Setting Up Tax Rates

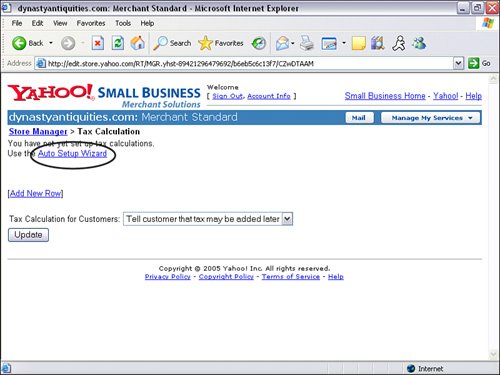

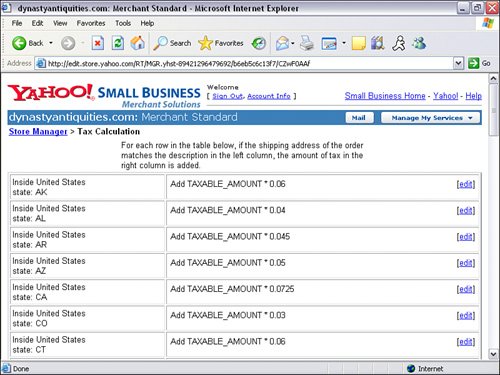

| If your product or service requires you to charge sales tax, you may set up tax rate rules in the Tax Rates page under Order Settings in the Store Manager control panel. There are two options for the type of tax rule: percentage or flat fee. Most taxes are percentage based. You may set up tax rules based on country, state, or ZIP code. If you are setting up United States tax rules for the first time, you may want to consider using the Auto Setup Wizard. The wizard will allow you to automatically fill in the values for each state's taxes. This will save you a tremendous amount of time by not having to find out what each state's sales tax is and enter each rate onebyone. To use Auto Setup Wizard to set up tax rates

|

EAN: 2147483647

Pages: 149