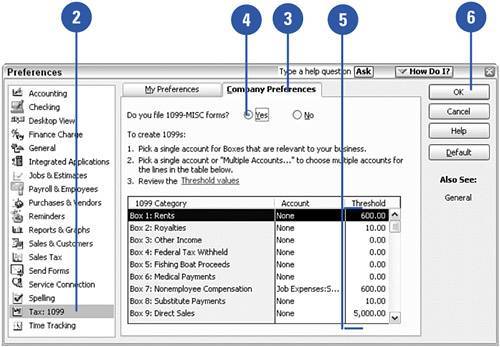

Setting 1099 Preferences

| You are required to issue 1099 forms to certain contractors and vendors. To track 1099 information for the contractors you pay, and to have QuickBooks determine who qualifies for a 1099 form, you must turn on the preferences for 1099s.

|