1.4 Global trends in GSW

What makes GSW particularly interesting is the diverse global network in which it takes place. This diversity is expected to increase in the future since different predictions on the size of the GSW market present a healthy picture of growth that no doubt will attract new producers . The demand for and supply of GSW has increased substantially since the early 1990s with continued demand from well-established users in the USA, UK, Australia and various Western European countries . Japan and Korea are fast emerging as customers and in some cases are also aspirant producers of various categories of GSW. According to the International Data Corporation ( reported in Krill 2001), the USA is likely to continue to be the most significant user of GSW, with predicted increases in spending from $5.5 billion in 2000 to a rather optimistic $17.6 billion by 2005. At the time of writing, such predictions on the size and growth of GSW can be considered less than reliable because of the US recession and war in the Middle East. However, substantial growth of GSW throughout the 1990s was stimulated by such factors as demand for ˜e-enablement of enterprises and an international shortage in IT skills that forced firms to look offshore for resources. Other factors concern continued momentum towards IT outsourcing in countries such as Japan and Korea, in part due to the gradual erosion of the guaranteed lifelong employment structure. On the supply side, deregulation of markets in a number of developing countries, and a series of initiatives in countries such as China to address issues of English language and telecommunications infrastructure, have helped to position previously ˜inactive countries more prominently in the global marketplace .

Castells (1996) presents a view of the informational global economy as a network organised around key metropolitan centres dispersed globally . These centres comprise important ˜nodes for the structuring and management of intertwined activities at different levels, including firms, teams and individual actors. Castells notion of a ˜network refers to both the physical (transport, computer systems and telecommunications) as well as the social (educational, expatriate networks, trade associations, personal contacts, etc.), in which economic, social, religious and even criminal activities need to be considered. The financial capitals of London, Tokyo and New York are good examples of major ˜command and control centres supported by various secondary nodes for the execution of various functions. Similarly, GSAs can be conceptualized as networks of users and providers of GSW services, infrastructure suppliers and a host of other actors. In GSW, global nodes situated around cities providing international market access to skills and knowledge structures serve global networks of firms. Telecommunications systems allow dispersion of these nodes around the globe, yet the nodes are themselves characterized by dispersion and concentration. The actors in these networks are connected by flows of various types of information, knowledge and capital, which help to shape the networks and also open up the possibilities of establishing new nodes.

For example, Indian firms, through the experience and knowledge gained with North American companies, are actively establishing new markets in Japan and Korea. An implication of this networked perspective on GSAs is that it is inadequate to consider relationships only in one-to-one configurations (for example, an Indian and a North American firm), but to situate the analysis within a wider web of users and providers operating in the global marketplace.

In the GSW marketplace today, joint dominance exists between the major ˜technopoles of Ireland, India and Israel that are being challenged by a number of other emergent centres such as Russia, the Philippines and China. Within these countries, the cities of Dublin, Bangalore, Moscow, Manila and Beijing comprise major GSW centres that in turn are connected in global markets and social networks, and also help to create various secondary nodes internally. Within each country, the networking architecture reproduces itself in dispersed regional and local centres such as Mumbai, Hyderabad and Delhi in India and Novosibirsk, Moscow and St Petersburg in Russia. These ˜networks of networks constitute a process by which the production and consumption of GSW are connected through information flows. Global (e.g. the USA and India) and internal ( ˜in-country or ˜in-city ) networks contain specialization and fierce internal and external competition between cities in different regions and states. Mumbai, Bangalore and Hyderabad firms, while competing with each other, also vie for global contracts, bidding against firms based in Dublin and Shanghai.

We now discuss some of the global nodes and emergent centres in the GSW network, with an emphasis on the specialization strengths and weaknesses, with a view to describing the complexity of this network. We start with the ˜big three nodes, India, Ireland and Israel before considering three major emergent GSW centres of the Philippines, Russia and China. (Owing to space constraints, we are not able to discuss other emergent centres such as Singapore, Malaysia, Pakistan and Sri Lanka in Asia; Brazil and Chile in South America; Hungary, Romania and Ukraine in Eastern Europe; and Egypt in the Middle East.) We also discuss the trend towards ˜nearshore software development that involves Canada, Mexico, the Caribbean and Venezuela.

India

Many estimates of software exports consider India to be the leader in GSW, registering an average annual growth of software exports of more than 40 per cent during the 1990s. The trade association NASSCOM (www. nasscom .org) estimate that India s IT software and services exports is worth $7.7 billion in software for foreign clients and there are plans to expand this to $50 billion by 2008. Software services currently account for 10.5 per cent of India s total exports, making GSW one of the key engines for growth of the economy. India has come a long way from the situation in 1985 when Texas Instruments first saw potential and, in a pioneering and landmark move, established their subsidiary in Bangalore. Texas Instruments realized the limited capacity of the Indian government to provide infrastructure and obtained permission to establish their own satellite links and related infrastructure. The remarkable success of this centre to undertake leading- edge work inspired other (mostly North American) firms to establish facilities in India, particularly in Bangalore. A number of these firms (for example, Motorola) aimed to do leading-edge work, and their Bangalore lab attained the highest possible quality rating for software processes of Capability Maturity Model (CMM) Level 5; in 1992, only one other centre in the world (IBM) achieved a similar rating. Motorola s success opened the floodgates for software work in India, and other firms followed, a few entering through the route of JVs, many through wholly owned subsidiaries and contract staff both on-site and offshore. About 265 of the Fortune 500 companies are now customers of the Indian IT industry and leading companies (e.g. Microsoft, SAP, Adobe and Quark) are setting up development centres. The success of companies like Motorola and Texas Instruments challenges the popular criticism that India has been a centre for only ˜lower-end work. There are currently more than 3,000 Indian software services exporters doing business in more than 100 countries; 25 companies account for 60 per cent of the sector s revenues and it is this vanguard that is spurring the global expansion and development of the IT services value chain.

A majority of the initial software work in India was of the type derogatively called ˜body-shopping whereby the developers would go on-site for the length of the project. This trend has been steadily changing and although in 1990, about 95 per cent of the work was done onsite and 5 per cent in India, in 1995 two- thirds of all software services export earnings were created by on-site work, and currently about 70 per cent of a given project s development is done in India. Although development in India as opposed to on-site means lower staff costs, it also presents tremendous challenges in managing attrition and coordinating distributed work.

While Indian companies have come a long way in building expertise in project management to deal with conditions of separation, they will in the future need to cope with further challenges arising from new competition (for example, China), and in developing new markets (in Europe and East Asia), building expertise in new technologies (for example, in mobile telephony), upgrading infrastructure and articulating new models for pricing and profit sharing as compared to the ˜time and material approaches of the past. Reliance on the US market has made India s suppliers susceptible to reductions in IT spending and Indian companies have begun to explore opportunities in Europe.

Ireland

Ireland is often cited as the world s second largest software exporter after the USA with software exports ranging from an estimated US$4 billion in 1998 to US$8 billion in 2000 (Moore 2001). A large proportion of investment in Europe by US companies goes to Ireland, making them the second biggest exporter of software after the USA. They produce about 60 per cent of the packaged software sold in Europe. Ireland has the advantage of a strong technological infrastructure, EU membership, a sound technical education system, English-language competence, proximity and cultural similarity with the UK and the USA. Although arguably not as innovative or entrepreneurial as Israel, the Irish software industry turns out software products as well as a variety of support services. O Riain (1997) traces the growth of the industry after 1973 when major MNCs were attracted by the Irish Industrial Development Authority s policies of financial incentives and significant investment in education and telecommunications. The late 1980s led to the arrival of sophisticated systems software companies such as Iona that were tempted by tax incentives and an attractive location to supply to the EU. The early 1990s saw European unification, that helped a booming Irish IT industry to grow at the rate of 20 per cent for most of the decade . Almost 80 per cent of the Irish software industry s output is exported.

By the end of 1998, an estimated 20,000 people were employed in the Irish ICT sector and total exports were valued at & pound ;4.2 billion. In 1999, there were some 570 indigenous software companies, 108 of which were foreign owned through arrangements such as subsidiaries. The major focus of the work was at the system level, including programming languages and tools for data management and data mining. Companies have been building on this core in order to create software applications specific to enterprises and industries. Most Irish companies are in software services and bespoke development with an emphasis on providing Internet and multimedia consulting. The main markets served are financial services, telecommunications, middleware, e-commerce and specific localization. O Riain (1997) points out that unlike in India, Ireland s development has avoided relying on contract programming or ˜body-shopping and, instead, many large MNCs including Anderson Consulting, Intel, Digital, SAP, Sun Microsystems, Ericsson and Prudential Insurance have chosen to locate in Ireland.

The growth of the Irish software industry has been enabled by the ready availability of skilled staff, low corporate taxation , generous incentives, low operating costs and world-class infrastructure including telecommunications. The government has played a key role in providing financial support to companies to set up and expand overseas (Cochran 2001). The software sector has been made a strategic priority, and support has come in the form of legislation on security and copyright as well as funding for research and development (R&D). This has helped to give the industry a high-quality , low-risk image, and most of the firms have ISO accreditation or CMM of Level 2 or higher. The industry has been given a tremendous boost by the return of large numbers of technically trained expatriate Irish from the USA with a desire to contribute to the development of the country. The software industry thus is in a position of strength drawing from the state support, the strong inward investments by MNCs and a robust people base.

-

O Riain (1997) identifies three future challenges to the industry:

-

The industry s continued reliance on MNCs makes them potentially vulnerable to the risk of the companies deciding to shift their operations to other more attractive nodes in the wider GSW network.

-

Irish companies need effective strategies to sustain their presence in the global economy in the face of a ˜brain drain of their educated people, especially the younger ones, primarily to the USA.

-

The weak venture capital base and funding for R&D as compared to Israel, serves to restrict entrepreneurial development and the creation of new technologies.

Israel

Israel has emerged as a major global player in software exports, being one of the few countries able to seize the opportunities that globalization provided in terms of technology and knowledge, organizational forms, capital markets and specialized skills. Growth in the ICT sector started as early as in 1948, and Motorola set up their first subsidiary outside of the USA in 1964 (Ariav and Goodman 1994). Contributing to this early growth was the key influence of military-trained computing graduates who after completing their service entered the flourishing civilian computing sector. This trend still continues.

The military-inspired growth of the 1980s was further strengthened in the 1990s with the growth of high-tech ˜clusters involving start-up and venture capital firms strongly linked with the high-tech clusters of the US Silicon Valley and elsewhere (Teubal 2001).

A number of new high-tech start-up companies opened in the late 1990s “ about 2,500 firms in 1998 and 1,000 in 1999. In 2001, there were over 4,000 start-up firms and 120 organizations listed on NASDAQ. Venture capital from private, public and foreign sources has been the key in providing the impetus to growth in software exports. Today Israel has the second largest number of technology firms listed on NASDAQ after the USA.

The combined factors of public policy initiatives such as high R&D spending, a highly educated population, English-language ability, tax incentives, marketing support for software exports and a large expatriate Jewish population has facilitated strong links to markets abroad, especially the USA. The availability of high-quality telecommunications services offered by several competing providers has created a cheap and reliable infrastructure to support software work. Israel has a large proportion of technically skilled people, and connections with bankers and investors in the West. The return of foreign-educated Israelis has supported continuing technology transfer and created a demanding and high-quality consumer base that gives the industry its reputation for being of high ˜battle tested quality. The process of globalization has fostered in Israel a new kind of export goods “ the sale of high-tech start-up companies to MNCs. Teubal (2001) calls this sale of technological assets rather than traditional merchandise and service exports one of Israel s most important export categories.

The centres of Tel-Aviv, Haifa and Jerusalem form the key software development areas, and between 1984 and 1992, the Israeli software industry tripled its sales and increased exports by 2,700 per cent. This trend has continued, reaching $1.3 billion in the first half of 2000, a 40 per cent jump from 1999 (IPR, 2000). There are about 300 software houses in Israel employing around 20,000 people. Nearly a third of Israel s software exports are sold to the USA, the remainder to Europe, an increase in part due to Israel s specialization in the Internet and communications sectors. Other areas of export include database management systems, application generators, computer centre operation, educational software and anti-virus protection. Israel also exhibits strength in niche areas of quality assurance of products and tools, security systems for the Internet and distance education. Major companies including Microsoft, IBM, Intel and National Semiconductor have Israeli subsidiaries (Ariav and Goodman 1994).

Israel shows the promise of becoming stronger and reaching an equal status with Ireland and India as a major provider of software. Israel s industry however differs fundamentally from India in that the key focus is on software products rather than on services. Compared to India, Israel has the advantage of being closer to the North American and European market. As a result of a service orientation, Indian firms have needed to familiarize themselves with customers while Israeli companies have chosen to compete internationally by developing technological assets that require less local interaction. Israel, like India, was affected by the 2001 slowdown of the US economy, and will need to redefine their future growth strategies. In addition, De Fontenay and Carmel (forthcoming) point out that the conflict with Palestine has affected growth of the industry, with foreign-customer concerns over safety and reliability in the event of increased violence. The current dependence on military-trained personnel to drive the civilian software industry may also pose a threat, since transfer of military-based technology may be less relevant in the future global scenario.

Russia

Although not one of the ˜big three software producers, Russia competes with India for offshore contracts from the USA and Europe. The McKinsey Global Institute estimates that Russia s offshore programming sector will grow at a rate of 50 “60 per cent a year in the early twenty-first century. Many large firms including IBM, Nortel, Sun Microsystems, Boeing, Motorola, Intel, SAP and Microsoft have already started operations in Russia. A recent report (ACCR 2001) indicates that there are 5,000 “8,000 programmers in Russia and annual revenue is between $60 and $100 million, reflecting a 40 “60 per cent average annual growth rate. Of software exports, around 30 per cent are products and the remainder software services, typically offshore programming work (Heeks 1999; Lakaeva 2000).

Russia has a number of advantages including costs (salaries half of even Indian wages ), a high-quality technical education and the third highest per capita number of scientists and engineers in the world. Many of these scientists had experience in nuclear , space, military and communications projects and moved into the software industry after the collapse of the Cold War. Mathematics and physics are strong areas in the skill base and Russian students are often winners in international programming contests. The cities of St Petersburg, Moscow, Vladivostok and Novosibirsk in Siberia are emerging as ˜clusters or ˜silicon cities . Proximity to markets in Western Europe and shared culture and history potentially reduce cross-cultural differences relative to India or China. Novosibirsk has special relevance for Germany owing to a large ethnic German population. This makes Russia an attractive potential partner for German companies as compared to Indian companies which have the handicap of the German language.

Many of the Russian offshore companies have 50 “300 programmers and are partly or fully foreign owned. Smaller companies with 10 “20 programmers rely more on links with friends and acquaintances to gain smaller contracts. Typical firms offer a list of services including Internet programming, Web design, Web server applications, database projects, system programming, real time and embedded systems, internationalization, translation and localization of software. The major end-users of these products and services include financial institutions, governments , educational institutions, industry and telecommunication Internet companies. Text recognition, anti-virus programs and the entertainment sector are other areas where export success has been achieved by Russian firms. High-level scientific work is also being done in Russia. Intel opened a subsidiary in Nizhy Novgorod in June 2000 to develop and support software for the next -generation Pentium processor.

While the future for Russia s software industry seems good, it needs to strengthen its institutional infrastructure by building something equivalent to India s NASSCOM. Russian companies also need to develop more sophistication in North American and European business practices and project management and to develop quality control processes that are in line with international standards. Growth has come despite the poor image of intellectual property protection (IPP) in Russian organizations. English is not as widely spoken as in Israel or India and the costs of bandwidth are higher than in other major offshore outsourcing countries. Other emerging vendor nations outside, but in the region of Russia, include Bulgaria, the Czech Republic, Hungary, Lithuania, Poland and Ukraine.

The Philippines

The Philippines is emerging as a key venue for offshore development, second to India in Asia, and is already a strong contender in a broad range of back-office services. The Philippines offshore software industry partly emerged as a result of the volcanic disaster of 1991 and the withdrawal of the US military in 1992, leaving behind a relatively reliable infrastructure that could still support a range of services. The Philippine government capitalized on this and developed trade around telecommunication and IT-enabled services as contrasted with India s development strategy in software services. Software exports for 2000 were estimated at US$200 million but it is not clear exactly what aspects this figure covers. There are some 30,000 Filipinos in the IT-related sector in several hundred firms, many of which are foreign owned (Hamlin 2001). The Philippines telecommunication services include call centres and data processing as well as IT services such as applications development, Web design, animation, database design, networking and software. A survey in 2000 by META, a US research group , ranked the Philippines number one among forty-seven countries in the ˜knowledge jobs category. Software ˜clusters have been set up in Subic Bay and the Clark Special Economic Zone, with airports, telecommunications, housing complexes and tourist facilities. This has attracted back-office operations mainly from the USA “ MNCs such as Barnes & Noble, Arthur Andersen and America Online.

The strengths of the Philippines include a good IT infrastructure especially in Manila and Clark IT parks, low labour costs (30 “40 per cent less than in the USA) a highly literate (94 per cent) population, and a high level of English-language proficiency.

A strong industry association in the IT and e-commerce Council helps to present a positive picture of the industry with comprehensive information stressing the quality of service and life in the Philippines. However, a record of political instability and a relatively poor general infrastructure still inhibit foreign investment. While the main telecommunications companies are expanding rapidly in the IT parks where the infrastructure is well developed, other parts of the country are still lacking in good- quality business accommodation, roads and support services. The geographical spread of the country, comprising 7,107 islands, makes it difficult to establish fixed telecommunication lines. Philippine law has also been slow to catch up with the new economy, a factor that may deter some MNCs from setting up operations because of IP fears.

China

China represents a major emerging supplier of software services especially after World Trade Organization (WTO) entry in November 2001. The Chinese software industry has grown at more than 20 per cent a year since the early 1990s, which is above the world average. The growth in 1999 was 30 per cent, to $2.16 billion, and future predictions are spectacular, on a par with India s success. China is perceived as a future threat to India in part owing to a relatively advanced user base of mobile phones and many more telephone connections and a vast pool of skilled human resources. The role of the Chinese government has been especially significant in attracting Chinese students in the USA to return home and establish new high-tech ventures. Saxenian (2001) quotes a survey that shows that about 18.8 per cent (around 160,000) of the Chinese students who studied in the USA between 1978 and 1998 returned to China to participate in these new ventures . This trend is significant as it supports the development of transnational networks of Chinese entrepreneurs with Silicon Valley, permitting a flow of capital, technology, marketing know-how and R&D into the Chinese companies. Through various science park-based ˜clusters , the transnational networks intersect with the local and national networks to further support the diffusion of innovation. The Chinese success in repatriation contrasts starkly with the Indian case, where the return of professionals is only a ˜trickle (Saxenian 2001).

The government plans to boost software exports from $130 million in 1999 to $1 billion in 2004 by offering tax breaks and access to cheap capital and by relaxing rules on sending employees abroad (Ju 2001). China has so far concentrated on the domestic market, in contrast to India. Responding to the Chinese competition, many Indian companies have started to open up development centres on the Chinese mainland to re-route low-end activities like coding and maintenance. Some Indian companies are even hiring Chinese programmers who are less expensive than Indians (by approximately 15 per cent) and their language background makes them more suitable to support the efforts of Indian firms to penetrate Japanese projects. The Chinese workers, however, have lesser experience in the areas of systems integration and project management.

The Chinese market is divided into system software (12 per cent), application software (63 per cent) and supporting software (25 per cent). China has about 400,000 people employed in the software industry spread over the economically developed regions and coastal areas such as Beijing, Shanghai, Shenzhen, Dalian, Shenyang, Fujian and Zhuhai. Beijing is set to become China s largest software production centre with the municipal government approving 221 new software companies in 2000. The Zhonguancun science and technology park in Beijing represents China s Silicon Valley and is home to IBM and Microsoft. There is also the potential for Hong Kong to serve as a hub for outsourcing to the Chinese mainland as it is considered less risky and there are more English-speaking people. Already, the Chinese cities of Guangzhou and Shenzhen are host to a growing number of satellite offices for Hong Kong software companies. Some current barriers to growth include factors similar to those in Russia: poor English-language capabilities outside of Hong Kong, weak understanding of Western business culture and a poor reputation for IPP. To a greater extent than in India, Chinese companies have a vast domestic market to concentrate on and the Chinese official machinery is making efforts to address these limitations, making China a potentially significant future player in the GSW marketplace.

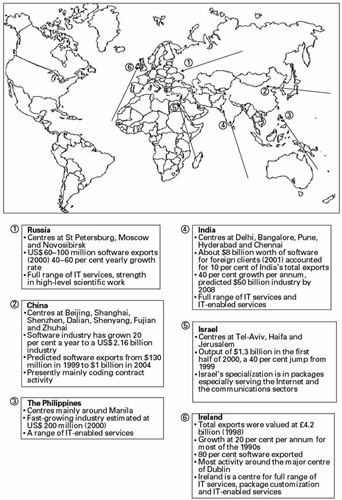

Figure 1.1 provides a brief summary of the major facets of these major software exporting countries, showing the spatial organization of the major centres.

Figure 1.1: Global offshore software production centres

EAN: 2147483647

Pages: 91