motors captured 47 per cent of the total market in 2001. However, a number of Chinese domestic producers “ Chery, Geely and Qinchuan Flyer “ have grabbed a significant share of the dynamic private car market from the multinational vehicle manufacturers by offering low priced basic cars .

These inroads into the market have been made possible by powerful backers. Chery is supported financially be the Anhui provincial government. The brothers Li, who own Geely, had made fortunes from the construction industry and motorcycle production, while the Qinchuan Flyer is ultimately an offshoot of NORINCO, the commercial arm of the People's Liberation Army.

These newcomers do not intend to remain at the bottom end of the market. Chery have recently invested US$55 million in a new paint-shop, whilst Geely have plans for six new models in the design stage. They are now looking for outside expertise to help them move up to the next level.

Major vehicle assemblers

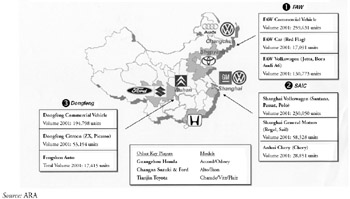

The geographical location of the major vehicle assemblers with multinational participation is illustrated in Figure 6.1.3. These include the Big Three, together with Guangzhou Honda, Changan Suzuki & Ford and Tianjin Toyota.

Figure 6.1.3: Mapping of major vehicle assemblers

The current market shares of the major manufacturers and their models are profiled in Tables 6.1.3 which details unit production and sales of each model during June and for the six month period to June 2002. The table shows clearly that the two Volkswagen models of the FAW-VW joint venture and the three models of the Shanghai-VW joint venture no longer predominate.

| In units | |||||

|---|---|---|---|---|---|

| Production | Sales | ||||

| Manufacturer | Model | June | Accumulated | June | Accumulated |

| FAW | Red Flag | 2,932 | 16,178 | 2,918 | 16,163 |

| Shanghai-VW | Santana 2000 | 7,711 | 29,849 | 7,655 | 29,653 |

| Passat | 5,016 | 28,131 | 5,004 | 28,088 | |

| POLO | 3,004 | 8,975 | 3,016 | 8,817 | |

| Shanghai GM | Buick G | 2,657 | 10,416 | 2,777 | 10,317 |

| Buick 3.0 | 728 | 3,839 | 901 | 3,743 | |

| Buick GL8 | 1,280 | 5,844 | 1,420 | 5,912 | |

| Sail | 2,142 | 11,715 | 2,020 | 12,285 | |

| FAW-VW | Jetta | 9,364 | 46,713 | 10,903 | 57,848 |

| Audi | 2,649 | 16,092 | 3,525 | 15,053 | |

| Guangzhou Honda | Accord | 5,582 | 25,417 | 5,379 | 25,364 |

| TAIC | Xiali | 8,950 | 39,523 | 6,731 | 46,442 |

| DCAC | Fukang | 5,124 | 26,975 | 5,289 | 30,216 |

| Elysee | 2,354 | 2,354 | 2,255 | 2,255 | |

| Channa | Alto | 5,187 | 26,617 | 3,925 | 26,829 |

| BAIC | Cherokee | 409 | 1,512 | 312 | 1,414 |

| DFAC | Aeolus | 3,133 | 14,037 | 1,776 | 12,866 |

| Source: China Association of Automobile Manufacturers | |||||

Profiles of the top ten automobile assemblers

| FAW (First Auto Works) | |

| Location | Changchun J |

| oint venture partner | VW |

| Models | Jetta, Audi A6, Bora, Red Flag (re-styled Audi 100) |

Comments

Long-established joint venture (1985). FAW is also a leading commercial vehicle manufacturer. In mid-2002, concluded a new 50/50 joint venture with Toyota to produce cars under Lexus brand; Crown saloon will be first model (2005).

Have recently taken control of Tianjin Auto.

Outlook: Winner

SAIC (Shanghai Auto Industry Corporation)

| Location | Shangai |

| Joint venture partners | VW, GM (since 1998) |

| Models | Santana, Santana 2000, |

Comments

Strongly supported by Shanghai Municipal Government.

Alliance with GM has caused tensions with long-time partner VW.

Actively purchasing shares in other regional manufacturers (eg Anhui Chery).

Outlook: Winner

Dong Feng Motors

| Location | Wuhan |

| Joint venture partner | PSA Citroen |

| Models | Fukang (aka Citroen ZX), |

Comments

Hampered by limited model range. In September 2002, concluded new JV with Nissan, with an ambitious target of 220,000 cars by 2006. PSA poised to introduce 307 model. Strong player on domestic CV market.

Outlook: Fortunes may improve with Nissan alliance.

Guangzhou Honda

| Location | Guangzhou (Honda took over the facility when Peugeot abandoned earlier joint venture in mid 1990s) |

| Joint venture partner | Honda (Chinese partner), |

| Models | Accord, Odyssey |

Comments

Accord is the best-selling 'prestige' car in China. Only plant to be operating above 70 per cent capacity. Outlook: Winner

Brilliance China

| Location | Shenyang |

| Joint venture partner | Alliances with Toyota, BMW and MG Rover |

| Model | Zhonghua saloon |

Comments

The 'mystery' company of the Chinese auto industry. Privately owned and listed on New York Stock Exchange. Was third most profitable auto company from manufacture of Jinbei van before profits slipped. Chairman and major shareholder, Yang Rong, has been publicly ousted.

Only received car manufacturing licence in June 2002. Outlook: Clouded. Timing when BMW 3-series production comes on stream may be critical.

TAIC (Tianjin Auto Industry Corp.)

| Location | Tianjin |

| Joint venture partner | Daihatsu |

| Model | Daihatsu Charade |

Comments

An early joint venture that stagnated. When Toyota decided to introduce the Vitz model, they built their own factory next door. Recently announced that they are to be taken over by FAW in first big consolidation of the Chinese auto industry.

Outlook: New ownership may revive loser.

Changan Auto

| Location | Chongqing |

| Joint venture partners | Suzuki, Ford |

| Models | Alto, Ikon (starts 2003) |

Comments

Solid, local sales base; but remote from other main consumer markets.

Alto engine meets higher emission standards than competitors .

Outlook: Perception of Ikon as dated model casts doubt on market prospects. Early introduction of Mondeo would have positive impact.

Anhui Chery

| Location | Wuhu |

| Joint venture partner | None |

| Models | Chery |

Comments

Spectacular sales growth in 2001/2 with Chery saloon (similar to Jetta).

Strong support of local government has enabled under- cut of competitors.

Part-owned by SAIC (see above).

Outlook: Winner

Geely Motors

| Location | Ningbo |

| Joint venture partner | None |

| Models | Merrie (Daihatsu derivative) |

Comments

Privately-owned company with background in construction and motorcycle industries. Competitively priced entry-level car. Achieved sales of 30,000 in 2001 from standing start. Outlook: Short- term winner

BAIC (Beijing Automotive Industry Co)

| Location | Beijing |

| Joint venture partner | Daimler Chrysler |

| Models | Cherokee Jeep |

Comments

The first automotive joint venture in China, with track record of expensive mistakes. In particular, the wrong product led to very poor sales.

Daimler-Chrysler cannot afford to walk away from the market and has committed to another 30 years ' co- operation.

In the short-term BAIC (and other Beijing-based companies) have contracted with Hyundai to build the Sonata, rumoured to become the official taxi for the Beijing Olympics

Outlook: Daimler-Chrysler will seek to revive fortunes with Mitsubishi-based SUVs. The Pajero model has been named.

Motorcycle manufacturing

Production and sales by engine size

The proportions of motorcycle production and sales by size of engine for two- and three-wheeler categories for the month and six months prior to June 2002 are detailed in Table 6.1.4. Among two-wheelers, there appears to be a marked shift toward higher- powered models in the 110 to 250 ml categories where current growth is strong. Conversely, both production and sales of smaller engine two-wheelers are in decline, although 100 ml models remain the second most popular size with a 29 per cent market share (125 ml models “ 68 per cent).

| In units | ||||||

|---|---|---|---|---|---|---|

| Production | Sales | |||||

| Index | June | Accumulated | Change, % | June | Accumulated | Change, % |

| Subtotal on 2Ws | 970,533 | 5,667,882 | 10.20 | 996,691 | 5,710,071 | 13.19 |

| 50ml | 86,018 | 399,623 | “14.65 | 89,894 | 424,401 | “8.63 |

| 60ml | 707 | 2,257 | “60.82 | 523 | 4,910 | “36.21 |

| 70ml | 9,140 | 57,834 | “37.64 | 9,806 | 63,078 | “31.34 |

| 80ml | 8,483 | 22,363 | “22.04 | 8,689 | 22,259 | “36.10 |

| 90ml | 25,773 | 177,147 | “16.78 | 25,829 | 179,436 | “13.02 |

| 100ml | 199,836 | 1,197,043 | “14.18 | 209,011 | 1,237,936 | “9.56 |

| 110ml | 72,964 | 487,990 | 42.18 | 75,954 | 493,238 | 45.62 |

| 125ml | 480,323 | 2,919,342 | 24.92 | 488,296 | 2,879,009 | 25.96 |

| 150ml | 79,660 | 344,706 | 47.25 | 80,837 | 347,822 | 55.83 |

| 250ml | 7,129 | 57,248 | 121.87 | 7,532 | 56,135 | 141.60 |

| Subtotal on 3Ws | 37,644 | 178,606 | “8.55 | 38,549 | 180,306 | “7.14 |

| 50ml | 2,507 | 15,295 | 21.98 | 3,100 | 15,471 | 31.03 |

| >50ml | 34,106 | 157,608 | “9.52 | 34,442 | 159,159 | “8.48 |

| 250ml | 723 | 4,301 | “24.50 | 628 | 4,220 | “24.71 |

| 750ml | 308 | 1,402 | “51.49 | 379 | 1,456 | “48.80 |

| Total | 1,008,177 | 5,846,488 | 9,51 | 1,035,240 | 5,890,377 | 12.44 |

| Source: China Association of Automobile Manufacturers | ||||||

Among three-wheelers, only sales of the very small engine models of 50 ml are growing. The most popular category, where sales year-on-year fell 8.5 per cent, remains the 50 to 250 ml category with an 88 per cent market share in the three-wheeled sector.

Exports of major motorcycle manufacturing enterprises

The unit exports of the top 15 motorcycle manufacturing enterprises in June 2002 are compared with June 2001 in Table 6.1.5. The two biggest exporters are

| In units | ||

|---|---|---|

| Enterprise | June | The Same Period of Last Year |

| Total | 564,874 | 669,292 |

| Chongqing Loncin (Group) Co., Ltd. | 91,998 | 120,895 |

| Chongqing Lifan-Honda Industry (Group) Co., Ltd. | 84,523 | 146,955 |

| Jincheng (Group) Co., Ltd. | 57,236 | 65,107 |

| Qianjiang (Group) Co., Ltd. | 41,345 | 42,335 |

| China South Aviation Power Machine Company | 35,515 | 29,784 |

| Chongqing Zongshen Hailing Machine Vehicle Co., Ltd. | 32,622 | 36,784 |

| Jianshe Industrial (Group) Co., Ltd. | 30,711 | 28,451 |

| Jilong Motorcycle Co., Ltd. | 27,611 | 46,914 |

| MACAT Motorcycle Co., Ltd. | 20,595 | 12,100 |

| China Jialing Industry Share Co., Ltd. | 18,019 | 26,940 |

| China Qingqi (Group) Co., Ltd. | 15,715 | 24,798 |

| Guangdong Kingtown Group Guangzhou Tianma Motorcycle Co., Ltd. | 11,152 | 6,320 |

| Dachangjiang (Group) Co., Ltd | 14,102 | 3,168 |

| Fosti Motorcycle (Group) Co., Ltd. | 10,418 | 1,060 |

| Luoyang Northern Enterprises (Group) Co., Ltd. | 9,893 | 16,039 |

| Changchun Changling (Group) Co., Ltd. | 2,904 | 6,631 |

| Source: China Association of Automobile Manufacturers | ||

Chongqing Loncin (Group) and Chongqing Lifan- Honda Industry (Group), accounting respectively for 16 per cent and 15 per cent in 1992, a reversal of their 1991 positions (18 per cent and 22 per cent). Overall, motorcycle exports slipped by 16 per cent in June alone, to 564,874 units.

EAN: 2147483647

Pages: 648