Section 5.7. Target PC-Oriented Markets

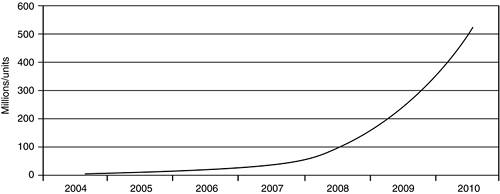

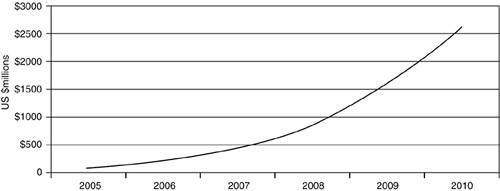

5.7. Target PC-Oriented MarketsPersonal ComputersSales of desktop computers are relatively flat year to year, but sales of notebook computers are increasing by about 20 percent per year. This growth is largely attributable to an increasing number of retail sales to consumers. As the consumer electronics industry strives to make its products "networkable" with PCs, PC makers are also developing products to support increasingly multimedia-orientedand networkedhome environments. Fueled by continued demand for notebook computers as well as consumer and corporate spending, worldwide PC sales in the third quarter of 2003 grew nearly 16 percent from 2002, about 5 percent above projections [13]. In September 2003, the market advisory firm IDC predicted that global PC shipments will grow by 8.8 percent, 7.2 percent, and 7.4 percent for 2005, 2006, and 2007, respectively [14]. PrintersAnalysts agree that the popularity of digital cameras and the transmission of digital images over the Internet are the main drivers of printer sales, particularly high-quality inkjets. Although images may be sent electronically, users still need hard copies of those pictures, as well as Web pages and other information they find online. In addition to lower printer prices and better image quality, consumers will benefit from increasedprinter capabilities, including the ability to connect to 802.11 wireless networks at home and in the office. Printers also are becoming more capable of communicating directly with other devices, such as handhelds and digital cameras, rather than relying on PCs for connectivity [15]. PeripheralsAdditional PC-related product categories, such as external or internal hard drives, will have increasing sales due to high demand from consumers who are developing their own multimedia content. These product categories are highly competitive, with vendors competing heavily with one another through the "coolest" features as well as by price. Because UWB solves both of these needs, it has very little resistance to overcome and will be integrated into products at a rapid rate. Also, because Wi-Fi and other wireless technologies have paved the way, UWB will likely have an even faster adoption rate. Taking into consideration all of the preceding discussion, and assuming that UWB continues to garner huge industry momentum, ON World projects that UWB chip sets volume production will increase by a 175 percent CAGR to more than 260 million units shipped in 2009. This growth will continue until 2010, when UWB silicon shipments will reach more than 500 million units, for a market worth more than $2.6 billion at that time. Table 5-1 and Figure 5-4 illustrate this projection.

Figure 5-4. Global UWB chip set units, 20042010 Similarly, Table 5-2 and Figure 5-5 illustrate the prediction of UWB chip set revenues through 2010.

Figure 5-5. UWB chip set revenues, 20042010 |

EAN: 2147483647

Pages: 93

- Integration Strategies and Tactics for Information Technology Governance

- Linking the IT Balanced Scorecard to the Business Objectives at a Major Canadian Financial Group

- Technical Issues Related to IT Governance Tactics: Product Metrics, Measurements and Process Control

- Governance in IT Outsourcing Partnerships

- The Evolution of IT Governance at NB Power