Inflection Point Analysis

|

Inflection point analysis (IPA) is extremely helpful in determining when leverage points are in transition. [18] Inflection points are defined as points of major change in any being, one relative to another. In people, inflection points may be identified as marriages, deaths, births, divorces, job changes, home purchases, etc.

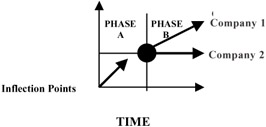

Companies 1 and 2 are relatively close in Phase A, but suddenly one gets it, and the other does not. At the inflection point, valuations based upon performance diverge in Phase B.

In business entities, we try to identify inflection points, because they typically indicate one, or more, competitor(s) is/are "getting it," while the others are not, or are not as well. Business is replete with examples of this phenomenon. Pictorially, we may view an inflection point as in Figure 9.

Figure 9: Inflection Point

In Table 10, what we see is that one company, relative to others in the pairs, "got it," compared to the others. For instance, in 1998, Apple had a bigger market cap than Microsoft. However, by 1998, Microsoft's market cap far exceeded Apple's. In fact, Apple's market cap remained at $4 billion. Clearly, one company got it, and one did not. Microsoft wanted itssoftware on everyone's computer; Apple only wanted its software on its own hardware. Such conditions are examples of major inflection points.

| Group | Company | Year/Market Cap ($s) | Year/Market Cap ($s) |

|---|---|---|---|

| A | Microsoft | 1989/3 billion | 1998/220 billion |

| Apple | 1989/4 billion | 1998/4 billion | |

| B | GE | 1983/25 billion | 1997/260 billion |

| Westinghouse | 1983/4 billion | 1997/17 billion | |

| C | Cisco | 1993/4 billion | 1998/76 billion |

| Bay Networks | 1993/2 billion | 1998/6 billion | |

| D | Nike | 1990/4 billion | 1998/10 billion |

| Reebok | 1990/3 billion | 1998/2 billion | |

| Source: Examples of major inflection points were highlighted by Slywotzky et al. (1999), as shown in table form. [a] | |||

|

[a]Slywotzky, A. J., Morrison, D. J., Moser, T., Mundt, K. A., & Quella, J. A. (1999). Profit Patterns. New York: Random House. | |||

However, knowing intellectually what an inflection point is and determining the early onset of such a condition is a whole other matter.

[18]Based on the pioneering work of Slywotzky, A. J., Morrison, D. J., Moser, T., Mundt, K. A., & Quella, J. A. (1999). Profit Patterns. New York: Random House, in their discussion of "The Polarization Phenomenon."

|

EAN: 2147483647

Pages: 139