Chapter 6.11: Pharmaceuticals

Liu Baocheng, Professor, University of International Business and Economics, and Gao Chunping PhD, Shijiazhuang Pharmaceutical Group Company

Overview

The sheer size and growth rate of the Chinese pharmaceutical market cannot have gone unnoticed by pharmaceutical companies with ambitions to compete for global market share and lucrative margins. With an annual growth rate averaging around 15 per cent for the past 15 years , the aggregate value of pharmaceutical output in 2000 stood at US$29.2 billion, an increase of 22 per cent over the previous year. This is double the average growth in the entire national industrial sector (11 per cent). Moreover, it is expected that this industry will continue to grow at 12 “13 per cent for the next five years, which will be almost double the targeted overall growth rate for China's GDP set forth in the new five year plan. Some analysts believe that China will become the largest pharmaceutical market in the world by 2020.

Backed by its large population and substantial increase in disposable income, it is estimated that the current customer base for pharmaceutical products is 400 million and that this will continue to expand by ten per cent per annum. In addition, increased life expectancy as well as the one child policy have boosted general awareness of health care.

In 2000, the total value of China's pharmaceutical market was equivalent to US$14.2 billion and per capita expenditure on health care was US$11. Shifts in the demographic pattern will have a significant impact on the pharmaceutical market. In 2000, China became an elderly nation with ten per cent of its population aged over 60. This figure is expected to rise to 11.52 per cent by 2005, 17 per cent by 2025 and 47 per cent by 2025 by 2050. Currently, 50 per cent of drug consumers are elderly. Even at the current average growth level, the market value of the elderly population will reach US$20 billion by 2005.

In the process of preparing for and now being a new member of the WTO, China has paved the way for far better access to foreign drugs. They can either be directly imported or manufactured by domestic foreign-invested pharmaceutical enterprises . China is committed to the reduction of import tariffs from the current 12 per cent to 5.5 “6.5 per cent over the next five years. Likewise, the Chinese government has streamlined regulations both in pharmaceutical manufacturing and in the marketing process. Since 1997, following the inception of the Chinese State Drug Administration (SDA), in order to ensure the safety and quality of pharmaceutical products, a massive programme has been enforced on existing manufacturing facilities for Good Manufacturing Practice (GMP) inspection in different phases with specified deadlines. For new facilities, GMP is a prerequisite before they are permitted to manufacture. In a drive to modernize the production of Traditional Chinese Medicine (TCM) and ensure consistent quality, the government has also introduced the Good Agricultural Practice (GAP) standard for farms producing herbal plants.

Aside from diagnostic equipment, the pharmaceutical market in terms of access routes can be broken down into two sectors: the prescription drug market and the over-the-counter (OTC) drug market. Over the past 10 years, the Chinese government has made substantial efforts to distinguish between prescription drugs and OTC drugs. The Categorical Administration Act for Prescription and OTC Drugs was officially implemented on 1 January 2000. Most chemical drugs are treated as prescription drugs and are sold in the in- house pharmacies of hospitals and clinics. The share of OTC drugs has been increasing by 15 per cent per annum. Motivated by profit incentives and loose regulatory control, most drug stores continue to sell beyond the borders of the OTC classification.

China's health care market broadly consists of three major sectors: chemical and biological drugs (typically referred as western drugs), TCMs and overall health enhancement products (HEP). The market share of biological drugs is still negligible at US$1.5 billion in sales, although the potential is apparent. HEPs are further classified into pharmaceutical grade and health food grade and include both chemical and botanical extractions. At the end of 1996, of the 1,731 drugs approved in China, western drugs amounted to 61.78 per cent (1,071) and TCMs stood at 31.54 per cent (546).

Cultural differences do not support a significant bias against western drugs. The consumption pattern is chemical drugs at 68 per cent, TCMs 20 per cent and dietary supplements 12 per cent. As a matter of fact, most Chinese consumers, including the elderly, are highly receptive to western drugs, particularly as a solution to acute symptoms and infectious diseases. Competition from TCM is only noticeable in the prevention and health enhancement markets. It is ironic that the import value of foreign-made natural herbal medicines has exceeded China's TCM export.

There are nearly 7,000 pharmaceutical manufacturers in China with 5 per cent involving foreign investment. Although exceptionally numerous , most domestic manufacturers are small in size and their product portfolios are very similar. Due to the lack of scale production and barely any funding for R&D, most are only able to serve the market at arm's length, typically under the umbrella of local protection, and will have to rely on hefty subsidies if encouraged to compete across the country. The Chinese government has recognized the problem of inefficiency and decided to reduce their numbers firstly to encourage organizational integration through acquisition and merger by a recognized market leader and secondly to force companies to close down when they are unable to meet the GMP standard. This radical restructuring process with government intervention is expected to reduce the number of pharmaceutical companies by half over the next two to three years.

The trend towards concentration is already being felt. In the meantime, foreign invested manufacturers have begun to capture a larger share of the market. The top nine companies accounted for 12.5 per cent of the entire market in the chemical drug industry in 1999, five of which are foreign funded companies: Glaxo SK, Johnson & Johnson, Pfizer Warner, Norvartis and United Pharm. The competitive advantage of foreign invested enterprises (FIEs) over domestic enterprises (DEs) in the pharmaceutical industry is reflected in their production efficiency, market promotion and profitability (see Table 6.11.1).

| Cost of goods | Sales expenses | Other promotion costs | Profit | |||||

|---|---|---|---|---|---|---|---|---|

| Year | DEs | FIEs | DEs | FIEs | DEs | FIEs | DEs | FIEs |

| 1994 | 77.0 | 56.6 | 4.0 | 16.7 | 10.3 | 4.0 | 8.7 | 22.7 |

| 1995 | 76.8 | 63.0 | 4.8 | 15.1 | 11.6 | 3.1 | 6.8 | 18.8 |

| 1996 | 77.4 | 56.4 | 5.7 | 20.4 | 9.7 | 0.0 | 7.2 | 23.2 |

| 1997 | 76.3 | 56.0 | 6.4 | 24.3 | 10.8 | 0.8 | 6.5 | 18.9 |

A recent sample survey conducted in early 2000 by China Pharmaceutical Distribution Association revealed the competitive pattern in the pharmaceutical market: “ 57.22 per cent are manufactured by domestic companies, 29.33 per cent by foreign invested companies and the remaining 13.45 per cent consists of direct imports.

The distribution system for pharmaceutical products is probably unique to China. The retail market has for decades been dominated by the hospital sector. Unlike in western countries , hospitals are heavily reliant on sales of drugs as their primary income source, rather than diagnostic and medical treatment services. 71 per cent of all pharmaceutical products are sold through in- house pharmacies in hospitals and clinics, while 29 per cent are sold in drug stores. Each hospital and clinic runs its own in-house pharmacy. Mainstream wholesale channels are still monopolized by the hierarchical three- tier wholesalers “ national, provincial and local. As a result, manufacturers are able to earn on average no more than 20 per cent of the retail price, with the rest being absorbed by the layers of distributors . Another unique problem derives from doctors . Since they are inadequately paid by the hospitals and clinics, doctors are tempted to solicit kickbacks from pharmaceutical companies for the drugs they prescribe. This can vary from 2 per cent to 20 per cent of the retail markup depending on the price level and popularity of the drugs. The Chinese government has recognized this as a serious social issue and since 2000 has been gradually disengaging pharmacies from hospitals. Now hospitals' income from diagnoses and treatment is beginning to grow at a faster rate than from sales of drugs.

Social medical health care is a fundamental factor in the health care market. For the past 500 years, China has maintained a policy to segregate urban residents from rural farmers in all areas of social welfare and health care is no exception. In cities, two- thirds of the population enjoys some kind of social medical insurance, while 83 per cent of farmers are not covered. While 70 per cent of the population is in the countryside, the per capita expenditure on health care is unevenly distributed between cities and countryside (see Table 6.11.2).

| Population (%) | ||

|---|---|---|

| Cities | Countryside | |

| Labour Insurance | 32 | 1 |

| Public Insurance | 28 | 3 |

| Partial Labour Insurance | 6 | |

| Medical Insurance | 3 | 2 |

| General Insurance | 1 | |

| Co- operative Insurance | 2 | 10 |

| No Insurance | 26 | 83 |

| Other | 2 | 1 |

The significance of medical insurance to pharmaceutical manufacturers lies in the fact that for a drug to be reimbursable , it must be included in the national Essential Drug List. Different regions tend to have different policies allowing them modify their own Reimbursement List depending on the prevalent diseases in their particular region as well as local government financial capabilities.

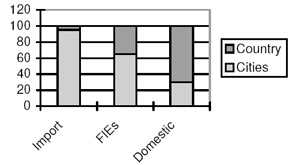

As discussed above, the sources of pharmaceutical products in are primarily foreign exporters, FIEs and domestic manufacturers. While Chinese domestic companies still have around 60 per cent market share, the quality difference, combined with pricing strategy and channel advantages mean that different sources have a distinctive market position in the cities and countryside. Imported products are concentrated in the cities (95 per cent), as are FIE products (65 per cent) whereas 70 per cent of all domestic products are positioned in the countryside (see Figure 6.11.1).

Figure 6.11.1: Market positions of pharmaceutical products in China by source

Over the past five years, Chinese domestic manufacturers have suffered a decline of 1.2 per cent in their market share. It is estimated that FIEs will combine with foreign exporters to seize the majority market share by 2004.

China's reliance on international trade for pharmaceutical products is still on a small scale although the rate of growth has exceeded the country's average. According to customs statistics, the total international trade value of Chinese pharmaceutical products was US$6.4 billion in 2000, an increase of 16.4 per cent on the previous year. Total exports registered 13.8 per cent growth at US$3.8 billion and imports grew at 18.7 per cent to US$2.6 billion. However, China still has a trade surplus of US$1.2 billion. This is because most conventional chemical drugs have been successfully duplicated in China with a low cost advantage, thus reducing reliance on imports. On the other hand, the bulk of exports are in the form of industrial intermediaries, which mainly rely on low price leadership and have already taken 22 per cent of the world market. Finally, although China is the home of TCM products, barely any TCM products have been approved officially as preventative or treatment drugs by western regulatory authorities such as the US Food and Drug Administration (FDA) or European Medicinal Evaluation Agency (EMEA). Most TCM drugs can only be sold as dietary supplements in western food stores.

As living standards rise, particularly in the cities and coastal regions, a number of formerly common diseases and conditions associated with poverty “ including many infectious diseases and certain types of malignant disease “ have been almost entirely eliminated. However, problems associated with quality of life are beginning to emerge and as a result of reduced physical exercise and mismanaged diet, incidences of 'modern' diseases such as diabetes, cardiovascular disease and stress- related disorders are on the increase.

One serious issue that concerns western companies is the level of protection for foreign intellectual property rights in the area of pharmaceutical manufacturing. Unlike India, China does not enforce compulsory licensing. However, according to Chinese patent law, if a foreign company fails to file for patent protection in China within one year of its initial patent being granted in other countries, they will be barred from any protection in China. 97.4 per cent of all chemical drugs in China are duplicated from western technology. Given that a new drug development would cost US$400 “1,000 million, and that even a licence would cost US$5 “ 6 million, it is unrealistic to expect Chinese companies to pay the full price for industrial patents to foreign companies, despite the fact that the Chinese government has demonstrated a high level of commitment to the Paris Convention of Industrial Property Rights and the Uruguay Agreement on Trade-related Intellectual Properties (TRIPS). So a feasible solution, aside from direct import, would be for western companies to collaborate with local partners in a joint venture involving technology licensing.

EAN: 2147483647

Pages: 648