Scheduling Recurring Transactions

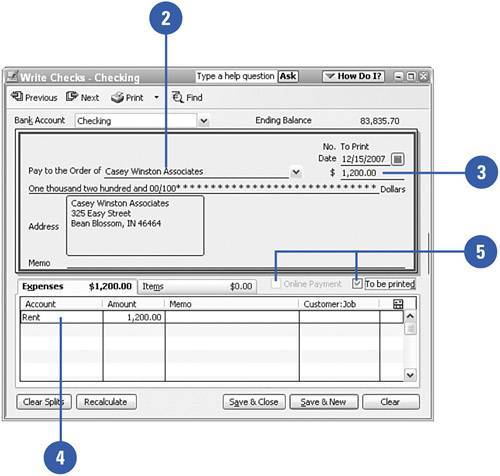

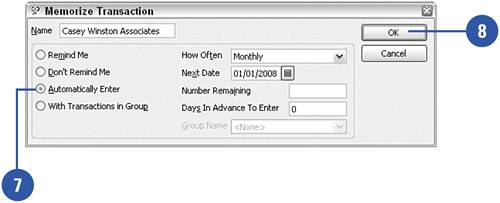

| The next level of convenience after having QuickBooks memorize a transaction for you is to have QuickBooks take care of executing the transaction too. After you get the hang of this procedure, you can let QuickBooks do all your work! Seriously, it's nice not to have to worry about paying the rent on timeask for a friendly reminder or just let your program do your chores automatically. This example sets up your monthly rent or mortgage payment as a recurring transaction. Create a Recurring Transaction

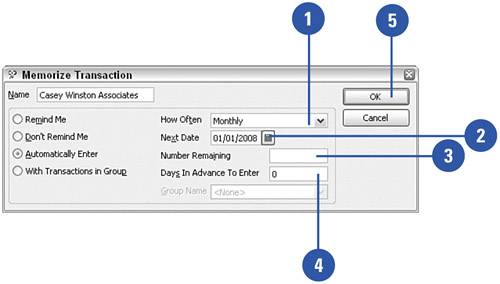

Choose Frequency of Recurrence

|