Assigning Tax Lines

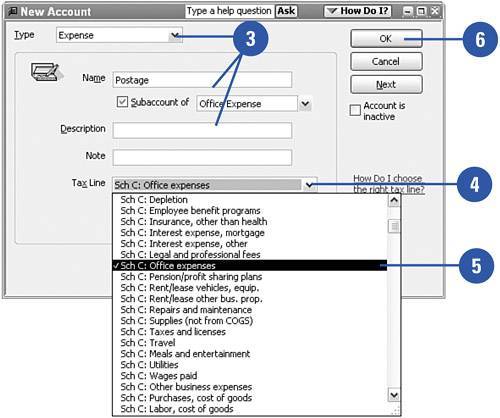

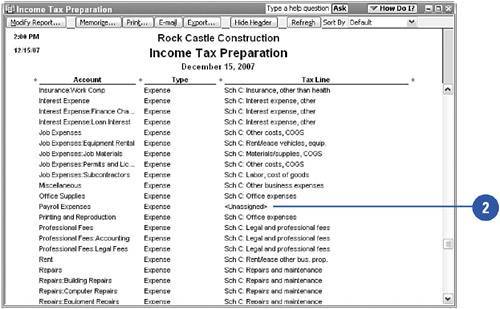

| If you plan to use QuickBooks to help prepare your company's income tax forms, you must assign a tax line to each of your company's accounts. You can assign tax lines as you set up your accounts, or you can open a chart of accounts report, see which accounts are unassigned, and assign tax lines to all your accounts at once. Assign a Tax Line When Setting Up a New Account

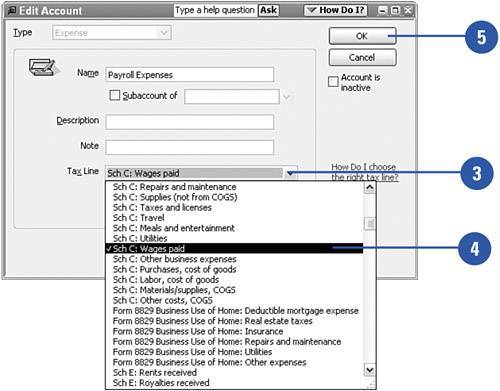

Assign a Tax Line to an Existing Account

|