SETTING THE STAGE

|

|

The B2B segment was expected to explode in the future. According to the Gartner Group, by 2004, it was projected to reach 6.7 trillion with North America accounting for nearly 40%. This growth may be due to several reasons.

One reason was the rapid transformation of business processes from paper to electronic due to the benefits of B2B—reduced costs, faster time to market, greater customer loyalty and broader market reach (Cisco System, 2001). Goldman Sachs predicted that B2B transactions would account for nearly 11 percent of the total business economy by 2002. Also, during an economic slowdown, businesses would look to increase efficiency through shortened product development cycles, collaboration, and lowered product costs through better planning—this resulted in businesses shifting into the B2B segment. Finally, the shift toward Net Markets by many brick-and-mortar businesses brought light many significant back-end integration issues. This translated to huge revenue opportunities for companies engaged in B2B—something that was becoming more evident as those marketplaces reached the next level of maturity.

![]()

Figure 3: Main Industries of the Conglomerates

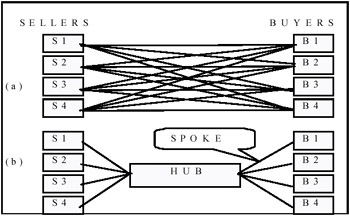

The B2B Industry had seen its share of growth prior to 2001. Many companies whether small or large wanted the ease of being able to buy and sell online. They counted on B2B companies to develop and implement a B2B e-commerce marketplace where customers could easily buy goods and services. A major trend that was taking place within the B2B industry was the ability for buyers and sellers to place orders with a multitude of suppliers by directly accessing their suppliers' electronic catalog. B2B e-commerce involved businesses selling products and services to each other over the Internet (About.com, 2001). With much business online, one of the main problems would be finding the best B2B Company with which to do business. A new breed of electronic "hubs" had emerged which could intelligently route business transactions over the web from one business to another (GE, 2001).

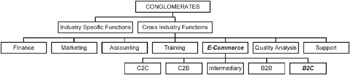

Conglomerates

Conglomerates were companies that engaged in diversified business operations such that no single operating segment, in a specific industry, generated a majority of revenue (Hoovers, 2001). Figure 3 shows that some of the main industries, in which these companies were involved.

The functions of these conglomerate companies, as shown in Figure 4, could be divided into two categories, industry-specific and cross-industry functions.

Figure 4: Functions of the Conglomerates

In consumer-to-consumer, consumers sold to other consumers (e.g., eBay). Through an intermediary, consumers were brought together to buy and sell. In consumer-to-business, consumers stated their price and firms either took it or left it (e.g., http://Priceline.com). Intermediaries played an important role in bringing the consumers and business together. Intermediary models were used in pricing the goods that were exchanged in transactions such as auction (e.g., http://TradeOut.com), reverse auction, fixed or menu pricing, bargaining, and barter (Afuah & Tucci, 2000). In business-to-consumer commerce, businesses sold to consumers (e.g., Dell online & http://Amazon.com) with or without an intermediary. Customers around the world could access 24-hours a day everyday, could receive goods instantaneously while e-tailors had no limit to the number of goods displayed and had low cost standards. In business-to-business, businesses bought and sold goods and services to and from each other (e.g., GXS). Buyers could put requests for new bids for suppliers and sellers around the world had a chance to bid. The more buyers, the better off the sellers were and vice versa (Afuah & Tucci, 2000).

The future of the conglomerates industry was expected to grow as new products were added and future competitors entered the market while, economically, personal disposable income increased. Since this industry was so vast and diversified, this study focused on one of the cross-industry functions, e-commerce or specifically, B2B.

The B2B Segment

B2B uses Web-based technologies to conduct business (buying, selling, or exchanging information) between two or more companies. As shown in Figure 5, the B2B segment involved B2B models, customer, services provided, industry functions, alliances, sales and promotion, technology, employees, industry standards, and competition (which included independent Internet and non-Internet companies).

Figure 5: B2B Segment

B2B Models

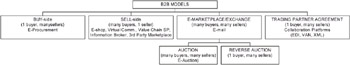

The B2B segment experimented with various new business models as seen in Figure 6. A business model was the method of doing business by which a company can generate revenue—it specified where a company was positioned in the value chain (Rappa, 2000). The strategic profiles of B2B models included BUY-side, SELL-side, eMarketplace or exchange, and Trading Partner Agreement model (IBM, 2001).

Figure 6: Strategic Profiles of B2B Models

BUY-Side Model

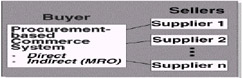

The BUY-side model (1 buyer, many sellers) provided electronic purchasing services to the business customer with its suppliers, as shown in Figure 7.

Source: IBM Website (2001). [Online]. http://www-1.ibm.com/servers/eserver/iseries/btob/b2b_definition.htm. Accessed February 20.

Figure 7: Buy-Side Model

SELL-Side Model

As shown in Figure 8, the SELL-side model (many buyers, 1 seller) provided electronic sales and distribution services for the supplier or seller through electronic business catalog, price lists, and order entry with high integration to the supplier back office systems (Yael, 2001).

Source: IBM Website (2001). [Online]. http://www-1.ibm.com/servers/eserver/iseries/btob/b2b_definition.htm. Accessed February 20.

Figure 8: Sell-Side Model

EMarketplace or Exchange Model

The eMarketplace or exchange model (many buyers, many sellers), as shown in Figure 9, combined suppliers and business customers by providing full scale sales and procurement to both the supplier and the customer and by transferring business documents automatically (Yael, 2001).

Figure 9: Emarketplace or Exchange Model

Trading Partner Agreement Model

The Trading Partner Agreement model (1 buyer, 1 seller) automated the process between companies for buying, selling, and enforcing contracts through collaboration platforms and applications such as Electronic Data Interchange (EDI), Value Added Networks (VAN), and eXtensive Markup Language (XML). This model was appropriate for contingents that were interested in focusing on specific functions such as collaborative design and engineering or in providing project support with a virtual team of consultants (Timmers, 1998).

Services Provided

Although the main services for most B2B companies were to provide buying and selling opportunities, there were many different services that these companies provided. However there were certain support services that companies provided to make its overall service more efficient. In order for companies in the B2B segment to stay competitive and add these support services, they had to create efficient supply chains. There were three basic services that many companies in the B2B segment offered: Enterprise Resource Planning, Quality Control, and Consulting and Training.

Industry Functions

There were two industry directions that B2B companies focused on: vertical and horizontal. Vertical industry functions were those functions that included all layers of production from manufacturing to consuming. An example of this would be ChemConnect, which was an online marketplace for buyers and sellers in the chemical industry. Horizontal industry functions were those functions that included a single layer of business incorporating different products and services in various sectors. For example, iMark.com acted as an intermediary between sellers and buyers of used capital equipment across different industries.

Alliances

Using collaborative capabilities or out-sourcing non-core functions to appropriate partners, partners could operate as a single business entity. With shared knowledge and joint decision-making, the added value, higher revenues, and reduced costs were all rewards. The main components of alliances within this industry segment comprised of technical partnerships, marketing partnerships, and product and service partnerships.

Sales and Promotion

B2B companies used a variety of sales and promotions techniques to ensure quality of service. There were three components that ensured the highest effectiveness: sales and marketing, support, and training.

-

Sales and Marketing. Activities in this category included both traditional marketing techniques and opportunities to participate in more unique forums. Some of the benefits of the GXS sales and marketing included: Website listing on http://www.gegxs.com, joint trade show participation, visibility/exposure to the GXS sales force, and participation at EC Forum, which was GXS's annual user group conference.

-

Support. To help its trading partners quickly build practices, GXS included a number of support methods in the program. Some of these include support during the installation and integration of the operational system, support to manage the overall process, and post-installation support.

-

Training. Training took multiple forms. Some partners required an in-depth technical knowledge of each GXS integration product. Other partners were content to under-stand how an integration solution benefits a company. Each partner was offered a level of training appropriate for its level of commitment to the program.

Technology

Technology was the main force behind the changes being experienced in the B2B area. The technologies behind this business were: a) the Internet – a mediating technology with many properties that had the potential to interconnect parties that were interdependent; b) software applications—including Electronic Data Interchange (EDI), Enterprise Application Integration (EAI), extensive Markup Language (XML), and Value Added Network (VAN); and c) knowledge management.

Industry Standards

The regulation that set the limits and standards of B2B commerce had not been firmly established. However in effort to define much-needed standards, several groups of experts had been organized: RosettaNet, CommerceNet, Open Buying on the Internet, The Organization for the Advancement of Structured Information Standards, and Microsoft's BizTalk (GE, 2001).

Competition

The main competitors within the B2B segment included independent Internet and non-Internet companies.

Independent Internet companies. These companies were not brick-and-mortar companies but dotcom companies. Some of the top competitors in the BUY-side model included FreeMarkets.com, the SELL-side model included TradeZone and Ariba, and the eMarketplace model included VerticalNet and FastParts. Companies such as FreeMarkets.com were vertically integrated and allowed buyers to bargain about price and obtain competitive offers from a number of sellers. Companies such as TradeZone and Ariba allowed sellers to provide an e-catalog, cross-selling or up-selling capabilities with integration of back-end order processing. Companies such as VerticalNet and FastParts were mainly horizontally integrated and matched buyers with sellers in a virtual marketplace (also called an exchange) through auction or reverse auction. These independent Internet companies varied in size, products, and services while maintaining different customers.

The strengths of these firms were in their B2B models, customers, services provided, ability to function within an industry vertically and horizontally, technical partnerships, and sales/promotion. With software, these competitors allowed the transformation of information easily and securely through organized procedures while buyers or sellers accessed supplier or customer information with superior service. These companies successfully transported secured data, operated high-performance networks, improved quality, reduced costs, and set global standards for manufacturers, distributors, and end-users. They were also strong in technical partnerships alliances. Through these partnerships, these companies successfully increased market share, reduced costs, obtained greater R&D capabilities, and offered better products/services while promoting and selling their applications.

Independent Internet companies were moderately competitive when it came to providing content for specific capabilities, overall creativity, minimization of organizations security, and ease of information exchanging through efficient applications. Independent Internet companies continued their moderately competitive status with joint decisions, selection of its partners, and initiating pilot programs. In order for Independent Internet companies to be considered strong against competition they had to gain a competitive edge in providing mutual benefits, create mutual trust in R&D, establish partner confidentiality, establish agreements on services offered, and have the ability to create complimentary products with certain partners.

The weakness of some of these competitors was in their industry standards involvement. They seemed less involved with organizations that promoted universal compliance. These companies' adherence to self-initiated rules and regulation, participation in forums, establishment of an in house check system, and employee compliance were weak.

The main trend in the B2B area was a shift by many dot-com companies to create a brick-and-mortar establishment as well.

Non-Internet companies. These companies were combined brick-and-mortar and dot-com companies. Some of the top competitors in the Buy-Side model included Japan Airlines, the Sell-Side model included Cisco Systems, and the eMarketplace model included the General Motors-Ford-DaimlerChrysler alliance. Companies such as Japan Airlines were set up by one or more buyers with the aim of shifting power and value in the marketplace to the buyers' side. Companies such as Cisco Systems were set up by a single vendor seeking many buyers. Companies such as General Motors, Ford and DaimlerChrysler formed an alliance (Covisint) to develop their own procurement system to match many buyers to many sellers. GXS had a variation eMarketplace model where it functioned as a private exchange. These non-Internet companies varied in size, products, and services while maintaining different customers.

The main strengths of these firms were their liquidity and capital. Also, other strengths included their B2B business models, customers, services provided, ability to function vertically and horizontally within industries, Ztechnical partnerships, and sales and promotion. With software, the non-Internet companies allowed secure transformation of information using different features and ease. These companies successfully transported secured data, operated high-performance networks, improved quality, reduced costs, and set global standards for buyers and sellers alike. Furthermore, the non-Internet companies did not have the disadvantage of being a "no name," rather an established, secure, brick and mortar business.

Non-Internet companies were moderately competitive in providing content for specific capabilities, overall creativity, minimization of organizations security, and ease of information exchanging through efficient applications. These non-Internet companies also continued their moderately competitive status with joint decisions, selection of its partners, and initiating pilot programs. For the non-Internet companies to be strong against competition they had to gain a competitive edge in providing mutual benefits, create mutual trust in R&D, establish partner confidentiality, establish agreements on services offered, and have the ability to create complimentary products with certain partners.

The weaknesses of these firms were alliances for partnerships. Through technical partnerships, these companies did not seem to successfully utilize the benefit of increased market share, reduced costs, greater R&D capabilities, and better products/services. The non-Internet companies were slow in careful partner selection, communication exploitation, and technology leveraging.

The major trend in the B2B area with these companies was creating an independent division or going private. The opportunities with these were the flexibility and greater market share obtained by being owner, operator, and manager of an independently run division.

General Competitive Environment. As the B2B segment was a highly competitive and rapidly changing market, it was sometimes hard to tell which company would succeed and which would fail. In Michael Porter's five-forces chain, an in-depth analysis was conducted for the B2B area as seen Figure 10.

Figure 10: Michael Porter's Five-Forces

ENTRY: The entry and exit barriers were low with many new entrants in the B2B area. This was due to the low cost standard of the Internet, flexibility, and minimum regulation. However, over time, market segments for B2B companies would mature and first comers would hold their position. This may lead to market capitalization and rigorous strategies of existing firms subsequently requiring significant up front investment for new competitors or narrow opportunities by offering specific products (Hopkins & Shoegren, 2000).

INTERNAL RIVALRY: With e-commerce, the internal rivalry was actually the survival of the fittest. The most successful B2B companies anticipated the need for change and acted in advance of the competition. The least successful B2B companies adjusted too slowly or ignored the need for change altogether. Forward-looking B2B companies used e-commerce to enhance their agility and improve their competitive advantage (Cisco Systems, 2001).

BUYER AND SUPPLIER POWER: The bargaining power was low and was likely to increase due to the availability of more sellers and products and the availability of information and comparative analysis on the Web (E-commerce and Perfect Competition, 2000). Supplier power was the backbone of the technical architecture of and products offered by B2B companies (Hopkins & Shogren, 2000). So, supplier power was high. However, supplier power may decrease due to the increased number of suppliers and ease of quote requests.

SUBSTITUTES AND COMPLEMENTS: Although the B2B segment was a young market with new competitors emerging daily, competition was dependent on first mover advantage and strategic partnerships to gain access to customers (Hopkins & Shogren, 2000). However, the threat of substitutes was high with more Web-based substitute products/services being offered.

The future vision of B2B was integrating supply chains with integrated businesses and solutions. While B2B was approaching its third generation, it was no longer enough to simply automate the process. The future of B2B would change the way companies conducted business. The next phase would include auctioning and global trading portals (Hopkins & Shogren, 2000).

|

|

EAN: 2147483647

Pages: 367