CASE DESCRIPTION: THE IMPACT OF NEW TECHNOLOGIES ON THE AIR TRAVEL INDUSTRY

|

|

CASE DESCRIPTION: THE IMPACT OF NEW TECHNOLOGIES ON THE AIR TRAVEL INDUSTRY

The Advent of Global Distribution Systems

In the mid-1970s, airlines began to offer travel agents access to direct, computerized reservation systems (see the discussion of the SABRE system, below) and in 1978, the airline industry was deregulated, leading to more price and service competition between airlines on the same route. Providers of computerized reservation systems provided access for travel agents via dialup telephone connections (and eventually permanent or broadband connections). This changed the way in which travel agents completed a transaction and gave them faster and better information about price and availability, compared with the previous, asynchronous process of booking direct with the airline. Travel agents were still essential to the process of booking a flight, as access to the specialized technology required to obtain this knowledge was unavailable to the consumer. Although unavailable for direct consumer use, computerized reservation systems allowed travel agents to provide a more effective service. The travel agent could confirm the booking in real time and seek alternatives if a flight was full, while the customer waited. A real time booking with an airline-booking agent was better than relying on an asynchronous transaction, conducted over several hours or days. The travel market became segmented, as travel agents increasingly targeted corporate customers, providing value-added services like negotiation of bulk fares and arranging complex itineraries (Clemons & Hann, 1999).

Direct reservation system terminals and connections were often offered free to travel agents, as airlines competed for market share with travel agents. A travel agent would normally not use more than one direct reservation system, since they took a great deal of time and training to use. Not all systems initially carried all airlines, but this changed as direct reservation systems became ubiquitous. However, a particular airline's direct reservation system would usually display that airline's flights first, giving them an advantage. Airlines also had to pay a fee to have their flights included in a competitor's reservation system, which would add to the cost of booking with that airline through a travel agent who used a competitor's reservation system. Over a period, direct reservation systems became more prevalent and encompassed a wider range of products and services, to become Global Distribution Systems (GDS).

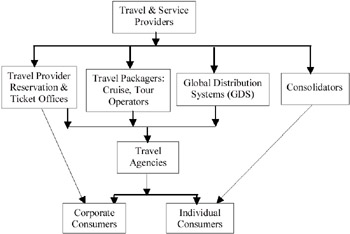

Figure 2: The Air Travel Industry Structure as Affected by GDS (e.g., SABRE)

GDS enabled travel and service providers (such as hotels and car-hire) the ability to market to customers in remote locations. The role of the travel agent changed as time went on, from knowledgeable travel and destination expert, to an intermediary, who saved the customer time and effort in booking a whole package of travel-related products and services. Another development in the 1980s was the emergence of consolidators: companies who purchased blocks of unsold seats from airlines and so were able to sell direct to the customer at a lower price than the Travel Agent could offer using GDS pricing. This trend fragmented the market, to some extent. Customers became aware of the differential pricing strategies used by airlines and became more price-sensitive as a result.

By the mid-1990s, the market had changed and travel agents became less buoyant. The airlines engaged in price wars and margins were reduced - the airlines sought to cap or to cut commission in an attempt to remain profitable. Although some of the larger agents had replaced dialup connections with broadband or permanently connected links, they were still relying on third-party providers for their information and level of service (the various airline reservation systems). The technology employed (direct access terminals) was becoming outdated, often having cumbersome, text-based interfaces, with difficult-to-negotiate menus and user-interfaces. Most travel agents relied on the same type of local knowledge that they had always used, to differentiate their value to the consumer.

Travel agents that focused on corporate customers could use information systems to provide better fare-search and point-of-sales tools such as ticket printing and this gave them some short-term competitive advantage during the 1990s. However, travel agents still faced two significant threats to their competitiveness during this period (Clemons & Hann, 1999): rebating (commission-sharing with corporate customers), by competitor travel agents, and commission caps and cuts by the airlines.

Internet Technologies

More recently, travel agents have faced additional threats to their profitability, enabled by the widespread use of the Internet. The first is disintermediation (cutting out the middleman) by the airlines and the computer-reservation system operators. The economics of individual transaction processing have been turned on their head by the ubiquity of internet access: it is now justifiable even for the airlines to serve individual customers, as the cost of processing an electronic transaction is so low, compared to the cost of processing a purchase transaction performed by a human salesperson. Airlines are attracted even more by the profitability of corporate electronic transactions. With sophisticated information systems, it is now possible for airlines to offer complex discounts on bulk purchases across many different routes and classes of travel, for corporate customers. It is also possible for them to use data-mining techniques to target dynamic discounts and value-added service offerings at high-value corporate customers, increasing the business that they attract through using direct sales channels.

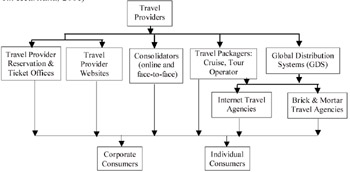

The second threat is competition from online travel agents whose overhead costs are much lower and who can achieve much wider economies of scale in processing large numbers of relatively low-margin purchase-transactions. Online travel agents use new technologies to access the direct reservation systems of multiple services in real time, allowing individual and corporate customers to directly coordinate flight, car hire, hotel and other services, as shown in Figure 3. However, there is a cost to using online travel booking services. The search cost can be high: air ticket prices may change from day-to-day or hour-to-hour. The time and effort involved in putting together a complex package of air and land travel services and hotel bookings is often too high for individual customers to contemplate. The online market may well be focused on the most price-sensitive segment of the air travel market: those willing to spend a disproportionate amount of time and effort in obtaining a low-cost ticket. Many customers may also visit an online travel agent's site to obtain information and then book elsewhere.

Figure 3: Structure of the Air Travel Industry Following E-Commerce Expansion (Modified from Heartland, 2001)

Following e-commerce developments, the travel industry is segmented between:

-

Traditional (brick and mortar) travel agents serving an increasingly smaller pool of individual customers who do not wish to spend the time and effort in searching for lower-priced travel.

-

Traditional travel agents serving the corporate market, whose margins are increasingly eroded by competition on customer rebates and by commission-limiting strategies on the part of airlines and other travel providers.

-

Consolidators whose business is increasingly threatened by the dynamic pricing strategies of online and direct sales channels.

-

Online travel agents who serve the corporate market and price-sensitive individuals.

-

Travel providers selling directly to companies and individuals, all of whom are price-sensitive and have excellent information about alternatives.

A Competitive Analysis of Changes in the Air Travel Industry

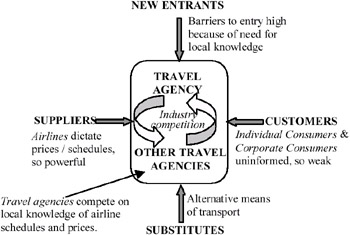

This section uses Porter's five-force model to analyze the impact of new technologies on competition in the air travel industry (Porter & Millar, 1985). This model analyzes the relative competitive pressures exerted on a firm (or type of firm, in this case) by five different industry "forces": direct competitors, new market entrants, substitute products/services, suppliers and customers of the firm. The most significant threats to the firm are then analyzed to determine how information technology can be used to reduce or sidestep the pressure.

Initially, the search time and cost that an individual would have to incur, in telephoning to discover information about alternative flights and airfares far outweighed the inconvenience of visiting a travel agent. The commission fees paid to travel agents were also applied to direct bookings made by individuals, so there was no cost or convenience advantage in not using a travel agent. Travel agents only competed with each other on service rather than cost. The service element mainly consisted of local knowledge about which airlines offered the best schedule from local airports to a particular destination and which airline's price structure was most attractive. The role of specialized system knowledge and local knowledge about airline schedules and pricing structures gave individual agents an advantage over other agents.

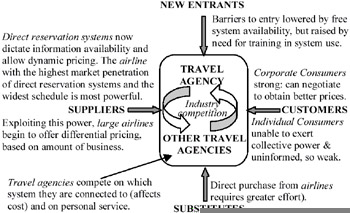

The use of direct reservation systems by travel agents raised the barriers to entry for those agents who were not early adopters of these systems. As airlines were competing with each other, to achieve market penetration, direct reservation system terminals and connections were often installed free of charge by the airlines. However, the investment required in training was high and late adopters of the new technology struggled to keep up. Once a critical mass of directly connected travel agents was achieved and flights could be entered in multiple systems, airlines were able to offer dynamic pricing, raising fares during periods of high demand and lowering fares during periods of low demand. Local knowledge on the part of travel agents became less important, as it rapidly became out of date and travel agents could only compete on the level of personal service that they offered. Exploiting their power, in the 1980s, the airlines began to adopt differential pricing, favoring travel agents purchasing more than a certain value of flights from in a month. Many small agents lost business as a result and had to introduce an additional fee to consumers, making them even more uncompetitive. Consumers lost out, as there was an incentive for larger agents to place as much business as possible with a preferred airline, whether or not this airline offered the best deal for the consumer. However, direct reservations were still not available to consumers, so consumers remained uninformed about choices and locked in to travel agents.

Figure 4: An Industry Analysis of the Non-Computerized Airline Industry

Two recent trends have affected the air travel product-market. An IS application that has radically changed the market for travel agents is the emergence of Global Distribution Systems (GDS), which serve as the main channel for airline ticket distribution in the USA. The evolution of SABRE from a direct reservation system for airline tickets into a GDS serving airlines, hotels, car rental, rail travel and cruise lines is one example. Many other GDSs are in operation today, lowering the costs of entry into the travel agent market immensely, although the subscription and booking fees are now more significant for small companies (Elias, 1999). The advent of GDS has changed the balance of power and the main players in the air travel industry and diversified travel agents into selling multiple products, all of which can be reserved in real time. As shown in Appendix 1, most of the major Global Distribution Systems are owned by consortia of airlines, allowing them to specialize in dynamic pricing over a subset of travel providers.

The second development is an increasing familiarity with Internet technology, on the part of consumers. The second is the replacement of traditional travel agents with online travel agents. As an initial response to use of the Internet by consumers, airlines attempted dis-intermediation (cutting out the middleman). By selling direct to the consumer, airlines were able to offer prices and value-added services unavailable to travel agents. Nevertheless, while dis-intermediation offers cost and value-added benefits to the consumer, it does not add a great deal of convenience. Online travel agents, such as Travelocity (a vertical integration venture by the SABRE Technology Group), Expedia and Orbitz emerged to fill the void. The specialized technology required to make direct bookings is now available to the consumer, often at lower cost (in terms of time and effort) than booking through a traditional travel agent. However, an examination of the major online travel agents and Global Distribution Systems shows that airlines are once again consolidating their ownership of the major distribution channels, to the probably disadvantage of bricks and mortar travel agents.

Figure 5: The Air Travel Industry as Affected by Global Distribution Systems

A Tale of Two Markets: How Local Environments Affect the Strategic Impact of IS

It is interesting to examine the differences in e-commerce impact between the USA and Europe. The single derivation of most USA Telcos (local telephony providers, which mainly originated from the demerger of the Bell Corp group of companies) meant that they adopted a homogenization of charging structures. USA telephony charging structures earn revenue mainly through the provision of long distance and value-added services. The provision of local telephony services has, until recently, been seen as a base cost of providing access to the network and has been charged accordingly, leading to essential free (or very low cost) local telephone calls. In Europe, on the other hand, a multiplicity of small nations, each with different cultures and funding structures led to a telephony environment which was, until fairly recently, hostile to cross-company traffic. Revenue was therefore earned mainly through local (and local long-distance) calls, rather than long-distance traffic in the USA sense of the word. Peak-hour local calls in the USA average at about seven cents per call (of up to 24 hours). Peak-hour local calls in Europe can cost 50 cents a minute.

It is not surprising then that the uptake of Internet access has been much higher in the USA than in Europe. While most companies in the USA have a website and the majority of these conduct some sort of business via that website (even if not fully automated), most of the smaller companies in Europe are still trying to figure out how to install a website and what to do with it, once they have it. Consumers are relatively unsophisticated, compared to American consumers, with a commensurately lower level of trust in Internet transactions (IBM, 2000). The travel industry in Europe has not been affected by new information technologies to anywhere near the same extent as the USA travel industry. Internet-based travel sales constituted only $2.2 billion or 1.2 percent of the European market in the year 2000 (Marcussen, 1999, 2001). However, this figure was an increase from 0.45 percent in 1999 and even the European bricks-and-mortar travel market is beginning to be described as "beleaguered." In contrast, USA Internet-based travel bookings are booming. In 1998, 2.08 percent of the travel market (by value) was transacted over the Internet. This figure is predicted to rise to 7.5 percent by 2003 (Elias, 1999). The winnings European travel agents will; be those who respond to changes in the market environment by employing newer technologies early in the game. As with the development of SABRE and the success of the online travel agent Orbitz (see the next section), exploiting market structures opportunistically through IT innovation leads to high rewards.

|

|

EAN: 2147483647

Pages: 367