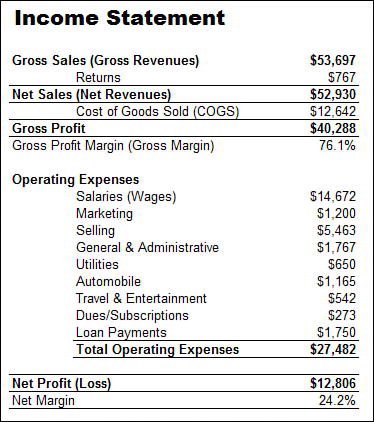

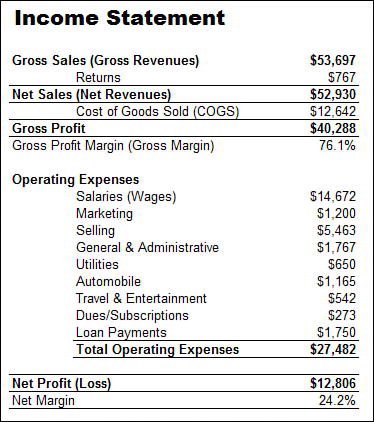

| You measure all your financial activity via a series of numerical reports that we call, in general, financial statements. There are two key financial statements for any business: the income statement and the balance sheet. Income Statement An income statement is a financial statement that details your business's revenues, expenses, and profit (or loss). As you can see in Figure A.1, it acts kind of like a giant equation. You start at the top with your revenues; then you subtract the cost of goods sold and the operating expenses. What you have left, at the bottom of the statement, is your net profit (or loss). Figure A.1. A typical income statement.

Operating expenses are typically broken out into multiple line items. In addition, you'll see the gross profit and net profit described as percentages of net revenues. (When shown this way, they're called gross margin and net margin.) Here's a brief explanation of the most important line items on the income statement: Gross Revenues. This line (also called Gross Sales) reflects all of your dollar sales for the period, not counting any damaged or returned goods. Returns. Sometimes called Returns and Allowances, this line reflects the cost of any returned or damaged merchandise, as well as any allowances and markdowns. Net Revenues. Net Revenues (also called Net Sales) reflect your Gross Revenues less your Returns and Allowances. Cost of Goods Sold. This line (also called COGS or Cost of Sales) reflects the direct costs of the products you sold for the period. Gross Profit. This line reflects the direct profit you made from sales during this period. It is calculated by subtracting the Cost of Goods Sold from Net Revenues. Gross Margin. This line (also called Gross Profit Margin) describes your Gross Profit as a percent of your Net Revenues. You calculate this number by dividing Gross Profit by Net Revenues. Operating Expenses. This line reflects all the indirect costs of your business. Typical line items within this overall category include Salaries, Advertising, Marketing, Selling, Office, Office Supplies, Rent, Leases, Utilities, Automobile, Travel and Entertainment (T&E), General and Administrative (G&A), Dues and Subscriptions, Licenses and Permits, and Training. Not included in this section are direct product costs (which should be reflected in the Cost of Goods Sold), loan payments, interest on loans, taxes, depreciation, and amortization. Net Profit (Loss). This line (also called Net Earnings or Net Income; the words "income," "earnings," and "profit" are synonymous) reflects your reported profit or loss. You calculate this number by subtracting Operating Expenses from Gross Profit; a loss is notated within parentheses. Net Margin. This line describes your Net Profit as a percentage of your Net Sales. You calculate this number by dividing Net Profit by Net Sales.

Note Not all income statements include the Gross Revenues and Returns lines. Many income statements start with the Net Revenues number as the first line, assuming the necessary gross-minus-returns calculation.

Note In all financial statements, a loss is typically noted by inserting the number in parentheses. So, if you see ($200), you note a loss of $200. An alternative, although less accepted, method is to put a negative sign in front of any losses. If you're printing in color, you would use red (in addition to the parentheses) to notate all losses.

Balance Sheet The balance sheet is a companion record to the income statement. As you can see in Figure A.2, it lists your business's assets (on the left side) and your liabilities (on the right). The total value of your assets should be equal to the total value of your liabilities; the basic concept is that what you're worth balances with what you owe. Figure A.2. A typical balance sheet.

Here's a brief explanation of the most important asset items on the balance sheet: Current Assets. This category includes those items that can be converted into cash within the next 12 months. Typical line items would include Cash, Accounts Receivable, Inventories, and Short-Term Investments. Fixed Assets. This category (sometimes called Long-Term Assets) includes assets that are not easily converted into cash, including Land, Buildings, Accumulated Depreciation (as a negative number), Improvements, Equipment, Furniture, and Vehicles. Long-Term Investments. This category includes any longer-term investments your business has made. Total Assets. This line reflects the value of everything your company owns. You calculate this number by adding together Current Assets and Fixed Assets.

The following are the key line items on the liabilities side of the balance sheet: Current Liabilities. This category includes any debts or monetary obligations payable within the next 12 months. Typical line items include Accounts Payable, Notes Payable, Interest Payable, and Taxes Payable. Long-Term Liabilities. This category includes debts and obligations that are due to be paid over a period exceeding 12 months. Typical line items include Long-Term Notes Payable and Deferred Taxes. Equity. This line (sometimes called Net Worth) reflects the owners' investment in the business. Depending on the type of ownership, this line may be broken into separate lines reflecting the individual equity positions of multiple partners or the company's capital stock and retained earnings. Total Liabilities and Net Worth. This line (sometimes called Total Liabilities and Equity) reflects the total amount of money due plus the owners' value. You calculate this number by adding Current Liabilities, Long-Term Liabilities, and Equity.

Note To make your balance sheet actually balance, the Total Liabilities and Net Worth number must equal the number for Total Assets.

|