A National Wi-Fi Network

|

| < Day Day Up > |

|

The companies attempting to build large-scale Wi-Fi networks take different approaches. One is the top-down network approach where the networks are built in the traditional way-by network operators who then charge a fee for access. The other is the bottom-up network approach whereby the network is built through a loose federation of HotSpot operators who offer access to all within the "federation." While both approaches have their problems, the top-down network model is dependent upon users willing to pay to use a fragmented service, whereby different venues are served by different networks with no single network providing wide coverage. This means that the end-user will need multiple accounts and passwords to stay connected.

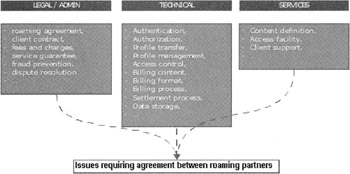

Figure 11.12: Aggregators are best suited to handle the legal, administrative, technical and services issues that arise during multilateral roaming partnerships.

The bottom-up approach presents a management nightmare unless there is a middleman to amass and manage the federation of HotSpots, such as an aggregator.

No matter which approach is used, the industry is coming to terms with the fact that roaming is essential and thus has begun moving in that direction-with the help of the aggregator crowd. Still, a concerted national effort is needed to create a national, virtual, single Wi-Fi network.

Some type of confederation is needed to put this virtual wireless network together. Although some aggregators might try, conventional wisdom is that neither a large aggregator (such as GRIC) nor a wireless network provider like Cometa can build, support and maintain a national network. The scope and scale of operation that is required for such an undertaking requires a massive organization. One such organization that has stepped to the plate is Pass-One.

One of the first tasks Pass-One took on was the crafting of a standardized multilateral roaming agreement. It hopes to have a final draft of this agreement completed sometime before the end of 2003. According to Phil Belanger, a Pass-One spokesperson, "It's similar to the ATM card model." But, Belanger warns, "It is only compelling if it's global."

When completed, the roaming agreement will require that all signing members, large or small, roam with every other member. Pass-One expects that within a year after its multilateral roaming agreement is finalized, any new member that joins the organization will automatically sign the agreement, allowing their end-users to roam with the other members of Pass-One. "The idea is the same as public access Internet. You might be a subscriber with a HotSpot in Nebraska, and when you get on a plane and go to Monte Carlo, if you see the Pass-One logo you won't have to give the local venue anything to use it. You won't have to verify. You will just get the service, and get one bill." Belanger also indicates that One-Pass would like to work with other groups, like Cometa.

It's Pass-One's hope that this will lead to a large international footprint. As more members come onboard, their end-users will enjoy the beginning of an international wireless network powered by Wi-Fi. But HotSpot operators must become a member of Pass-One to participate in this potentially international WLAN network.

Another organization working on a pervasive virtual wireless LAN is the previously discussed Wireless Broadband Alliance, which plans to have an inter-operator roaming platform in effect before mid-2003. Look for this group to move quickly to expand its coverage across national borders.

AT&T, Intel, and IBM have formed the company Cometa Networks, along with global investors Apax Partners and 3i. The new company plans to build a large number of Wi-Fi HotSpots in 50 U.S. metropolitan areas by 2005. These HotSpots are slated to enable end-users to retain consistent logins, IDs, passwords, and payment methods as they roam. This one-stop Wi-Fi shopping center has IBM providing the back-office infrastructure, AT&T delivering the IP network and backhaul, and Intel using its integrated Banias mobile processing software to drive the technology into portable devices.

Cometa plans to sell its services to two distinct market segments. The first consists of large venue owners, such as regional or national convenience store chains, gas stations, and restaurants. The plan is to split the costs of installing the HotSpots. However, the company hasn't shared its revenue-sharing plan.

IBM will install the WLAN gear. AT&T Wireless will handle the initial authentication and backhaul connections by working with local carriers for DSL or T-1 connections.

The second consists of telecom carriers (both wired and wireless) that want to add a wireless LAN service to their data offerings.

Cometa's chief operating officer Joe Gensheimer suggests that a number of Cometa HotSpots, while bearing the logo of a particular carrier or retail chain, may end up working like today's ATMs, which handle a broad range of different brands of ATM cards and credit cards. "We're neutral. There might be five people connecting to one HotSpot. A Sprint customer will think it's a Sprint HotSpot, the iPass customer will think it's an iPass HotSpot, and an AT&T customer will think it belongs to AT&T."

Cometa's partners, whether a wireless or wired carrier, ISP, or some type of WISP, can then resell the services to their customers (venue owners or individual HotSpot operators), if they so desire.

The big question: "Does the emergence of Cometa spur or further confuse the WISP marketplace?" On the cellular/Wi-Fi partnership level, companies such as Cingular, which have hinted that they'd rather buy their way into the WISP marketplace, are delighted that a group of industry heavyweights have taken on the task of building a nationwide Wi-Fi network in which they can participate. On other levels, carriers such as T-Mobile, which already has significant investment in HotSpot operations, will look to Cometa to help fill any gaps in its coverage.

Cometa's co-founder Larry Brilliant believes that Cometa's projected ability to accommodate users in a seamless way provides a perfect business model. He says that the multiple competing market channels Cometa can tap into through wholesale agreements can achieve scale, although it will take some time for the new network to reach critical mass.

Cometa's business model, however, hinges on one critical factor: the willingness of Cometa partners to share the same network and to agree to use AT&T's backhaul services. For although the facility and backhaul cost savings look good on paper, Cometa may have a tendency to build HotSpots only in locales it finds most economically beneficial, for example, only where AT&T already has backhaul in place and where Cometa can strike favorable deals. These locales, however, may not be where HotSpot operators want to target key subscribers and differentiate service offerings. And, in fact, that issue has already come up in Cingular Wireless's negotiations with Cometa.

Still, although Cometa is poised to become the largest HotSpot provider in the U.S., it probably won't be the single-source solution. Not only for the reasons listed previously in this chapter, but also because the company doesn't plan on aggregating access to already established HotSpots. Brilliant and others believe that closing off roaming with other Wi-Fi providers is the only way to ensure quality of service and offer customers a simple way to sign on and register themselves on their network. Although the company did mitigate its stance somewhat by saying that if HotSpot operators want to meet Cometa's technical specifications and allow the company to migrate their HotSpots into its network management center, Cometa would be amenable to including them in their network.

Nonetheless, Cometa should come to terms with the fact that partnering with aggregators like Boingo, GRIC, and iPass is the only way for it to provide optimal nationwide coverage. That may happen. On March 4, 2003, Cometa Networks announced that it had signed iPass as its first partner in its ambitious plan to set up a network of 20,000 HotSpots in the next two years. The realization of such a plan would represent a giant leap forward for Cometa. On iPass's behalf, Cometa is just one more service partner, albeit on a larger scale than its other partners (e.g. Wayport). iPass uses its partners to provide the HotSpot locations, Internet access, and backhaul connections while iPass works behind the scenes handling the authentication, billing, and settlement for the HotSpot operators. John Russo, vice president of marketing for iPass, commenting on the partnership deal, said, "We'll take the Cometa [Wi-Fi] infrastructure and make it part of the iPass virtual network. It extends the number of useable hotspots, the user continues to see only the iPass user interface."

So, as you see, Cometa's business model is a bit different than what we've seen previously. But if it works, it could definitely accelerate the Wi-Fi explosion.

|

| < Day Day Up > |

|

EAN: 2147483647

Pages: 273