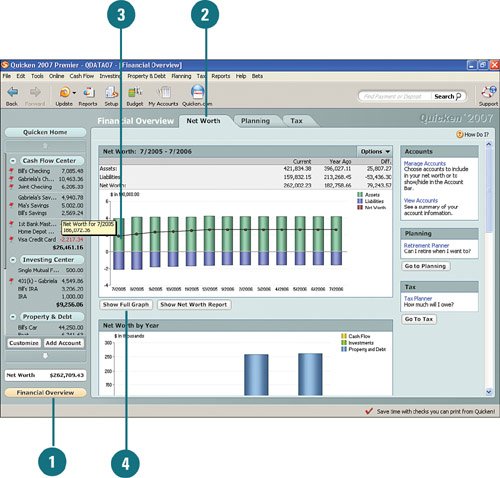

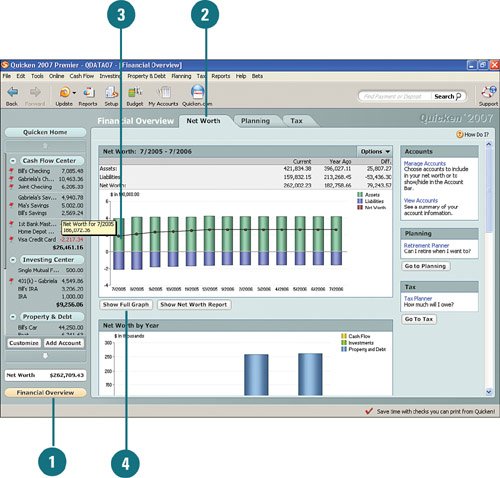

| One nice feature of Quicken is the Financial Overview. It gives you a complete, big picture of your finances with the click of a button. It's a bird's-eye view of your overall net worth, based on your assets and liabilities for the month and for each month over the past year. Assets include savings or properties, and liabilities include your debt, such as credit card debt and loans. Your net worth is determined by subtracting your liabilities from your assets. You can see instantly where you stand and where you need to adjust your financial situation, if needed. View Your Assets, Liabilities, and Net Worth  On the activity bar, click Financial Overview. On the activity bar, click Financial Overview.

If you're not already there, click the Net Worth tab to view a graph view of your assets, liabilities, and net worth over the past year. If you're not already there, click the Net Worth tab to view a graph view of your assets, liabilities, and net worth over the past year.

To view your assets, liabilities, or net worth for a specific month, hover your mouse pointer (point, but don't click) over a bar on the graph. A tooltip box pops up, showing you what your net worth was for that time period. To view your assets, liabilities, or net worth for a specific month, hover your mouse pointer (point, but don't click) over a bar on the graph. A tooltip box pops up, showing you what your net worth was for that time period.

To see a full view of the graph, click Show Full Graph. To see a full view of the graph, click Show Full Graph.

See Also See Chapter 9, "Planning for the Future," on page 223, for more detailed information on using the Planning Center and creating plans. See Chapter 12, "Managing Your Tax Information," on page 325, for more information on using the Tax Center. |

For Your Information You can get a clue with the color key. There is a color key in the upper-right corner to help you determine which colors on the graph represent assets, liabilities, and net worth. |

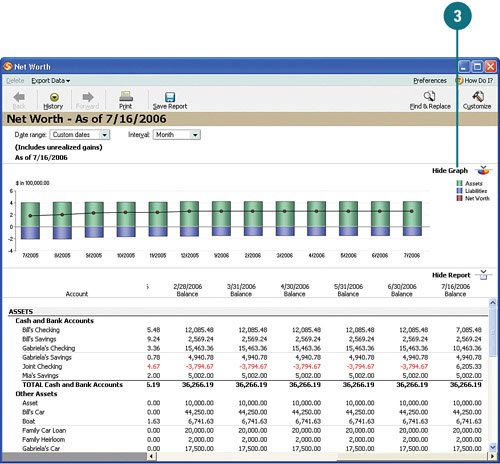

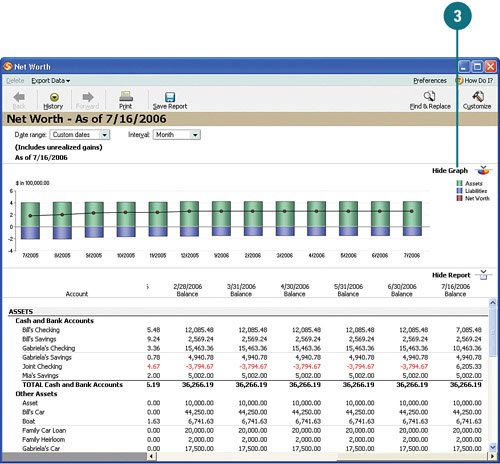

View Net Worth Graph Details  From the Net Worth window, you can customize the graph by selecting a custom date from the Date Range drop-down or a different interval of time from the Interval drop-down. From the Net Worth window, you can customize the graph by selecting a custom date from the Date Range drop-down or a different interval of time from the Interval drop-down.

Click Show Report to see a detailed breakdown of your assets and liabilities, including their totals. Click Show Report to see a detailed breakdown of your assets and liabilities, including their totals.

Click Hide Graph to view only the report showing the breakdown of your assets and liabilities. When you are finished reviewing the information, close the window. Click Hide Graph to view only the report showing the breakdown of your assets and liabilities. When you are finished reviewing the information, close the window.

See Also See Chapter 11, "Working with Reports," on page 309, for more information on viewing, customizing, saving, and printing reports. |

Did You Know? There are alternative ways of accessing the graph and report. There are multiple ways to access the full graph net worth view or the Net Worth report. You can use the Options menu located in the upper-right corner of the Net Worth tab on the Financial Overview to access the same information as shown in this and the preceding tasks. Clicking the Show Net Worth Report button (shown next to the Show Full Graph button in the previous task) also opens the Net Worth report. In addition, you can right-click the graph to access the full graph net worth view and report. |

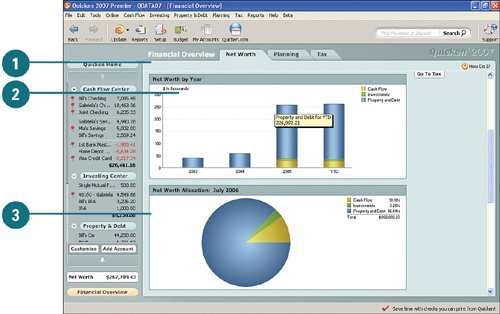

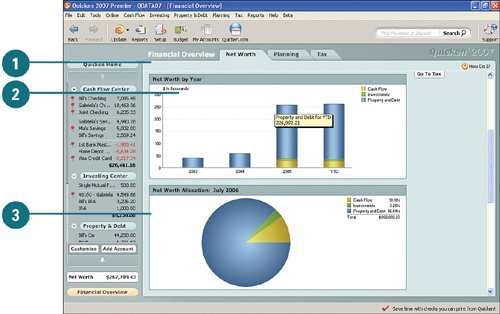

View Additional Net Worth Breakdowns  To view additional net worth information, scroll down to the Net Worth section to reveal additional details. To view additional net worth information, scroll down to the Net Worth section to reveal additional details.

The Net Worth by Year section shows your cash flow, investment, or property and debt net worth for a specific year or year-to-date. Hover your mouse over the bars to see the net worth for each activity. The Net Worth by Year section shows your cash flow, investment, or property and debt net worth for a specific year or year-to-date. Hover your mouse over the bars to see the net worth for each activity.

The Net Worth Allocation section shows what percentage of your net worth comes from your cash flow, investment, or property. Hover your mouse over the pie chart to see how the net worth percentages break down. The Net Worth Allocation section shows what percentage of your net worth comes from your cash flow, investment, or property. Hover your mouse over the pie chart to see how the net worth percentages break down.

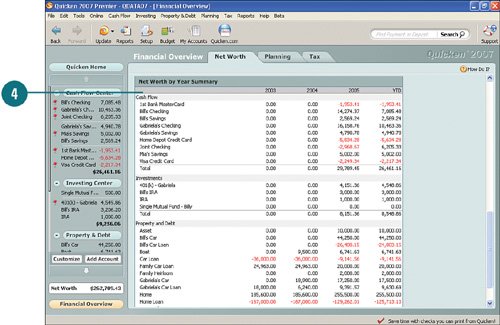

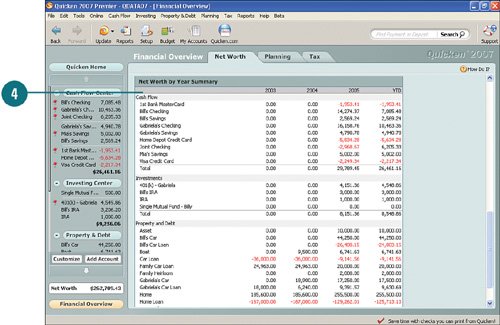

Scroll down farther to view the Net Worth by Year Summary section. It provides net worth by year and year-to-date for each of your cash flow, investment, and property accounts. Figures that appear in red are negative net worth. Scroll down farther to view the Net Worth by Year Summary section. It provides net worth by year and year-to-date for each of your cash flow, investment, and property accounts. Figures that appear in red are negative net worth.

For Your Information You can hide accounts in Quicken. Hiding an account doesn't mean you'll need to open up a Swiss bank account with an alias. When you want Quicken to track the balance of an account, but you don't want that balance used for net worth or considered for a debt reduction plan, you can hide it. For example, if you have a savings goal, you can continue to save the set amount each month; Quicken tracks how much you are saving, but the account and the amount are hidden until you reach your goal. Another situation where you should hide an account is when an account is closed or has a zero balance. Instead of deleting it, you should hide it so that Quicken can still use it for reporting and forecasting, but the account won't clutter up your account lists. For more, see the task on the next page. |

|