Priorities of Each Adaptive Process

The concept of assigning priorities to the adaptive processes could be controversial. Some might insist on giving equal importance to each process and argue for the criticality of simultaneously having low cost, excellent customer targeting, and superior innovation. Choosing priorities does not dismiss one process or another but recognizes the intrinsic difference of each strategic position with its unavoidable, inherent trade-offs.

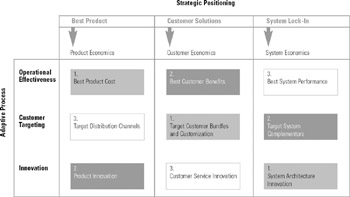

We've ranked the adaptive process priorities for each strategic option (see figure 8.7). The "consistency corridor" aligns the process of highest importance to each strategic position. Accordingly, the best-product position needs the lowest-cost infrastructure, which originates in the operational effectiveness process. Second, it requires the support of a stream of new products to prolong its current vitality into the future, the innovation process. Finally, the customer targeting process ensures the massive access to distribution channels.

Figure 8.7: Priorities of Adaptive Processes in Each Strategic Position

The customer solutions position has the effective targeting of the customer as its first priority. This is necessary to identify the required product bundles and to detect the needs for customization. Second, the operational effectiveness process ensures the delivery of the products and services to improve the customer economics. Innovation has the third ranking, not because it is unimportant for joint product development with the customer, but because the customer solutions position does not necessarily require leadership in new products, services, and features relative to that called for in the other strategic positions. Often the new product capabilities to support this strategy originate through alliances and the close collaboration with the customer.

The system lock-in position has innovation as its leading adaptive process. It contributes to the creation of the systems architecture that allows for standards to be conceived and owned. The next level of support comes from targeting the system's complementors to consolidate the lock-in position and, quite significantly, the lock-out of competitors. Finally, the operational effectiveness position is responsible for improving the system performance. While this process is important, the two previous adaptive processes are more relevant.

EAN: 2147483647

Pages: 214