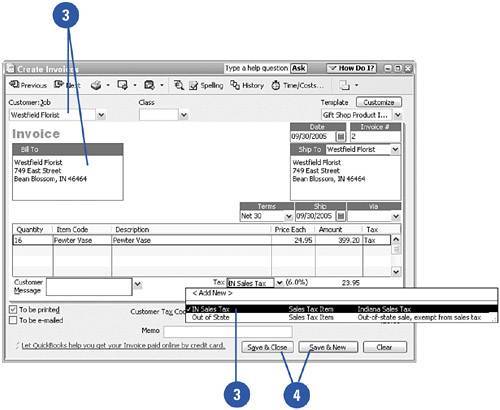

Charging Sales Tax to Customers

| QuickBooks calculates sales tax based on the rate you entered. All items on an invoice that are subject to tax are added together and the tax rate is applied. Items that have been designated as non-taxable are exempted from the tax calculation. All you have to do is indicate which tax rate to use and QuickBooks does the rest. If you charge the same tax rate on everything you sell, the process of charging sales tax is easier still.

|