Outsourcing Payroll

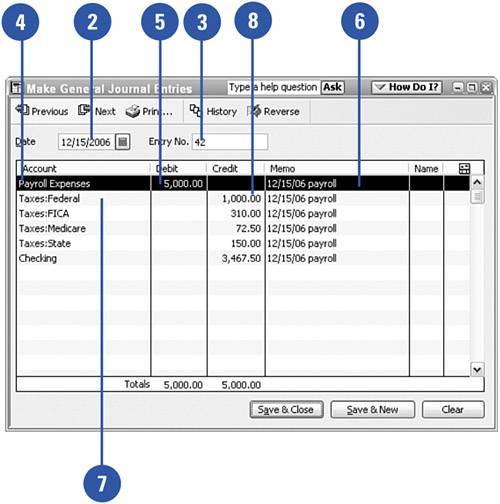

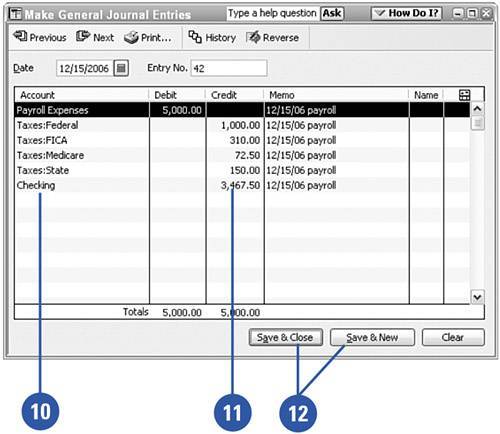

| If you use QuickBooks to process your payroll, all the payroll expenses and payroll tax liabilities are already entered in your company's financial records. If, instead, you hire an outside service to produce your payroll, the payroll expense and the liability amounts must be entered in your QuickBooks file. Record Payroll Expense and Payroll Liabilities

|