THE COST-BENEFIT ANALYSIS OF MARKETING ACROSS CULTURES

Finally the problem for marketers is that there has been no commonly accepted framework that relates models of cross culture and reconciliation to bottom-line business results. Supplier, distributor, and buyer give different emphasis to individual or team efforts, different emphasis to personal relationships within business, different emphasis to status of older, more experienced staff, different emphasis on the present and future, etc. But what does this mean in terms of marketing strategy? What are the consequences for prioritizing resource allocation and strategic decision making in marketing planning when trying to put effort and/or resource into reconciling these dilemmas? How can we synergize these models of cross culture with the marketing planning formulation process? These questions have gone unanswered for too long.

For example, an in-depth survey by Woolliams and Dickerson (1999) was conducted across Eastern Europe, the Middle East, and Africa for a major client seeking to be more effective in its global marketing effort. It revealed a need for a model to manage the complex relationships of their key customers around the world. Their employees and distributors were interviewed from the European emerging markets department of a selected company division. This was intended to uncover the existing dilemmas between the different partners and customers from the different cultures. A common need was identified for a strategic decision-making model that would enable respondents to align sales resources around the world.

The new model, based on many of these types of situations from our consulting practice over the last few years , is an extension of portfolio analysis that includes cross culture. The challenge is to find, prioritize, and quantify the cultural dilemmas that have to be reconciled. In our new model we first elicit these dilemmas and then identify from which dimension of culture they derive. We then obtain opinions from key players (e.g. supplier, distributor, and customer in the supply chain) as to how each dilemma impacts on business. Measures include the effect on short-term sales, medium- term sales, costs, time delays, etc. We then combine these data using hierarchical clustering algorithms, concordance, and correspondence analysis to produce a cultural business portfolio map. In practice the parties themselves can use the model. They follow our prescriptive approach, identifying the relevant variables for themselves in an atmosphere of collaboration and mutual respect with their business partners.

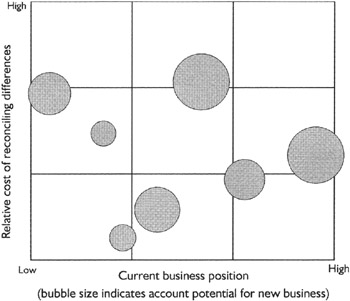

After entering the relevant variables into the computer model, a map is generated that demonstrates to a decision-maker where problems with customers exist. One axis represents an index of the relative attractiveness of each subsidiary, distributor, or customer (market potential, cultural differences) and the other represents the current or evolving business position and status of the development of the supplier-customer relationship (e.g. market share, revenues , low or high context). Now the strategist has a decision-making framework that gives a holistic view and serves as a basis for prioritizing strategic actions to gain competitive advantage.

Suppose for example that Rockwell needs to make a decision about where to invest a limited marketing budget to build relationships with major customers in Russia, Lithuania, and Turkey. Russia demonstrates a great potential for increased sales growth, but there also exists a major cultural difference with the supplier that will cost Rockwell $500,000. The cultural difference between Rockwell and the Russian customer is small (indicating that the market penetration rate may be higher and the sales budget easier to achieve) but the Lithuanian customer only distributes products within a small geographical territory. In contrast, a customer in Turkey is distributing products in the emerging markets with high prospects for sales growth, but the cultural differences will require an up-front Rockwell investment that will cost $250,000 this year and $250,000 next year before a return on the relationship (ROR) is realized. How should Rockwell prioritize market development?

Rather than just seeing cultural differences and their reconciliation as a cost, they should be seen as an investment - just like R&D. Investing this accounting period on developing the relationship and reconciling strategic dilemmas will generate increased sales growth in the next period.

| Classical model | Our new model |

|---|---|

| Profit and Loss account | Profit and Loss account |

| Sales Revenue | Sales Revenue |

| Less costs of sales (includes reconciling dilemmas) | Less direct cost of sales |

| = Gross Margin | = Gross Margin |

| Less fixed costs | Less reconciling dilemmas |

| = Net Profit before Tax and Interest | Less Fixed costs = Net Profit before Tax and Interest |

| Balance Sheet | Balance Sheet |

| Fixed Assets | Fixed Assets |

| Current Assets | Current Assets |

| Cash | Cash |

| Stock | Stock |

| Dilemmas reconciled | |

| _ | - |

| Liabilities | Liabilities |

| Creditors | Creditors |

| = | = |

| Total Finance | Total Finance |

Our ROR index (measuring the relative return on different relationship investments) provides a means to evaluate market options. It is computed as the additional gross sales margin as a function of the discounted amount of investment required to reconcile the cultural differences in a given marketplace . This index enables the strategist to identify where the cultural differences exist with customers today and where they can be in the future. The index also provides the shareholder with an informed analysis and rationale of management's planning, as well as being a welcome addition to a company's corporate annual report. Senior management will now have a clear picture of where to allocate resources to build the relationships in each market and to prioritize the reconciliation of strategic dilemmas as a means to sustain sales growth.

Figure 9.5: Prioritizing reconciliations by cross referencing to business benefits

In the same way that ISO9000 provides a vehicle for quality management certification and action, our new framework provides a mechanism for undertaking a cultural audit in business strategy formulation. Management benefits from using this model to both identify the impact of cross-cultural dilemmas in their business strategy, as well as providing a decision-making framework for prioritizing action and investment.

As trading in the global village becomes the norm, market planning that can accommodate cross culture becomes mandatory. The model described here could become an essential component of Rockwell's toolkit to maximize shareholder value.

This chapter again shows how marketing, and the dilemmas of marketing, must pervade thinking at all levels. Marketing can no longer be a functional discipline that is a single, discrete arm of an organization chart. Marketing must have a diffuse relationship throughout the organization. It is no longer simply market push or pull, no longer top down or bottom up, but a different type of logic that transcends these differences to provide integrated solutions. Our new marketing paradigm thus requires a mindset that reconciles these continuing dilemmas that can arise from all of the above cultural dimensions. Today's successful marketing is the result of linking learning effort across each dimension with the contrasting orientations and viewpoints.

EAN: 2147483647

Pages: 82