Discussion

|

Throughout its years of nation building, Singapore's experience has been that the necessary infrastructure and policy frameworks must first be put in place before growth opportunities can be pursued. This approach brings strategic advantages to businesses through creation of economic value. For example, Singapore's world-class airport and seaport, which regularly corners accolades from the international media, are examples of this line of thinking. Recognizing that the new economy is conducive for small countries to be major players in the world stage, Singapore has taken the initiative to deregulate and liberalize the telecommunications market as a prelude to putting in place an advanced landline and wireless telecommunications infrastructure for the emerging e-economy. That an advanced telecommunications infrastructure can be correlated with economic growth has been demonstrated by a number of studies (Samarajiva & Shields, 1990; Saunders, Warford & Wallenius, 1994). The U.S. Department of Commerce has estimated that ICT generates up to 40 percent of real economic growth in the U.S., a trend which is set to increase further in the years to come (quoted in http://act.iol.ie). In the context of the foregoing, the emphasis has been on establishing an information architecture in Singapore which is globally competitive. Advantages accruing from early adoption would help to position Singapore as an e-commerce hub in the Asia-Pacific region, besides reaping economic dividends through creation of employment opportunities.

Despite the impetus provided for privatization and globalization providing capital flow, the state is still acknowledged to play an important role in economic development efforts and technological competitiveness (Porter, 1998; Castells, 1996). In Singapore, the government has thus been the prime mover in encouraging businesses to embrace e-commerce. Early adopters of e-commerce in Singapore have been the well established (listed) companies, which supplemented their physical operations with e-commerce capabilities on the Web. This has also been the case in other countries (Steinfield, Bouwman & Adelaar, 2002).

The number of wholly digital enterprises in Singapore is estimated to be in the order of a few hundred. Some of these include:

-

http://www.acmabooks.com—an online bookstore featuring more than 500,000 titles

-

http://www.soundbuzz.com—an online music portal featuring more than 100,000 titles in several languages

-

http://www.cozee.com—an e-market place boasting an A-Z listing of services for households

-

http://www.adolescentadulthood.com—a dating website started by a school student, and which is netting him S$12,000 a month

-

http://www.SurfIP.gov.sg—a website that helps inventors sell their ideas

Many other e-marketplaces have also mushroomed to serve the needs of the online community in retail, finance, stock trading, and other sectors.

The number of organizations in the private sector warming up to the new economy has increased over the years. In a survey of a cross-section of industries carried out in 2001, it was found that 98.7 percent of them have Internet access while 75.7 percent have their own websites (Ho, 2002). Business-to-Business sales are also giving a fillip to e-commerce activities (Table 3), while cross-border e-commerce is also increasing in value (Table 4). Clearly, B2B commerce is dominating online commerce. It is likely that the bulk of B2B contributions are from established companies moving their current transactions online. The high volume of e-commerce transactions is a profound indication that the infrastructure and frameworks for intelligent enterprises in Singapore are fundamentally sound.

| Year | Value (S$ million) |

|---|---|

| 1998 | 5,671 |

| 1999 | 40,425 |

| 2000 | 92,701 |

| 2002 | 109,460 |

| Source: Ho, 2002 | |

| Year | Domestic (S$ million) | Export (S$ million) |

|---|---|---|

| 1998 | 1,758 | 3,913 |

| 1999 | 25,468 | 14,958 |

| 2000 | 52,840 | 39,862 |

| 2001 | 51,440 | 58,014 |

| Source: Ho, 2002 | ||

All this suggests that the Government's plans to dot-com the private sector are proceeding according to course. Though the initial focus was on companies in growth sectors such as logistics, manufacturing, education, finance, etc., since they contribute more towards Singapore's economy, the intent is also to ensure that at least half of the 100,000 small and medium size enterprises use some form of e-commerce in their operations by the year 2003. Adoption of e-commerce by these enterprises is a crucial aspect of dot-coming the private sector. Pursuant to the foregoing, a S$30 million incentive scheme has been made available for these companies to jump start their e-commerce operations. They will, however, have to fulfill certain requirements: at least 30 percent local shareholding, fixed assets must not exceed S$15 million, and workforce size must not exceed 200. The subsidy is capped at S$20,000 per company.

In another recent survey, it was found that the take-up rate for e-commerce can be boosted further if PKI awareness could be raised among companies (http://www.ida.gov.sg). Not many recognize that PKI is the most secure platform for e-commerce transactions. To boost adoption of PKI by businesses, 19 infocommunication industry players have grouped together at the request of IDA to form the PKI Forum Singapore (Ho, 2002; http://www.pkiforumsingapore.org). The Forum aims to generate awareness of PKI among businesses and stimulate growth of e-commerce and m-commerce.

Prospects for further growth of intelligent enterprises in Singapore are very bright for a number of reasons. The necessary infrastructure and frameworks are now in place to support a plethora of services and applications. ICT is firmly entrenched in society and the economy (Tables 5, 6 and 7). Of interest to note is that ICT now contributes toward 20 percent of the GDP.

| Year | % households with PCs | % households with Internet access |

|---|---|---|

| 1996 | 40 | 8 |

| 2000 | 61 | 50 |

| Source: Ho, 2002 | ||

| Sector | 1997 | 1998 | 1999 | 2000 | 2001(July) | 2002 (July) |

|---|---|---|---|---|---|---|

| Mobile phone | 743 000 | 1 020 000 | 1 471 300 | 2 442 100 | 3 020 300 | 3 244 800 |

| Internet dial-up | 267 400 | 393 600 | 582 600 | 1 940 300 | 1 915 800 | 2 000 700 |

| Source: www.ida.govs.sg | ||||||

| Item | Jan 2001 | Jan 2003 |

|---|---|---|

| Business-to-Business Commerce | S$81.5 billion | S$81.5 billion |

| Business-to-Consumer Commerce | S$1.9 billion | S$2.1 billion |

| Online Banking Users (as % of Net users more than 15 years old) | 20.1 % | 30.8 % |

| Online Shoppers | 21.0 % | NA |

| Source: www.ida.govs.sg | ||

We envisage that the potential for business on the wireless platform in Singapore is also bright for the following reasons:

-

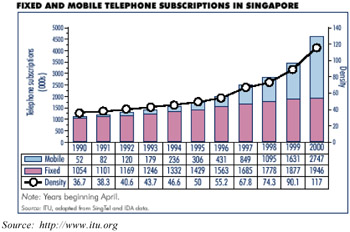

A trend towards increased usage of mobile phones and less use of fixed line telephony is evident (Figure 1).

Figure 1: Trend in Penetration Rates for Mobile and Fixed Line Telephony. -

The mobile phone market is heading for saturation, thus raising the possibility of a leveling off of the revenue base of the telcos. Further growth is thus likely to come from new applications spearheaded by the telcos on the mobile platform.

-

Whilst accessing the Internet via a PC requires a high upfront investment in the form of a PC, accessing the Internet via a mobile phone requires a low investment in the form of a mobile phone—a cost reduction factor of about 20 times. With the popularity of the Internet and the mobile phone, a convergence is likely on this platform.

-

Telcos have pumped massive investments in 3G wireless networks. With current subscriber fees going downhill, the need to source for new revenue streams will very likely see telcos teaming up with content providers, software developers and systems integrators to drive m-commerce applications.

Recognizing the profound implications of information and communication technologies in the new economy, significant emphasis is placed on these in the education system. There is one PC for every five students in the 360+ schools in Singapore and 30 percent of curriculum time is devoted to the use of information technology in the lessons. All schools are linked to the Ministry of Education by an ATM network for interactive multimedia learning and Internet-based teaching. Each school is allocated 2 Mbps of bandwidth, with provision for scaling this up to 155 Mbps in due course. The strong emphasis placed on information technology in schools is among the reasons why the younger generation in Singapore is rather IT-savvy and comfortable with the digital society.

The high level of IT literacy in schools has engendered the rise of a number of student start-ups leveraging on the broadband network. Recent media reports have featured two digital enterprises started by students, one being a dating website which nets the owner S$12,000 a month, and another a web page design business, which provides its two owners S$3,000 each per month.

As the business model for m-commerce is still evolving, early entrants stand to gain a competitive advantage through increased market share, which later entrants would be hard put to match. There is a good likelihood that the wireless platform will become the predominant platform in the telecommunications value chain in the near future.

Strategies to stimulate further growth

Whilst the current global recession as well as the post 9/11 international economic order have affected the growth of e-commerce in Singapore, there are a number of strategies which can be adopted, in our opinion, to stimulate further growth. We elaborate on this here:

-

Encourage the incorporation of more new companies which are wholly intelligent enterprises. While more of existing companies need to be encouraged to deploy relevant aspects of their offline operations online in order to achieve increments in productivity and efficiency, the process can often be slow for various reasons—for example, inertia on the part of company owners to embrace new technology paradigms, uncertainties in pivoting a company to cyberspace, and reluctance in tinkering with existing systems which are functioning well. Such holding back, however, does not apply for new intelligent enterprises. For example, Deixin (1998) has argued that it is easier for new companies to embrace the latest business practices because "they do not have to unlearn and bury old habits or ways of doing businesses in order to create new ones, they do not have to dismantle existing systems, they do not have to deal with individuals who stand to lose out because of change, or even change the psychological contract between employees and the organization." Obviously, the challenge of integrating the physical and virtual operations does not arise for such businesses. Further incentives and policies would need to be formulated in order to help stimulate the formation of such businesses.

-

Encourage proliferation of intermediaries in the e-commerce value chain. There is a popular perception that with the maturation of e-commerce activities, traditional middlemen would be eliminated from the supply chain between sellers and buyers because of greater access to information about products and their availability. Whilst this is perceived to have happened to some extent in Singapore, it has not been widespread. Insertion of intermediaries in the e-commerce supply chain can, in fact, stimulate business activities. Jin and Robey (1999) have espoused the need for such intermediaries in the Internet economy—for example, the important role played by auction companies when they constitute an intermediate node in the B2B and B2C supply chains as well as the case of web-enabled finance companies that act as go-betweens between buyers and sellers have been used to support this assertion. Chircu and Kauffman (2000) have also noted the importance of cybermediaries in the value chain between manufacturer and customer as they help to develop new forms of e-commerce in existing channels. The positioning of such intermediaries has also the advantage that, by being closer to the marketplace, they can help to leverage the supply chain through self-directed initiatives as well as through mutually reinforcing relationships among partners in the value chain, thus generating further value for businesses. New policies and incentives in relation to the insertion of intermediaries would thus need to be incorporated.

-

Encourage formation of more wholly digital enterprises. The notion of a company as an entity having a physical space and other accoutrements of corporatese is a misnomer in today's networked world. It is entirely possible for wholly digital enterprises which have only an Internet address to survive in the digital economy, notwithstanding the dot-com debacle of recent times. The need to encourage new business models and revenue streams through appropriate policy instruments is thus important as this would provide a fillip for the mushrooming of such enterprises. Such companies would be better able to capitalize on the potential of the Internet than traditional brick-and-mortar companies and thus, stimulate further development of e-commerce activities.

-

Accelerate e-business partnerships to create an extended virtual enterprise. While in traditional companies, value is premised on a mix of factors such as physical assets and human resources, business relationships are also a key driver of profitable and sustainable operations. Cyberspace opens up new opportunities for creating relationships in a borderless economy between organizations through leveraging on the strengths of their respective core competencies in order to create an extended virtual enterprise, whereby each partner constitutes a node in the total solution. The strategic positioning of the various partners in the supply chain enables tapping of new business opportunities. Such a process has been called ecosystem virtualization by Chen (1998), who notes that the enabling collaboration at different levels benefits all members through shared businesses and information processes. Much depends on the private sector to create these arrangements.

-

Encourage the younger generation to strike out digitally on their own. Singapore has a rather ICT-savvy population, especially the younger generation. We have previously argued that it makes sense for the younger generation to be entrepreneurial as they are generally risk-averse and the opportunity cost for them is low (Tan & Subramaniam, 2002). Instances of students who have been able to capitalize on the potential of the Internet to make money have been recounted earlier. More schemes and incentives need to be put in place for the younger generation to tap digital business opportunities via Small Office-Home Office (SOHO) setups. As it is, there are little opportunities for advanced school students to obtain funding for commercializing interesting ideas. Incentives and policies to target the younger generation in this regard would be helpful. An environment promoting technopreneurship and innovation among the student community is, however, fast gaining momentum.

-

Address impediments faced by industry in the use of PKI. That the development of online commerce has grown tremendously despite the embracing of PKI by only a limited number of businesses speaks volumes for the potential of e-commerce in Singapore. Even though there is recognition that PKI provides the most secure environment for e-commerce transactions on the Net and it has been in operation since 1997, its adoption has been constrained by the lack of a critical mass of users. The reason can be traced mainly to the high cost of its use since the installation of proprietary hardware and software is entailed. Moreover, there are not enough applications to support PKI. There is, however, official recognition of this problem, and efforts are being made to address it.

Lessons Learned from the Singapore Experience

The mature state of development of online commerce in Singapore offers useful pointers for replicating such experiences and practices in other countries. Some of the lessons that can be drawn from the Singapore experience with regard to the architecture and frameworks for digital enterprises are summarized below:

-

Deregulation and liberalization of the telecommunications sector are very important as this would allow international players to enter the market and help jump-start the installation of advanced infrastructure. It will also provide a fillip to online commerce activities.

-

A high speed digital telecommunications network leveraging on a diversity of platforms is indispensable for providing good network connectivity and ubiquity. Narrowband connection using 56 K modem is likely to become obsolete as the price gap between these offerings narrows further. Countries without adequate telecommunications infrastructure will not be able to participate effectively in the emerging information economy—they need to go beyond plain old telecommunication services!

-

A slew of policy initiatives and frameworks drawn from best practices elsewhere and fine-tuned for local sensitizing are important. It should be constantly reviewed for effectiveness.

-

The state needs to be the key driver in the promotion of intelligent enterprises, both through an e-government approach as well as by laying the necessary infrastructure and frameworks for the private sector to capitalize on the opportunities that the digital economy presents. Laws and regulations that are perceived to constrain e-commerce activities need to be amended. It also needs to invest in bandwidth at the Internet gateway so that affordable access is available for people and businesses.

-

A popular e-culture needs to be entrenched, especially among the younger generation, as they would be the key actors in the new economy. Focus must be on schools to provide students with the necessary ICT literacy skills.

-

In the process of focusing on e-commerce, it is important not to overlook the potential of m-commerce for it has a synergistic effect on the development of online commerce.

-

Public and private sectors need to work together closely in order to realize the desired national objectives.

In summary, the e-commerce infrastructure and policy frameworks established in Singapore not only conform to established models but also exceeds these in a number of areas. The high volume of e-commerce transactions is another indication of the viability of the model being used. In the year 1999, Singapore was ranked seventh in the Asia-Pacific region for total consumer online spending (Boston Consulting Group, 1999). In the year 2000, Singapore was ranked first in Asia and fourth in the world for e-commerce infrastructure (The World Competitiveness Yearbook, 2000).

|

EAN: 2147483647

Pages: 195