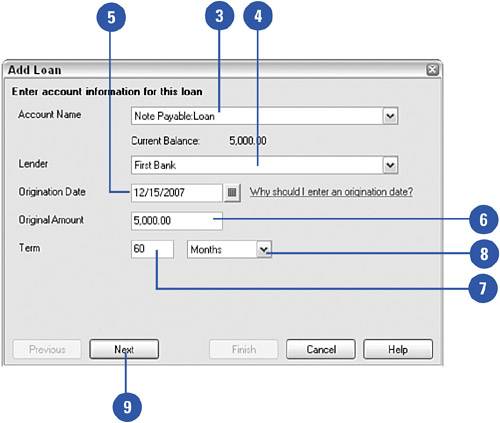

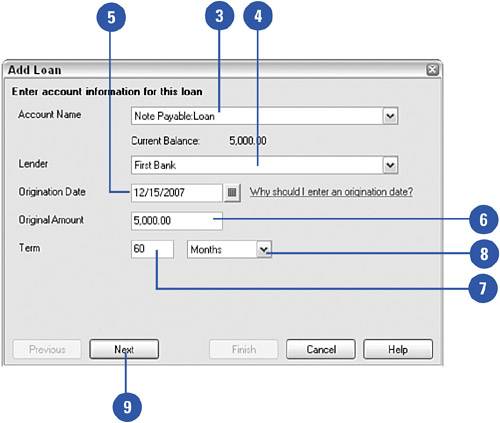

| Interest is calculated based on an annual interest rate, and is calculated either as simple interest or compound interest. For simple interest, you multiply the loan amount by the annual interest rate and then divide the interest by 12 to arrive at a monthly interest rate. For compound interest, the principal balance on which the interest is calculated is reduced each time a payment is made. The amount of interest changes with each payment since the interest is recalculated on a constantly changing loan balance. Fortunately, loan calculators are available on the Internet that enable you to experiment with borrowing scenarios, and these calculators compute the interest for you. Even better, you can use the QuickBooks Loan Manager to calculate compound interest and show you how much of each payment represents principal and interest. A number of calculators are available on the Intuit website: http://accountant.intuit.com/practice_resources/calculators/index.html  Enter the liability account where the loan balance is recorded. Enter the liability account where the loan balance is recorded.

Enter the name of the lender. Enter the name of the lender.

Enter the date on which the loan was initiated. Enter the date on which the loan was initiated.

Enter the principal balance. Enter the principal balance.

Enter the number of payments you will make. Enter the number of payments you will make.

Enter the frequency with which you will make payments. Enter the frequency with which you will make payments.

Click Next. Click Next.

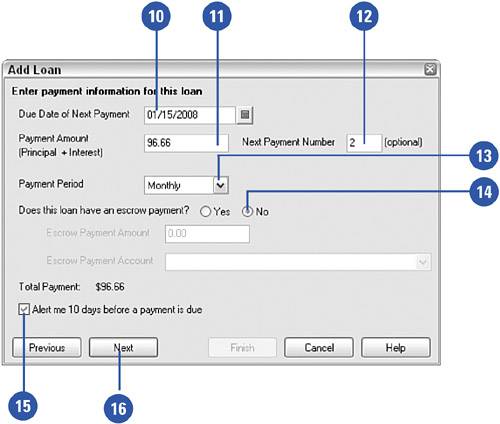

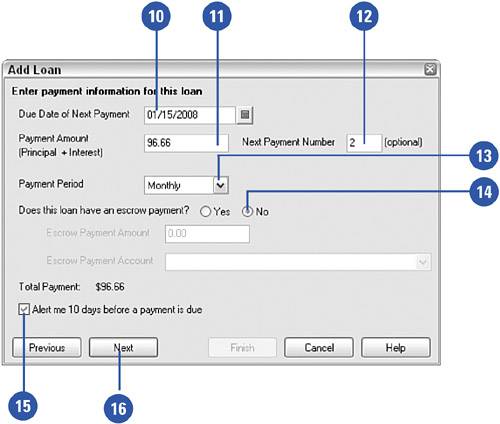

Enter the due date of the next payment. Enter the due date of the next payment.

Enter the payment amount. Enter the payment amount.

Enter the number of the next payment. Enter the number of the next payment.

Enter the payment frequency. Enter the payment frequency.

Enter escrow payment information if applicable. Enter escrow payment information if applicable.

Did You Know? Escrow payments increase the amount of the loan payments. Mortgages are the most common type of loan that include escrow payments. Escrow payments are payments made to a separate fund that is held by the lending institution and used to pay such items as property taxes and insurance.

|

Check here if you want a 10-day advance warning of the payment due date. Check here if you want a 10-day advance warning of the payment due date.

Click Next. Click Next.

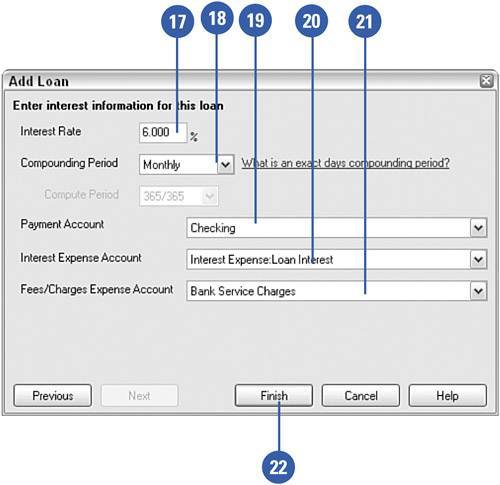

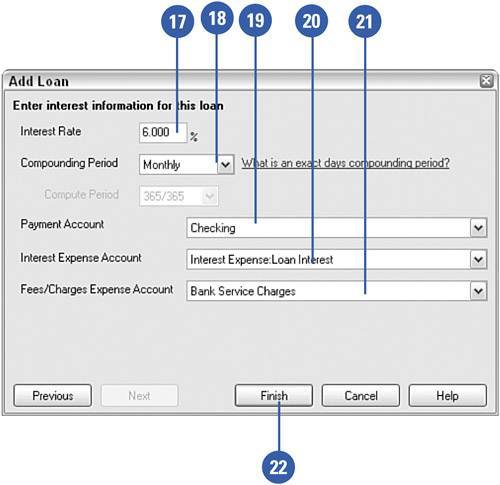

Enter the interest rate. Enter the interest rate.

Enter the frequency with which interest is compounded. Enter the frequency with which interest is compounded.

Did You Know? QuickBooks offers only two compounding options. When entering the compounding period, your only choices are Monthly and Exact Days. Monthly interest is calculated and compounded once each month. A lender that uses the Exact Days method compounds interest daily, based on either 360 or 365 days in an annual cycle.

|

Enter the account from which payments will be drawn. Enter the account from which payments will be drawn.

Enter the account in which interest expense should be recorded. Enter the account in which interest expense should be recorded.

Enter the account in which any bank fees or service charges should be recorded. Enter the account in which any bank fees or service charges should be recorded.

Click Finish. Click Finish.

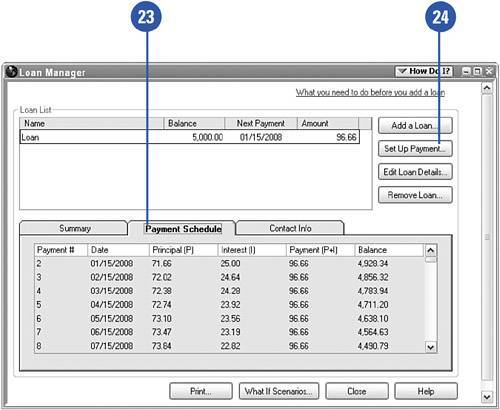

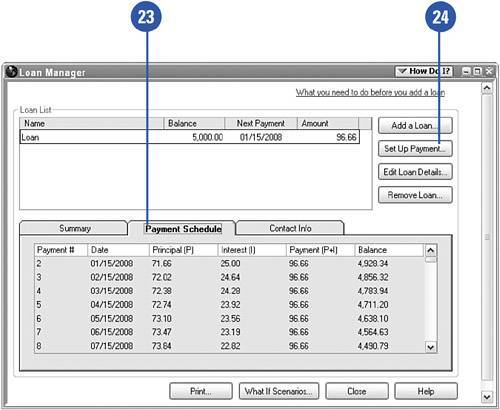

Click the Payment Schedule tab to see a detailed list of how your payments will be recorded. Click the Payment Schedule tab to see a detailed list of how your payments will be recorded.

Click Set Up Payment to open the check window and issue a payment for this loan. QuickBooks fills out the check with the proper interest and principal disbursement. Click Set Up Payment to open the check window and issue a payment for this loan. QuickBooks fills out the check with the proper interest and principal disbursement.

Did You Know? Use the Loan Manager when making payments. Return to the Loan Manager and click Set Up Payment each time you are required to make a payment on the loan. This way, interest is calculated correctly and your loan balance is reduced according to your repayment schedule. |

|