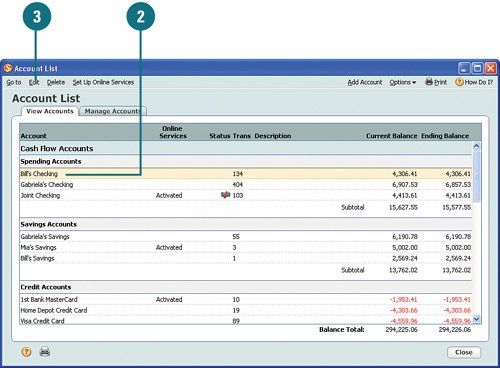

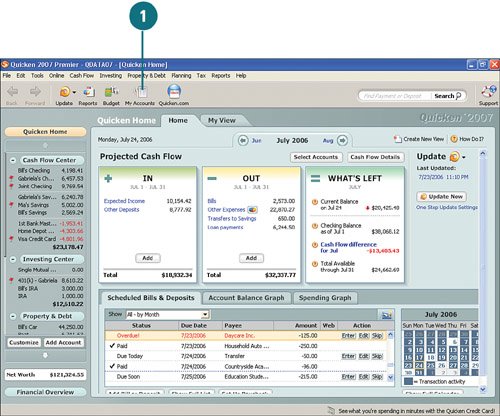

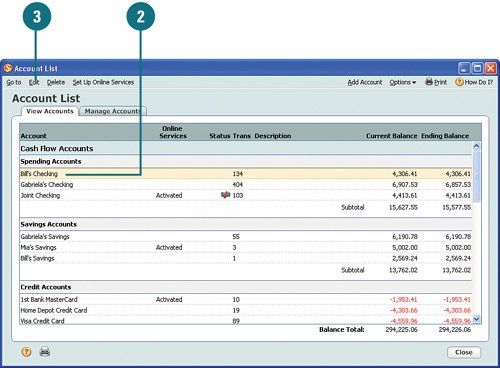

| As you work with your accounts, you most likely will need to update account information, such as the interest rate, minimum or maximum balances, the account name, or the online services information. Because the editing process is similar for all accounts, the following task steps through the process for one account type using the Account List window. Therefore, the steps to edit account details may differ from what you see here depending on the type of account you are editing. Edit Accounts  Open the Account List window by clicking My Accounts on the toolbar. You can also click the Tools menu and select Account List. Open the Account List window by clicking My Accounts on the toolbar. You can also click the Tools menu and select Account List.

Scroll to the section of the window where the account you want to edit is listed. For example, to update a checking account, scroll to the Spending Accounts section and select the account you want to update Scroll to the section of the window where the account you want to edit is listed. For example, to update a checking account, scroll to the Spending Accounts section and select the account you want to update

Click Edit. Click Edit.

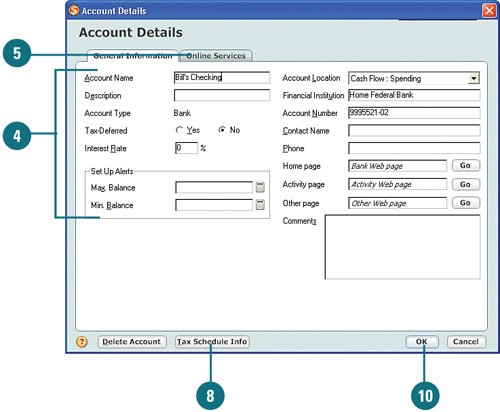

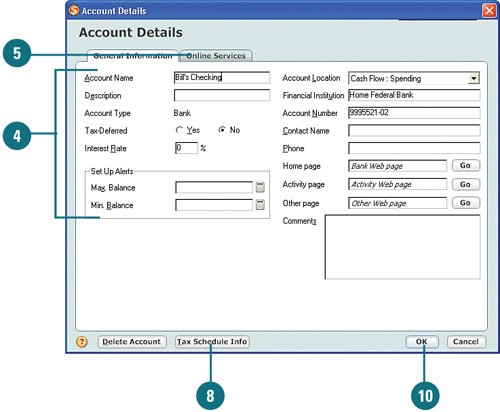

On the Account Details window, type, select, or change the account information. On the Account Details window, type, select, or change the account information.

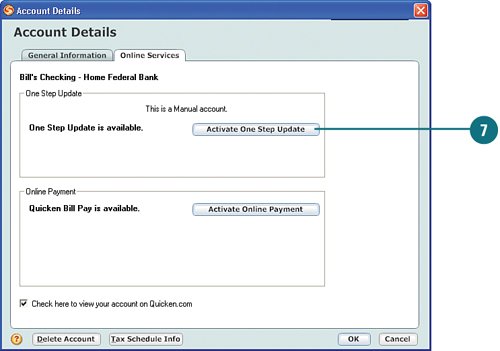

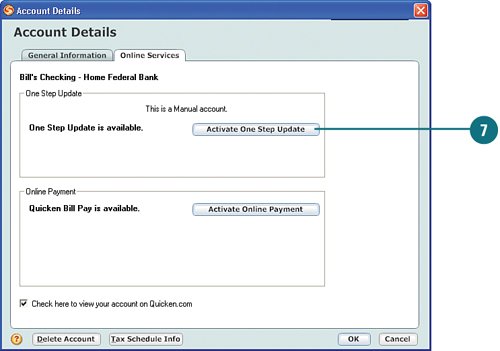

To update online information for the account, click the Online Services tab. To update online information for the account, click the Online Services tab.

If the account is already set up and you want to deactivate it, click Remove from One Step Update (not shown). If the account is already set up and you want to deactivate it, click Remove from One Step Update (not shown).

If the online services are available, but not activated and you want to activate it, click Activate One Step Update and complete the setup. If the online services are available, but not activated and you want to activate it, click Activate One Step Update and complete the setup.

See Also See "Using Online Updates" on page 79 for more information on setting up accounts for online access. |

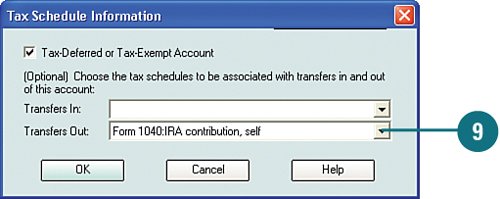

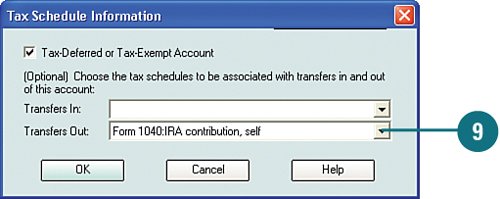

To review or change the tax schedules associated with this account, click Tax Schedule Info. To review or change the tax schedules associated with this account, click Tax Schedule Info.

Select new tax schedules, if needed, and click OK. Select new tax schedules, if needed, and click OK.

When you are finished making changes, click OK. When you are finished making changes, click OK.

Did You Know? You cannot deactivate an account with active transactions. If there are transactions waiting to be entered into the account register, a message appears telling you so. Enter all transactions before deactivating the online account. |

Performing Additional Functions in the Account List Window You can use the menu bar on the Account List window to access other areas of Quicken, such as the following: You can open an account register by selecting the account and clicking Go To. You can set up an account for online access by selecting the account and clicking Set Up Online Services. You can print the account list by clicking Print. You can select print options or change the list view by using the Options menu. You can click How Do I? to access Quicken's Help system.

|

Did You Know? It is beneficial to track tax-deferred accounts and tax schedules for accounts. Be sure to tell Quicken if an account can be tax deferred or is tax exempt. You should also tell Quicken about the tax schedules used for incoming and outgoing account funds. Quicken uses this information for tax reports, when estimating your taxes (for example, in the Tax Planner), and when you export tax-related information to TurboTax. |

|