Matching Transactions

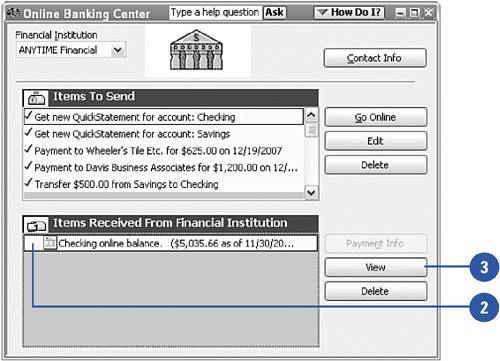

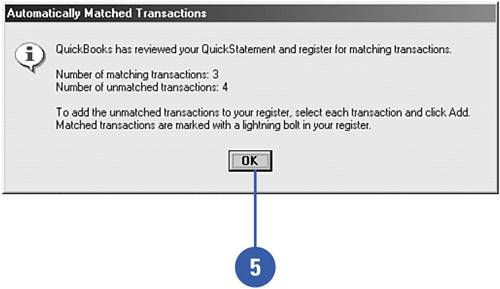

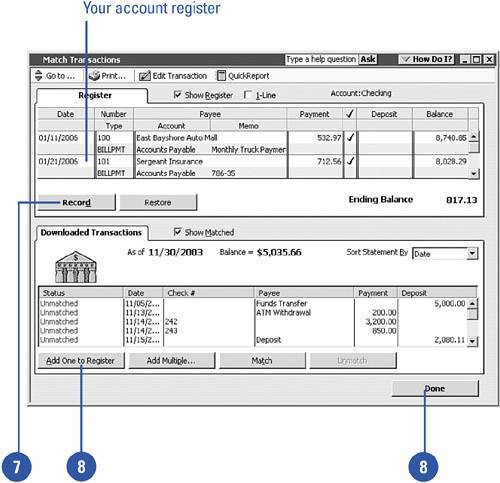

| When you download your bank statement, QuickBooks automatically attempts to match transactions in your bank statement with transactions in your QuickBooks program. Unmatched transactions are noted at the bottom of the window. You can order QuickBooks to record an unmatched transaction in your bank account register.

|