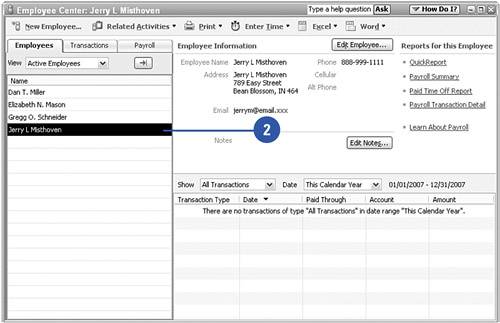

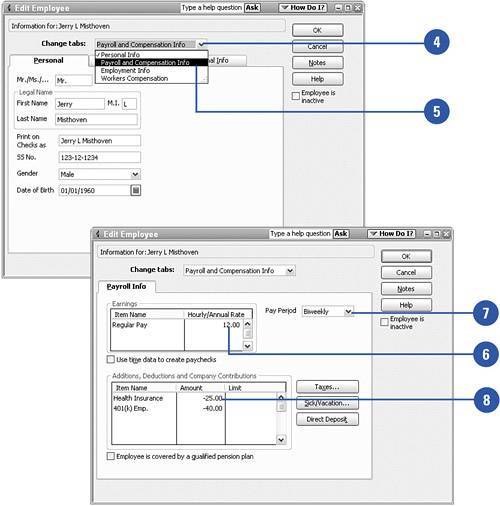

Setting Up Employee Payroll Information

| After you've entered the specific personal information about an employee, it's time to enter the payroll information for the employee. Here you'll enter the amount of salary or hourly wage the employee earns as well as any deductions, other than taxes, that you will withhold from the employee's paycheck.

|