Setting Up an Accounting System

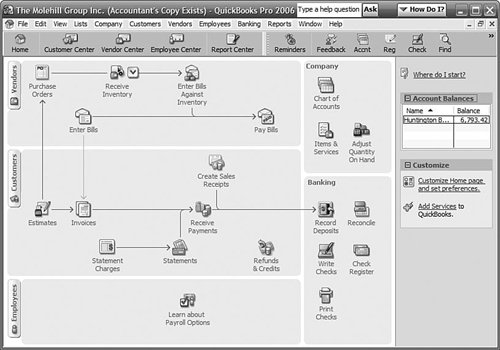

| Throwing all your receipts in a shoebox is just a start. To truly track your business's finances, you need to incorporate all the data from those receipts and from your inventory and customer management systems into some sort of an accounting system. This chapter isn't the place to go into all that's involved in setting up a detailed small business accounting system; lots of other books and online resources are more appropriate to the task. We can, however, take a look at what you need to track to make your accounting system work. Tracking Your Business ActivityAll accounting systems track basic types of activities: revenues and expenses. Revenues are the sales you make to your eBay customers. Expenses are the costs you incur in the running of your businessthe inventory you have to purchase, as well as all those other things you need to buy to make your business run. In accounting terms, the money you take in creates a credit on your books. The money you spend creates a debit. When your credits exceed your debits, you're making a profit (or at least generating positive cash flow). When your debits exceed your credits, your business is losing money. Obviously, the former position is preferable. To make your accounting system work, you have to enter each and every financial activity of your business. Purchase some merchandise for sale, enter it in the books. Make a sale, enter it in the books. Buy some supplies, enter them in the books. You get the idea. Note Confused? Brush up on these essential accounting concepts in Appendix A, "Accounting Basics." At regular intervalstypically at the end of each monthyou add up all the credits and debits (after putting them in the proper slots) and take a snapshot as to how your business is doing. These snapshots are the financial statements you use to measure the financial condition of your business. Key Financial StatementsThere are two key financial statements that you should prepare at the end of each month. They are the income statement (sometimes called a profit and loss statement, or P/L) and a balance sheet. These documents measure the condition of your business from two different angles. Income StatementThe income statement reflects the revenue your business generates, the expenses you pay, and the profit (or loss) that filters down. This is done by showing your revenues, subtracting the cost of goods sold (which reveals the gross profit), and then subtracting all your operating expenses to show your net profit. And, after all, it's that net profit number that really matters. The top of the income statement lists all the money your business took inyour business's revenues. The bottom of the statement lists all the money you paidyour business's expenses. Subtract the bottom from the top and the number you get, expressed on the last line of the statement, is your business's profit or loss. Most businesses will create an income statement for each month in the year and then a comprehensive income statement at the end of the year. Many businesses like to track their progress over the course of the year and create a year-to-date income statement at the end of each month, as well. Balance SheetThe other essential financial statement is the balance sheet. The balance sheet looks at your business in a slightly different fashion from an income statement. Instead of looking at pure monetary profit (or loss), the balance sheet measures how much your business is worth. It does this by comparing your assets (the things you ownincluding your cash on hand) with your liabilities (the money you owe to others). Assets go on the left side of the balance sheet, and liabilities go on the right. The total number for each column should be equalhence the "balance" part of the title. You should generate a balance sheet at the end of every month and at the end of the year. Note See Appendix A for a detailed explanation of income statement and balance sheet line items. Software for Small Business AccountingHow do you put together all your business data and generate these financial statements? You have two practical options: hire an accountant or use an accounting software program. (You could also, I suppose, keep your books by hand, on oversized sheets of ledger paper while wearing a green eyeshadealthough hardly anyone except latter-day Bob Cratchets do it that way anymore.) We'll look at accounting software first. There are many different programs you can use to keep your business's books. The simplest of these programs are the personal financial management programs, such as Quicken and Microsoft Money. They may be able to do the job if your business is simple enough, but most small businesses will find them somewhat limited in functionality. A better choice for many eBay businesses is QuickBooks, which is a more full-featured small business accounting program. If your business is big or unique enough, however, even QuickBooks might not be powerful enough; in that instance, you can evaluate other more powerful business accounting packages. QuickenThe most popular financial management program today is Intuit's Quicken (www.quicken.com). Quicken comes in various flavors, only one of which has features of use to the small business. That version, Quicken Premier Home & Business, lets you track your business expenses, record assets and liabilities, generate customer invoices, and create basic financial statements. Microsoft MoneyMicrosoft Money (www.microsoft.com/money/) is a direct competitor to Quicken. Like Quicken, Money comes in various flavors; the version of interest to eBay businesses is Microsoft Money Small Business. This version offers similar functionality to Quicken Premier Home & Business, as well as basic payroll management. QuickBookA better option for most small business owners is Intuit's companion package to Quicken, called QuickBooks (www.quickbooks.com). There are a number of versions of QuickBooksSimple Start, Pro, Premier, and Enterprise Solutions. For most eBay businesses, either the Simple Start or Pro version (shown in Figure 6.1) should be more than good enough. Figure 6.1. One of the most popular small business accounting packagesIntuit's QuickBooks Pro. You can use QuickBooks not only to do your monthly accounting and generate regular financial statements, but also to manage your inventory, track your sales, and do your year-end taxes. QuickBooks even integrates with PayPal, so you can download all your PayPal-related transactions into the software program, and manage everything all in one place. Intuit also offers a web-based version of QuickBooks, called QuickBooks Online Edition, which you can access from the main QuickBooks website. This Online Edition keeps all your records online, so you can do your accounting from any computer, using nothing more than your web browser. QuickBooks Online Edition isn't quite as robust as the standalone version, which makes it best for those eBay businesses with simpler needs. You'll pay $19.95 per month (or more, depending on the plan) for this service. Tip If you use QuickBooks, you want to download eBay's Accounting Assistant program. Accounting Assistant lets you export eBay and PayPal data directly into QuickBooks, and is free to usealthough to generate the necessary data you also need a subscription to eBay Stores, Selling Manager (Basic or Pro), or Seller's Assistant (Basic or Pro). Get more detailsand download the programat pages.ebay.com/help/sell/accounting-assistant-ov.html. Other Small-Business Accounting PackagesIf QuickBooks doesn't satisfy your accounting needs, other small business accounting programs are available. Some of these programs are more fully featured than QuickBooks, and more complicated to use. That might not present a problem if you're relatively numbers-savvy, but if accounting doesn't run in your blood, some of these programs might be more than you can handle. Here are a few of these accounting packages to consider:

Working with an AccountantEven if you use an accounting program like QuickBooks, you still might want to employ the services of a professional accountantat least to prepare your year-end taxes. That's because an accountant is likely to be more experienced and qualified than you to manage your business's tax obligations. Many small businesses use QuickBooks to generate their monthly financial statements but then call in an accountant to prepare their quarterly estimated taxes and year-end tax statements. This is a pretty good combination; you can have QuickBooks print out just the right data that your accountant will need to prepare your taxes. Of course, you can also use an accountant to handle all of your financial activities. This is a particularly good idea if (1) your business is generating a high volume of sales, and (2) you aren't particularly interested in or good at handling the books. You'll pay for this service, of course, but if your business is big enough, it's probably worthwhile. Where do you find a reputable accountant? You should check with your local chamber of commerce or SBA office, as well as other local small business organizations. It wouldn't hurt to ask other small business owners; word-of-mouth is often the best way to find simpatico service providers. In addition, you can use the Internet to search for small business accountants in your area. Check out these websites:

However you find an accountant, know up front that he or she will need you to keep some very specific financial recordslike those we discussed earlier in this chapter. Your accountant can't track your business unless you're tracking your business, so work with your accountant to set up the best recordkeeping system for your business needs. |

EAN: 2147483647

Pages: 208