Chapter 5.3: China s Securities Market

China Securities Regulatory Commission

The current status of China's securities industry

China's securities market has evolved and developed gradually alongside the progress of China's opening up and economic reform. With the establishment of the Shanghai Stock Exchange in December 1990 and the Shenzhen Stock Exchange in June 1991, China's securities market has formally taken shape. In more than ten years of development, the securities industry has experienced a process of transition from virtually nothing to its present scale, from decentralization to centralization, from manual operation to the adoption of modern technologies, from a regional to a national market and from a domestically oriented to an internationally integrated market. Remarkable progress has been achieved in both the size of the market and the trading technology. China's securities market is now the third largest in Asia after Tokyo and Hong Kong and has formed a market structure that comprises A-share, B- share, H-share and a multitude of other financing options, which have played a vitally important role in improving financing structures, optimizing resource allocations and propelling the economic development.

By the end of June 2002, 1,188 companies were listed on the Shanghai and Shenzhen stock exchanges with a total market capitalization and float capitalization of RMB4.77 trillion and RMB1.56 trillion respectively. The number of investor accounts totalled RMB68.07 million. There were 51 close-ended contractual securities investment funds and five open - ended securities investment funds, with a total funding of about RMB100 billion. The futures market has reversed the continued downturn of the past few years and begun to gather momentum for growth. In terms of securities trading technology, paperless systems have been applied to the issuance and trading of shares and funds, and all securities trading agencies have started to implement uniform technical standards.

While the securities market is developing rapidly , the securities regulatory mechanism is also gradually being perfected. Initially, the regulation and supervision of the securities market was dispersed among a number of central government departments such as the State Planning Commission (now the State Development Planning Commission), the Ministry of Finance and State Commission for the Restructuring of the Economic Structure (now the Office for Restructuring the Economy), and local government. A dual regulatory system evolved later, with the Securities Commission of the State Council being responsible for macro control and the China Securities Regulatory Commission (CSRC) exercising specific regulatory functions. The promulgation of the Securities Law in December 1998 firmly established China's securities regulatory regime with centralized and unified regulation and supervision of the securities market in the country by CSRC at the core , supported by self-disciplinary regulation by the stock exchanges and Securities Industry Association.

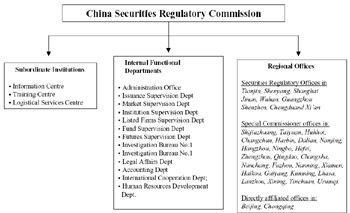

CSRC is an agency directly affiliated with the State Council. Within it are 13 functional departments and three subordinate institutions. CSRC is also represented regionally by nine securities regulatory offices, two offices directly affiliated with it and 25 special commissioner offices of securities regulation and supervision in key cities in China (see Figure 5.3.1). Self- regulating organizations in the industry include China

Figure 5.3.1: Breakdown of departments within the CSRC

Securities Industry Association, Shanghai and Shenzhen stock exchanges, China Association of Futures Industry and the commodity exchanges in Shanghai, Dalian and Zhengzhou. These organizations conduct self-regulation and supervision in accordance with relevant industry regulations. In a newly developing market such as China, the role of self-regulating organisations is still weak because of the immature market mechanism. With improvements in this and the levels of regulation and supervision, many regulatory and supervisory functions will gradually be transferred from the CSRC to self-regulating organisations.

The legal framework regarding the securities market is still in development. Under the principle of 'rule of law, regulation and supervision, self-discipline and standardisation', a legal framework of laws and regulations governing the securities market has taken shape. The core of this is the Corporations Law and Securities Law, supplemented by administrative regulations, and the key body is the departmental regulations and normative circulars, rules established by the stock exchanges and the rules and regulations introduced by self-regulating organisations such as the Securities Industry Association.

The Corporations Law and Securities Law are the two basic laws governing China's securities market. The administrative regulations by the State Council either fill in the legislative blanks in related areas or provide specific details on related legal regimes. The departmental regulations and normative circulars issued by the CSRC in accordance with relevant laws and administrative regulations are to provide particulars and supplements on relevant laws and regulations, thereby constituting the important elements of China's legal systems governing the securities market.

Following China's accession to the WTO, the CSRC has rectified and amended all regulations and administrative approval procedures in order to comply with the commitments China has made in relation to the securities industry. Some new rules have been promulgated, such as the Rules for the Establishment of Securities Companies with Foreign Equity Participation and the Rules for the establishment of Fund Management Companies with Foreign Equity Participation. At the same time, both Shanghai and Shenzhen Stock Exchanges are revising their rules of management on memberships and on B-share trading seats, in compliance with China's WTO commitments.

[*] This chapter was originally written in Chinese and was translated by Li Yong.

EAN: 2147483647

Pages: 648