Section 9.4. Doing Your Taxes Online

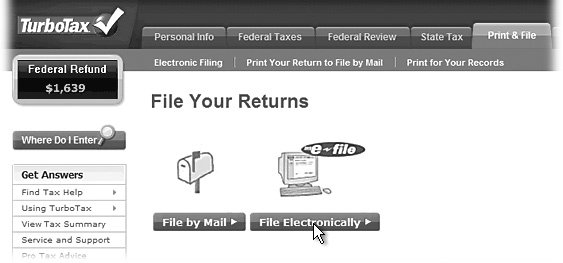

9.4. Doing Your Taxes OnlineIf you've moved your banking and investing activities to the Internet, it's not much of a leap to move another big money matter into the electronic realm: paying the piperUncle Samin the annual Filing O' the Taxes. Electronic filing, where you submit your return directly to the Internal Revenue Service's computers over the Internet, has been steadily gaining popularity. In fact, Congress wants the IRS to have at least 80 percent of tax returns filed electronically by 2007. Now, you can't prepare your return directly on the IRS Web site. You have to hire a professional tax preparer or use computer software like TurboTax to upload your finished file. But even if you still like to do the yearly summation on paperwearing your green eyeshade while your fingers tap- dance across the calculatorthe Web can at least save you a trip to the post office on a quest for obscure forms you might need. And if you have questions on your return as you wade through it, there are plenty of experts around the Net to offer adviceincluding the Tax Man himself, Mr. Internal Revenue Service, with a government Web site full of answers. 9.4.1. Filing a Federal Tax Return ElectronicallyHaving software help you calculate your taxes saves both time and temper when preparing a return. It can mean more accurate resultsthe IRS recently estimated than more than 17 percent of tax returns filed on paper contained mistakes like calculations based on the wrong tax tables, basic math errors, and general oversights in submitting some forms and information. Tip: If, like 70 percent of Americans, you make less than $50,000 a year, you might qualify for free online filing right from the IRS itself. Its Free File program provides online tax preparation and electronic filing from the government's online tax-accounting partner firms. You can find out more about the program, the companies working with the IRS, and its other requirements, at www.irs.gov/efile. A software program like TurboTax or TaxCut guides you through the process, does the math, and automatically checks for errors. Both programs let you upload the information right to the IRS before April 15 rolls around. Even if you don't have the desktop versions of these programs, you can use their online editions to calculate and file your return for a small fee; read on. 9.4.1.1. Using a tax-preparation service onlineTo file your taxes electronically with a Web service, you first set up an account. Thereafter, the site walks you through preparing your return. You'll be asked a series of questions; you should have all your important tax documentation, like your W-2 forms, within reach. Once you complete the process, your finished return's electronically filed over a secure connection right to the IRS. The IRS then runs your electronic return through a programmed set of error checks and validations, right on the spot, to make sure you supplied all the information it needs, and in the right format. If everything passes muster, the IRS accepts your return, and you can move on with life for another year. If your return flunks a test, the IRS gives you an error code telling you why. The online tax software can tell you how to fix the problem and resubmit your return. Note: In 38 states and the District of Columbia, you can e-file your state tax returns at the same time you send in your Federal return. The IRS passes your state return on to your local tax collectors. You can find out if your state participates in this Federal/State e-file for Taxpayers program by searching at www.irs.gov or on this book's "Missing CD" page at www.missingmanuals.com. If it turns out you owe money on your taxes, you can either print out a voucher to send with a check by mail, or you can have the IRS automatically deduct the money from your bank account. If you're one of the fortunate souls getting money back from your Dear Uncle Sam, you can have it deposited directly into your bank account in much less time than it takes them to cut you a check and mail it to you. Here are some popular sites that handle Federal and state tax preparation:

Beware of tax-preparation services from companies you've never heard of, or email offers from " accountants " who promise cheap, excellent returns whipped up in no time. You don't want to share your personal information with these people.

9.4.2. Finding Tax Information and Forms OnlineFor any sort of tax- related question, make the Internal Revenue Service's Web your first stop at www.irs.gov. Not only do you get your information straight from the horse's mouth, but the horse also has every tax form you could possibly need available for download. These downloadable forms come as PDF files (Section 3.4.4), which you can print out on your own printer; they come out looking exactly like the forms you would get at the post office or H&R Block. If you still do your taxes by hand, this is your one-stop -shopping place for paperwork. The IRS site has useful tools, too, like a calculator for figuring out your withholding and a list of taxexempt charities you can claim on your return if you made a donation. The major online services and portal sites mentioned earlier in this bookmainly AOL, MSN, and Yahoohave tax-preparation advice, plus tax calculators , forms, checklists, glossaries, rates, rules, and more. |

EAN: 2147483647

Pages: 147