Transforming Technologies: Retail Exchanges and RFID

Transforming Technologies Retail Exchanges and RFID

Leigh Sparks and Beverly Wagner

Overview

Recent years have witnessed a transformation of the retail landscape (Dawson, 2000, 2001). The way in which retailers manage their supply chains has been altered fundamentally (Sparks, 1998; Fernie and Sparks, 1998). The nature and extent of these supply chains has also changed. Retailer activity has become more global in its scope. Logistics and other activities have to be managed over greater distances than ever before. The nature of retail competition itself has changed, with an increase in business range and concentration. From being a local activity, retailing for some companies has progressed through the national level, to an international and in certain cases a global scale.

As retailers grow and seek to enhance their activities and reduce costs, they search for the most appropriate management methods, tools and activities. For some, an almost virtual organization has evolved with outsourcing being its prime activity (as with Benetton and Tommy Hilfiger). Some elements of the business, for example, supply or production, can readily be out-sourced (as with Tesco’s distribution centres), whereas some activities remain internal (such as Tesco’s Clubcard data). In either case closer relations amongst a network of contractors become essential. The nature of these retailer relationships varies. Some are more collaborative or associative than transaction focused (Dawson and Shaw, 1990). In all cases, however, the need to control costs, yet provide requisite service on this scale, becomes a key focus of attention. An array of new concepts has therefore been introduced into the management of retail supply chains in an attempt to improve performance: for example Quick Response (QR) (Fernie, 1994; Fiorito, May and Straughn, 1995; Kincade, Vass and Cassill, 2001), Efficient Consumer Response (ECR) (Kurt Salmon Associates, 1993; McMichael, Mackay and Altmann, 2000) and Collaborative Planning, Forecasting and Replenishment (CPFR) (Angeles, 2000) have become common techniques. The benefits arising from these are sometimes questioned, however (Kotzab, 1999). To some extent, these are tools within a wider potential restructuring of supply chains.

This restructuring takes a number of forms. Some involve relationship changes, others physical infrastructure investment or disinvestment. Strategic issues need consideration, but then so do tactical practices. In essence, all aspects of supply chains are being reexamined and reconsidered. Some changes are small and specific, though with considerable implications: for example, GPS tracking systems in vehicles. Others are large and complex with many ramifications, such as the move to stockless distribution. One common aspect of many of the changes being considered and implemented is technology. Technology has been used in supply chains for a considerable time, normally to provide dimensions of control and information. There is no doubt that investment in information and other technologies can deliver huge benefits if applied to the right problems and if the organization is structured appropriately.

This chapter looks at two technologies that have emerged in recent years. Both have been claimed to have the potential to transform aspects of the retail supply chain. Neither is without its controversies and detractors, but then neither is also without its adherents. In the first case, retail exchanges or B2B marketplaces, there was much hype about their potential, perhaps associated with the dual issues of the dot.com boom and the thought of competing with Wal-Mart more equally. The practice has perhaps been less spectacular, although some exchanges remain in operation and report good business. The second technology (Radio Frequency Identification: RFID) is hardly off the pages currently, and again is being held out as a technology with a huge future in supply chains. The chapter aims, by considering these two technologies, to show the potential that technologies have for transforming supply chain operations, but also to raise questions about why the pace of change is slower than might be anticipated.

Retail Exchanges

Business-to-business (B2B) exchanges are essentially Web-enabled market spaces that bring together buyers and sellers (Lightfoot and Harris, 2003; Lu and Antony, 2003). They have been described as a ‘killer application’(Scully and Woods, 1999) due to the potential they hold out to efficiently manage procurement activities in distribution channels. Through a variety of applications they can affect the power in a supply chain, enabling buyers and suppliers perhaps to leverage their position and to extend their reach. By utilizing common tools and standards, opportunities for efficiency and wider sourcing and new markets may also emerge.

There are a number of ways of cataloguing such exchanges. Lu and Antony (2003) divide them into:

- marketplaces based around a specific industry sector (vertical marketplace);

- marketplaces based around products and services (horizontal marketplace);

- marketplaces focused on functions.

Whatever the form, they work by providing space that allows matching and aggregation. Marketplaces contain a matching mechanism that brings together buyers and sellers and thus matches their needs and capabilities, perhaps in a dynamic pricing environment. They also contain an aggregation mechanism that brings together a large number of buyers and sellers in one place, aiming to reduce transaction costs and improve choice and market efficiency. The consortia marketplaces may be constructed from either horizontal or vertical approaches.

There is another way of looking at marketplaces however. Table 10.1 positions them along a continuum from public to private. The table also recognizes however that some marketplaces may be private and open to suppliers for only one firm. This internalizing process is a demonstration of the power that some firms have in the market, but also suggests that there are benefits over and above the price-driven approach suggested by Lu and Antony (2003).

|

Public e-markets |

Consortia exchanges |

Private exchange |

|

|---|---|---|---|

|

Ownership |

By third party |

Jointly by 2 + industry incumbents |

By one company |

|

Access |

Public |

Equity holders and selected trading partners |

Invitation only |

|

Examples of functionality |

Procurement through online catalogues, auctions |

Procurement through online catalogues, auctions. Recent expansion into inventory management. |

Collaborative value chain processes. Interaction in real time. |

|

Main source of value |

Price savings from aggregation, discovery |

Price savings from standardization, discovery |

Savings in value chain process, total cost of ownership |

|

Business processes |

Standardized Non-proprietary |

Typically standardized, non-proprietary |

Customized, proprietary |

|

Relationship with trading partners |

One-off, sporadic |

Typically one-off, sporadic |

Long-term, committed |

|

Examples |

Fastparts.com, Medibuy |

Covisint, Transora |

Dell Computers, Wal-Mart |

|

Source: Hoffman, Keedy and Roberts, 2002 |

|||

In the retail industry, there have been a number of such exchanges developed. Perhaps unusually, one of the first (begun in 1991 and moved to the Internet in 1997), and still one of the most influential has been a private exchange, Wal-Mart’s Retail Link. Probably due to the sheer power of Wal-Mart, this exchange has become the standard for its suppliers and has been identified as one of the advantages that Wal-Mart enjoys over its competitors:

Retail Link provides information and an array of products that allows a supplier to impact all aspects of their business. By using the information available in Retail Link, suppliers can plan, execute and analyze their businesses – thus providing better service to our common customers. Retail Link is a website that is accessible to any area within your company. Wal-Mart requires all suppliers to participate in

Retail Link because of the benefits it provides. Should you become a supplier with Wal-Mart, you will be provided with the requirements for accessing Retail Link. (www.walmartstores.com/wmstore/wmstores/Mainsupplier.jsp, accessed 1 Dec 2003)

Based on a data warehouse of over 100 TB (Terabytes), through Retail Link, Wal-Mart provides to its suppliers an array of information on how their products are sold in Wal-Mart stores. Each evening, over 170 million rows are added to the sales table, representing line items on a customer receipt. By 4:00 am every morning, over 4,000 suppliers can receive information on their sales in every Wal-Mart store across the globe for the day before. Depending on their financial arrangements with Wal-Mart, some suppliers can get market basket detail that shows not only how many of their own products were sold, but also what other products were purchased by the consumer at the same time. Additionally, each Retail

Link supplier has access to up to two years of historical sales data on its products in the Wal-Mart chain. Access to this information allows for better collaborative forecasting and replenishment, which increases sales and margins for all involved. Some suppliers take this even further and work with Wal-Mart to create co-managed inventory, where the supplier takes over much of the assortment and planning functions to help improve sales (Wal-Mart, 1999).

Retail Link provides massive advantages for Wal-Mart as it allows real- time, visible analysis of performance by lines of business, individual products, suppliers and stores. Suppliers are organized through common standards and share common tools for the analysis of current and historical data, which in turn helps estimates of future activity and performance. Such benefits have encouraged other leading retailers such as Tesco to develop their own information exchanges.

Wal-Mart gained a lead on many of the other leading retailers by its early investment in Retail Link. One of the responses to this development has been the development of consortia retail exchanges. Of these, two main retail ones have been developed.

Global NetXchange (GNX) was initiated in February 2000 by Carrefour and Sears Roebuck, and now has more than 30 leading companies as customers including Kroger, Metro, Coles Myer, PPR and Sainsbury (see www.gnx.com).

WorldWide Retail Exchange (WWRE) was set up in March 2000, by an initial consortium of 17 leading retailers. Amongst its current 64-plus members are Ahold, Auchan, Best Buy, Casino, Delhaize, Gap, JC Penney, Jusco, Kingfisher, Kmart, Marks and Spencer, Safeway (UK and US), Target, Tesco, Dixons, Dansk, Edeka, Dairy Farm and El Corte Ingles (see www.wwre.com).

GlobalNetXchange claims to be a globally integrated retail supply chain network, leveraging the Internet to seamlessly connect trading partners across extended retail supply chains. This open network changes the way retailers collaborate with their global supply chain partners to satisfy demand, quickly and profitably. Table 10.2 suggests how this is achieved. The links with techniques such as CPFR are clear. In addition however, the exchange supports a range of auctions and complex bid/quote processes. With supplier and retailer catalogues online, searching, sourcing and spot purchasing are made easier. In the third quarter of 2003, GNX conducted nearly 3,200 auctions worth US $1.6 billion.

Examples of activities include (www.gnx.com):

- Pinault-Printemps-Redoute changing its apparel buying process through online negotiations with GNX. By enabling simultaneous negotiations with multiple suppliers, improving the quality and consistency of information from vendors and reducing extra steps, paperwork and travel, procurement cycle times and costs were reduced (costs by 10 per cent), buyer productivity was raised and purchase prices were optimized.

|

Collaborative demand forecasting: retailers and suppliers can improve forecast accuracy by enabling collaborative demand planning processes. Trading partners can share their production and demand forecasts via demand planning tools. These will deliver automatic consolidation of forecasts, comparison of demand and production forecasts, and identify exceptional conditions. Exceptions can be reviewed by the entire supply chain, and the appropriate adjustments to both production and demand forecasts made instantaneously. |

|

Collaborative supply planning: trading partners can reduce inventory and improve cycle times by sharing production schedules and proactively resolving problems. This sharing of information allows manufacturers to compare production and capacity schedules and identify unusual conditions. Exceptions can be reviewed and schedules can be adjusted appropriately in order to create synchronized supply plans. |

|

Global inventory visibility: suppliers and other trading partners are able to share information about current inventory levels in order to rapidly fulfil urgent needs for critical purchases. Inventory levels may be published by product and location when the need arises; trading partners can then search these locations to determine where inventory is available. |

|

Collaborative order processing: members can improve customer service across a ‘virtual supply chain’ by instituting collaborative order processing. Trading partners can request an availability check for a product or service. This request can then be forwarded automatically to the identified supplier. GlobalNetXchange provides the trading partner with accurate availability date and source of supply. |

|

Source: www.globalnetxchange.com/ |

- Metro linked with Procter & Gamble using the GNX Web-based CPFR tool, to enable them to jointly manage the promotions planning process, share real-time information and gain visibility into supply chain processes. At the pilot stage forecast accuracy was improved and 46 per cent more stock-keeping units (SKUs) could fit into the range. Warehouse inventory levels fell by two weeks with high on-shelf availability. The collaborative process itself was less labour and time intensive.

- Sainsbury aimed to use GNX to streamline its new product development and lifecycle management process for retailer brand products. Sainsbury estimate that development times for entire new product lines was reduced by about 33 per cent. In addition paperwork was reduced, inefficiencies and errors were eliminated and due diligence was more proactively managed.

The WWRE was established to give participating retailers and manufacturers the opportunity to simplify, rationalize and automate supply chain processes, thereby eliminating inefficiencies in the supply chain (see www.wwre.com). The WWRE enables Web-based transactions among retailers and suppliers operating in the food, general merchandise, textile/home and drugstore sectors. WWRE sees exchanges as revolutionizing trading relations in a number of ways. First, it creates open systems in which firms can establish short or long-term relations with one or more partners. Second, buyers and suppliers who previously had trouble reaching each other can be connected. Suppliers can gain access to more buyers. Buyers can participate easily and view items from multiple suppliers. Third, the electronic interface will lower transaction costs for both buyer and seller. Finally, this transparency is likely to drive down prices by rapidly developing and implementing new e- business models and advanced technologies. Costs across product development, e-procurement and supply chain processes are reduced through WWRE activities. Value is generated through three layers (WWRE, 2003):

- application-based value such as e-procurement, negotiations, efficiency gains by simplifying, eliminating and automating existing business processes;

- service-based value such as sourcing and logistics services, service gains by improving existing business processes in an efficient and innovative way;

- collaborative-based value such as VICS CPFR, innovation gains by new facilities provision for collaborative commerce.

Table 10.3 summarizes some of the solutions and services offered by WWRE. GNX provides similar solutions using slightly different descriptions (Table 10.2). GNX and WWRE seem to be focusing on process change within their members’ organizations, encouraging them to take the collaborative exchange concept on board and use the exchange applications to drive change management (Retail Week, 22 Mar 2002). However, to a considerable extent these ‘new’ solutions do resemble the four tenets of ECR: efficient assortment, efficient store replenishment, efficient store promotion and efficient product introduction.

|

Solution/service |

Function |

|---|---|

|

CPFR |

Collaborative Planning develops mutually agreed forecasts based on the best data available to both parties. Results have been improved trading relationships and streamline processes. |

|

World trade logistics |

WTL address trade compliance, logistics costs estimation and analysis. Designed to streamline and automate global supply chain trade logistics operations in one centralized location |

|

Surplus Goods Exchange |

The SGE offers an efficient, low-cost and neutral end-to-end online trading process that integrates all aspects of freight logistics, financial settlement and dispute resolution |

|

WISP |

Worldwide Indirect Sourcing and Procurement (WISP) |

|

Design and planning management |

Supporting collaborative new product development |

|

WWRE university |

Offers online course registration, career development tools, training materials |

|

Source: www.wwre.com |

|

Are we therefore seeing old wine in new bottles? Eng Yong and Spickett-Jones (2002) reported that current Internet exchanges are more suitable for commodity-based products and services, and that key issues concerning collaborative planning, forecasting and replenishment have been impeded by the short-term focus of transaction-based activities in emarketplaces. The main reasons why ECR and CPFR were inhibited were that the fundamental close relationship, essential for co-operative behaviour between buyer and supplier, did not exist (Kotzab, 1999; Perry and Sohal, 2000; Angeles, 2000).

Retail exchanges therefore bring into question the universal trade-off between richness and reach. Richness means the quality of information, defined by the user, such as accuracy, bandwidth, currency, customization, interactivity, relevance and security. Reach means the number of people who participate in the sharing of that information. Until recently it has been impossible to share simultaneously richness and reach (Evans and Wurster, 2000). The Internet has changed this, and retail exchanges aim to exploit the opportunities presented in terms of both richness (greater collaboration) and reach (opening up new markets for both large and small suppliers). However, this goal will remain uncertain until common standards are available that will enable everybody to communicate with everyone else at virtually zero cost. It is this, according to Evans and Wurster, that constitutes the ‘sea change’. When proprietary EDI systems can be superseded by industry-wide extranets and everyone can exchange rich information without the constraints of reach, the channel choices for marketers, supply chains and the boundaries of organizations will be thrown into question.

Retailers are large enough to force radical changes along the supply channel. But this can only be effective if all parties in that channel are developing at the same pace: that is, the supply channel is only as strong as its weakest link. Some suppliers may not have the structures, systems and procedures to support radical supply chain change. Traditionally, supply chain management has been sub-optimized because parties in the channel are not able to articulate the architecture of their supply chain. It remains doubtful if retailers have really thought through the implications of retail exchanges in the longer term for themselves and the consequences on their supply channel partners. Retail exchanges may not be the ‘killer application’ yet, but gains may be accrued along the way as retailers and others begin to realize what the possibilities are. Change is not as radical as was once envisaged, but then perhaps it never is? This leaves us with a number of questions about retail exchanges (see Sparks and Wagner, 2003).

Will the Exchanges Simply Reflect the Traditional Marketplace?

The ways in which relationships in retailing and supply chains changed in the 1990s and the move away from transactional approaches is well documented. Any description of major retail supply chains has now to consider relationships and partnering as a key focus. It is also clear that as these changes have progressed, so the depth and nature of the relationships have also changed. But what do retail exchanges do to these relations? Although exchanges are in the context of electronic marketplaces there are some personal elements to them, particularly with regard to the establishment, but they are essentially impersonal, transactional-based operations. To a great extent, retail exchanges could be perceived as a retrograde step back to the previous method of operations, albeit that the scale and scope of the transactions differ.

How Will the Exchange Affect Co operation Between Trading Partners?

Exchanges not only enable relationships to form and to continue, but also offer a ready ground for testing prices, quantities and specifications. The fact that exchanges may be easy to use, and could become the business norm, might expose business relationships to broader scrutiny. What is not yet apparent is the true extent to which buyers or suppliers are willing to use such exchanges compared with traditional business practices. The fact that the consortium exchanges are controlled by a group of competitors adds further to the complexities surrounding business relations in retail supply. There is a danger of falling foul of competition law.

How Can Businesses Participate in the Exchange to Create Value for Themselves and Prevent it Shifting to Competitors?

Exchanges have the potential to be exclusive clubs. Exchanges also however have the potential to alter existing relationship practices. The raison d’être for exchanges is one of price reduction from scale efficiencies, so smaller local firms may find it tough to break in. The impact of exchanges is therefore likely to accelerate tendencies towards concentration. This will occur at the buyer and the supplier level, but is also likely to impact on those physically and virtually handling the transactions. Will they become simply mechanisms to enable the big to get even bigger, or is this an ideal platform for large-scale industry-wide supply chain process improvements?

Radio Frequency Identification (RFID)

The last few years have been filled with claims about another potentially transforming technology. Radio Frequency Identification (RFID) has become the ‘hot topic’ in supply chains and retailing. As one of its proponents states:

RFID has the potential to become one of retail’s truly rare transforming technologies … the business case is compelling … RFID has the ability to reduce labour costs, simplify business procedures, improve inventory control, productivity and turnover, increase sales, reduce shrinkage, and improve customer satisfaction.

(LakeWest Group, 2002: 1–2)

This of course is not a new technology, and neither are the claims about its impact wholly novel, though they do tend to hyperbole (for instance, ‘20–20 visibility in the supply chain and 100 per cent availability is just around the corner’, Retail Week, 14 Nov 2003, p 25). Transponders have been around for decades. The difference now is the change in their cost, size and capability.

An RFID system typically contains a tag or label embedded with a single chip computer and an antenna, and a reader (much like a wireless LAN radio) that communicates with the tag (see www.rfidjournal.com for a glossary of terms). This basic system structure however contains a number of alternative choices for implementation. For example tags can be passive or active. Passive tags pick up energy from the reader to operate and communicate with the reader. In essence they are simply ‘read’. They have no power source and are short read-range, but are cheap and probably last longer. Active tags have an embedded power source that provides for a greater range but reduces tag life and raises costs. Active tags can store a variety of data and can be read and written to. With readers being fixed position or hand-held/movable, tags able to transmit in a field rather than one direction and various choices of frequency depending on the range required or the product involved, the scope for flexible systems is apparent.

Tags can be applied at a variety of levels. In the supply chain, they could be applied to every single item produced, as well as to every carton, box, crate or pallet in which the product might be handled. Non-stock items can be tagged as easily as stock items. The tag could be visibly attached to a product (possibly detachable later) or hidden invisibly or even woven into the fabric, for example a sweater or even a bank note. In comparison with bar-codes, tags can be read around corners and through materials. This means that a pallet of products or a trolley of groceries can be simultaneously scanned/read.

There are also choices to be made in terms of data storage on the tag. Tags can be read-only, thus containing a unique identifier only. Alternatively tags can contain read and write capabilities allowing additional information to be held or added to each time they are read. A tag for example can be programmed to hold all information about a product as well as the distribution points it passed before it reached the customer. Some systems allow data to be stored on the tag in a portable dynamic database. Others allow data to be edited, added to or locked, which can be valuable in different circumstances. As might be expected given such different possibilities, one of the big issues in RFID has been the agreeing of standards for data. Other questions that need to be resolved include the choice of frequency and the ability to read chips from different countries or even companies.

Table 10.4 provides a way of thinking about RFID functions. It suggests that some of the activities within RFID are basically the replacement of current activities. For example, the RFID tag can act essentially as a ‘super bar-code’. Advantages derive from this area of application through the ability to things better. However, RFID also offers the potential to be able to do new things. For example it will be possible to have remote and unattended activities to a greater extent than currently. It will also be possible to have temperature and other regimes checked by reading RFID tags. The ability to do both new things and existing things more efficiently is clearly an attraction to proponents of the technology.

|

Function |

Activity |

Value |

|---|---|---|

|

Super bar-code |

Permits faster and multiple reads of labels without opening containers. |

|

|

Accurate tracking via unique identifier. |

Faster scanning (productivity). Accurate tracking (reduce shrinkage). Real-time stock location(higher availability, increased sales). ePODs (reduced disputes). |

|

|

Carry additional information (read/write only) |

R/W tags may include sell-by date etc. Added information on each tag may pose a security risk. |

Permits some high-speed checking locally (quantity per pallet etc). Decentralized information (to be balanced against security risk). |

|

Perform new tasks (active tags only) |

Maintain records of events (eg when opened, temperature regime). Locate products by tags associated with beacon. |

E-seals when filling containers, provide accurate shipping manifest for customs (secure shipping lanes). Telematics related benefits. |

|

Source: adapted from www.ilt2003.co.uk/g/logos/MurrayBrabender_files/frame.htm (accessed 10 Nov 2003) |

||

A number of areas of benefit are therefore claimed to be available through the introduction of RFID. These include (LakeWest Group, 2002):

- Reduced out-of-stocks and improved shelf management. Real-time product movement information can be captured using RFID and so replenishment will be more efficient, in-store product misplacement will be identified and inventory movement at warehouse and store will be more effective.

- Reduced shrinkage/fraud. RFID provides embedded tracking capabilities which mean that inappropriate product movement will be more readily identified.

- Improved productivity and streamlined processes. The abilities of RFID in terms of remote or unattended scanning, plus the speed at which this is achieved (for say a mixed pallet of goods) means that there is the potential to reduce labour costs. Time and accuracy benefits are generated.

- Enhanced point-of-sale checkout efficiency – these time and accuracy benefits apply equally to the store checkout.

The benefits of RFID are therefore fairly clear. RFID provides the ability to have total visibility at the item level throughout the supply chain and to achieve this visibility with more speed, greater accuracy and fewer people than were ever thought possible. This has obviously attracted considerable attention, and RFID is being proposed for many areas of the supply chain and the retail store (NCR, 2003). Retailers have begun to explore the possibilities of the technology through various trials (see for instance LakeWest Group and MeadWestvaco Intelligent Systems, 2003; various issues of www.rfidjournal.com). For example:

- Benetton announced its intention to embed RFID tags into all of the garments in one of its lines to track items arriving at the back of store.

- Prada tagged all of its merchandise in its New York Epicenter store so store staff could access a database on all stock items available without having to check the back-room. RFID tags have also been embedded in its customer loyalty cards, allowing dynamic accessorizing in the changing room among other personal features.

- Tesco has used RFID technology and a security camera to detect motion on razor blades in store in a smart shelf scheme run with Gillette. It has also announced that it will in 2004 put RFID tags on cases of non-food items at its distribution centers and track them through to stores.

- Wal-Mart is asking its top 100 suppliers to put RFID tags carrying Electronic Product Codes on pallets and cases by the start of 2005. Wal- Mart is contacting the suppliers ahead of this, but will probably not issue a compliance order in 2004, moving to that over time. Wal-Mart receives roughly 1 billion cases per year from its top 100 suppliers. The company will not be tracking every single case from the top 100 suppliers by 1 January 2005, but that is the eventual aim. The current goal is to track all pallets and cases. By announcing this statement, Wal-Mart is pushing the pace on RFID implementation (as it did on exchanges).

More detailed information on two of the experiments and trials is presented in the boxes on pages 201 and 202. These provide summaries of the experiments that Marks and Spencer and Sainsbury have been carrying out. They raise some of the potential benefits and issues in RFID implementation and point to some of the potential problems. All these experiments and testing show that there is a belief and willingness to see RFID implemented in the supply chain, but that it may not be as simple or straightforward as first envisaged. There are a number of ways of thinking about the problems of implementation with RFID (Table 10.5).

|

Area |

Problem |

Description |

|---|---|---|

|

Technology |

Size and data storage Scanning accuracy Infrastructure costs |

Functionality comes at a cost in terms of money and size. Smaller tags with increased data capacity at a lower cost are needed. When several items are read closely in conjunction, problems of interference arise. Tags can be faulty at production causing misreads. Readers may be insufficiently accurate. Readers are not yet cheap enough and will undoubtedly also develop in capabilities, causing upgrade issues |

|

Costs |

Cost vs functionality |

The current cost to manufacture even the basic tags may be prohibitive. When functionality is additional then costs rise. |

|

Standardization |

Product identification Manufacture and equipment standards |

All points along the distribution channel need to recognize that standardization is the key to the technology. Without standardization a global system will not work. Some steps have been made in this direction. Standardization among manufacturers to avoid bespoke systems is also needed |

|

Others |

Consumer privacy Operations and maintenance Intelligent use of data |

Considerable adverse reaction to the trials has been generated (see www.spychips.com), with consumer concern about personal data tracking and privacy intrusion at the forefront. If tags are to be reused then data management becomes an even bigger issue The data collected have major impacts on people and processes. RFID is not simply a replacement technology and thus a creative vision of new processes and the skills of the people involved is needed. |

|

Source: adapted from LakeWest Group (2002), various issues of www.rfidjournal.com |

||

Marks and Spencer Pilots RFID

Marks and Spencer has been looking at RFID for some time. It has had an experimental scheme in food distribution that is now ready to roll out. Marks and Spencer has also however recently trialled RFID tracking tags in clothes at one of its UK stores.

The small-scale (one store, four week) pilot is basically a technology test aimed at stock accuracy, so as to lower safety stock and warehouse/store contact with the merchandise. Inaccuracies from incorrect delivery, damage and other merchandise movement compound to create a large problem at store level. As a result forecasts are driven by deduced not real stock. Manual stock counts are needed to remedy this, at some cost. Ideally the goal would be to keep a minimum of stock, maintained on a real-time basis. But stock is held in store and at the warehouse due to mistrust of forecast information. Suppliers also hold safety stock. Reducing the stock held and the need for handling and counting would be a considerable benefit.

The tags are contained within throwaway paper labels called intelligent labels attached to, but not embedded in, a selection of men’s suits, shirts and ties. The passive tags hold the number unique to each garment. The information associated with this number is held on Marks and Spencer’s secure database and relates only to that product or garment’s details: for example, the size, style and colour. The intelligent label is attached to the garment alongside the pricing label and is designed to be cut off and thrown away after purchase. For items such as shirts, which are pre-packed, the tag is stuck onto the transparent shirt bag.

Two scanners are used for the tags. A portal installed at the distribution centre and the loading bay of the store allows rails of hanging garments and trolleys containing packaged garments, to be pushed through and read at speed. A mobile scanner in a shopping trolley that has a hand-held reader will scan several garments at the same time out on the shop floor. This is pioneering, but hardly a satisfactory long-term solution, given its size, and Marks and Spencer have expressed some frustration at the lack of readiness of technology in this area.

Given high-profile media interest in consumer privacy issues, Marks and Spencer contacted one of the leading consumer advocacy groups before the trial (CASPIAN – see www.nocards.com) to discuss privacy implications. It is understood that it took some of the concerns into account. The pilot focuses on only the store operational benefits of RFID and not on any potential links to consumers.

Marks and Spencer emphasize that many of the figures for potential savings appear to be highly speculative, and that the costs and benefits have yet to be fully understood. There may also be differential aims and costs/benefits depending on product group. Marks and Spencer believe that the business case for tagging food items is based more around efficiency and speed of handling with some degree of accuracy (hence tray- level tagging), whereas the clothing business case is primarily built around accuracy (hence item-level tagging) with some efficiency benefits. In the long run the company may benefit from its ability to run RFID within a closed-loop environment, given its retailer-brand policy. Implementation issues may therefore be somewhat reduced.

Sources: adapted from material at www.amrresearch.com, www.spychips.com/, www.silicon.com (accessed 1 Dec 2003), Ft.com (accessed 25 Nov 2003) and Retail Week, 14 Nov 2003, p 26.

The Value of RFID for the Retailer: The Sainsbury’s Case

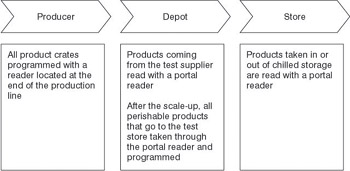

Sainsbury’s RFID trial was predicated on a basis of an information- enriched supply chain. The trial focused initially on tracking chilled goods with one supplier, a single depot and a single store, before it was widened to other goods in the line going to the store. The RFID tags were applied to recyclable plastic crates. The tags were programmed with:

- the description and quality of the product in the crate;

- the use-by dates of these products;

- the crate’s own ID number.

Programming was achieved at the end of the production line. Goods were then read at the depot’s goods receipt area and on delivery to the store.

Benefits achievable from a full-scale implementation were estimated to be £8.5 million per annum based mainly on retail store replenishment productivity, reduction of stock loss and on removal of checking stock and codes. Payback for the system was estimated to be between two to three years. These benefits were estimated without any supplier participation, which could be considerable if item stock-outs are minimized.

Source: adapted from Karkkainen, 2003: 532–4.

Figure 10.1 Sainsbury’s RFID Trial

The table suggests that there are a number of dimensions to the problem of implementation. While RFID has been used in some business sectors for some time, the extension to the retail supply chain presents new problems. These new problems are due to the scale of the retail supply chain (one Woolworths’ distribution centre for example has over 100,000 dollies and cages) and the environmental characteristics under which the systems will have to operate. As such there are always going to be technological problems as the technology is used in new situations and new generations of technology are developed. Given the scope of the possible RFID implementation in the retail supply chain, there are also always going to be issues of costs. While the cost of basic tags has fallen, their sheer ubiquity of use in a retailer demands a huge volume. Costs therefore have to be minimal. At the same time, as this is a supply chain issue, there is also concern over the cost of implementation and compliance. To what extent can the costs and benefits of the technology be shared by retailers, suppliers and logistics services providers?

Quite a lot of the problems posed in Table 10.5 can be put down to the timing of technology adoption. In any innovation there are obviously leaders and laggards. In this case, as the claims for RFID are so broad, there are leaders and laggards in aspects of implementation ranging from the type of tag to the standards to be used, components of the supply chain to be tested and so on. Some of the issues may be termed teething troubles; other issues may force a fundamental rethink about the whole transforming nature of the technology. Despite the bold claims of its proponents, and a widespread belief it is a question of when, not if, a totally transparent global supply chain at the item level still seems some way off. More likely are small-scale closed-loop developments focused on particular supply chains or problem areas.

Given the critical nature of Wal-Mart’s mandate to its top 100 suppliers (noted above) it is worth considering further the latest news about this situation (www.amrresearch.com: accessed 1 Dec 2003). From a mid- November meeting between Wal-Mart and these suppliers, they report that:

- Wal-Mart did not recommend any specific solutions, vendors, or provide an implementation guide.

- Operational changes saw the project constrained to Texas, pallet not carton level reading required and other changes to protocols and data requirements.

- Data requirements seem to be pushing up the likely final specifications for the tag (and therefore the cost).

- Some specific technology, implementation and deployment problems remain.

- Suppliers need urgently to understand what all this will mean for their production processes and costs.

In short, there still seems a long way to go, despite a deadline of only 13 months. Perhaps the Wal-Mart example shows the substantial difficulties in implementation for retailers and suppliers. The list in Table 10.5 may be far from complete. Even for a relatively limited application in the retail supply chain, there still seems much to do to implement RFID in a cost- effective and useful manner. This may be an issue of time rather than technology, but this is by no means certain.

Two particular problems deserve further consideration. First, and probably unexpectedly, there has been a considerable and voluble consumer backlash against the technology on the grounds of privacy invasion. Tags can be placed in individual items and can continue to work after a consumer has purchased the product. Individual items can be associated with individual consumers and a very detailed picture of purchase and behaviour can be drawn up. Consumer advocates have been vocal in their criticism (see www.spychips.com) and as a result, many of the trials identified earlier (such as Prada and Benetton) have been halted. While RFID may have begun as a supply chain initiative, the potential for consumer identification is clear, whether done deliberately or accidentally. Any allegation of use of hidden RFID tags to spy on consumers provokes bad publicity for retailers, whatever the real situation.

Second, while a lot of thought has been given to the technology itself, not much seems to have been devoted to the handling of the data the systems could generate and the use of this data. Rewriting the supply chain using RFID is a change management project writ large. As such there is need for much greater concern over how the data are to be stored and analysed, and how their use will need to focus on aspects of process and people change. The implications are considerable.

The technology itself is advancing rapidly and needs therefore to be monitored carefully. Capital costs are not going to be cheap however, despite the fall in prices in tags. People, processes and technology will be affected by any implementation, particularly if the data from the systems can be applied appropriately. Given that a total supply chain solution is some way off, it is likely that retailers are going to have to run several types of systems for some time, adding further to the cost issues (AT Kearney, 2003).

Conclusions

The claim that a technology will transform a business is too easily made. There have been many false dawns in retailing and retail supply systems. The two technologies considered here, retail exchanges and RFID, are the latest in a long line of such potential transformations. Yet, in the end, companies still have to move boxes from a point of production to some point of consumption. The focus has to be on doing this in the most effective and efficient way. Here, the technologies do have things to offer. By focusing on the detailed applications (new product development and tagging merchandise-ready units for example) so costs can be driven out of the system, control can be improved and the detailed operations of the supply chain can be enhanced. Is this a transformation? Probably not. But is it important to retailers? Definitely.

References

Angeles, R (2000) Revisiting the role of the Internet-EDI in the Current Electronic Scene, Logistics Information Management, 13 (1), pp 45–57

AT Kearney (2003) Meeting the Retail RFID Mandate, November [Online] www.atkearney.com/shared_res/pdf/Retail_RFID_S.pdf (accessed 1 Dec 2003)

Dawson, J A (2000) Retailing at century end: competing in volatile markets, Industrial Marketing Management, 29, pp 37–44

Dawson, J A (2001) Is there a new commerce in Europe? International Review of Retail and Distribution Management, 11, pp 287–99

Dawson, J A and Shaw, S (1990) The changing character of retailersupplier relationships, in Retail Distribution Management, ed J Fernie, Kogan Page, London

Eng Yong, T and Spickett-Jones, G (2002) An Investigation of the Concept of E-Marketplace in Supply Chain Management, British Academy of Management Conference, London

Evans, P and Wurster, T S (2000) Blown to Bits: How the new economics of information transforms strategy, Harvard Business School Press, Boston, MA

Fernie, J (1994) Quick Response: an international perspective, International Journal of Physical Distribution and Logistics Management, 24 (6), 38–46

Fernie, J and Sparks, L (eds) (1998) Logistics and Retail Management, Kogan Page, London

Fiorito, S, May, E and Straughn, K (1995) Quick response in retailing: components and implementation, International Journal of Retail and Distribution Management, 23 (5), pp 12–21

Hoffman, W, Keedy, J and Roberts, K (2002) The unexpected return of B2B, McKinsey Quarterly, 3 [Online] http://www.mckinseyquarterly.com/article_page.asp?ar=1210&L2=24&L3=47 (accessed 1 Dec 2003)

Karkkainen, M (2003) Increasing efficiency in the supply chain for short shelf life goods using RFID tagging, International Journal of Retail and Distribution Management, 31 (10), pp 529–36

Kincade, D H, Vass, D and Cassill, N L (2001) Implementation of technology and relationships to supply chain performance: apparel manufacturers’ perspectives, International Review of Retail, Distribution and Consumer Research, 11, pp 301–27

Kotzab, H (1999) Improving supply chain performance by efficient consumer response? A critical comparison of existing ECR approaches, Journal of Business and Industrial Marketing, 14 (5/6), pp 364–67

Kurt Salmon Associates (1993) Economic Consumer Response: Enhancing customer value in the grocery industry, Kurt Salmon Associates, Washington, DC

LakeWest Group (2002) RFID: Retail’s new transforming technology, June [Online] http://www.lakewest.com/PDFdocs/RFIDper cent20Retails percent20Newpercent20Transformingpercent20Technology_June per cent202002.PDF (accessed 1 Dec 2003)

LakeWest Group and MeadWestvaco Intelligent Systems (2003) RFID in Retail: The future is now, June [Online] http://www.lakewest.com/PDFdocs/RFIDpercent20Inpercent20Retail percent20Thepercent20Futurepercent20Isper cent20Now_June per cent202003.pdf (accessed 1 Dec 2003)

Lightfoot, W and Harris, J R (2003) The effect of the Internet in industrial channels: an industry example, Industrial Management and Data Systems, 103 (2), pp 78–84

Lu, D and Antony, J (2003) Implications of B2B marketplaces to supply chain development, TQM Magazine, 15 (3), pp 173–79

McMichael, H, Mackay, D and Altmann, G (2000) Quick Response in the Australian TCF industry: a case study of supplier response, International Journal of Physical Distribution and Logistics Management, 30 (7/8), pp 611–26

NCR Corporation (2003) 50 Ideas for Revolutionizing the Store through RFID [Online] www.ncr.com/repository/articles/pdf/sa_RFID_whitepaper.pdf (accessed 1 Dec 2003)

Perry, M and Sohal, A S (2000) Quick Response practices and technologies in developing supply chains, International Journal of Physical Distribution and Logistics, 30 (7/8), pp 627–39

Scully, A and Woods, W (1999) B2B Exchanges: The killer application in the business-to-business internet revolution, ISI Publications

Sparks, L (1998). The retail logistics transformation, in Logistics and Retail Management, ed J Fernie and L Sparks, pp 1–22, Kogan Page, London

Sparks, L and Wagner, B (2003) Retail exchanges: a research agenda, Supply Chain Management, 8 (1), pp 17–25

Wal-Mart (1999) The role of standards in the growth of global electronic commerce, prepared statement by Wal-Mart Stores, Inc before the Subcommittee on Science, Technology and Space of the Committee on Commerce, Science and Transportation, United States Senate, Washington, 28 Oct 1999 [Online] www.senate.gov/commerce/ hearings/1028hab.pdf (accessed 1 Dec 2003)

WWRE (2003) WWRE Overview Presentation [Online] /www.worldwideretailexchange.org/cs/en/press_room/exec_speeches.htm (accessed 1 Dec 2003)

Preface

- Retail Logistics: Changes and Challenges

- Relationships in the Supply Chain

- The Internationalization of the Retail Supply Chain

- Market Orientation and Supply Chain Management in the Fashion Industry

- Fashion Logistics and Quick Response

- Logistics in Tesco: Past, Present and Future

- Temperature-Controlled Supply Chains

- Rethinking Efficient Replenishment in the Grocery Sector

- The Development of E-tail Logistics

- Transforming Technologies: Retail Exchanges and RFID

- Enterprise Resource Planning (ERP) Systems: Issues in Implementation

EAN: 2147483647

Pages: 119

- Chapter I e-Search: A Conceptual Framework of Online Consumer Behavior

- Chapter IV How Consumers Think About Interactive Aspects of Web Advertising

- Chapter X Converting Browsers to Buyers: Key Considerations in Designing Business-to-Consumer Web Sites

- Chapter XIV Product Catalog and Shopping Cart Effective Design

- Chapter XVI Turning Web Surfers into Loyal Customers: Cognitive Lock-In Through Interface Design and Web Site Usability