Slope Analysis

|

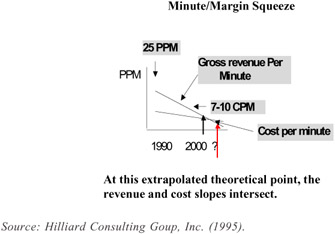

Another tool that helps provide insight when reviewing business trends and performance comes from a suite of tools coined "Slope Analysis." Slope analysis is based on graphing trends of key variables over time (in the above case, unit price and unit cost), based on actual data, and then extrapolating those slopes to future periods. Such a slope analysis for the IXC market would have indicated, several years before AT&T and MCI proclaimed an understanding of this relationship, that the IXC business model was dead, or at least severely challenged, as currently constructed. That is, the slope analysis would have indicated that gross revenue per minute was degrading significantly faster than corresponding costs. When such a relationship comes to be, it indicates through extrapolation that at some point in the probable not too distant future, gross revenue will not provide the margins required to cover costs, let alone make a profit.

Figure 6: Slope Analysis

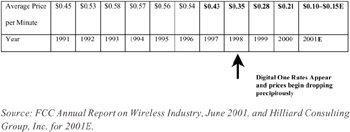

The wireless narrowband market may be trending in a similar fashion to the IXC market relative to gross revenue per minute price degradation, as seen in Figure 7.

Figure 7: Average Price/Minute for Mobile Telephone Service

What is not known at this time is what the wireless carriers are experiencing on a cost per minute basis.

Nevertheless, such a trending, even with estimates, may provide a leading indicator that a business case may shortly no longer be sustainable, and that a market exit or fundamental change in the business case may be required.

Converging/Diverging Gross Margin Analysis

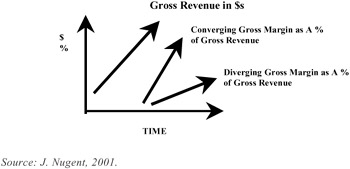

Another powerful form of slope analysis involves what is known as "Converging/Diverging Gross Margin Analysis." Gross margin is simply the difference between net sales and cost of goods (or services) sold. It is a measure of operational efficiency. Gross margin may be the single most important metric in any business.

In a converging/diverging gross margin analysis, we try to determine if the gross margin is increasing as a percent, or decreasing as a percent, of net revenue over time. If we determine that gross margins are increasing as a percent of net revenue over time (converging = a good thing), this indicates that each successive sale is more profitable operationally than those that preceded it. And conversely, if we see a decreasing gross margin as a percent of net revenue over time (diverging = a bad thing), this indicates that each successive sale is operationally less profitable than the sales preceding it (Figure 8).

Figure 8: Converging and Diverging Gross Margins

Diverging gross margins indicate a serious deteriorating operational condition. It is important to discern the underlying reasons for a convergence or divergence of gross margins as soon as possible. Understanding why margins are converging may allow one to improve business even further.

Conversely, understanding why gross margins are diverging should highlight fundamental problems as early as possible. These margins may be measured as often as monthly. Seasonal businesses will have to be aware of variations due to the unique natures of their businesses. Important Note: Converging gross margins indicate increasing operational efficiencies, as each successive sale is more profitable than the one that preceded it. And conversely, diverging gross margins indicate impairment in the operational efficiency of the enterprise with each successive sale. Diverging gross margins are a matter of the utmost importance!

In order to plot these converging or diverging margins, we simply need to capture data from past income statements. A recent 1997 example of this condition was seen when AT&T spun out its wireless business unit. A careful reading of that entity's financials at the time would have indicated that the wireless unit experienced a serious decline in its gross margin—a whooping diverging gross margin in a single year. The importance of this diverging gross margin was shortly felt by shareholders who bought shares at the IPO price, as soon thereafter, the AT&T Wireless share price dropped precipitously.

Here, we see that the gross margin analysis does not necessarily tell us "why" operations are becoming less efficient, only that they are. Had we drilled down on the AT&T Wireless entity after determining it had a diverging gross margin, we would have seen that this condition arose because of "off-net" or roaming charges paid to other carriers. That is, AT&T marketing and sales organizations introduced a widely accepted calling plan into the market long before AT&T had sufficient infrastructure to complete calls nationally on its own wireless network under its "Digital One Rate Plan." This required AT&T to originate and terminate calls on other carrier's networks at a relatively high cost. This determination of a diverging gross margin in AT&T's case would have further indicated a continuing and relatively large capital requirement in order to build out its network infrastructure in order to bring off-net traffic on-net. And this understanding would have highlighted an impending cash crisis, when viewed in terms of the network buildout required to become operationally cost effective. Hence, a simple converging/diverging gross margin analysis would have led us to better understand the current and continuing issues facing AT&T and AT&T Wireless before others became aware of the issues.

|

EAN: 2147483647

Pages: 139