Positioning Profit Improvement

|

Positioning an improvement in customer profits is a three-step process: (1) definition of a customer problem to be solved or a customer opportunity to be capitalized; (2) prescription of the profit-improvement benefit from solving the problem or capitalizing on the opportunity; (3) and description of the operational and financial workings of the system that can yield the improved profit.

Step 1: Problem/Opportunity Definition

Your initial task is to establish consultant credibility. Initial credibility comes only from displaying knowledge of a customer's business. Until a customer can say, "That supplier knows my business," the customer will rarely be inclined to say, "That supplier can improve my profit."

In fact, you must be knowledgeable about two areas of a customer's business. First, you must know the location of significant cost centers that are susceptible to reduction. Second, you must know how a customer's customers can be induced to buy more from the customer. In the first instance, you must prescribe a system that will reduce customer costs. This is a problem-solving system. In the second instance, you must prescribe a system that will increase customer sales. This is an opportunity-seizing system.

Defining a customer problem or opportunity has two parts: what you know and how you know it. The second part documents the first by citing the sources of your knowledge. It also reinforces your credibility. There are three likely sources of knowledge about a customer cost problem or sales opportunity. One is that the customer revealed it. This is the "horse's mouth" source. A second source of knowledge is past experience with the customer, with other companies in the same industry, or your track record symbolized by its norms. The third is that knowledge can come from homework. This is the "midnight oil" source.

Step 2: Profit-Improvement Prescription

The objective of the first step in a consultative presentation is to say to a customer, in effect: "You have a situation that is detrimental to your profit. Either you are incurring unnecessary costs or you are failing to capture available sales revenues." The objective of the second step is to say, "Working together, we can reduce some of those costs or gain some of those sales as a cost-beneficial investment."

In this way, you further reinforce the perception of being knowledgeable about the customer's business by framing the system's benefit in businesslike terms of return on investment. By quantifying an added value the system can make to the customer's operations, you are creating a business-manager-to-business-manager context for customer decision making in contrast to a vendor-to-purchaser context.

The prescription for customer profit improvement must specify the positive return that can predictably result from installation of your system. The return should be specified as both a percentage rate of improvement and its equivalent in dollars. These quantifications, the end-benefit specifications in money terms, rather than specifics about the system's performance or components, are the ultimate specifications of the consultant's system. These are what a customer will or will not buy. They are therefore what you must prescribe for delivery.

IBM consultants approach top-tier management of key retail customers on behalf of IBM's computer-assisted checkout station. The consultants prescribe profit improvement benefits of reduced costs and increased sales like this: "For a store with gross weekly sales of $140,000, savings are projected at $7,650 a month by faster customer checkout and faster balancing of cash registers." The time required to check out an average order is said to be reduced by almost 30 percent. In addition, IBM sales representatives claim that the elimination of time and cost expenses of correcting checker errors can contribute annual savings of more than $91,000 per store.

If a store is growing, its total savings every year can approach one week's gross sales at the $140,000 level. The net value of these savings falls directly to the store's bottom line. The essential contribution made by IBM is providing added growth funds that supplement revenues from sales and can be invested for still further growth. In the course of making its contribution, IBM consultatively sells computers.

The same solution can often make a contribution to decreasing customers' costs as well as increasing their revenues. In almost every case, the increased revenues exceed the cost savings. Revenues are also the reason customers are in business. So it is always preferable to sell the revenue gain rather than the cost reduction, unless the costs being reduced are costs of sale. In that event, a profit-centered line-of-business manager will be responsible for both.

The preeminence of revenues over cost savings does not mean you should not sell profit improvement through cost reduction. It means that you have two options, one of which is generally to be preferred.

If you sell simulation software that lets a manufacturing customer design new products on computer screens instead of by constructing physical prototypes, you can affect customer revenues and costs at the same time:

-

You can affect revenues by helping the customer get new products to market faster, create products that are more reliable, longer lasting, and more energy-efficient, that are safer, that have better styling, and that are easier to customize.

-

You can affect costs by reducing the number of physical models and tests, using fewer engineers and less design time, using less material, reducing repair costs under warranty and cutting down on recalls, paying for fewer design changes, lowering training costs, and reducing nonperformance penalties and late charges.

How do you decide which to sell?

Your decision must be based on comparative contribution:

What are the revenue gains from helping the customers get faster to market with a new model? How long do they take to pay back the investment and pay out the proposed improved profits?

How do the revenue gains compare to the costs saved by increased design productivity, with its labor and time savings?

How do the savings from design productivity plus savings from reduced warranty costs compare to the revenue gains in their muchness and soonness?

Does any combination of cost savings compare favorably with the proposed revenue gains?

In spite of the fact that cost reductions are typically less than revenue expansions, they can have five saving graces. First, costs are easier to quantify. Second, costs can often be reduced faster than revenues can accrue.

Because costs are internal, a third advantage can be the greater certainty of realizing a proposed saving than an added revenue stream. Fourth, once a cost is reduced or eliminated, it stays removed forever and can be credited year after year, indefinitely. And fifth, cost savings may be the most cost-effective strategy for mature customers in oligarchic markets where market shares can only be traded, not gained.

Step 3: System Specification

The third presentation step is to specify the system that will deliver the promised profit-improvement mix and to justify its premium price by interpreting price in terms of investment in the new mix. Customers must not be asked to buy systems; you must invite them to improve profit. They are not quoted a system's price; you must promise them a positive return on the investment in their system.

The purpose of defining the system is not to sell it, but rather to present proof that the promised benefit is derived from known capabilities that have been prescribed precisely because they will contribute in the most cost-beneficial way to the customer's profit improvement. The system substantiates your promise. Its capabilities, plus your personal expertise in applying them, are the means of conferring new profitability on the customer.

Defining a customer problem or opportunity should condition a customer to relate to you as a business manager. The next presentation step, prescribing a quantified benefit, should condition a customer to regard the system as a profit-making investment, not as a cost or a collection of components. Defining the system and justifying its price should condition a customer to credit the prescription as believable and achievable.

The final step in a system's presentation is to set down the standards by which you progressively monitor the system's ability to deliver the promised benefit in partnership with the customer. At least three control standards should be set so that a working partnership can be confirmed between consultant and customer:

-

Time frames for the accomplishment of each installation and operational stage

-

Checkpoints for measuring the impacts of phasing the system into customer business functions

-

Periodic progress review and report sessions to head off problems and anticipate new applications and opportunities for system extension, upgrading, modernization, and replacement

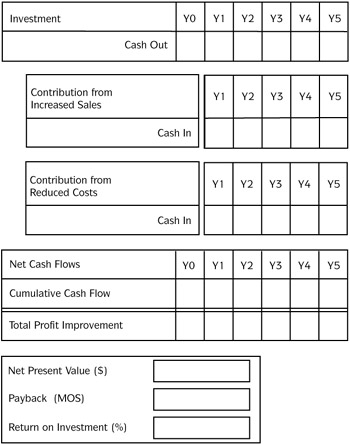

The comparative analysis of customers' costs to improve their profits by doing business with you and the benefits they can expect to receive are the heart of Consultative Selling. Cost-benefit analysis, which should really be called "investment-return analysis," positions profit projects as fundable or scrap. It tells customers how much they must lay out for how much they can get back. The basic format for costing the benefits of a profit improvement project with a five-year commercial life is shown in Figure 3-1. Compare it with Figure 9-1, which shows a similar analysis of an investment's costs and benefits in the software format of PIPWARE.

Figure 3-1: Cost-benefit work flow.

Figure 3-2 is a glossary of guidelines to analyze the relationship between costs and the benefits that flow from them.

Investment

Represents customers' total incremental expenditure to obtain our solution, including but over and above their costs to do business with us: capital equipment and materials, software, services other than annual maintenance, training, and other variable costs that will have to be expensed. It is assumed that the total investment is a one-time cost that will be paid out in full in Year 0. Total investment is the "cost" in the cost-benefit analysis.

Multiply the total investment in capital equipment by the current depreciation rate permitted by the accelerated cost recovery schedule (ACRS). Subtract the resulting cash flows generated by cumulative annual depreciation from the total investment.

Cash Flow

Represents the incremental cash benefits generated by the savings and revenues from our solution. They are calculated on a recurrent annual basis that can be accumulated at the end of the useful life of the total investment. Cash flow is the "benefits" in the cost-benefit analysis.

Payback

The cumulative cash flows to date have exactly returned the customers' total investments so that they are released from risk and made whole again. After payback, cash flows become positive so that profits can occur.

Net Present Value (NPV)

Represents today's current value of the sum of all the future cash flows after they have been discounted for annual opportunity loss based on what the same total investment might have saved or earned if invested elsewhere. Annual opportunity loss is calculated over the useful life of the total investment.

(The Year One net present value of $50,000 by the time it will be received in Year Two is $41,667, which represents $50,000 discounted by the factor of 0.83333.)

Internal Rate of Return (IRR)

The average annual percent return per dollar invested calculated in discounted dollars. If NPV = $60 at 10 percent cost of capital and if $60 = a rate of return of 8 percent, IRR = 18 percent, (8 percent + 10 percent cost of capital). Cost of capital is the customer's hurdle rate.

Figure 3-2: Glossary of cost-benefit guidelines.

|

EAN: 2147483647

Pages: 105