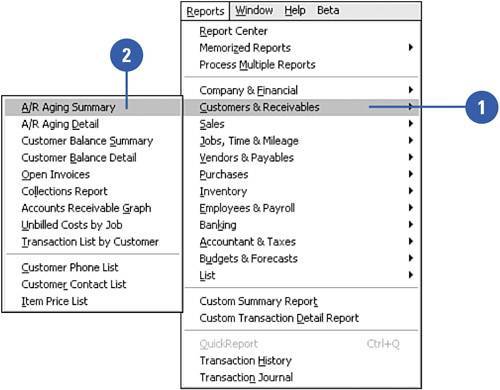

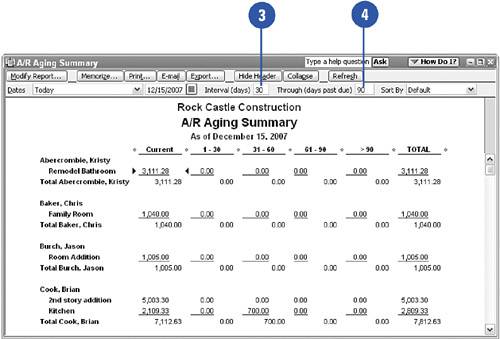

Preparing an Accounts Receivable Aging Summary Report

| The accounts receivable aging reports provide insight into how timely your customer payments are received. The aging summary report shows outstanding balances arranged by customer name and divided into time periods: amounts due currently, 130 days overdue, 3160 days overdue, 6190 days overdue, and more than 90 days overdue.

|