The Case Studies

|

Our argument now turns to illustrating the use of the stakeholder mapping methodology through three case illustrations. Two are major development projects with profound importance for the future of the two countries concerned. They are taken from the work of Hobballah (1998) and El-Missiri (1999), respectively. The third is much smaller in scale, but one in which the stakes are no less high for that country. It is taken from the work of Weekes (1999). These research reports were updated using The Financial Times Limited website (http://www.ft.com). Figure 2 provides the code to the stakeholder maps. The internal stakeholders are those who are members of the project coalition or providing finance; the external ones are those others affected by the project in a significant way (Calvert 1995).

Figure 2: Code to Stakeholder Maps

SOLIDERE: Redeveloping Beirut's Central District

By 1991, over fifteen years of civil war had left the central district of Beirut in ruins. Formerly the most cosmopolitan commercial and cultural district in the Middle East, Beirut's Central District (BCD) was to be redeveloped with the aim of regaining its former role in the regional economic and social life. The master plan was developed by the Egyptian firm of consulting engineers, Dar Al-Handasah, with a scope including:

-

Responsibility for a total area of 1.8 million square meters of prime real estate

-

Reclamation of 608,000 square meters of unofficial landfill on the coast—the Reclaimed Land

-

Provision of a modern urban infrastructure of roads, parks, and telecommunications

-

Restoration of those existing buildings that were not beyond saving and were of historical value—the Retained Buildings

-

Extension of the corniche and the provision of two marinas

-

Reconstruction and expansion of the traditional souks.

There were two main problems that influenced the choice of organization for the project. First, the financial and managerial resources of Lebanon at the end of the war were completely inadequate to the challenges of delivering this master plan. Second, Lebanese property rights meant that the former tenants of the ruined buildings had the right to take up their tenancies again at the pre-war levels of rent. A further, but less intractable, problem was that many of the surviving buildings were "squatted" by those dislocated by the war, those to whom the country had a moral obligation. For these reasons, a private company was incorporated in 1994—the Soci t Libanaise pour le D veloppement et la Reconstruction du Centre Ville de Beyrouth (SOLIDERE)—as concessionaire for the redevelopment works. Essentially a form of public/private partnership, SOLIDERE had the right to:

-

Expropriate land and buildings in return for A-class shares in its equity

-

Raise equity capital through the sale of B-class shares to Lebanese nationals and firms, and some other categories of Middle Eastern investors—the Eligible Persons

-

Raise loan capital on the international markets

-

Make profits on the sale and rental of its assets

-

Be exempt from taxes on its profits for ten years, while its shareholders are exempt from taxes on their dividends and capital gains for the same period.

The scale of the project is indicated by the fact that the final capitalization of SOLIDERE is equivalent to roughly one third of the total gross domestic product (GDP) of Lebanon. It is broken down into three main phases:

-

1994-9—stabilization of the landfill, completion of infrastructure works in the traditional central district, and restoration of the Retained Buildings.

-

2000-9—infrastructure work on the Reclaimed Land and further development of traditional central district.

-

2010-19—development of the Reclaimed Land.

The first phase of the project is over both program and budget, but within the bounds of available finance. The main program slippages are due to the extent of the archaeological program and problems with the stabilization of the landfill, while the principal sources of budget variances are the squatter relocation program and the restoration of the Retained Buildings.

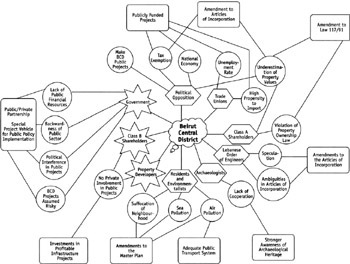

The stakeholder map for the project is shown in Figure 3. The principal internal stakeholders are:

-

Class A shareholders, who are angry at the expropriation of their property and its alleged undervaluation by the Appraisal Committee.

-

Class B shareholders, whose principal aim is a return on their capital.

-

The project sponsor—the Lebanese government. Allied to this group are the former President Hariri, who is himself the largest B-class shareholder and an owner of construction firms, and pro-government political groups. The concern of this stakeholder is the revival of Beirut as an international commercial center and the economic benefits that entail. Hariri played a crucial champion role in the incorporation of SOLIDERE.

Figure 3: SOLIDERE Case Study Stakeholder Map

The principal external stakeholders are:

-

The international community, in the shape of many Western leaders and the United Nations (UN) who are openly backing the project as a major contribution to political stability in the region.

-

International merchant banks, providing loan capital.

-

The Lebanese Order of Engineers (LOE), voicing concerns over the lack of accountability of SOLIDERE.

-

Local banks, which are financing individual property developments.

-

The national and international archaeological community, concerned about capturing the heritage of the area.

-

Residents and environmentalists, particularly concerned with the land reclamation aspects of the project and the lack of mass transport in the scheme.

-

Property developers.

-

The political opposition, consisting of various left-wing, religious, and nationalist parties, voicing concerns about the use of a public-private partnership, tax holidays, and the up-market character of the developments.

-

Trade unions, concerned about the use of cheap foreign workers in the construction.

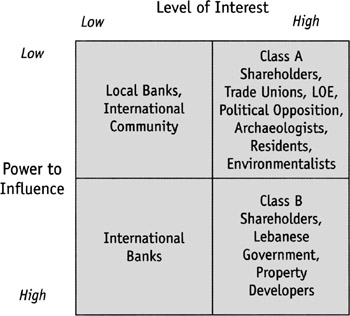

Figure 4 shows the power/interest matrix for the BCD project. It shows how the key players are the class B shareholders, the Lebanese government itself, and the property developers who will carry out the individual developments once the infrastructure is provided. President Hariri lost a vote of confidence in December 1998, and since then there have been worries about government support for SOLIDERE. The class B shareholders and property developers dissatisfaction with the progress of the project recently led to the share-price of SOLIDERE dropping to a nadir by September 1999 on low profits due to an economic slowdown and continuing tension with Israel. International property developers such as Prince Alwaleed have engaged in protracted negotiations before agreeing to invest.

Figure 4: SOLIDERE Case Study Power/Interest Matrix

The international banks are happy so long as their loans are secure. A number of groups have a high interest, but the political balance of power nullifies the ability of the trade unions, the political opposition, and the LOE to lobby for stronger government control over SOLIDERE, and the class A shareholders to obtain relief for their grievances. The government of Salim el-Hoss has so far not attempted to alter the structure of SOLIDERE. The archaeological community has received concessions, but little has been offered to environmentalists and residents. However, the failure by SOLIDERE to protect some of the retained buildings is presently the subject of litigation. While the international community wishes the project well, supported by high-profile visits from the likes of Jacques Chirac and Kofi Annan, they have relatively little interest in the project as such. The local banks would in any case find investments for their funds without the intervention of SOLIDERE.

Toshka: Greening Al-Sae'ed

The Nile River is fundamental to the economy of Egypt and its lower valley is one of the most intensively farmed regions of the world. Yet only 5.5 percent of Egypt's total area is inhabited—most is desert—and some 40 percent of the population is crammed into the two principal cities of Cairo and Alexandria. For centuries the people of Egypt have lived by the rhythm of the river. Attempts by the Egyptians to manage the river more proactively began with the completion of the Aswan Dam in 1901, and the Aswan High Dam in 1971; the latter also providing 2.1 million kilowatts of hydroelectric power generation capacity. The massive lake behind Aswan High Dam is known as Lake Nasser in Egypt and Lake Nubia in the Sudan. In 1978, a 22 km overflow canal—the Makhar Toshka—was completed, and used for the first time in the floods of 1996 by dumping millions of litres of water into the Monkhafad Toshka, a depression in the Western Desert to the northwest of Lake Nasser.

In the sixties and seventies, feasibility studies showed that the Monkhafad Toshka area was suitable for reclamation for agricultural use, and proposals were developed for the provision of the irrigation that would be required there, in one of the most inhospitable environments in Africa. However, Egypt was unable to obtain financing for such a project without the security of peace with Israel, which was secured in 1979. The main features of the Toshka irrigation project that would deliver 5.5 billion cubic meters of irrigation water each year to 226,700 hectares are:

-

A 70 km main canal—the Sheikh Zayed Canal

-

A massive pumping station located 8 km north of the Makhar Toshka—the Mubarak Pumping Station—to pump water from Lake Nasser into the main canal

-

Four branch canals totalling 199 km

-

Road infrastructure.

Construction work started at the beginning of 1997, with completion due at the end of 2001—the total budget is in the region of 770m, and the project is broadly on program. It is financed by the Egyptian government through internal resources and Arab development funds. Once the irrigation and infrastructure systems are completed, private Egyptian and foreign Arab investors have been offered a variety of incentives to make the agricultural investments, ranging from tax breaks to subsidised power. The World Bank is providing a further $200 million for land reclamation. Irrigation water will be provided to the farms free of charge. The project is strongly championed by President Mubarak. The irrigation project is the cornerstone of the 53.1 bn South Valley Development Project, which is expected to lead to 3 million people transferring to the region by 2017. It is one of five current megaprojects aimed at developing Egypt.

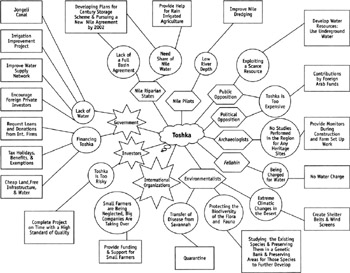

As shown in Figure 5, the principal internal stakeholders are:

-

The Government of Egypt, which sees the project as the solution to Egypt's problems of population growth and overcrowding in the Nile River Valley. These include high levels of unemployment, massive imports of major foodstuffs, and the rise of fundamentalist politics amongst the urban lumpenproletariat.

-

The agricultural investors. Principal amongst these is Prince Alwaleed, the nephew of King Faud of Saudi Arabia and the world's richest businessmen. Other major investors include the governments of the United Arab Emirates and Qatar—the main canal is named after the head of state of the former—and two private groups of Egyptian businessmen.

Figure 5: Toshka Case Study Stakeholder Map

The principal external stakeholders are:

-

The principal Nile riparian states. The treaties of 1929 and 1959 govern the sharing of the waters of the Nile between the riparian states. However, these are, in essence, agreements between Egypt and the Sudan, and have never been recognised by Ethiopia. Yet Ethiopia accounts for 85 percent of all water flowing into the Nile down the Blue Nile. One attempt to counter this problem was the construction of the 360 km Jongeli Canal through the Sudd swamps in southern Sudan where 90 percent of the volume of the White Nile is lost to evaporation, which started in 1976. However, the civil war in the Sudan led to its abandonment in 1984 after 267 km had been completed.

-

The other riparian states—Burundi, Tanzania, Uganda, and Eritrea—have their own plans for hydroelectric developments, but these are presently disrupted by wars and other problems.

-

Egyptian political opposition groups, principally the New Wafd Party, argue that the resources invested could have been put to much better use elsewhere in the country. However, the ruling National Democratic Party of Mubarak holds 95 percent of the seats in the legislature.

-

The Nile River pilots fear that the loss of 10 percent of the flow due to its diversion for irrigation will lead to navigation problems. These could be reduced by dredging.

-

The fellahin—farmers of the lower Nile valley—fear that their own agriculture will be damaged and that they will be charged for water.

-

International agencies, particularly Japanese and Arab development funds and the United Nations Food and Agriculture Organization, are supporting the development, providing both aid and advice.

-

The environmentalists' principle fear is that the removal of the desert barrier will create a route for parasites and diseases from tropical Africa to move north to the Mediterranean coast. They have some support in the Egyptian Environment Ministry. These problems could be met by introducing a quarantine regime to control the movement of organic products, but this runs counter to the assurances given to the agricultural investors regarding their freedom to exploit the new farmland.

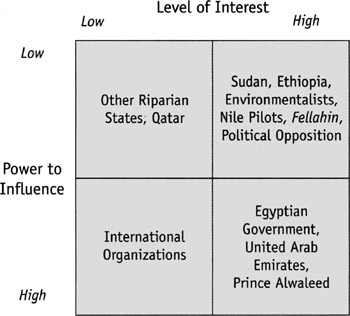

Figure 6 shows the power/interest matrix for the Toshka project. The key players are the Egyptian government and the principal agricultural investors, although Qatar's power is lower than the others due to its history of poor diplomatic relations with Egypt. Government support for the project remains strong. The political dominance of the governing party neutralizes the power of the opponents of the project within Egypt. Environmentalists have at this point voiced little concern regarding the project, while the archaeological dimension is unknown and has not been raised. The political tension between Egypt, the Sudan, and Ethiopia remains acute. There are also military and political issues among the primary countries. A significant change in the political situation could place either Sudan or Ethiopia in the high power category and/or frighten off investors. International aid agencies are central to the finance of the project and need to be kept satisfied regarding mission of the project. The other riparian states presently show little interest, but there are worries that Eritrea might become more proactive once its political situation stabilizes.

Figure 6: Toshka Case Study Power/Interest Matrix

Montserrat: Rehousing the People

In June 1997, the start of a sequence of major volcanic eruptions left two thirds of the British dependent territory of Montserrat uninhabitable—including the capital, airport, and docks (Patullo 2000). Although the eruption had been predicted, and there was little loss of life, the lack of contingency planning left most of the population homeless. Many went abroad; the rest lived in tents and public buildings in the north of the island. The Immediate Housing Development Program (IHDP) was launched in July 1997, with the appointment of Brown and Root as construction managers, to house 1,000 people as soon as possible. As of August 1999, the IHDP was well behind time and over budget, and as late as March 2000, there were still few people living in temporary accommodation.

The IHPD was organized into three phases:

-

Davy Hill—fifty prefabricated houses provided by International Building Systems (IBS) of the United States (US)

-

Lookout Phase 1—fifty blockhouses designed by a local architect and built by local contractors

-

Lookout Phase 2—fifty blockhouses and 100 Force-10 prefabricated houses sourced from Australia.

The IBS houses proved to be completely unsuitable for the Montserrat environment because the sealants melted in the heat and the houses therefore leaked when it rained. The use of local contractors for the first phase of blockhouses caused many problems due to their lack of skills in managing the building process, especially when all materials had to be imported. The decision by Brown and Root to strip all topsoil instead of using strip foundations led to extensive erosion of the steeply sloping site during heavy rains. The Force-10 houses were poorly adapted to the sloping site, leaving only one door usable, and instilling worries about uplift during the inevitable hurricanes. More generally, the houses were well below the standards expected by the population, and tended to be one-bedroom when the overwhelming requirement was for two-bedroom properties. None conformed to local building regulations. Waste was discharged from the sites into the sea within the tidal area at one of the only two beaches with the potential for tourist development.

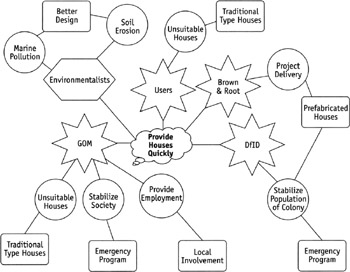

The stakeholders on the IHPD project, mapped in Figure 7, are:

-

The Department for International Development (DfID), the responsible UK ministry, which financed the project to fulfill its responsibilities to the UK dependent territory.

-

Brown and Root, appointed as construction managers in July 1997 on a New Engineering Contract type 5 for an initial budget of 6.5m.

-

The Government of Montserrat (GoM), with the overriding need to rebuild the country.

-

The users, i.e., the homeless population, very dissatisfied with the quality of the houses provided and delays in provision.

-

Environmentalists, concerned about the inappropriate construction techniques and treatment of waste.

Figure 7: Montserrat Case Study Stakeholder Map

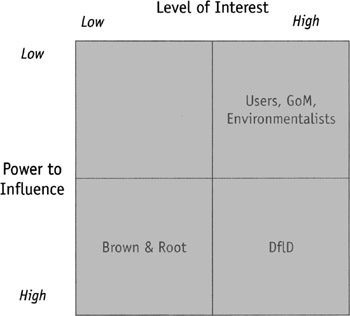

The power/interest matrix for the project is illustrated in Figure 8. The research revealed considerable confusion amongst representatives of the project coalition as to who the client for the project was—DfID or GoM. Different interpretations of the role of Brown and Root were also reported, particularly whether they bore any of the risks associated with the project. This matter is presently the subject of litigation. However, analysis shows that the key player is DfID—the GoM was simply informed that Brown and Root had been appointed. Brown and Root has high power but low interest—this is simply another construction project for them. The other stakeholders fall into the high interest/low power category. Even the GoM has little say in what goes on. Their pressure to localize construction led to the second phase being awarded to local construction firms, but this proved to cause serious problems in progress, and even the design by the local architect was criticized. In the third phase, the local industry reverted to its role as a source of labor only. The long-suffering people of Montserrat—the users—are those with the highest interest, but least power.

Figure 8: Montserrat Case Study Power/Interest Matrix

Discussion

These are three very different projects, but the stakeholder analysis approach that we have developed yields insights into the dynamics of each project. Two of the projects might be called TINA projects ("there is no alternative", in Mrs. Thatcher's famous words)—BCD and IHDP. There is, therefore, no opposition to the project mission as such, but to the details of its implementation. In these cases it is clear that those who have lost the most—the residents of the areas devastated by the "horsemen of the apocalypse"—have the least say in the development and implementation of the project mission. Those who provide the redevelopment capital—be they the public or private sectors—are the key players.

The Toshka project is different in that it is the result of a clear political choice, and there is opposition to the very idea of the project—on an opportunity cost basis within the country and a geo-political basis from other riparian states. To date, the strength, internally and externally, of the Egyptian government has allowed the project to proceed smoothly, but there can be no guarantee that it will not meet the same fate as the Jongeli Canal in the future. What none of these projects have faced is the problem of local loser opposition. This can consist of either those who will directly lose out as a result of the project, such as the towns of Halsskov and Dover with the Storebaelt and Channel fixed links (Bonke 1998; Winch 1996); or NIMBY ("not in my back yard") opposition, where the mission is not contested in principle, but its local effects are opposed. Strong environmentalist attention has not been attracted to any of these projects. This is probably due to the TINA nature of two of them, but this is more surprising in the case of Toshka. This may well be a function of the lack of local losers. As so often, at least in Europe, failure to effectively manage the archaeological aspects of the project have led to delays in rebuilding BCD.

Both local losers and environmentalist opponents of projects have demonstrated the organizational capacity on a number of projects to shift themselves from the low power to high power categories, and have enforced the renegotiation of the mission of many projects. Their roles as stakeholders are increasingly institutionalized through the regulatory system in the shape of land use policies and procedures and environmental impact assessments.

The supply side of the project coalition—designers and contractors—has only been included in the stakeholder mapping for Montserrat. This is because, on our evidence, they only played an independent role in defining the project mission on that project, where Brown and Root were responsible for selecting the prefabricated housing types. On our evidence, they played no such role for Toshka and BCD. However, it seems unlikely that the presence of Hitachi in the consortium for the Mubarak Pumping Station is independent of Japanese aid funding; in other words, stakeholder analysis must take into account the possibility of alliances and dependencies between internal and external stakeholders.

|

EAN: 2147483647

Pages: 207