BACKGROUND

|

|

Importance of the Payment System

In many countries, the payment system had been taken for granted until the financial crisis in the 1970s which brought into focus its importance to the stability of an economy (Bank for International Settlements, 1994) and resulted in the increasing use of technology in this system (Hopton, 1983; Mester, 2000; Guibourg, 2001).

An efficient payment system is necessary to support trading in goods and services because payment constitutes an essential practice in the commerce of any economy, and prompt settlement has major implications on the stability and liquidity of the economic system. There have been suggestions that an efficient payment system is necessary for economic advancement, particularly in developing and emerging market economies (OECD, 1993; Balino et al., 1994; Folkers-Landau et al., 1994; Bhala, 1995; Listfield & Montes-Negret, 1994, 1995; Sato & Humphrey, 1995; Balino et al., 1996; Cecchetti & Krause, 2001). Governments of these economies are aware that a competent payment system can help improve macroeconomic management, resources utilization and the control of monetary aggregates. On the global front, the trends in business globalisation and financial market liberalisation have also propelled these governments to address the need for competency in their payment systems in order to remain relevant in the global trade and financial systems.

Technology has been used to automate the payment system for the purpose of injecting the system with unprecedented efficiencies (Morelli, 1986; Folkerts-Laudau et al., 1994; Balino et al., 1994). The benefits to an economy of information technology applications in the payment system are apparent in the speed, traceability and liquidity that the technology can provide over and above manual processing. Payment systems are becoming more electronic in many open trade economies. Developing and emerging market economies cannot afford to be locked out of the global market because of technology inadequacies, as trade is their lifeline for economic well being and development.

The People's Republic of China, like many other developing and emerging market economies, has been experiencing pressures to reform its payment system since the initiation in 1979 of its economic reform program and its transition from a command to a market-based economy. The initial desire of the Chinese government in constructing an efficient electronic payment system was to lessen the high level of cash usage and improve monetary control within the economy. The high usage of cash has given rise to a sharp increase in counterfeit currency activity in the Chinese economy, especially when its doors were first opened to world trade (Jinrongshibao, 22/5/95). In addition to counterfeit currency in the system, an inefficient payment system can result in flight of capital or unauthorised withdrawal of capital. It has been estimated that flight of capital totalled to about US$27 billion in the early 1990s with more than $7 billion of China's foreign exchange reserves leaking out of the country's financial reserve system without trace. It was intended that the construction of a national electronic payment system (known as "China National Advanced Payment System" or "CNAPS") would also curb unauthorised leakage from the financial system. High value payments have to be cleared by the Central Bank in this modern electronic payment system, and this would provide a better means of tracing the flow of funds than the manual system. Although government departments and affiliated organizations have been conforming to the policy of using the electronic payment system for payment settlement, the electronic payment system is still relatively underused among the Chinese. Attempts by the government and banks to cultivate mass acceptance (especially among private individuals) for the Chinese payment system has been confronted with several daunting obstacles. In fact, the poorly developed electronic payment system in China has been accused of stifling overall economic development (Lee, 2000; Business China, 2001).

The Chinese government is keen to resolve problems and difficulties that prevent the full realization of a supportive and efficient electronic payment system, especially in view of its recent successful admission into the World Trade Organization (WTO).

The "Golden Card" Project

In 1993, the Chinese government initiated the "Golden Card" project[1] that aimed to build a modern nationwide electronic card-based payment infrastructure facilitating monetary management. This initiative was driven by the vision that the widespread use of a bankcard as a payment alternative would enable better monetary control and low cash usage within the economy. The State Golden Card Project and Leading Group was subsequently formed, with representations from various state-owned entities (telecommunication, banking, science and technology sectors, and local government authorities), to lead this project. Through this group, the government began to aggressively promulgate the issuing of bankcards by its (state-owned) banks and the use of these bankcards under this Golden Card project. The project targeted to achieve 200 million cards in circulation in more than 400 cities and developed county-cities, which have a total population of 300 million inhabitants, by 2003. The 10-year time span was envisaged to involve three phases of development (Zhao, 1999):

-

1994–1996 (Experiment phase). The Golden Card project commenced in the prosperous areas and coastal regions whose infrastructures were relatively well developed and where financial and commercial activities had been more significant in economic contribution. Twelve cities[2] primarily along China's East Coast were selected as the beachheads in this phase, and three million cards were targeted for issue to the inhabitants of these regions.

-

1997–1999 (Diffusion phase). It was planned to implement the Golden Card project in 30 to 50 additional cities, which have a combined population of 100 million people. The national target set for the total number of bankcards issued in all the selected cities (inclusive of cities that were targeted during the experiment phase) was 60 million bankcards.

-

2000–2003 (Popularisation phase). In this phase, the use of bankcards was to become predominant in more than 400 cities within the Chinese economy, and the aim was to achieve 200 million bankcards in these cities.

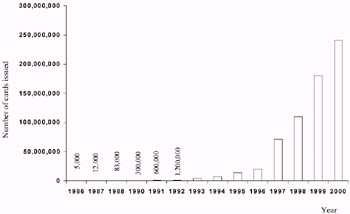

The Golden Card project has added great impetus to the issue of bankcards by the local banks. The inauguration of the project was carried out with fanfare, and a high level of publicity was given to the advantages of making use of a bankcard—"one could travel the whole of China with a bankcard in hand." The number of bankcards has indeed grown at a rapid rate over the years. Figure 1 shows a significant increase in the issue of bankcards since 1993, which dwarfed those numbers attained in the early stages when the bankcard had just emerged in the Chinese economy. Since 1995, the growth rate for the number of bankcards on issue has been at least 40% each year. In fact, the number of bankcards on issue has exceeded the predetermined targets of the different phases. At the end of 1996 (end of the experimental phase), the actual number of bankcards issued was 20 million, at least six times greater than the predetermined target of three million cards. By the end of 1998, the actual number of cards issued (110 million) had already exceeded the predetermined target of 60 million cards in the diffusion phase. And, by the end of 2000, the number of bankcards on issue exceeded the pre-determined target of the popularization phase by 20%.

Figure 1: Accumulated Number of Bankcards on Issues

History of the Bankcard in China

The history of the country's first contact with credit cards traces back to the period when the then head of state, Deng Xiaoping, was holding the reins of power and was opening the economy to world trade. Along with the new economic development, the Bank of China became the first agent in the country to handle overseas issued credit cards in 1979. This role exposed the bank to experience the value of the credit card business and led to the initiative of issuing a domestic bankcard in 1985. The Bank of China Pearl Delta branch issued the first bankcard in the nation in that year. This first bankcard was a local card that was only usable within the Pearl Delta region. In 1986, the Bank of China branch in Beijing introduced a nationwide bankcard, known as the Great Wall Card, for domestic use in local currency. After the bank joined Master International and Visa International as a member in 1987, it issued the first international Great Wall Card. Since 1989, the other state-owned banks have become members of these organisations and have begun to issue similar bankcards, or their corporate bankcards.

Types of Bankcard

In China, the issue of credit cards has been subject to tight control and distribution, and a majority of the cards issued by the banks are ATM cards, POS cards or a combination of both (known as a debit card). Presently, the number of credit cards issued in the domestic economy is less than 10% of the total cards issued by the local banks in the economy. The ATM, POS and debit cards are largely referred to as "bankcards" in China. The ATM card is a means of access to banking transactions at the ATM. The transactions conducted at the ATM have been commonly deposit, withdrawal, saving and inquiry transactions that can also be conducted over the bank counter. The POS card, on the other hand, is a means of access to electronic payment for goods and services between the seller and buyer (who is also a POS cardholder). Debit cards incorporate the withdrawal and deposit features of the savings card. They have the additional attribute of being a payment card (POS card) that allows the cardholders to close transactions through their escrow accounts, which have a preexisting credit balance to cover a certain value of the total transactions. The transactions will not be aggregated like the credit card on an accrual basis but are supposed to be debited directly, online[3], at the cardholder's bank account, as soon as the cardholder gives the authorization.

[1]The "Golden Card" project is one of the eight projects that were initiated by the Chinese government to develop electronic information systems. The other projects were the State's Public Economic and Information Telecommunications Project (Golden Bridge), the Foreign Trade Information Resource Network (Golden Customs), the Electronic Currency and Modern Payment System (Golden Card), the Taxation and Electronic System (Golden Taxation), the Industrial Production and Circulation Information System (Golden Enterprises), the Agricultural Comprehensive Management and Service Information System (Golden Agriculture), China Education and Scientific Research Computer Network and Talent Project (Golden Intellectual), and finally, the National Economic Macro-Policymaking Support System (Golden Policy).

[2]Liaoning Province, Dalian City, Beijing City, Tianjin City, Shandong Province, Qindao City, Jiangsu Province, Shanghai City, Hangzhou City, Xiamen City, Guangdong Province, and Hainan Province.

[3]"Online" means the equipment that reads the magnetic-strip card is directly linked to the processing bank or clearinghouse computer.

|

|

EAN: 2147483647

Pages: 367