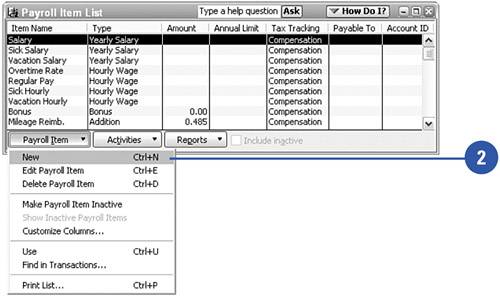

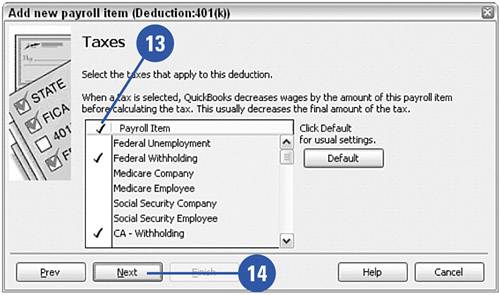

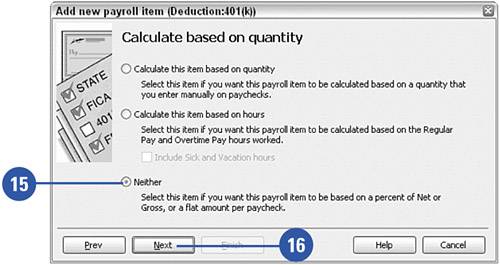

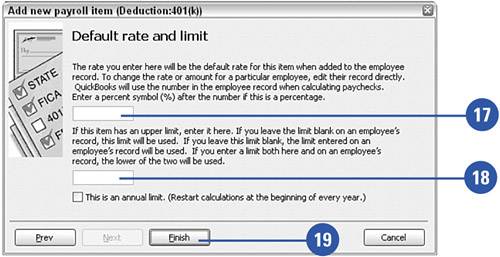

Setting Up Payroll Deductions

| Employers deduct a variety of amounts from employee pay. In addition to payroll taxes, there can be deductions for contributions to a disability plan, health insurance plan, 401(k) plan, fundraising organization such as United Way, cafeteria benefit plan, and more. The process for setting up each of these items is similar. For this example, we'll look at the procedure for setting up a payroll deduction for contributions to a 401(k) plan. Set Up Payroll Deductions

|